AI Crypto Trading is revolutionizing how investors engage with digital assets. From lightning-fast AI crypto trading bots scanning markets 24/7 to machine learning algorithms predicting trends, artificial intelligence is poised to unveil the future of crypto trading. This comprehensive guide explores what AI-driven crypto trading is, recent trends (2023–2026), top AI trading bots (with pros, cons, and ideal users), real-world use cases, and what’s next. We’ll maintain a balanced, factual perspective – highlighting both the potential and the pitfalls – to meet the needs of beginners and fintech professionals alike. Let’s dive in.

Overview of AI Crypto Trading

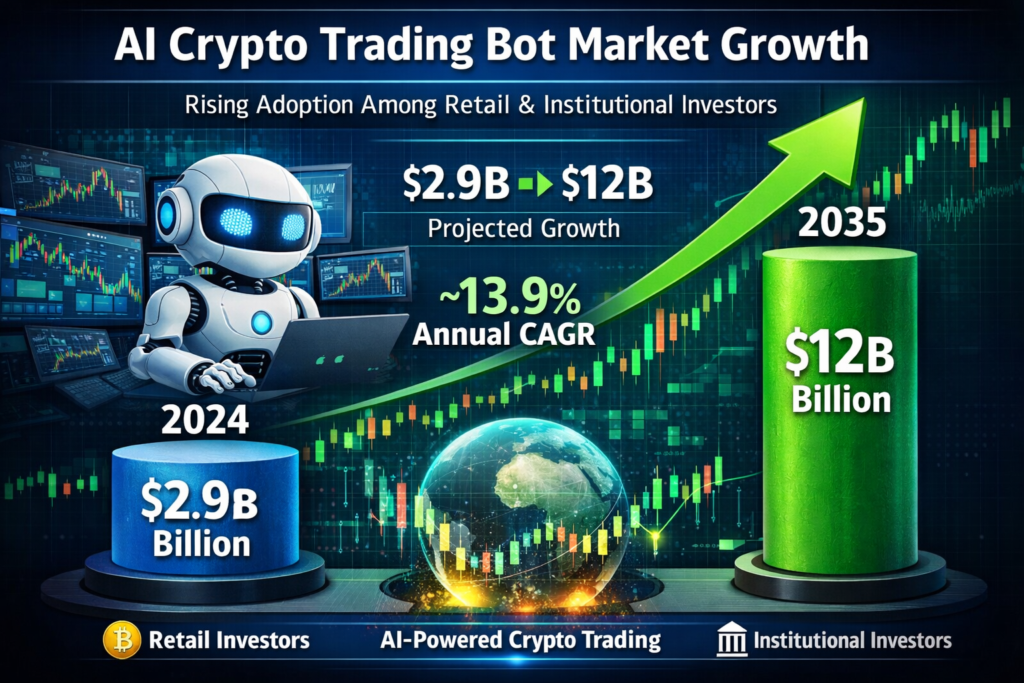

| Category | Key Insights | Critical Data |

|---|---|---|

| Market Growth | AI crypto trading bot market expanding rapidly, transforming from niche to mainstream adoption | $2.9B → $12B by 2035 (13.9% CAGR) |

| Trading Volume | Algorithmic and AI-enhanced bots dominate crypto market execution globally | 70%+ of trades automated in 2023 (~$94 trillion volume) |

| Performance Potential | AI models show capability to outperform traditional strategies in backtests | 1,640% return (Bitcoin AI model, 2018-2024 study) |

| Top Platforms | Cryptohopper 3Commas Pionex Coinrule | 16 free bots on Pionex; 3Commas from $15/mo; all support multi-exchange trading |

| Core Advantages | 24/7 operation, emotion-free execution, superhuman speed, pattern recognition across millions of data points | Millisecond reaction times vs. human seconds; continuous market monitoring |

| Critical Limitations | Past performance doesn’t guarantee future results; model breakdown during regime shifts; requires human oversight | Many bots fail to beat market in live conditions; $10-12B in AI-related scams (2024) |

| Use Cases | Arbitrage, market making, sentiment trading, portfolio rebalancing, risk management, liquidity provision | Cross-exchange price gaps closed in milliseconds; news sentiment analyzed instantly |

| Future Trends | Autonomous AI agents, DeFi integration, regulatory evolution, improved accessibility and education | Up to 1M AI agents predicted on blockchain by 2025 |

| Expert Warning | “The biggest misconception is that an AI bot is like a money printer… It’s not like that.” – Nodari Kolmakhidze, CFO Cindicator | AI excels at past data but struggles with unprecedented market events |

| Best Practice | Use AI as a tool, not a replacement for strategy; start small, maintain oversight, combine human insight with machine speed | Hybrid human-AI approach yields optimal risk-adjusted returns |

