Pepperstone Review: Who Is It Best For- Beginners or Pros?

Pepperstone Overviews

Pepperstone is a globally regulated forex and CFD trading platform offering raw spreads from 0.0 pips, ultra-fast execution, and access to 1,200+ instruments across forex, stocks, indices, commodities, ETFs, and crypto.

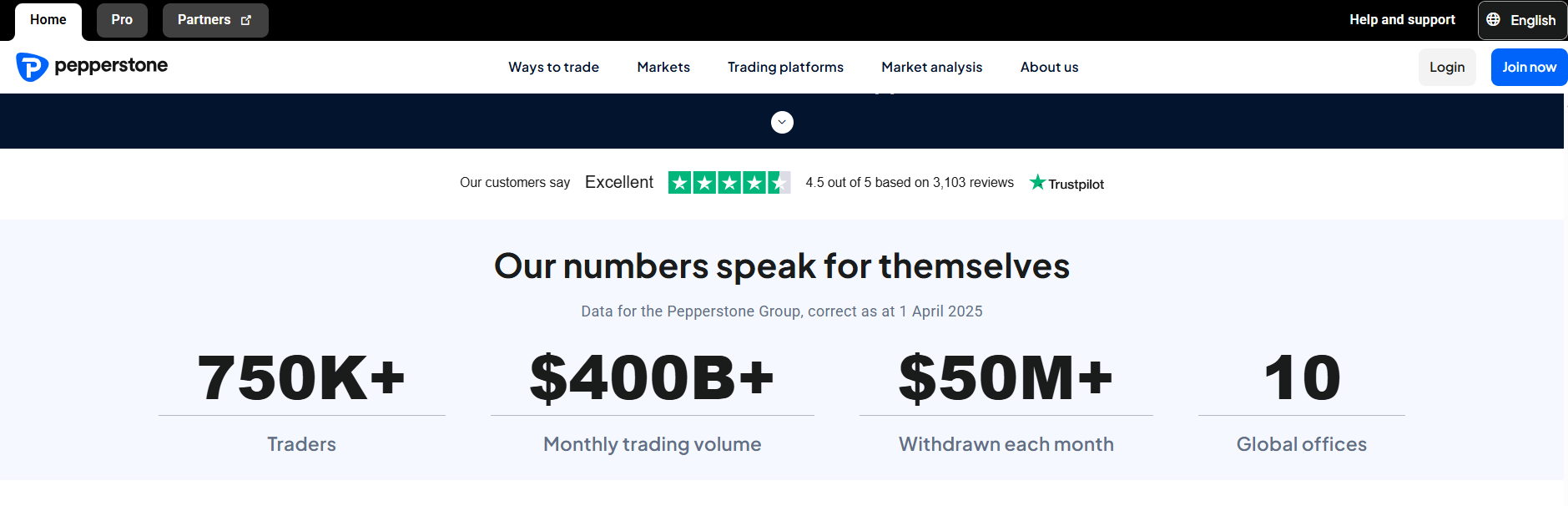

Pepperstone is a well-established online trading company that has grown rapidly since its inception. Founded in 2010 in Melbourne, Australia by a team of traders aiming to improve online forex trading, Pepperstone has evolved into a global fintech with the agility of a startup, features of which are further discussed in this Pepperstone Review. Over the years it expanded internationally and now operates via regulated entities in multiple jurisdictions, including the UK, Europe, Middle East, Africa, and Asia-Pacific. Today, Pepperstone is recognized as one of the world’s largest forex and CFD brokers, evidenced by an average daily trading volume of $12.55 billion and a client base of over 400,000 traders worldwide.

In terms of ownership and corporate development, Pepperstone remains a privately held company. It attracted private equity investment (CHAMP Private Equity acquired a stake in 2016) but later returned to majority management ownership by 2018, under CEO Tamas Szabo’s leadership. The group now has a diversified global presence with offices in key financial centers – from its original Melbourne base to London, Düsseldorf, Dubai, Nairobi, and Nassau – reflecting its truly international reach.

What sets Pepperstone apart is its focus on providing a seamless trading experience through technology and competitive pricing. The broker offers institutional-grade liquidity and execution speeds that appeal to active traders. Orders are executed via a No Dealing Desk model, resulting in ultra-fast trade execution (often ~30 milliseconds on average) and minimal slippage. This commitment to technology and low-latency trade processing was born out of the founders’ frustration with delayed executions and poor pricing at other brokers back in 2010. By leveraging Equinix data centers and top-tier liquidity providers, Pepperstone caters to high-frequency traders and those using automated strategies.

Pepperstone’s reputation for competitive spreads and low fees is another hallmark. It introduced the Razor account with raw interbank spreads (as low as 0.0 pips) plus a small commission, aiming to provide cost-effective trading for scalpers and professionals. Meanwhile, its Standard account offers commission-free trading with slightly higher spreads, which is convenient for beginners or casual traders. This transparent pricing structure – combined with over 1,200 tradeable instruments across forex, indices, commodities, shares, ETFs and crypto – allows Pepperstone to serve a broad range of trading strategies and preferences.

Over the years, Pepperstone has garnered numerous awards underscoring its strengths. It has been repeatedly recognized as a top broker for overall client satisfaction, value for money, and trade execution quality. Notably, Pepperstone was awarded “Best Overall Broker” (2025) by CompareForexBrokers, and has won the Global Forex Broker of the Year title multiple times in the FxScouts awards. Such accolades reflect Pepperstone’s consistent focus on customer service, competitive pricing, and innovation. For example, Pepperstone was an early adopter of integrating TradingView (a popular advanced charting platform) for its clients and in 2024 even introduced 24-hour trading on U.S. share CFDs, allowing clients to trade certain stocks around the clock.

