Trading 212 is a popular online brokerage platform that offers various investment products, including Invest, CFD, and ISA. With over 1.4 million registered traders in the European Union, Trading 212 has established itself as one of the leading online brokerages.

The primary sources of income for Trading 212 include profits from spreads, stock lending, overnight and weekend fees, and conversion fees. These revenue sources contribute to the company’s financial sustainability and profit generation strategies.

Key Takeaways:

- Trading 212 generates income through spreads, stock lending, overnight and weekend fees, and conversion fees.

- The Invest product offers commission-free trading on stocks and ETFs.

- The CFD product allows trading on various assets like forex, stocks, commodities, and indices.

- Trading 212’s ISA account provides tax-sheltered investing in stocks and ETFs without administration fees.

- The company also earns interest from stock lending and charges fees for holding CFD positions open and currency conversion.

How Does Trading 212 Make Money?

Trading 212, a prominent online brokerage, employs a multifaceted approach to generate revenue, sustaining its operations and providing a platform for over 1.4 million traders within the European Union. Let’s unravel the intricate financial mechanisms that fuel the success of Trading 212.

At the heart of Trading 212’s revenue model lies the concept of spreads. Spreads represent the difference between the buying (bid) and selling (ask) prices of financial assets. Traditionally, Trading 212 relied on referral fees from affiliate partners. However, since May 2021, the platform independently manages its trading volume, retaining the entire spread. This transition underscores the platform’s commitment to risk management, ensuring it can compensate traders in the event of highly leveraged trades.

The Invest product allows users to trade over 10,000 stocks and ETFs without paying commission. The CFD product enables users to trade contracts for difference on assets such as forex, stocks, commodities, and indices. Trading 212’s ISA product is a tax-sheltered account that allows users to invest in stocks and ETFs without administration fees.

Another avenue contributing to Trading 212’s revenue stream is stock lending. Through this practice, the platform utilises the shares owned by its customers, lending them to other institutions in exchange for interest. The lent shares act as collateral, supported by US Treasury Bonds held in a third-party account. This strategic move not only diversifies income but also adds a layer of security to the platform’s financial structure.

For CFD (Contracts for Difference) traders on Trading 212, overnight and weekend fees, also known as interest swap rates, play a significant role. When users hold positions overnight or through the weekend, they pay a quasi-interest on the funds lent by Trading 212 to keep these positions open. The swap rate, influenced by factors such as the type of asset, position, and overall trading volume, reflects the dynamic nature of this revenue stream.