What Is AI Crypto Trading?

AI crypto trading refers to using artificial intelligence techniques (like machine learning and deep learning) to analyze cryptocurrency market data and execute trades automatically. In traditional algorithmic trading, bots follow preset rules (“if X happens, do Y”). AI takes this a step further – enabling bots to learn from data, adapt strategies, and even analyze sentiment in ways static algorithms canno. In simple terms, an AI trading system behaves a bit like an expert analyst who never sleeps and constantly improves:

- Data-Driven Decisions: AI models can crunch millions of data points in milliseconds – far beyond human capacity – spotting complex patterns or arbitrage opportunities across exchanges. This means an AI bot might notice a price inefficiency and execute a profitable trade while a human is still blinking.

- Continuous Learning: Unlike a fixed rule bot, an AI-driven bot can adjust its strategy based on new data. For example, if market conditions change, a well-trained AI bot can modify its trading rules on the fly to avoid losses, much like an experienced trader would.

- 24/7 Operation: Crypto markets never close, and AI bots are always on. They don’t tire or make emotional decisions, which helps in volatile markets. An AI bot can react at 3 AM to a tweet that would otherwise go unnoticed until morning.

- Sentiment Analysis & Beyond: Advanced AI uses techniques like natural language processing to gauge market sentiment from news or social media. This means an AI trading program might read thousands of tweets or news articles about Bitcoin and factor that into its strategy – something nearly impossible for a human to do in real time.

Why it matters: These capabilities give traders a potential edge. AI can help manage the speed, scale, and complexity of crypto markets. For instance, if a sudden price drop triggers panic, an AI bot could swiftly execute pre-planned risk management trades without succumbing to fear. In essence, AI crypto trading aims to combine the best of both worlds – human-like insight with machine-like speed.

However, AI is no magic money tree, as we’ll discuss. Success still depends on sound strategies and oversight. To better understand the impact, let’s look at how AI trading evolved in recent years and what the data shows.

The Rise of AI-Driven Crypto Trading (2023–2026 Trends)

The past two years have seen explosive growth in AI’s role within crypto trading, reshaping market dynamics. Several key trends and statistics highlight this surge:

- Dominance of Algorithmic Trading: By 2023, automated trading (much of it AI-enhanced) became ubiquitous in crypto markets. Bots executed over 70% of all crypto trade volume in 2023, handling about $94 trillion in trading volume globally. Analysts predict that by 2025, AI-driven algorithms could manage nearly 90% of total trading volume across markets, highlighting how pervasive these systems are becoming in finance. In other words, the majority of crypto trades are already made by “machines” — and increasingly “smart” machines.

- Outperforming Traditional Strategies: There are early signs that AI can boost performance. A study of Bitcoin trading strategies (2018–2024) showed an AI-led model achieving a staggering 1,640% total return, vastly outperforming standard strategies over the same period. While backtested results should be viewed with caution, they fuel excitement that AI might identify profit opportunities humans miss. Hedge funds using AI have, in some cases, beaten peers by double-digit percentages in returns.

- AI Hype and Market Sentiment: The AI boom extended beyond just trading tools to the assets themselves. In 2023, crypto tokens linked to AI projects soared ~165% in value over 12 months, outpacing even Bitcoin’s gains. This “AI rally” in crypto was driven by investor excitement that AI-related cryptocurrencies (e.g. AI infrastructure or chatbot tokens) could be the next big thing. It shows how the narrative of AI’s promise influenced market sentiment and created new trading opportunities (and risks) in the crypto space.