In summary, Pepperstone’s overview showcases a broker with over a decade of experience that successfully blends strong regulatory compliance with cutting-edge trading infrastructure. It remains known for its neutral, client-friendly approach – offering fast execution and low costs – while continuously expanding its product range and platform capabilities. This makes Pepperstone a compelling choice for both beginners entering the markets and seasoned traders seeking a reliable, technology-driven trading partner.

Is Pepperstone Safe? Broker Regulations

Pepperstone is generally regarded as a safe and trustworthy broker, thanks to its strong regulatory oversight and robust client protection measures. The company operates under a multi-regulatory framework, complying with some of the strictest financial regulators worldwide:

- ASIC (Australia): Pepperstone Group Limited is licensed by the Australian Securities & Investments Commission, under which it first operated. ASIC imposes rigorous standards on capital adequacy, audit, and client fund handling.

- FCA (United Kingdom): Pepperstone Limited is authorized by the UK’s Financial Conduct Authority. The FCA is known for its stringent consumer protection rules. Under the FCA, Pepperstone clients in the UK are eligible for the Financial Services Compensation Scheme (FSCS) – meaning deposits are insured up to £85,000 if the broker were to fail. This adds an extra layer of safety for UK clients.

- CySEC (Cyprus) & BaFin (Germany): In Europe, Pepperstone is regulated by CySEC and BaFin, enabling it to passport services across the EU. EU retail clients enjoy the investor compensation fund protection (up to €20,000 under CySEC’s scheme) and regulatory oversight aligned with ESMA standards.

- DFSA (Dubai): Pepperstone has a license in the Dubai International Financial Centre, adhering to the DFSA’s rules. This caters to clients in the Middle East with the comfort of a respected local regulator.

- CMA (Kenya): Pepperstone Markets Kenya Limited is regulated by the Capital Markets Authority of Kenya, which is notable as many brokers do not have local African licenses. This shows Pepperstone’s commitment to operating legally even in emerging markets.

- SCB (Bahamas): Pepperstone Markets Limited is regulated by the Securities Commission of The Bahamas. This entity allows Pepperstone to serve clients globally (outside the stricter jurisdictions) under a recognized regulatory framework. While SCB is considered a Tier-2 regulator, Pepperstone voluntarily adopts many best practices even under this license.

Being regulated by seven authorities globally means Pepperstone’s operations, financials, and conduct are monitored. Importantly, Pepperstone segregates all retail client funds from its own funds, holding client money in trusted Tier-1 banks. This segregation ensures that, even if Pepperstone had financial issues, client funds would remain separate and protected from creditors.

Additionally, Pepperstone has taken further steps to bolster safety:

- It maintains a Professional Indemnity Insurance policy (underwritten by Lloyd’s of London) to cover certain losses or claims, providing financial backing in case of unforeseen liabilities.

- The group undergoes regular independent audits. Pepperstone has engaged Ernst & Young (a Big Four accounting firm) to audit its financials, which adds transparency and credibility to its reporting.

- In 2022, Pepperstone also became a member of the Financial Commission, an external dispute resolution organization. Membership in this commission provides an additional compensation fund (up to €20,000 per client) in the event of a dispute ruling in the client’s favor. This is an extra layer of recourse primarily for clients of the offshore entity, beyond the national regulators.

Negative Balance Protection: For retail traders, Pepperstone offers negative balance protection (NBP). This means if market volatility causes your account balance to go below zero (for instance, due to a sudden gap or flash crash), Pepperstone will reset the balance to zero so you do not end up owing money. NBP is mandated under EU/UK/Australia rules for retail clients, and Pepperstone extends this policy to ensure clients are not financially ruined by rare extreme events. (Professional clients, who opt out of retail status, do not have an automatic NBP guarantee; however, Pepperstone notes it may forgive negative balances up to a certain amount on a case-by-case basis.)

Security of Platforms and Data: Pepperstone’s trading platforms and websites use encryption to protect user data. They also support two-factor authentication (2FA) for the client area and trading accounts, adding login security. The broker’s record in terms of cybersecurity has been clean, with no known breaches publicly reported.

Track Record: With over a decade in business, Pepperstone has built a positive track record. There have been no major scandals involving client fund misuse or fraud by the company. The only notable compliance issue was back in 2014 when Pepperstone exited the Japanese market after ASIC raised concerns it was serving Japanese clients without a local license. Pepperstone promptly ceased that activity. This indicates a willingness to abide by regulations and correct course when needed. Moreover, throughout volatility events like the 2015 Swiss franc crisis and 2020 oil price collapse, Pepperstone weathered the storms without any reports of insolvency or inability to meet client payouts – a testament to its risk management.

In summary, Pepperstone scores high on safety due to multi-jurisdiction regulation, strong internal controls, and client-focused protections. No broker is risk-free, but Pepperstone provides a secure environment that should give traders confidence. Always, traders should also do their own due diligence and use appropriate risk management, but Pepperstone as a brokerage has demonstrated a reliable and safe operation so far.

How to Trade with

Trade Assets

Pepperstone offers a broad range of trading instruments covering virtually all major markets. All trading is done via CFDs (Contracts for Difference) or, in the UK/Ireland, spread bets – which means you can speculate on price movements without owning the underlying asset. Here’s an overview of what you can trade with Pepperstone:

- Forex: As a forex specialist originally, Pepperstone provides 60+ currency pairs. This includes all major pairs (EUR/USD, GBP/USD, USD/JPY, etc.), minor pairs (crosses like EUR/GBP, AUD/JPY) and some exotic currencies (such as USD/ZAR, USD/TRY). Spreads on major FX are very tight – often around 0.0–0.3 pips on EUR/USD (Razor account)t. Pepperstone’s deep liquidity makes it ideal for forex trading, from short-term scalping to long-term hedging.