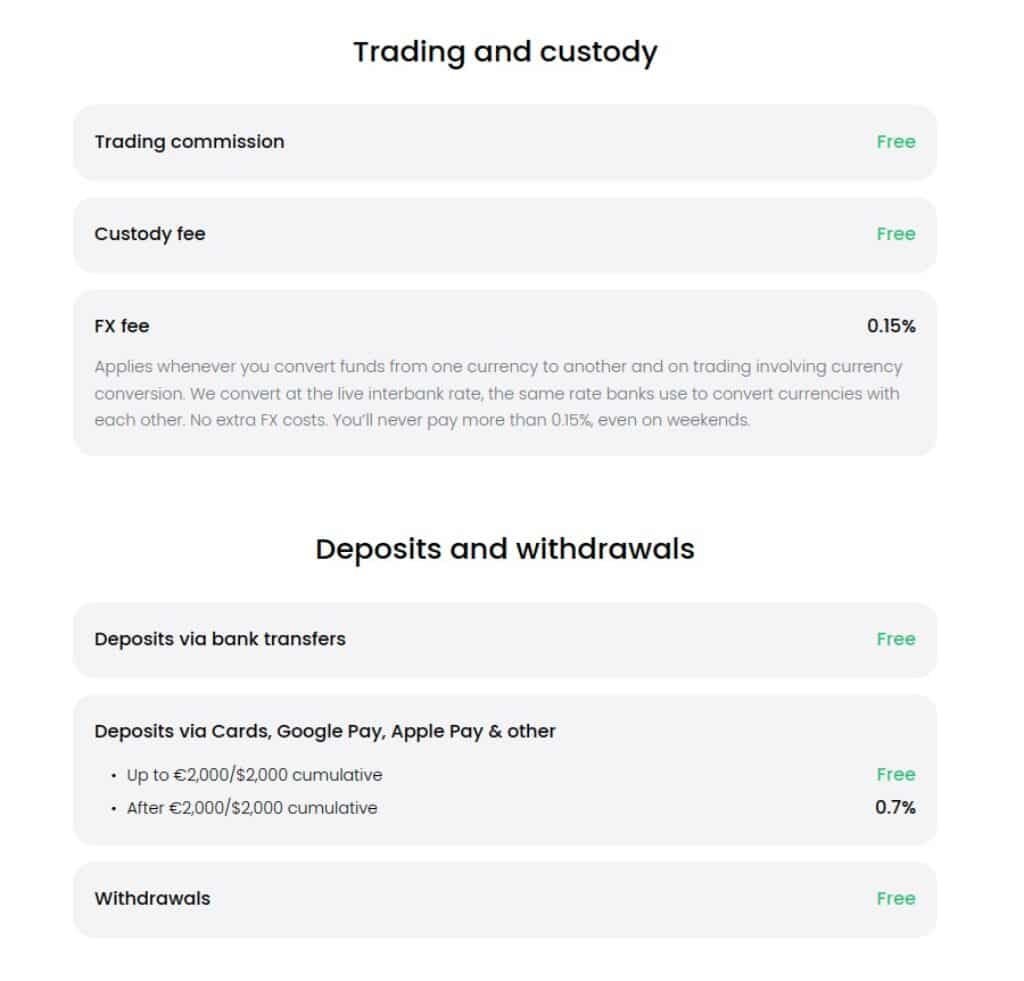

Introducing currency conversion fees in April 2021 was another strategic move by Trading 212. These fees are applied when trading in a currency different from the account’s default, contributing to the platform’s overall revenue. The fees are set at 0.15% for Invest and ISA accounts, and 0.5% for CFDs. Despite these charges, Trading 212 maintains a competitive edge, offering one of the lowest conversion fees among UK-based online brokerages.

Examining Trading 212’s cost structure, while it once boasted a zero-commission trading model, the platform does incur certain fees. These include charges for trades in a different currency, credit/debit card deposits, and Apple/Google Pay deposits, among others. Stamp duty is also applicable to share and ETF purchases. Additionally, there’s a hint of potential premium services in the future, indicating avenues for further revenue generation.

In conclusion, Trading 212’s revenue generation is a symphony of spreads, stock lending, overnight and weekend fees, and currency conversion charges. This diversified approach, coupled with transparent fee structures, positions Trading 212 as a robust and sustainable online brokerage, navigating the complexities of the financial landscape while providing valuable services to its extensive user base.

Exploring Trading 212’s Cost Structure

Trading 212’s cost structure is a nuanced landscape where traders encounter various fees and charges. While the platform once touted a zero-commission trading model, understanding the intricacies of its current cost framework is crucial for users seeking transparency in their financial transactions.

One notable aspect of Trading 212’s cost structure is the 0.15% charge for trades conducted in a currency different from the account’s default. This fee ensures that users are aware of the currency implications when engaging in trades across borders. While this may seem nominal, it plays a pivotal role in the overall financial considerations for traders.

In the realm of share dealing and holding stocks within an ISA, Trading 212 distinguishes itself by imposing no charges. This no-fee approach aligns with the platform’s commitment to offering a cost-effective environment for investors, particularly those utilising the tax-sheltered ISA product.

Currency conversion fees represent another dimension of Trading 212’s cost structure. With a rate of 0.5%, these fees come into play when users trade CFDs in a currency different from their default account currency. This fee ensures the platform’s competitiveness in the market, with Trading 212 positioning itself as one of the UK-based online brokerages offering some of the lowest conversion charges.

Bank transfer deposits stand out as a no-charge feature within Trading 212’s cost structure. This user-friendly approach accommodates traders who prefer the security and convenience of bank transfers without incurring additional fees. The absence of charges for bank transfers is a strategic move to attract a diverse range of traders with varying preferences.

Credit and debit card deposits, as well as Apple/Google Pay deposits, incur a 0.70% charge on amounts exceeding £2,000. While this represents a nominal percentage, it’s a notable aspect of Trading 212’s cost structure, especially for users engaging in larger transactions. This fee structure encourages users to consider alternative deposit methods for more cost-effective transactions, aligning with the platform’s commitment to providing choices that suit individual preferences.

Stamp duty, a traditional cost associated with share and ETF purchases, is part of Trading 212’s cost structure. While not directly imposed by the platform, users must be aware of this external fee when engaging in certain transactions. This fee adds a layer of consideration for investors, particularly those involved in the purchase of shares and ETFs.

Looking ahead, there’s a subtle indication within Trading 212’s cost structure that additional ‘premium’ services may be introduced. While details are currently sparse, this hints at potential future costs for users seeking access to enhanced features or services beyond the standard offerings. The anticipation of such premium services aligns with the platform’s strategy to evolve and potentially diversify its revenue streams.

How Does Trading 212’s Market Maker Model Work?

Trading 212 operates as a market maker broker with a unique hybrid model that combines elements of a market maker and a no dealing desk (NDD) service. As a market maker, Trading 212 acts as the counterparty to clients’ orders, matching buyers and sellers internally on its order book. This model allows for efficient execution and quick order filling, ensuring a seamless trading experience for users.

