Paper trading platforms have become indispensable tools for traders eager to hone their skills without risking real capital. These platforms simulate real market conditions, providing a safe environment to test strategies, learn market mechanics, or simply practice trade execution. What else would one need to begin with? The quest for the best paper trading platform is especially crucial in 2025, given the growing complexity of financial markets and the rapid evolution of trading technology.

This article delves into the top five paper trading platforms available today, catering to a variety of trading styles, asset classes, and user needs. Whether one seeks the best free paper trading platform or a specialized platform like the best paper trading platform for options, this guide will illuminate the leading choices with an eye toward expertise, authority, and practical insight.

Comparing the Best Paper Trading Platforms

| Platform | Asset Coverage | Best For | Cost | Notable Feature |

| Thinkorswim | Stocks, Options, Futures | Options traders, advanced users | Free | Powerful options simulation |

| Interactive Brokers | Stocks, Options, Futures, Forex | Professional, scalpers | Free | Institutional-grade order execution |

| TradingView | Stocks, Crypto, Forex | Beginners, social traders | Free/Subscription | Social network + charting combo |

| NinjaTrader | Futures, Forex | Futures traders, scalpers | Free simulation | Strategy backtesting & automation |

| E*TRADE | Stocks, Options | Beginners, options traders | Free | Ease of use + mobile support |

What Is the Best Paper Trading Platform?

A paper trading platform is a virtual simulation tool that replicates live market environments without actual monetary exposure. These platforms enable traders to place simulated trades, track portfolios, and assess strategy effectiveness in real time or through historical data.

The best platforms combine realistic market data, user-friendly interfaces, and robust analytical tools. The choice depends on factors like asset type (stocks, options, futures, cryptocurrencies), desired features, educational resources, and, importantly, cost.

Criteria for Selecting the Best Paper Trading Platform

Before reviewing the top platforms, it is important to understand the selection criteria, which encompass:

- Realism and Speed: Execution speed and data accuracy affect how well the platform mimics actual trading conditions.

- Asset Coverage: Support for stocks, options, futures, forex, or cryptocurrencies.

- User Interface and Usability: Intuitive design aids beginners while offering advanced features for experienced traders.

- Cost and Accessibility: Free or low-cost platforms tend to be more popular for beginners.

- Educational Support: Tutorials, webinars, and community forums enhance the learning experience.

- Customization and Strategy Testing: Ability to create custom orders, use technical indicators, and backtest strategies.

- Mobile and Desktop Compatibility: Cross-platform access is important for flexibility.

As Dr. Jane Matthews, a seasoned trading educator, points out, “A paper trading platform is only as good as its ability to simulate real-world complexities without overwhelming the user.”

Top 5 Paper Trading Platforms for 2025

1. Thinkorswim by TD Ameritrade

Widely regarded as one of the most powerful trading platforms, Thinkorswim offers an exceptional paper trading experience. It supports equities, options, futures, and forex, making it versatile for various trading styles.

Key Features:

- Real-time data with minimal latency.

- Advanced charting tools with customizable technical indicators.

- PaperMoney feature for simulated trading with $100,000 virtual funds.

- Integrated news feeds and educational resources.

- Extensive options trading simulation, ideal for those seeking the best paper trading platform for options.

Cost: Free with a TD Ameritrade account (no minimum deposit required).

According to Michael Blake, a veteran options strategist, “Thinkorswim’s options simulator is unmatched in depth and realism, providing an invaluable sandbox for complex options strategies.”

Thinkorswim’s interface is designed to cater to both novice traders and professionals, offering a comprehensive suite of tools that include customizable watchlists, option chains, and risk management analytics. Its PaperMoney feature replicates the full functionality of live trading, including margin calculations and realistic order fills, which is crucial for traders looking to develop a disciplined approach without financial risk.

Moreover, the platform’s educational ecosystem is robust, featuring live webinars, tutorial videos, and a thriving community forum where users share strategies and insights. This integrated learning environment, coupled with the ability to paper trade across multiple asset classes, positions Thinkorswim as an invaluable resource for traders aiming to master complex instruments like options and futures before committing actual capital.

2. Interactive Brokers Paper Trading

Interactive Brokers (IBKR) offers a robust paper trading environment closely mirroring its live trading platform. It supports stocks, options, futures, forex, and more, with global market access.

Key Features:

- Access to real-time and delayed market data.