- Stock Index CFDs: You can trade price movements in major equity indices from around the world. Pepperstone offers 25+ index CFDs including the US indices (US500, NAS100, US30), Europe indices (UK100, GER40, FRA40, EUSTX50, etc.), Asia-Pacific indices (AUS200, Japan 225, HK50, China 50) and more. Index CFDs allow you to take positions on entire markets with low margin. For example, you could go long or short on the S&P 500 index or Germany’s DAX. Pepperstone’s index CFDs have competitive spreads (e.g. 0.4 pts on US500) and no commissions.

- Share CFDs: Pepperstone offers hundreds of share CFDs from markets including the U.S., U.K., Germany, and Australia. You can trade popular individual stocks like Apple, Tesla, Amazon, Google, and many others. U.S. shares are available as CFDs with commissions around $0.02 per share (min $1) or as spread-only in some cases; UK/AU shares have comparable small commissions (usually 0.10% of trade size). One unique aspect is that Pepperstone in mid-2024 enabled 24-hour trading on leading US share CFDs, meaning you can trade some big U.S. stocks outside normal exchange hours. Share CFDs allow leverage (typically 5:1 for major stocks) and the ability to short sell easily. Do note that Pepperstone’s share CFD lineup, while extensive, might not cover every listed company – it focuses on the most traded and high-cap names.

- ETF CFDs: In addition to individual stocks, Pepperstone provides CFDs on Exchange-Traded Funds (ETFs). This lets you trade broad themes or sectors. Examples include CFDs tracking the price of popular ETFs like SPY (S&P 500 ETF), QQQ (Nasdaq 100 ETF), or various commodity and bond ETFs. There are dozens of ETFs available, allowing diversification or hedging strategies through a single instrument.

- Commodity CFDs: Traders can access metals, energy, and soft commodities via Pepperstone:

- Metals: Gold and silver are offered as XAU/USD and XAG/USD pairs, with competitive spreads (gold as low as 0.05). Other metals like platinum or palladium are also available.

- Energy: You can trade crude oil (WTI, Brent), natural gas, and even gasoline. Oil CFDs are a popular choice; Pepperstone’s spreads on US crude can be as tight as 2-3 cents. They also offer oil as cash or futures-based CFDs.

- Soft Commodities: Pepperstone provides CFDs on commodities like sugar, coffee, cotton, and orange juice (availability may vary by region). These allow speculation on agricultural markets with leverage.

- Cryptocurrency CFDs: Crypto trading is available through Pepperstone’s CFD offering on major digital assets. Currently, about 17 cryptocurrencies are offered (including Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Dash, etc.) plus a few crypto index baskets. Importantly, crypto CFDs are available 24/7 (even when other markets are closed). Pepperstone’s crypto spreads are competitive for a CFD broker, but note that U.K. retail clients are restricted from crypto CFDs due to FCA rules. Non-UK clients can trade crypto with leverage up to 2:1 (Australia/EU) or higher in certain jurisdictions (e.g. 5:1 or 10:1 under SCB).

- Currency Index CFDs: Pepperstone offers a few unique instruments like the U.S. Dollar Index (USDX) and other currency indexes (for EUR and JPY). These indices measure the value of a currency against a basket of peers. For example, USDX tracks the USD vs a basket of major currencies. Trading currency indices can be useful for macro traders who want a broad view (e.g. bullish on USD broadly).

- Others: Pepperstone also features CFD Forwards on some instruments (allowing you to trade a forward contract with a fixed expiry, often used to avoid overnight financing costs on longer-term trades, particularly for commodities or indices). They continuously update their product range; for instance, they introduced currency baskets and thematic indices to meet client demand.

In total, Pepperstone’s product lineup of 1,200+ instruments ensures that whether you want to trade major FX pairs, speculate on a stock like Apple, trade gold or oil, or even go long/short on Bitcoin, you can do it all on one platformt. This diversity is a key advantage for traders who like to explore multiple markets or switch strategies.

A few standout features of Pepperstone’s instrument offering:

- Competitive Trading Conditions: Across all these markets, Pepperstone generally offers tight spreads and low commissions, thanks to its high volume and liquidity. For example, forex spreads can be near zero on Razor accounts, index CFDs often have lower spreads than many competitors, and there are no commissions on index, commodity, or crypto CFDs (cost is built into the spread).

- Ability to Short Sell: CFDs by nature allow easy shorting. With Pepperstone you can short stock indices, individual shares, currencies, etc., without any uptick rule or borrowing hassle. This is great for traders who want to play both rising and falling markets.

- Fractional lots: Pepperstone allows trading in fractional contract sizes for flexibility. You can trade as little as 0.01 lots in forex (1,000 units) or micro-lots on gold, or even fractions of a share CFD, so you don’t need a large amount of capital to get started in any market.

- 24-hour Markets: Forex runs 24/5, but Pepperstone also offers some 24/7 markets – crypto CFDs trade nonstop, and as mentioned, select US equities CFDs are now tradable almost around the clock. This provides more opportunities, especially for clients in various time zones or those who can only trade outside normal hours.

Overall, Pepperstone’s instrument range is expansive enough to satisfy most CFD traders. It’s especially strong in forex and index products (the traditional areas of CFDs) but has expanded well into stock CFDs and cryptos too. Whether you’re a currency enthusiast or want to dabble in tech stocks or commodities, Pepperstone likely has suitable instruments available. Just remember, all these are leveraged CFD products, so you’re trading on margin and should manage your risk accordingly.

How To Trade?