The order book matching process involves aggregating and matching orders from different clients, resulting in netted-off positions. This means that Trading 212 may profit when traders lose on their trades, but it is not guaranteed. The outcome depends on the timing and closure of positions, as orders can be paired and offset, resulting in a complex net position for the broker.

Transparency is a key aspect of Trading 212’s market maker model. The company strives to provide traders with a clear understanding of its operations and regulatory environment. On its website, Trading 212 offers a comprehensive overview of its regulatory status and licenses, ensuring that traders have access to all the necessary information before making trading decisions.

Trading Fees and Other Charges

Trading 212 aims to keep trading fees to a minimum, making it an attractive option for retail traders. The broker does not charge inactivity fees for accounts with funds, allowing traders to maintain flexibility in their trading activities. However, there are certain fees that traders should be aware of, including overnight fees and account funding fees.

Overnight fees are charged when traders hold CFD positions open beyond the trading day or over the weekend. These fees are applied to compensate for the costs incurred by the broker in facilitating overnight positions. Account funding fees may also be charged for deposits that exceed a certain amount or are made through specific payment methods.

Commission-Free Trading and Product Range

One of the key benefits of trading on Trading 212 is the availability of commission-free trading on certain assets. This allows traders to execute their trades without incurring additional costs, making it a cost-effective option. However, it is important to note that spreads and other fees may still apply.

Trading 212 offers a diverse range of products to cater to various trading preferences. Apart from CFD trading, the platform also provides access to forex trading, allowing traders to speculate on currency price movements. With a wide range of currency pairs available, traders can take advantage of market opportunities in the forex market.

| Trading Fees | Inactivity Fee | Overnight Fee | Account Funding Fee | Commission-Free Trading |

|---|---|---|---|---|

| Low trading fees | No inactivity fees | Charged for holding CFD positions open overnight or over the weekend | May be charged for deposits exceeding a certain amount or made through specific payment methods | Commission-free trading available on certain assets |

Conclusion

In conclusion, Trading 212 offers a user-friendly platform that provides ample investment opportunities for traders. With options to trade stocks, engage in CFD trading, and take advantage of the tax benefits offered by their ISA account, users have a variety of options to suit their investment preferences.

One of the standout features of Trading 212 is their commission-free trading on select assets, making it an attractive choice for new traders looking to enter the market. Their aim is to make trading accessible to retail traders, ensuring that everyone has an opportunity to participate.

However, it is important to note the risk factors associated with CFD trading and the volatile nature of the Forex market. While Trading 212 provides a seamless and convenient trading experience, it is crucial for traders to fully understand the potential risks involved before engaging in these activities.

Overall, trading with Trading 212 offers a comprehensive trading experience with a focus on user-friendly features, accessibility, and a wide range of investment options. Whether you’re interested in stocks trading, CFD trading, or taking advantage of their ISA account, Trading 212 provides a platform that caters to diverse trading needs.

FAQ

How does Trading 212 make money?

Trading 212 generates income from various sources, including profits from spreads, stock lending, overnight and weekend fees, and conversion fees.

What is Trading 212's market maker model?

Trading 212 operates as a hybrid market maker broker with NDD (No Dealing Desk) service. This means that it acts as a counterparty to clients’ orders and matches buyers and sellers internally on an order book.

What fees does Trading 212 charge?

Trading 212 charges numerous fees, including overnight fees for holding CFD positions open overnight or over the weekend, as well as account funding fees for deposits exceeding a certain amount or made through specific payment methods. However, they do not charge an inactivity fee for accounts with funds.

What investment products does Trading 212 offer?

Trading 212 offers a range of investment products, including Invest, CFD, and ISA. These allow users to trade stocks and ETFs without commission, trade contracts for difference (CFDs) on various assets, and invest in stocks and ETFs tax-free, respectively.

How many registered traders are there on Trading 212?

Trading 212 has over 1.4 million registered traders on its platform, making it one of the leading online brokerages in the European Union.

Does Trading 212 offer commission-free trading?

Yes, Trading 212 offers commission-free trading on certain assets, allowing users to trade without paying any additional fees.

What risks should I consider when trading with Trading 212?

While Trading 212 provides a user-friendly platform for trading, it’s important to consider the risks associated with CFD trading and the volatile nature of forex markets. It’s essential to understand these risks and have a proper risk management strategy in place.

What assets can I trade on Trading 212?

Trading 212 provides access to a wide range of assets for trading, including stocks, ETFs, forex, commodities, and indices.

Can I invest tax-free with Trading 212?

Yes, Trading 212’s ISA product allows users to invest in stocks and ETFs tax-free, without paying administration fees.