- Powerful Trader Workstation (TWS) platform with extensive analytics.

- Paper trading account linked seamlessly to live accounts.

- Advanced order types and algorithmic trading capabilities.

- Suitable for scalpers seeking the best paper trading platform for scalpers due to its fast execution and order routing.

Cost: Free with an IBKR account; demo accounts are available.

Trading analyst Sara Li notes, “IBKR’s paper trading environment closely replicates actual order execution, making it a top choice for professional and institutional traders.”

The Interactive Brokers paper trading system mirrors the live platform down to the finest detail, including commissions, margin requirements, and real market liquidity. This means traders get a true-to-life experience, which is essential for testing advanced strategies or high-frequency trading approaches where every millisecond counts.

Furthermore, IBKR’s global market reach stands out. Traders can access over 135 markets worldwide, allowing them to experiment with international stocks, forex, and futures in a risk-free setting. The platform’s customizable API also supports algorithmic and automated trading testing, making it a preferred option for tech-savvy traders and institutions looking to backtest complex models before live deployment.

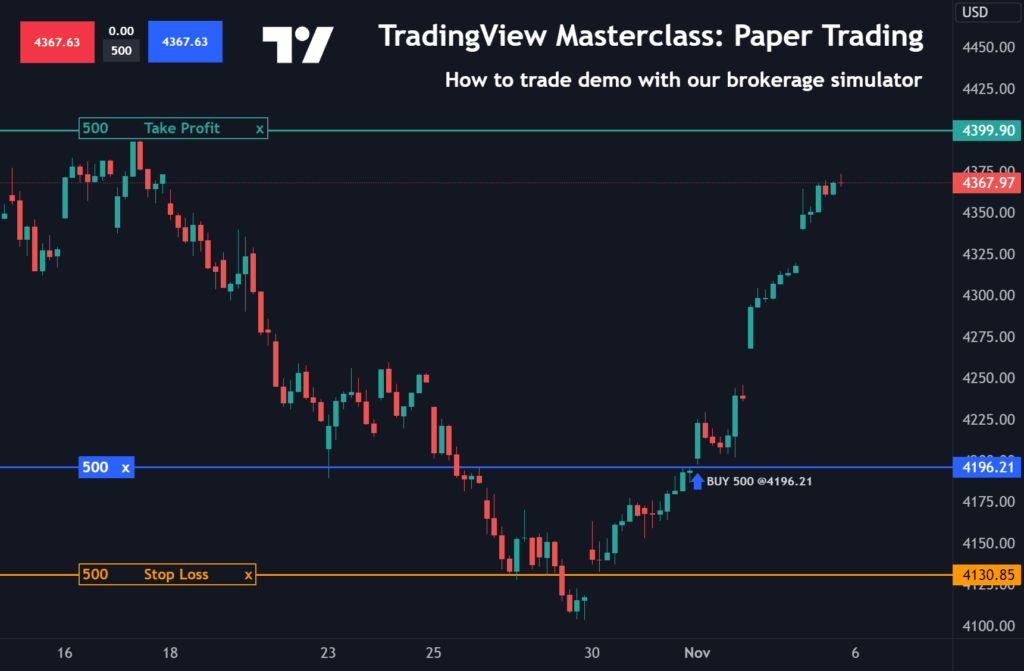

3. TradingView Paper Trading

TradingView is a browser-based platform popular for its social networking features and charting tools. Its paper trading feature allows traders to test strategies on multiple asset classes.

Key Features:

- User-friendly interface with drag-and-drop charting.

- Wide variety of technical indicators and community scripts.

- Real-time simulated order execution.

- Integration with select brokers for live trading.

- Excellent for beginners searching for the best paper trading platform for beginners or those who prefer a free, web-based option.

Cost: Free tier available; Pro subscriptions unlock additional features.

As one active user describes, “TradingView blends social trading with paper trading, creating a vibrant learning ecosystem.”

One of TradingView’s standout features is its extensive library of community-created indicators and automated trading scripts. This crowdsourced innovation allows users to experiment with a variety of trading styles and ideas, which can be immediately tested through the integrated paper trading system. This iterative process is particularly valuable for beginners who can quickly see the impact of technical analysis techniques without financial risk.

Additionally, TradingView’s social aspect fosters peer learning. Traders can follow market analysts, share charts, discuss trade ideas, and receive feedback, all within the platform. This collaborative environment often accelerates learning and builds confidence. The platform’s compatibility with mobile devices also ensures that traders can practice paper trading on the go, maintaining engagement in dynamic market conditions.