Trading with Pepperstone is straightforward and user-friendly, even if you’re relatively new to online trading. Below is a step-by-step guide on how to get started and execute trades with Pepperstone, along with an overview of the tools and features available to clients:

- Open and Fund Your Account: First, you’ll need to register for a Pepperstone trading account (covered in detail in the next section). The signup can be completed online in minutes – you provide personal details, verify your identity, and choose your account type (Standard or Razor). Once approved, access the Pepperstone login or directly log in to the Secure Client Area. From there, you can deposit funds using your preferred payment method (e.g. credit card, bank transfer, PayPal). Pepperstone requires no minimum deposit, though about $10 is recommended to have sufficient margin for trading. Deposits are typically processed instantly or within one business day, depending on the method.

- Choose a Trading Platform: Pepperstone offers several platforms to access your account:

- MetaTrader 4 or 5: Downloadable platforms (Windows/Mac) or available as WebTrader. These are popular for forex trading, known for their reliability and support of Expert Advisors (automated strategies). MT4/MT5 have a learning curve but are industry-standard.

- cTrader: A modern trading platform with an intuitive interface, available for download or via web. cTrader offers advanced order types, level II pricing (depth of market), and an excellent charting package. It’s favored by many algorithmic traders and has its own C# based coding language (cTrader Automate) for bots.

- TradingView: Pepperstone has integrated with TradingView, so you can trade directly through TradingView’s web-based charts (after linking your Pepperstone account). TradingView is renowned for its powerful charting and social features – you can apply hundreds of indicators or see community trade ideas, then place trades through Pepperstone without leaving the chart.

- Mobile Apps: All the above platforms have mobile versions. MT4/MT5 apps (iOS/Android), cTrader mobile, or even TradingView’s app can be used to monitor and manage trades on the go. The mobile apps are fully functional, allowing you to open/close positions, analyze charts, and receive price alerts.

- Pepperstone Web Platform: In the secure client area, Pepperstone also offers a simple web-based trading interface (aside from TradingView) for quick access. This “Pepperstone Platform” is user-friendly for checking your account or executing basic trades without installing software.

- Practice on a Demo (Optional): If you are a beginner or want to test strategies, Pepperstone provides a free demo account. The demo simulates real-market conditions and comes funded with virtual money (up to $50,000). It’s a great way to get familiar with the platform and test trade execution, charts, etc., without risking real funds. Note that Pepperstone’s standard demo expires after 30 days (for non-live clients), but if you have a live account, you can request a non-expiring demo for ongoing practice.

- Navigating the Platform & Analysis Tools: Once you’re on a platform (say MT5 or cTrader), you’ll see your trading dashboard:

- The market watch window lists all available instruments. You can search or filter to find the asset you want (e.g., typing “EURUSD” or “Gold”). On some platforms you may need to add certain symbols to the watchlist (Pepperstone provides a full list of symbols; if something isn’t visible by default, you can enable it via the symbols menu).

- Charts: Open a chart for your chosen instrument. Pepperstone’s platforms support advanced charting – you can apply technical indicators (moving averages, RSI, MACD, etc.), draw trendlines or Fibonacci levels, and switch timeframes from 1-minute up to monthly. With TradingView integration, you have an even more powerful charting toolkit at your disposal, which is beneficial for in-depth technical analysis.

- Analysis & News: Pepperstone’s client platform might not have a built-in news feed for all assets, but they do offer an economic calendar and Reuters news in MT5. Additionally, Pepperstone’s website has a “Market Analysis” section where their analysts post daily insights, videos, and weekly outlooks (the Navigating Markets blog and The Daily Fix are examples). You can use these resources alongside platform tools to inform your trades.

- Placing a Trade: To execute a trade on Pepperstone:

- Select the instrument you wish to trade (e.g., EUR/USD).

- Click New Order (MT5) or the Buy/Sell buttons (cTrader/TradingView) to open an order window.

- Choose your trade size (volume). Pepperstone allows micro-lots (0.01) and up, so input the amount you want. For instance, 0.10 lots in forex equals 10,000 units of base currency.

- Set any stop-loss or take-profit levels if desired. It’s good practice to define your risk (stop-loss) when entering a trade. You can also set these after entering the trade by modifying the position.

- Choose order type: Market execution (buy/sell at current market price) or Pending order (like placing a limit or stop order to trigger at a specific price).

- If market order, simply click Buy or Sell. Your trade will be executed almost instantly given Pepperstone’s fast execution engine.

- Once open, your position will appear in the Trade/Positions tab with real-time profit/loss. You can monitor it and adjust your stop or limit orders as needed. Pepperstone offers trailing stop functionality too (on MT4/MT5) which can auto-adjust your stop as the trade moves in your favor.

- To close a trade, you can click the X or right-click and select Close Position. The trade will be closed at the current market price, realizing any profit or loss.

- Utilize Risk Management Features: Pepperstone platforms have all standard risk management tools:

- You can use Guaranteed Stop Loss Orders on certain platforms (like if provided via cTrader or TradingView) for selected instruments, though Pepperstone generally uses normal stop orders (which execute at the next available price; slippage can occur in very volatile markets).

- Margin alerts: Pepperstone will alert you if your margin level falls too low (usually at 100% margin level you get a warning). The stop-out level is 50% margin level – at that point Pepperstone will automatically close positions to prevent your account from going negative. This automated risk management ensures you don’t lose more than your deposit, especially with the added negative balance protection in place.