- Real-World Use Cases Emerge: We also saw striking examples of AI in action. In one experiment, six AI models were given $10,000 each to trade crypto live – including familiar names like ChatGPT and newer specialized AIs. Some, like a model called DeepSeek, achieved triple-digit percentage gains during the test before volatile swings, outperforming others like GPT. In a lighter example, a high school student in Oklahoma let ChatGPT manage a $100 crypto portfolio; the AI-driven picks significantly outperformed the market over that period. These cases illustrate both the potential and unpredictability of handing money to AI.

- Institutional Adoption: Major exchanges and financial players are integrating AI into their operations. For instance, Coinbase and Kraken made AI-focused acquisitions/partnerships in 2024 to embed AI trading capabilities in their platforms. Even Binance’s founder, Changpeng “CZ” Zhao, is bullish on AI’s role – saying if he were starting over today, he’d build an AI-driven trading agent and predicting AI-powered agents will fuel the next wave of exchange growth. His vision: “An AI trading agent for simple execution… DeFi is the future,” underlining the belief that AI + DeFi could one day surpass traditional crypto exchanges.

“The biggest misconception is that an AI bot is like a money printer… It’s not like that.” – Nodari Kolmakhidze, CFO of Cindicator (builder of Stoic.AI), warning traders not to expect automatic profits.

Despite the excitement, experts urge caution. Many AI trading bots do not consistently beat the market in real conditions. They excel at processing past data, but unforeseen market regime changes or black swan events can still throw them off. As Kolmakhidze notes, even strong AI models can break down when volatility shifts. In fact, 2024 saw record crypto scam losses (nearly $10–12 billion) partly because scammers now wield generative AI (deepfake videos, fake “trading gurus” online) to trick victims. So while AI is a powerful tool, it’s no guarantee of easy riches – understanding its limits is crucial.

In summary, AI-driven crypto trading moved from niche to next normal by 2024. It brings speed, scale, and new strategies, but also requires new levels of vigilance. Next, let’s explore how AI crypto trading bots work and what advantages (and challenges) they offer.

How AI Crypto Trading Bots Work

AI crypto trading bots are essentially software programs that use AI algorithms to make trading decisions. They connect to exchanges via API, monitor market conditions, and execute buys or sells based on their training and parameters. Here’s a closer look at their benefits, and just as importantly, their challenges:

Key Benefits of AI Trading Bots

- Superhuman Speed & 24/7 Trading: AI bots react in fractions of a second. They can scan multiple order books and news feeds and place orders in the time it takes a human to blink. This speed advantage is critical in fast-moving crypto markets (e.g. catching an arbitrage gap before it closes). Plus, bots never sleep – they can trade around the clock, ensuring no opportunity is missed at 3AM on a Sunday. As one analyst quipped, today’s AI functions like “an associate or an intern that can work 24 hours a day” to assist human traders.

- Emotion-Free Decision Making: Greed and fear are often a trader’s worst enemies. AI systems execute strategies without panic or overconfidence. This discipline can enforce risk measures like stop-loss orders strictly. For example, if an AI’s rules say sell at a 5% drop, it will do so unflinchingly – whereas a human might hesitate or second-guess, potentially leading to deeper losses.

- Data Crunching & Pattern Recognition: AI thrives on big data. Bots can ingest years of price history, technical indicators, on-chain data, and even social media sentiment. They might discover subtle correlations or patterns that humans overlook. For instance, an AI might learn that “when Bitcoin volume surges and a particular altcoin lags, that altcoin often jumps 10% within a day” – and trade on that insight. This ability to detect complex, non-intuitive patterns can yield creative strategies beyond standard technical analysis.

- Adaptive Learning: Advanced AI bots use techniques like deep learning and reinforcement learning to improve over time. A reinforcement learning bot, for example, will simulate thousands of trades and iteratively learn what works (earning rewards for profits). Over time, it might learn to optimize a strategy (say, how to optimally place limit orders in volatile markets). Unlike a static algorithm, an AI bot isn’t stuck with one playbook – it can rewrite parts of its playbook when the old one stops working, providing resilience in changing market conditions.