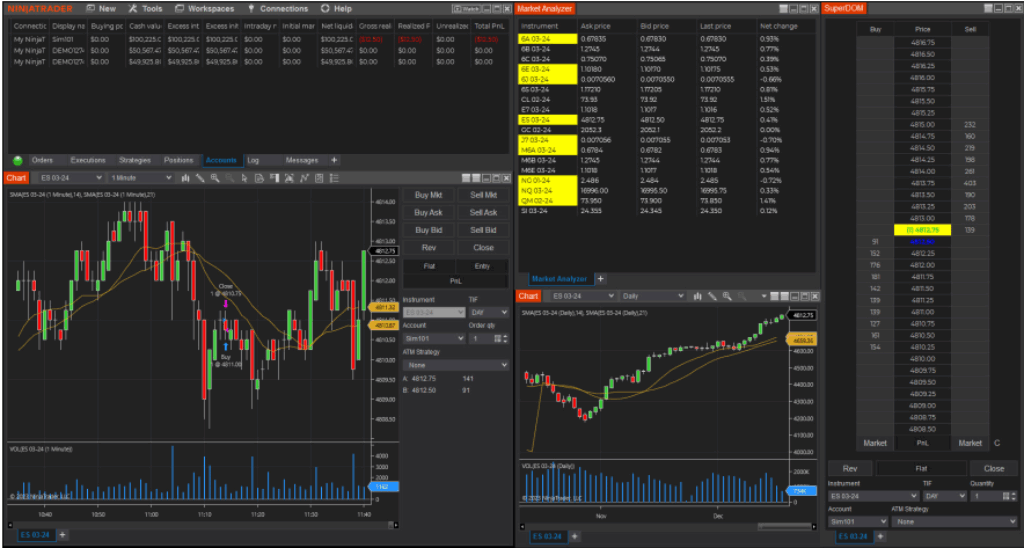

4. NinjaTrader

NinjaTrader is favored by active traders focusing on futures and forex markets, offering powerful simulation tools.

Key Features:

- Advanced charting with customizable indicators.

- Simulated order fills with real market data.

- Strategy analyzer for backtesting and optimization.

- Strong support for automated trading.

- Recognized as a best paper money trading platform for futures and scalping strategies.

Cost: Free for simulation and charting; paid licenses for live trading.

Futures coach Robert Klein asserts, “NinjaTrader’s simulation offers a professional-grade experience, essential for mastering fast-paced futures markets.”

NinjaTrader’s comprehensive backtesting engine allows traders to rigorously evaluate their strategies using historical market data before applying them in the paper trading environment. This dual approach of backtesting and live simulation enables traders to refine their tactics with scientific precision, a feature that is indispensable for high-stakes futures and forex trading.

Moreover, NinjaTrader supports automated trading strategies via custom coding, allowing traders to program bots or use third-party algorithms in a risk-free setting. The platform’s depth in order types and execution speed makes it particularly suitable for scalpers and day traders who rely on rapid decision-making and precise entry/exit points. Its detailed performance analytics also help traders identify strengths and weaknesses, fostering continuous improvement.