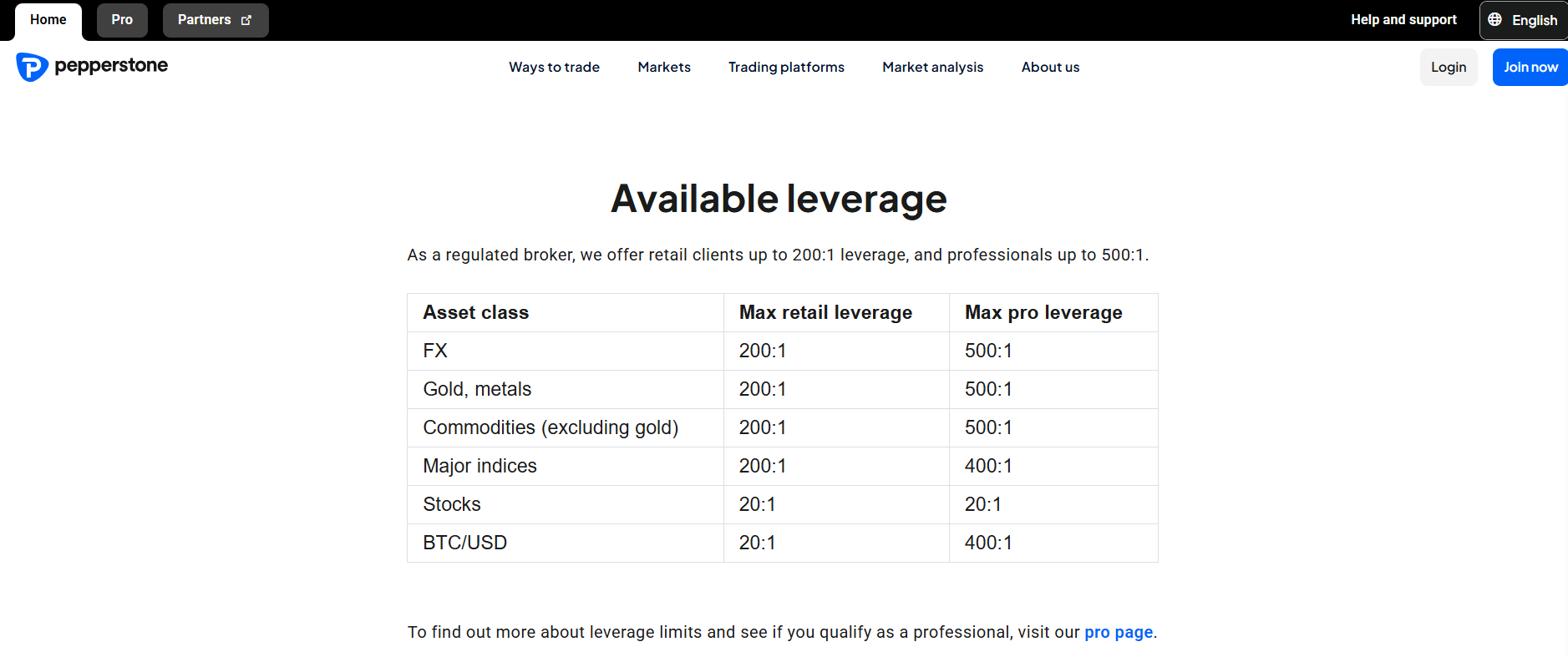

- Leverage settings: During account opening, you select your desired leverage (subject to maximum allowed by your region). You can request to lower your leverage if you want to reduce risk. U.K./EU/AU retail accounts are fixed at strict leverage limits (30:1 on majors, etc.), whereas other entities let you choose higher. Always trade with an appropriate leverage for your risk tolerance – Pepperstone provides calculators in the client area to help calculate margin requirements for trades.

- Advanced Trading Options: Pepperstone supports advanced trading strategies:

- Algorithmic trading: As mentioned, you can deploy Expert Advisors on MT4/MT5 or cBots on cTrader to automate your trades. Pepperstone imposes no restrictions on EAs; strategies like scalping, hedging, and high-frequency trading are allowed.

- Copy Trading: Pepperstone has partnerships for social trading – for example, Myfxbook’s AutoTrade and DupliTrade are supported. This means clients can allocate part of their account to copy professional strategy providers. Additionally, via TradingView, one could follow community trade ideas manually.

- VPS Hosting: For serious algorithmic traders, Pepperstone offers a free VPS service if certain trading volume conditions are met. A VPS allows you to run your trading bots 24/7 on a remote server near Pepperstone’s data center for minimal latency.

- Withdrawing Funds: When you’re ready to take profit or simply return funds, you can request a withdrawal through the secure client area. Pepperstone processes withdrawal requests typically within one business day. The funds will be returned via the original funding method where possible (e.g., back to the same bank account or card used). The time to receive funds can range from minutes (for e-wallets) to a few business days (for international bank wires). Pepperstone does not charge withdrawal fees except in the case of bank wires outside certain regions, as noted in the deposits/withdrawals section.

Overall, trading with Pepperstone is efficient due to the combination of user-friendly platforms, rich features, and responsive trade execution. Both beginners and advanced traders will find that Pepperstone’s environment supports their needs – whether it’s practicing on a demo, placing a simple trade on a major currency, or running a complex automated strategy on a VPS. The key is to make use of the tools provided (analysis resources, risk management settings, etc.) to trade responsibly and effectively.

How Can I Open Pepperstone Account? A Simple Tutorial

Opening an account with Pepperstone is a straightforward process. The broker has streamlined its onboarding so that you can go from registration to trading in a short time, all done online. Here’s a step-by-step tutorial on how to open a Pepperstone account, including what information and documents you’ll need, and how long each step typically takes:

Step 1: Begin Registration

Go to the Pepperstone website and click on the “Join Now” or “Open Live Account” button. You’ll be prompted to enter your email address and set a password, or alternatively sign up using your Google or Facebook account credentials for convenience. Make sure to use an email you have access to, as you will need to verify it. Select the country you reside in if asked.

Step 2: Provide Personal Details

After creating login credentials, you’ll fill out an online application form with personal information. This typically includes:

- Name, Date of Birth, and Contact Details: Ensure your name and date of birth exactly match your identification documents.

