Swing trading in 2025 demands agility, precision, and the right stock picks. This strategy thrives in volatile markets, making India’s dynamic equity landscape a fertile ground for short-term trades. However, when it comes to the selection of the best, even the best of the traders seek a little guidance from experts. In this guide, I will break down the 5 best stocks for swing trading in India in 2025, listed down based on liquidity, volatility, technical setups, and industry momentum.

Top 5 Swing Trading Stocks in India – 2025

| Stock | Symbol | Pattern | Target | Duration |

|---|---|---|---|---|

| Tata Motors | TATAMOTORS | Cup & Handle | 8-12% | 5-7 days |

| ICICI Bank | ICICIBANK | Triangle Breakout | 5-8% | 3-6 days |

| Infosys | INFY | Bollinger Squeeze | 4-6% | Earnings |

| Adani Enterprises | ADANIENT | Mean Reversion | 10-15% | Sessions |

| Zomato | ZOMATO | Breakout-Retest | 6-9% | 4-5 days |

Why Swing Trading Is Still Relevant in 2025?

Swing trading has not only survived but thrived in today’s fast-paced, algorithm-driven markets. With the right approach, it allows traders to profit from small but significant price movements without getting trapped in the daily noise of intraday charts.

According to Vikram Batra, a senior equity strategist at MorganFront,

“Swing trading capitalizes on short bursts of momentum, often riding trends that fundamental analysts miss. In today’s market, that agility is a significant edge.”

Additionally, the rise of high-quality technical screeners and real-time news platforms makes it easier than ever to spot setups, track indicators, and execute precise trades with confidence.

Key Criteria for Selecting Swing Trading Stocks

| Criteria | Importance for Swing Traders |

|---|---|

| Liquidity | Ensures tight spreads and easy entry/exit |

| Volatility | Allows meaningful price movement within days |

| Technical Setup | Flags breakouts, support-resistance, etc. |

| Sector Momentum | Outperforming sectors tend to drive faster gains |

| News Sensitivity | Triggers short-term price action |

The stocks highlighted in this list have been chosen not only because of their historical performance but also for their responsiveness to technical indicators, sectoral momentum, and short-term trading catalysts.

5 Best Stocks for Swing Trading in India in 2025

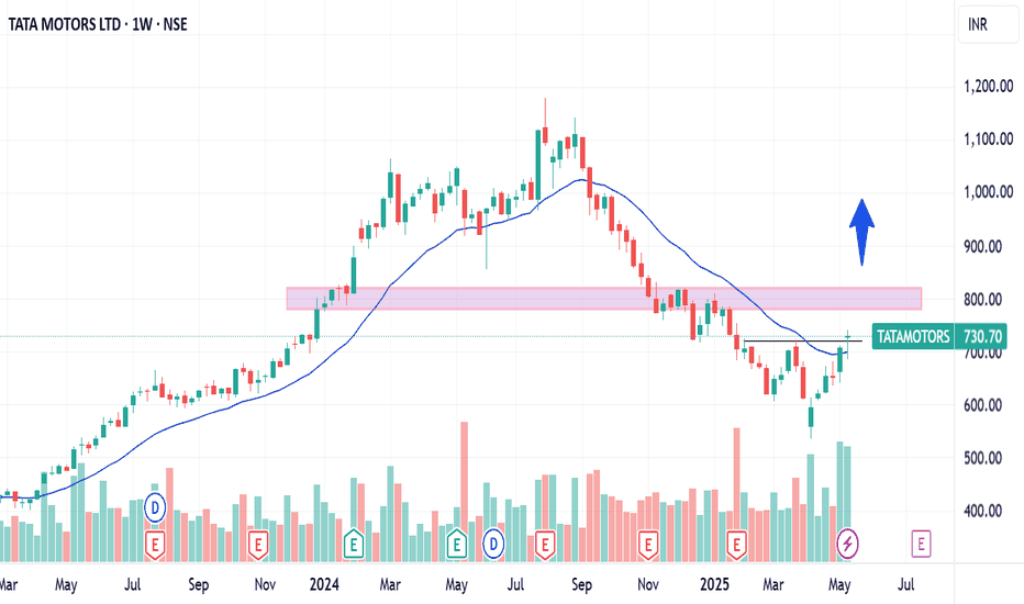

1. Tata Motors (NSE: TATAMOTORS)

- Why it fits: High volatility with sustained uptrends

- Chart pattern: Cup-and-handle, with RSI support

- Swing outlook: Potential 8–12% movement in 5–7 trading days

Tata Motors has consistently maintained its position as a high-beta stock, ideal for momentum-based swing strategies. The company’s aggressive push into electric vehicles and its dominant presence in both domestic and international markets have made it a favorite among traders. Short bursts of buying interest often triggered by product launches or EV adoption data and create identifiable technical breakouts with enough volume to support short-term positions.