- Multitasking and Diverse Strategies: One AI platform can deploy multiple strategies simultaneously – trend-following, arbitrage, mean reversion, etc. – something a single human trader would struggle to manage. Bots can also monitor many markets at once. For example, an AI could be arbitraging price differences between exchanges, trend-trading on another asset, and scraping Twitter for sentiment cues all at the same time. This diversification can improve overall performance and reduce risk.

Risks and Limitations to Consider

While AI trading bots have compelling advantages, they come with important caveats:

- “Past Performance ≠ Future Results”: AI models are only as good as their data and assumptions. Many excel in backtesting (looking at historical data) but falter in live markets. As Glassnode analyst Brett Singer noted, in realistic conditions many AI bots “did not beat the market” and often rely on simplistic backtests that don’t hold up. In short, an AI might be great at recognizing yesterday’s pattern but could be blindsided by tomorrow’s entirely new scenario.

- Model Breakdown & Need for Oversight: Even a successful trading AI can fail abruptly if market regimes shift. For example, a bot trained on a bull market might keep “buying the dip” in a bear market – racking up losses. Without human oversight to intervene or retrain it, an AI can quickly spiral. “They are good at predicting the past but not the future,” as Kolmakhidze puts it, emphasizing that human judgment is still needed for long-term success. Think of an AI bot as a junior analyst: it works tirelessly and can handle grunt work, but a senior trader should still check its work.

- Complexity and Cost: The barriers to entry for truly effective AI trading can be high. Developing a proprietary AI algorithm requires expertise in machine learning, access to quality data, and computational resources. Many off-the-shelf “AI bots” are actually basic algorithms with a buzzword attached. For everyday traders, using AI often means trusting a third-party platform or bot, which comes with fees and sometimes a steep learning curve. Even user-friendly AI bots might require time to configure properly.

- False Sense of Security: There’s a psychological risk that traders might become over-reliant on AI and take undue risks, assuming the “bot knows best.” In reality, AI can make mistakes – even bizarre ones – especially if fed bad data or faced with unprecedented events. Over-trusting an AI (or using high leverage because “the bot is in control”) can end in disaster. Prudent traders use AI as a tool, not an infallible guide.

- Regulatory and Security Concerns: As AI agents become more autonomous (some even holding crypto in smart contracts), regulators have started paying attention. There are questions about accountability: If an AI algorithm manipulates the market or triggers a flash crash, who is responsible? Additionally, scams are on the rise with AI. Users must be wary of fake AI trading services or signals (e.g. deepfake videos of celebrities “endorsing” a trading bot). Always vet the credibility of any AI trading product. Stick to reputable platforms and understand how your bot works – avoid “black box” promises of guaranteed profits.

Bottom line: AI can greatly enhance crypto trading through speed, efficiency, and insights. But it’s not a replacement for strategy or due diligence. As one trader wisely said, AI won’t replace traders – but traders who use AI may replace those who don’t. The optimal approach is a symbiosis: human expertise sets the goals and risk limits, and AI provides firepower to execute and adapt.

Next, let’s examine some of the top AI crypto trading bots available today, and see how they stack up in terms of features, pros/cons, and who they’re best suited for.

Top AI Crypto Trading Bots

Not all trading bots are created equal. Some are feature-rich with cutting-edge AI, while others focus on simplicity or specific strategies. Below we compare several top-performing AI crypto trading bots – highlighting their pros, cons, and ideal users. These platforms have gained popularity for combining automation with AI or smart algorithms to help traders up their game.

1. Cryptohopper

Cryptohopper is a well-known AI-powered trading bot that caters to both beginners and advanced traders. It runs in the cloud and connects to major exchanges.