- Residential Address: Pepperstone will later verify this, so use your current address.

- Employment Status and Financial Info: You’ll be asked about your occupation, annual income range, and perhaps net worth. This is to comply with regulatory “Know Your Customer” (KYC) and suitability checks.

- Trading Experience: Pepperstone will ask a few questions about your prior trading experience, knowledge of markets, and the types of instruments you’ve traded. Answer honestly – this helps them ensure you understand the risks. Even if you’re a beginner, it won’t prevent you from opening an account; it’s more for regulatory compliance and potentially guiding the leverage level suitable for you.

- Account Preferences: Choose your account type (Standard or Razor), base currency (e.g. USD, EUR, GBP, AUD, etc.), and leverage. If you’re in a region where you can choose leverage, you might see options like 50:1, 100:1, 200:1 (some jurisdictions are capped at 30:1 for retail). Select what you intend to use – keep in mind higher leverage = higher risk.

- Password Setup: If not done earlier, you’ll set a secure password for your Pepperstone client area.

At this stage, Pepperstone will present and ask you to agree to various legal documents (Client Agreement, Product Disclosure Statement, Risk Disclosure, etc.). It’s wise to read or at least save these for reference. Check the box confirming you agree to terms and that you’ve provided truthful information.

Step 3: Identity Verification (KYC)

Pepperstone, like all regulated brokers, must verify your identity and address to activate your live account. The good news is this can be done digitally by uploading scans or photos of your documents:

- Proof of Identity: Usually a passport is preferred due to the clear MRZ code (which helps in automated verification). Alternatively, you can use a driver’s license or national ID card. The document should be government-issued, show your name, photo, and DOB, and not be expired.

- Proof of Address: A recent utility bill, bank statement, or official letter that clearly shows your name and residential address (and date) will serve. It generally needs to be within the last 3 months. Examples: electricity bill, water bill, credit card statement, tax letter. Ensure the document is a full-page PDF or image and the address matches what you put on your application.

Pepperstone’s application interface will prompt you to upload these files. They accept common file formats (JPEG, PNG, PDF). If you’re using a smartphone, you can even take a photo of the documents – just make sure it’s clear and all corners are visible. The broker also offers electronic verification for some countries, meaning they might try to verify you via databases without requiring documents – but if that fails or isn’t available in your country, manual document upload is the way.

Step 4: Application Review and Approval

Once you’ve submitted the required info and documents, Pepperstone’s compliance team will review your application. The verification process is quite quick in most cases. Pepperstone aims to verify new accounts within 4 to 8 hours (often faster) provided all documents are in order. Many users report same-day approval, especially if applying during weekdays. You will receive an email notification when your account is approved.

If there are any issues (e.g., unclear documents or missing info), Pepperstone will email you with instructions on what else is needed. To avoid delays, ensure:

- Your documents are clear and legible.

- You’ve uploaded both sides of ID if using a driver’s license.

- The name/address on documents matches your application.

- You respond promptly if Pepperstone requests any additional verification (occasionally, they may ask for a selfie with ID or a verification code if needed for extra security).

Step 5: Fund Your Account

After approval, you can log into the Pepperstone Secure Client Area with the credentials you set. From there, go to the “Funds” section and select “Add Funds” or “Deposit”. Choose your preferred deposit method:

- Bank Transfer: Pepperstone will provide their bank details for a wire. In domestic regions (like Australia, UK, EU) they have local bank accounts for faster transfers. International wires typically take 1-3 days.

- Credit/Debit Card: You can deposit via Visa or MasterCard. This is usually instant. Pepperstone does not charge card fees.

- PayPal / Skrill / Neteller: These e-wallet deposits are also typically instant and free of charge from Pepperstone’s side.

- Others: Depending on your region, methods like POLi (Australia), BPay, UnionPay (China), MPesa (Kenya) etc., might be available.

Select currency and amount, then follow the prompts. Note that the minimum deposit is effectively $0 – you could start with even $50, but around $10 is suggested to comfortably cover margin for a few trades. Pepperstone will credit your trading account as soon as they receive the funds. Card and wallet deposits reflect in minutes; bank transfers once funds arrive in their account.

Step 6: Download Trading Platform and Login

While waiting for funds (or even before funding), you can set up your trading platform. Download MT4/MT5 or cTrader from Pepperstone’s website (or use the web versions). You will receive trading account credentials (account number and server info) in the email upon account creation.

Launch your chosen platform and log in with:

- Account number (login ID)

- Password (trading password, which might be the same as your client area password or separately provided)

- Server (Pepperstone has several servers – e.g., “Pepperstone-01” or similar – the email will specify which to use).

On MT4/MT5, go to File > Login to Trade Account and enter these details. On cTrader, use your cTrader ID (which links to your Pepperstone account). If any issues logging in, double-check the server selection and credentials; Pepperstone’s support can help if needed.

Step 7: Start Trading (or Practice)

With platform ready and funds in your account, you can begin trading live. If you prefer to practice first, Pepperstone automatically also provides a demo account (or you can create one in the client area). It’s often wise to do a few test trades on demo to familiarize with order placement. When ready on live, ensure you understand the margin impact of your trades and start with small position sizes.

Timeline Summary: In many cases, the entire account opening process can be completed within the same day:

- Registration form: 5-10 minutes.

- Document upload: immediately after (or within a few hours if you need time to gather docs).

- Approval: a few hours by Pepperstone’s team (during business hours).

- Funding: instant if by card/e-wallet, or a couple of days by bank transfer.

This means one could register on a morning and potentially be trading live by that afternoon (especially using card funding). Pepperstone’s onboarding is considered fast and hassle-free, as noted by many users and independent reviewers.