The stock typically respects moving averages like the 21-EMA and shows strong reactions around psychological levels. Traders often find it responding predictably to support zones, making it easier to frame stop-loss and exit strategies. This reliability in technical behavior has made Tata Motors a textbook swing candidate, even amid broader market corrections.

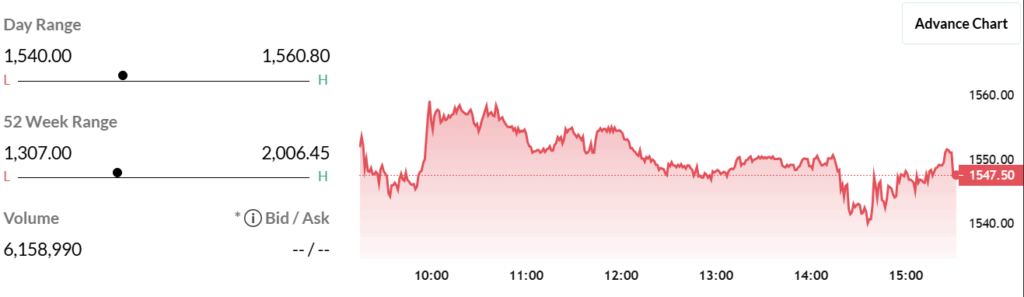

2. ICICI Bank (NSE: ICICIBANK)

- Why it fits: Dense liquidity and consistent trend reversals

- Chart pattern: Ascending triangle breakout

- Swing outlook: A 5–8% swing in 3–6 days, typically post-F&O expiry

ICICI Bank offers a rare blend of stability and tradable volatility. It consistently shows symmetrical chart setups ahead of RBI policy decisions or financial results, attracting attention from both retail and institutional players. The large volume base ensures that price action is clean and slippage is minimal which provides a critical advantage for swing traders executing multiple trades per month.

Also, the banking sector has shown a clear pattern of rotation in 2025. During this cycle, ICICI Bank has often led the pack in terms of breakout momentum. Its strong fundamentals also serve as a safety net, ensuring that downside risk is somewhat contained, even when broader sentiment turns cautious.

3. Infosys (NSE: INFY)

- Why it fits: Prone to short-term volatility despite a stable long-term base

- Chart pattern: Bollinger Band squeeze with MACD crossover

- Swing outlook: Target zones of 4–6% post-earnings release

Infosys, one of India’s IT giants, becomes a prime swing candidate every quarter around earnings announcements. The stock tends to compress within tight Bollinger Bands, then expands rapidly after the earnings reaction: up or down, and thus making it suitable for both long and short swing trades. These reactions often align with MACD crossovers, which further validate entry signals.

Another advantage is its responsiveness to global tech cues. As U.S. tech earnings influence Indian IT stocks, traders can often anticipate movement in Infosys by observing Nasdaq behavior. Additionally, even during lull periods, the stock forms technical patterns like flags and pennants, offering swing entries with defined risk levels.

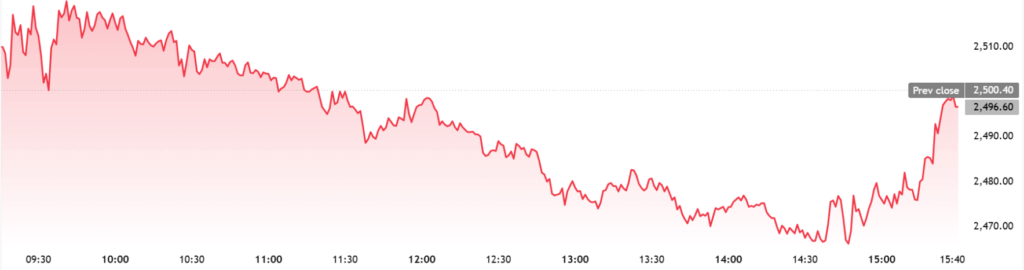

4. Adani Enterprises (NSE: ADANIENT)

- Why it fits: Sharp corrections followed by aggressive recoveries

- Chart pattern: Mean reversion plays, often within Fibonacci levels

- Swing outlook: Capable of 10–15% moves in volatile sessions

Adani Enterprises remains one of the most talked-about and volatile large-cap stocks in India. Its dramatic moves—often spurred by news, regulatory changes, or group-level developments—make it ideal for seasoned swing traders. The stock exhibits strong V-shaped recoveries and sharp retracements, which can be exploited using Fibonacci retracement levels.