- Beginner-friendly: Pre-built templates and copy-trading features allow you to mirror strategies from top traders

- Advanced AI capabilities: Algorithmic Intelligence learns from your strategies and adapts to market changes automatically

- Comprehensive toolkit: Strategy design, simultaneous backtesting, and cross-exchange arbitrage support

- Multi-exchange management: Trade multiple cryptocurrencies across different exchanges from one unified interface

- No coding required: Get started immediately without programming knowledge

- Steep learning curve: The extensive feature set can be overwhelming for new users

- Complex optimization: Properly configuring AI and bots requires time and understanding

- Tiered pricing limitations: Advanced features like arbitrage and market-making require higher subscription plans

- No guaranteed results: AI optimization doesn’t ensure profits—active strategy monitoring remains essential

- No-code automation seekers: Traders wanting AI-assisted automation without programming

- Intermediate traders: Users who actively refine strategies while the platform handles execution and adaptation

- Multi-exchange users: Those managing portfolios across multiple trading platforms

- Strategy experimenters: Traders testing diverse bot strategies (trend-following, arbitrage, etc.) simultaneously

2. 3Commas

3Commas is a powerful and widely-used crypto trading bot platform known for its advanced trading tools. While not explicitly an “AI bot” in the way it’s marketed, it offers smart automation features and can integrate signals that emulate AI decision-making.

- Extremely customizable: Set up complex trade bots (grid bots, DCA bots, options bots, etc.) and fine-tune every parameter to match your strategy

- Multi-exchange trading: Manage trades across multiple exchanges from one unified interface with comprehensive portfolio tracking

- Robust analytics: Advanced performance tracking and analytics tools help experienced traders continuously optimize their strategies

- Signal marketplace: Access a marketplace to subscribe to trading signals or bot configurations, including AI-powered insights from third parties

- Professional toolkit: Provides all the tools needed to build or implement sophisticated trading strategies

- Affordable pricing: Starting around $15/month makes advanced automation accessible to more traders

- Not beginner-friendly: The platform can be overwhelming for users without prior trading or coding experience

- Steep learning curve: Mastering the strategy builder requires significant time and effort

- Requires ongoing management: Bots need constant tweaking as market conditions change—not a “set and forget” solution

- No native AI learning: The platform doesn’t learn on its own; leveraging AI requires integrating external signal sources or your own models

- Seasoned traders and quants: Those with solid trading knowledge willing to invest time in mastering the platform

- Control enthusiasts: Traders who desire full control over their automated strategies with deep customization options

- Day traders: Active traders who need fine-grained control over execution across multiple exchanges

- Large investors: Portfolio managers requiring professional-grade tools for sophisticated strategy implementation

- Graduating traders: Those moving from simpler bots to professional-grade automation platforms

3. Pionex

Pionex is a unique player – it’s actually a cryptocurrency exchange that comes with 16 free built-in trading bots accessible to all users. It’s very popular among retail traders for its low fees and integrated automation, including some AI features.

- Beginner-friendly and free: Zero upfront cost with access to a complete suite of trading bots (grid trading, DCA, arbitrage, trailing stop, etc.)

- Automated strategy handling: Pionex manages the complex strategy work—you simply set basic parameters

- PionexGPT AI assistant: AI-powered tool that suggests trading strategies based on current market data analysis

- Ultra-low trading fees: As an exchange, Pionex offers minimal fees making high-frequency bot trading cost-effective

- Simple interface: Deploy, pause, or adjust bots with just a few clicks

- Multi-bot capability: Run multiple bots simultaneously across different cryptocurrencies

- Platform-locked trading: Must trade exclusively on Pionex’s exchange, which may not suit traders committed to other platforms

- Limited customization: Built-in bots follow preset logic with less flexibility for custom strategy design compared to platforms like 3Commas or Cryptohopper

- Fixed bot logic: Grid and arbitrage bots operate on predetermined algorithms with minimal modification options

- Advisory AI only: PionexGPT provides suggestions but won’t autonomously learn or modify your bots—implementation requires manual action

- New traders: Those wanting to explore automated trading without coding knowledge or subscription fees

- Casual traders: Users seeking straightforward, pre-made trading strategies without complex setup

- Grid trading enthusiasts: Traders who prefer simple grid trading or basic arbitrage strategies packaged accessibly

- Cost-sensitive users: Budget-conscious traders who want free bot access with only standard trading fees

- Entry-level automation: Perfect as a first step to experience AI-assisted crypto trading through ready-made tools

4. Coinrule

Coinrule is a popular no-code crypto trading platform that isn’t an AI bot per se, but it enables automation with an easy interface and has started integrating AI-driven market insights into its templates. It deserves mention as a bridge between manual and AI trading.