Note: If you’re in a country that Pepperstone does not service, you will typically be unable to complete the online application (the country might not show in the dropdown). In that case, unfortunately you cannot open an account due to regulations. But for the vast majority of supported countries, the process above applies.

Once your account is open and funded, you also have the ability to open additional sub-accounts (for example, if you want one in USD and another in EUR, or one Razor and one Standard account). This can be done through the client area without filling the whole form again – it’s a quick request and the new account is created instantly. Many traders use multiple accounts to separate strategies or to use different base currencies.

In summary, opening a Pepperstone account is user-friendly. Just be prepared with the standard KYC documents and correct information. Pepperstone’s efficient system and support will guide you through, and soon you’ll be ready to trade on one of the world’s leading platforms.

Pepperstone Charts and Analysis

Pepperstone provides traders with robust charting tools and a variety of analysis resources, ensuring that both technical and fundamental analysts have what they need to make informed trading decisions. Here’s a closer look at what Pepperstone offers in terms of charts and market analysis:

Trading Platform Charting:

No matter which Pepperstone platform you choose (MT4, MT5, cTrader, or TradingView), you will have access to advanced interactive charts:

- MetaTrader 4/5: Charts on MT4/MT5 are highly configurable. You can open multiple charts, apply 50+ built-in technical indicators, and install custom indicators or templates. Timeframes range from 1-minute up to monthly. MetaTrader’s charting is relatively lightweight but effective – you can zoom in/out, detach charts (MT5) and even run backtesting for strategies. One limitation is that MT4’s interface is a bit dated and not as intuitive for new users, but its reliability and widespread use mean there are countless guides and custom add-ons available.

- cTrader: The cTrader platform offers a more modern charting experience out-of-the-box. It has an extensive library of technical indicators and drawing tools, and even features like tick charts and customizable templates for layouts. cTrader allows you to view up to 4 charts in a split screen and supports one-click trading from the chart. It’s known for smooth graphics and ease of use when performing technical analysis (like dragging stop-loss lines directly on the chart).

- TradingView (Web): This is perhaps the gold standard for charting. Pepperstone’s TradingView integration means you can use TradingView’s charts with live Pepperstone pricing. TradingView offers 100+ indicators, various chart types (including Renko, Heikin Ashi, etc.), drawing tools for anything from simple trend lines to GAN boxes and harmonic patterns, and the ability to script custom indicators/strategies using Pine Script. Plus, you can engage with the TradingView social community – view trade ideas or analyses published by others. For traders who value visuals and innovative chart features, TradingView via Pepperstone is a huge plus. Not many brokers offer direct TradingView trading, putting Pepperstone ahead in this aspect.

- Mobile Charting: On Pepperstone’s mobile apps (MT4/5 or cTrader mobile), you also have charting capabilities. While more limited due to screen size, you can still add popular indicators, draw basic trend lines, and switch timeframes on mobile. It’s useful for monitoring trades or doing quick analysis on the go, though for detailed chart work, desktop/web is preferable.

Chart Trading Features:

Pepperstone’s platforms support trading from the charts:

- You can drag-and-drop pending orders onto charts or adjust stops/limits by dragging the lines.

- There are options to visualize your trades on the chart (showing entry, SL, TP levels).

- The platforms also allow setting alerts on price levels or indicator conditions – e.g., get an alert when price crosses a certain trendline or moving average. This is especially powerful in TradingView, where custom alerts can be set.

Technical Analysis Tools:

Beyond the default indicators, Pepperstone offers Smart Trader Tools for MetaTrader – a suite of 28 add-ons (if you deposit at least $500). These tools include advanced indicators and utilities like:

- Correlation Matrix: To see correlation between different markets.

- Sentiment Trader: Shows client sentiment (long vs short positions) on various assets.

- Session Map: Indicates which global markets are open and volatility times.

- Excel RTD Link: If you want to log data or create custom dashboards in Excel.

- Mini Terminal: For quick order execution with presets and more complex order strategies.

These can enhance chart-based trading by providing institutional-grade analysis tools within MT4/MT5.

For cTrader, Pepperstone supports cTrader Automate (formerly cAlgo) for coding custom indicators and cBots, so technical users can create or import sophisticated indicators beyond the standard ones.

Market Analysis and Research:

Pepperstone supplements platform tools with a rich array of research content:

- Daily Market Analysis: Pepperstone’s in-house analysts (e.g., Chris Weston, a well-known strategist at Pepperstone) publish daily commentary on market movers. The Daily Fix blog/email gives a rundown of key overnight developments and setups to watch.

- Weekly Outlooks and Webinars: They often provide weekly outlook videos covering major forex pairs or events to watch in the coming week. Pepperstone hosts webinars on various topics – from live market analysis sessions to educational series (like how to trade a particular event or technical analysis basics).

- Economic Calendar: On Pepperstone’s website, there’s an economic calendar showing upcoming data releases and events. This is integrated into some platforms like MT5’s news tab as well.

- Trading Guides: Pepperstone offers an array of written guides for clients (accessible via their “Learn to Trade” section). These cover topics such as risk management, trading strategies, technical indicator explanations, etc., which can help traders make better use of charts and analysis techniques.

- Third-Party Research: Pepperstone has partnered in the past with third-party research providers. For instance, they used to offer access to Autochartist (which scans markets for chart patterns and key levels) and Delkos (news impact analysis tool). Such tools automatically identify trading opportunities or alert you to significant chart patterns (like approaching breakouts) on the instruments you trade. Check Pepperstone’s “Trading Tools” section to see the latest research tools available to clients.

Usability for Different Traders:

- For beginners, Pepperstone’s charts are friendly given that you can start on a simple interface like TradingView or even Pepperstone’s web trader, which is intuitive. They also provide tutorial content on how to read charts and use indicators. A new trader might, for example, use TradingView’s easy interface to draw support/resistance and consult Pepperstone’s educational articles to understand what those mean.