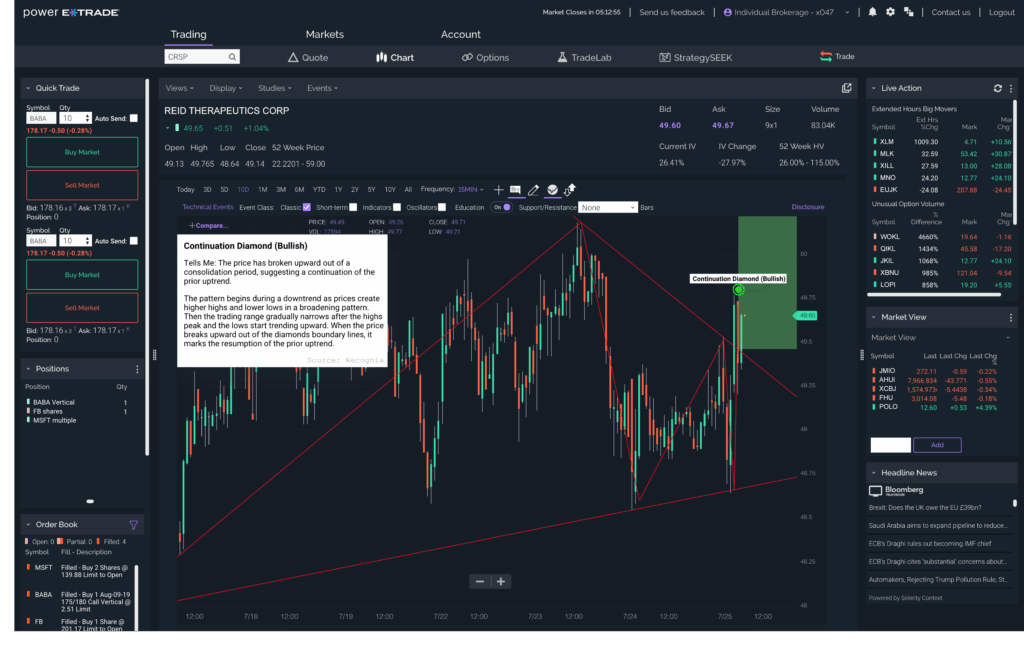

5. E*TRADE Paper Trading

ETRADE provides a straightforward paper trading experience through its Power ETRADE platform, with emphasis on ease of use and accessibility.

Key Features:

- Virtual trading with real-time market data.

- User-friendly interface with useful educational tools.

- Strong support for options trading, useful for those seeking the best options paper trading platform.

- Mobile app support.

Cost: Free with an E*TRADE account.

Amanda Reynolds, a veteran trading educator and financial analyst, states, “E*TRADE’s Power platform simplifies the complexities of trading by offering a seamless paper trading experience that equips beginners with practical skills while allowing seasoned traders to test new strategies without risk.”

Power E*TRADE’s streamlined design reduces complexity without sacrificing essential features, making it an excellent choice for beginners or casual traders who want to practice without being overwhelmed. The platform offers detailed option chains and a visual strategy builder, which simplifies understanding options strategies — a major advantage for new traders exploring the derivatives market.

In addition, E*TRADE offers integrated educational content, including webinars, articles, and tutorials, all accessible within the platform. This seamless blend of practice and learning promotes skill development. The mobile app extends this convenience, allowing traders to paper trade anywhere, making consistent practice more achievable and adaptable to modern lifestyles.

Practical Advice for Choosing a Paper Trading Platform

Selecting the right paper trading platform depends on trading goals and experience level. Beginners may gravitate towards TradingView or E*TRADE due to their accessible interfaces. More advanced traders needing complex order types and analytics may prefer Thinkorswim or Interactive Brokers. Those focusing on futures should explore NinjaTrader.

It is crucial to remember that paper trading can never perfectly replicate the psychological impact of real money risk. Nonetheless, it remains a vital step in building competence and confidence before committing capital.

Conclusion

As has been discussed earlier in the article, the best paper trading platform varies by individual needs and trading objectives. The five platforms reviewed—Thinkorswim, Interactive Brokers, TradingView, NinjaTrader, and E*TRADE—represent a cross-section of the best tools available in 2025 for simulated trading. Each offers unique strengths, from options mastery to global market access or social integration.

Traders seeking to sharpen their skills without risking capital will find value in these platforms’ realistic environments and extensive features. It is important to evaluate these options carefully, prioritizing platform reliability, asset coverage, and usability.

Conclusively, consistent practice on a paper trading platform tailored to specific trading goals is the bedrock of developing long-term trading success.

FAQs

What is the best paper trading platform for beginners?

TradingView and E*TRADE are widely considered the best paper trading platforms for beginners due to their user-friendly interfaces, accessibility, and comprehensive educational resources.

Are paper trading platforms free?

Most of the top paper trading platforms, including Thinkorswim, TradingView, and Interactive Brokers, offer free paper trading accounts with no upfront cost. Some advanced features may require paid subscriptions.

Which platform is best for options paper trading?

Thinkorswim by TD Ameritrade is recognized as the best platform for options paper trading, offering advanced tools to simulate complex options strategies.

Can paper trading help with scalping strategies?

Yes, Interactive Brokers and NinjaTrader provide fast execution and advanced order types, making them suitable for paper trading scalping strategies.

Is paper trading an accurate reflection of real trading?

While paper trading provides valuable practice, it cannot fully replicate the psychological pressures and slippage experienced in live trading. However, it is an essential learning tool.