- User-friendly rule builder: Create trading rules using plain language and dropdown menus with zero programming required (e.g., “If Bitcoin drops 5% in a day, then buy X amount”)

- Pre-built templates: Extensive library of ready-made rule templates perfect for beginners, including “Buy the Dip” and “Trailing Take Profit” strategies

- Backtesting capabilities: Test your strategies against historical data to evaluate potential performance before going live

- Weekly market insights: Team-provided market analysis and strategy ideas, some incorporating AI analytics like scoring systems for momentum strategies

- Wide platform support: Manage automation across numerous exchanges and DeFi protocols, supporting both centralized and decentralized platforms

- No self-learning AI: Bots follow your set rules without autonomous adaptation—strategies require manual updates as market conditions change

- Static rule execution: Rules remain unchanged until you manually modify them, risking outdated strategies in dynamic markets

- Limited for advanced traders: Less complex than custom-coded bots or sophisticated platforms, potentially restricting advanced users

- High-frequency limitations: Intricate logic and high-frequency trading strategies can be challenging to implement with the rule builder

- Expensive premium tiers: Top-tier plans offering more simultaneous rules come with steep pricing

- No-code traders: Those wanting trading automation without programming skills, preferring guided, simple experiences

- Strategy implementers: Users with specific trading ideas (like “sell half my Ether if price jumps 10% in an hour”) but lacking coding knowledge

- Part-time traders: Traders who want to establish safeguards or opportunistic rules and run them passively

- Educational stepping stone: Beginners learning automation who may eventually graduate to more complex AI-driven platforms

- Rule-based strategists: Those comfortable with if-then logic who want straightforward automation for specific market scenarios

Other Notable Bots:

- Bitsgap: A versatile platform known for its smart arbitrage and grid bots. It provides a unified interface to trade on multiple exchanges with automation. Good for moderate to advanced users; not explicitly an AI bot, but quite powerful for semi-automated strategies and portfolio management.

- HaasOnline: An advanced bot solution (with options for running on your own server) favored by professionals. It offers algorithmic trading with a drag-and-drop strategy builder and supports scripting. High flexibility, but best for those with technical know-how.

- Stoic by Cindicator: An app-based crypto trading bot powered by AI (it uses hedge-fund style AI strategies). It’s very hands-off – you basically allocate funds and Stoic’s AI manages a balanced portfolio for you. Ideal for long-term holders who want AI guidance with minimal effort, though it’s less transparent about strategy.

- Hummingbot: Open-source and free, Hummingbot is popular for DIY quant traders and liquidity providers. It isn’t plug-and-play – you need to configure it via code or config files – but it’s extremely powerful for market making and arbitrage. Some users enhance Hummingbot with their own AI models (via a plugin called FreqAI), which is an emerging trend for developers.

Each bot has its unique strengths. When choosing, consider your skill level, budget, and trading goals. A casual investor might start with a simpler, low-cost option like Pionex or Coinrule. A professional looking to exploit market micro-structure might go for 3Commas or even code a custom bot. Always start small and test – find what fits your style.

Real-World Examples and Use Cases

To ground things in reality, let’s explore a few concrete examples of AI in crypto trading:

- Market Making and Liquidity Provision: Firms like Gravity Labs use AI-driven bots to act as market makers on exchanges. These bots place buy and sell orders 24/7 and dynamically adjust spreads using AI to manage risk. The result is smoother trading experiences – even during high volatility, AI market makers help prevent order books from drying up. This is a critical behind-the-scenes use of AI that most retail traders benefit from without realizing – tighter spreads and better liquidity thanks to bots “with brains” maintaining the marke.

- Arbitrage and Cross-Exchange Trading: Crypto prices can vary slightly across exchanges. AI trading systems excel at arbitrage – buying on one exchange and selling on another almost simultaneously to profit from price differences. For example, in 2024 an AI bot might detect that on Exchange A, Ether is $10 cheaper than on Exchange B. It will instantly buy on A and sell on B for a near risk-free profit, accounting for fees. Humans doing this manually would be too slow. Some sophisticated hedge funds run AI arbitrage bots that also factor in transfer times, blockchain fees, and even predict when price gaps are likely to occur.