However, timing and discipline are critical. Unlike fundamentally stable stocks, Adani Enterprises reacts swiftly to both news and sentiment, meaning a well-defined entry and exit plan is essential. Many traders use gap-fill strategies or trendline breaks to identify opportunities, and the liquidity ensures that even large trades can be executed without much slippage.

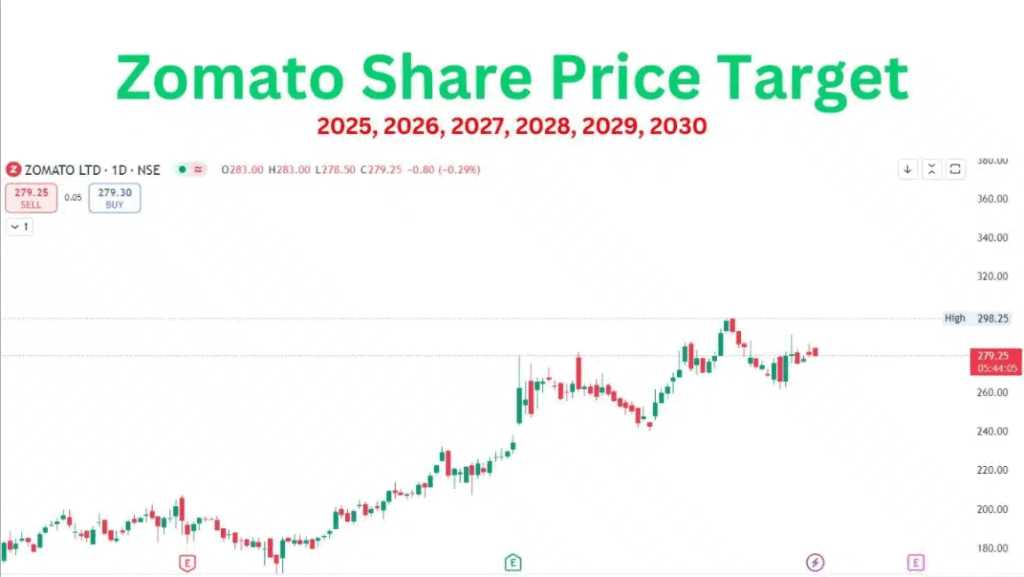

5. Zomato (NSE: ZOMATO)

- Why it fits: Retail-driven momentum and frequent news catalysts

- Chart pattern: Breakout-retest formation

- Swing outlook: 6–9% return over 4–5 sessions, especially post-GST updates or results

Zomato has evolved from a speculative startup to a mid-cap momentum darling. The stock sees heavy retail participation, and its price frequently reacts to regulatory news, order growth metrics, or even food-tech sector commentary. These events create high-probability trade setups—particularly when the stock breaks out of consolidation zones on high volume.

In 2025, food delivery platforms like Zomato are facing both opportunities and challenges. This duality generates volatility, which can be harnessed effectively by swing traders. The stock’s behavior around round-number resistance levels and moving averages like the 50-DMA allows for tight risk-reward strategies, especially in short trade windows.

Tools and Services for Smarter Swing Picks

| Tool/Service | Key Features |

|---|---|

| Chartink | Real-time filters, technical patterns, free access |

| TradingView | Advanced indicators, social sharing, alert systems |

| Screener.in | Fundamental screening with custom filters |

| Tickertape | Sentiment analysis, broker forecast integrations |

These platforms are not just for professionals. Retail traders seeking the best stock screener for swing trading can configure filters for RSI, volume breakout, and moving average crossovers with just a few clicks. Additionally, services like Equitymaster and MarketsMojo often provide curated lists of best stocks to swing trade today, complete with entry and stop-loss levels.

Conclusion

The best stocks for swing trading change with market cycles, but the principles remain the same: volatility, liquidity, and technical clarity. Whether riding the breakout in ICICI Bank or catching a quick mean reversion in Adani Enterprises, success hinges on preparation and execution. Swing trading is not gambling—it is a game of probabilities backed by technical rationale.