- Sentiment Trading Around News: Imagine a sudden tweet by a prominent figure or a breaking news story (say a regulatory announcement). AI systems plugged into newsfeeds and Twitter can analyze the sentiment and keywords within seconds. For instance, an AI might “read” a tweet by Elon Musk hinting at Dogecoin and determine the sentiment is positive – it could immediately place buy orders for Doge before most human traders have finished reading the tweet. This happened frequently in 2021–2023; now in 2024, such AI-driven news trading is even more prevalent. Some bots close positions just minutes later for a quick profit once the news-driven spike fades.

- Portfolio Rebalancing for Investors: Not all AI trading is about rapid in-and-out trades. Some crypto investment apps use AI to periodically rebalance a portfolio to maintain target allocations. For example, if your goal is 50% Bitcoin, 30% Ether, 20% others, an AI can monitor prices and trade to top-up or trim positions as needed. It might also utilize AI forecasts to tilt the portfolio – e.g. if AI predicts Ether has higher short-term upside, it might temporarily increase Ether allocation. This provides a more dynamic management than a fixed monthly rebalance schedule a human might use.

- Risk Management and Fraud Detection: Exchanges are employing AI to monitor trading activity for anomalies. For example, if someone’s trading bot malfunctions and starts executing erratic orders, AI can flag this before it causes a flash crash. Additionally, AI can detect patterns indicative of wash trading or manipulation and alert compliance teams. While this is more about exchange operations, it’s a crucial use case to make markets safer as AI trading grows.

These examples show AI’s versatility – from high-frequency strategies to safer long-term investing and operational security. They also highlight that AI adoption spans retail hobbyists, professional traders, and exchanges alike.

The Future of AI in Crypto Trading: What’s Next?

As we look ahead, AI is set to become even more entwined with the crypto world. Here are some forward-looking insights:

- Proliferation of Autonomous “Agent” Traders: We’re moving toward a scenario where entire classes of trading entities are AI agents operating on blockchain. By late 2024, some experts predicted we could see up to one million AI agents on blockchain networks by 2025 doing various economic tasks (trading, investing, lending) autonomously. This “agentic finance” paradigm means your trading opponent or partner might increasingly be an AI. Projects are already working on standards for on-chain AI identity and reputation, so that AI agents can trust and trade with each other. It’s both exciting and a bit sci-fi – an emerging economy of AI agents transacting value without human intervention.

- Integration with DeFi and DEXs: AI crypto trading is not just for centralized exchanges. Decentralized finance (DeFi) will see more AI-driven strategies as well. Imagine AI-managed liquidity pools that adjust fees or token ratios based on market conditions, or AI-run decentralized hedge funds where anyone can contribute capital and an AI agent allocates it across DeFi yield farms and trades. Even Changpeng Zhao (CZ) highlighted that a simple AI trading agent combined with a privacy-focused DEX could be a game-changer, potentially helping DEX volumes one day overtake centralized exchange volumes. We’re already seeing early versions of this, like on-chain trading competitions between AIs.

- Regulatory Evolution: With AI handling more financial decisions, expect increased regulatory scrutiny and perhaps new rules. Regulators might require AI trading algorithms (especially at big firms) to be tested under stress scenarios to prevent systemic risks. There may be guidelines on using AI for retail trading advice (to prevent misuse or over-promising). Conversely, regulators might use AI themselves to monitor markets – an AI policing other AIs for signs of manipulation. Ensuring transparency of AI decisions (“why did the bot do that trade?”) could become a hot topic, potentially spurring development of explainable AI in trading.

- More Accessibility and Education: As competition grows, AI trading tools will likely become more user-friendly and widely accessible. We might see built-in AI advisors on major exchanges (some, like Binance and Coinbase, are already exploring AI-help features on their platforms). Education will play a key role – crypto communities and platforms are starting to teach users how to leverage AI responsibly. In the near future, learning to use an AI trading bot might be as common as learning technical analysis is today. Resources to simulate AI strategies in a sandbox before using real money will likely expand, helping demystify the technology for newcomers.

- Improved AI Models: The AI models themselves are rapidly evolving. Today’s trading bots might use fairly standard machine learning, but tomorrow’s could use more advanced architectures (like GPT-style transformers for sequence prediction or more powerful reinforcement learning models). This could enhance their ability to handle complex scenarios. We may also see hybrid human-AI models – for instance, an AI that actively asks a human for input when it’s unsure (“Should I proceed with this trade? Y/N”). Such human-in-the-loop designs can combine AI efficiency with human intuition for critical decisions.

In essence, the future of crypto trading may involve less of the traditional screen-staring day trader and more of the tech-augmented investor. Some traders will focus on strategy and let their personal AI handle execution. Others might subscribe to AI-driven funds. And for those who prefer full control, tools will exist to custom-train your own mini “hedge fund in a box.” It’s an exciting frontier – but remember that the core principles of trading remain: due diligence, risk management, and continuous learning.

Conclusion: Navigating the AI-Empowered Crypto Frontier

AI is undeniably transforming crypto trading, opening doors to opportunities that simply didn’t exist a few years ago. From rapid-fire bots arbitraging away price gaps to intelligent agents managing our portfolios, the marriage of AI and crypto is creating a new financial landscape. As with any powerful technology, there’s both promise and peril.

For traders and investors, the key is to embrace the useful tools AI offers without abandoning common sense and caution. Do your research before using any AI trading system, start with small amounts, and treat results (good or bad) as feedback to learn from. Leverage AI for what it’s great at – crunching data, executing fast, staying disciplined – but continue to apply human oversight, creativity, and skepticism – qualities that remain uniquely valuable.

The future likely holds a more collaborative human-AI trading environment. Imagine having a personal AI assistant that knows your preferences, constantly scans the crypto markets for you, and alerts you with “hey, I’ve spotted a potential setup or a risk you should look at.” In fact, that future is almost here. By staying informed and adaptable, you can make AI your ally in the crypto markets.

As we unveil this future, remember that technology is a means, not an end. The goal is better trading outcomes and financial well-being. If used wisely, AI can help achieve that – it can be the compass and engine in your crypto journey, but you remain the captain. The crypto world has always been about innovation and empowerment, and AI crypto trading is the next chapter in that story. It’s time to turn the page, with eyes open and mindset ready for the opportunities ahead.

[The above content is for educational purposes and does not constitute financial advice. Always conduct thorough research or consult a professional before using AI trading tools or making investment decisions.]

FAQ

What is AI crypto trading?

AI crypto trading uses artificial intelligence algorithms to analyze cryptocurrency markets and execute trades automatically. These systems process large volumes of data—price movements, indicators, news, and social sentiment—to make fast decisions. AI trading typically involves bots or software that learn from market patterns and adapt strategies, aiming to improve efficiency, reduce emotional decisions, and identify opportunities humans may miss.

Do AI trading bots guarantee profits?

No, AI trading bots do not guarantee profits. They can automate strategies efficiently, but their performance depends on the underlying strategy and market conditions. Crypto markets are volatile, and bots can still make poor decisions if fed incorrect data or faced with unexpected events. Think of a bot like a calculator: it executes instructions perfectly, but the output depends on the input. Successful AI trading still requires risk management and regular monitoring.

Which is the best AI crypto trading bot?

There is no single “best” bot—your choice depends on your goals and experience level. Cryptohopper is popular for its AI-driven features and ease of use. 3Commas suits advanced users who want more customization and AI signal integration. Pionex is beginner-friendly with free built-in bots, while Coinrule is ideal for no-code automated rules. Other strong options include Bitsgap, HaasOnline, and Stoic. Try free trials or demo modes before choosing a long-term tool.

How can a beginner start with AI crypto trading?

If you’re new to AI crypto trading, start small and simple:

1. **Educate Yourself:** Learn how trading bots work and understand terms like grid trading, arbitrage, and stop-loss. A basic foundation helps you use any tool more effectively.

2. **Choose a Beginner-Friendly Platform:** Platforms like Pionex (ready-made bots) or Coinrule (no-code rules) are ideal for beginners.

3. **Use Demo or Paper Trading:** Many bots offer simulation modes where you can test strategies without risking real money.