- For advanced technical traders, Pepperstone essentially provides a playground – you have the APIs to connect custom charting software if you want, or you can use cTrader’s depth of market for scalping strategies, or write complex scripts in MetaTrader. The data Pepperstone provides is high-quality tick data, which is great for backtesting algorithms on historical charts (especially if you use MT5 with Pepperstone’s price history or download data via cTrader).

- Multiple Time Frame Analysis: Pepperstone’s platform versatility means you can have MT5 open with a daily chart and TradingView open with a 1-hour chart simultaneously, analyzing the same market in different ways. All of this at no extra cost.

In short, Pepperstone equips traders with comprehensive charting capabilities that rival any broker in the industry. Whether you rely on pure price action, a medley of technical indicators, or automated pattern recognition, the tools are at your disposal. Combined with Pepperstone’s insightful market analysis and news flow, traders are well-served in making analytical decisions. The key advantage is choice: you are not locked into a single clunky platform – you can select the charting environment that fits your style (be it the feature-rich TradingView, the speedy cTrader, or the ubiquitous MetaTrader) and still trade your Pepperstone account seamlessly.

Pepperstone Account Types

Pepperstone offers two primary retail account types designed to cater to different trading styles. Both account types give you access to the full range of instruments and platforms, but they differ in pricing structure. Below is a comparison of Standard vs. Razor accounts in a structured format:

| Feature | Standard Account | Razor Account |

|---|---|---|

| Spreads | Spread-only pricing – spreads start from ~1.0 pips on major FX (e.g., EUR/USD). No commissions are added, so the spread is the total cost.Typical EUR/USD spread ~1.0–1.3 pips. | Raw ECN spreads – spreads start from 0.0 pips on major FX pairs. You get interbank-grade pricing with no mark-up on Pepperstone’s side.Typical EUR/USD spread ~0.0–0.3 pips (variable). |

| Commission | None (zero commission on all trades). Costs are built into the spread, which is slightly wider to compensate. | Yes (commission per trade in addition to spread). For FX & metals: $7 round-turn per 1.0 lot (100k) on MT4/MT5 (≈ $3.50 per side). cTrader is $6 round-turn per lot (≈ $3 per side). No commission on indices, commodities, and crypto CFDs (spread-only even on Razor). |

| Ideal For | Newer or casual traders who prefer simplicity. With no commissions to calculate, the cost is just the spread. Also suitable for longer-term traders where a fraction-of-a-pip difference is less critical. | Active traders, scalpers, and high-volume traders. Designed for cost efficiency on large trades—raw spreads + commission often yield lower total cost per trade, especially in volatile times; favored by algo and day traders. |

| Minimum Deposit | No minimum deposit (Pepperstone recommends ~$200 to start). Fund in any supported base currency; often chosen by beginners starting with smaller capital. | No minimum deposit (same policy). Razor users typically deposit more to meet margin for frequent trades; no extra deposit requirement beyond Standard. |

| Available Platforms | All platforms supported (MT4, MT5, cTrader, TradingView). No platform restriction—use any Pepperstone platform. | All platforms supported as well (MT4/MT5, cTrader, TradingView). Note: commission rates differ slightly by platform (MT vs cTrader). |

| Leverage & Margin | Same leverage options for both account types. Retail in ESMA/UK/AU regions max 30:1 on forex (lower on other assets). Clients under SCB/CMA may access up to 200:1 or 400:1 on forex. Account type doesn’t affect leverage; regulation does. | Same as Standard. Razor doesn’t inherently get more leverage; Professional clients (AU/UK/EU) can access higher leverage (e.g., up to 500:1) once classified as pro—this stems from client status, not account type. |

| Swap-free (Islamic) Option | Yes—Islamic Standard accounts available. No overnight interest; a fixed administration fee may apply on positions held overnight beyond 2 days (eligible instruments). Available on request for qualifying clients. | Yes—Islamic Razor accounts available. Instead of swaps, a fixed nightly fee is charged. Both account types may have slightly wider spreads or nightly fees to replace interest, while remaining Sharia-compliant. |

| Additional Notes | Same execution speeds and liquidity as Razor (STP with deep liquidity). Advantageous for very small trades (micro-lots) where Razor’s commission may outweigh the spread benefit. | Ultra-tight spreads reveal true market pricing. Factor commission into total cost (e.g., 0.2-pip spread + commission). During liquid times Razor often yields lower effective costs for frequent trading; many professionals default to Razor. |

Both account types benefit from the same infrastructure: fast execution, high liquidity, and access to all of Pepperstone’s markets and platforms. There is no difference in execution quality or priority between them; it purely comes down to how you prefer to pay for your trading costs. You can even have one of each to test which works better for you. Pepperstone’s transparent approach (by clearly delineating these options) is well-received, as traders can choose the account that aligns with their strategy.

Do I Have Negative Balance Protection with This Broker?

Yes, most Pepperstone clients have Negative Balance Protection (NBP), but it’s important to understand the conditions and how it works. Negative balance protection means that if your trading account were to go into a negative balance (due to extreme market movements where losses exceed your account equity), Pepperstone will reset your balance to zero, so you are not liable to pay that negative amount. Essentially, you cannot lose more money than you deposit.

Here’s how NBP is applied at Pepperstone:

- Retail Clients: If you are a retail client (which is the default classification for traders who do not opt in as professionals in regions like Europe or Australia), Pepperstone provides NBP on your account. This is actually a regulatory requirement in many jurisdictions: for example, the EU and UK regulators mandate that brokers must ensure retail clients don’t have negative balances. Pepperstone explicitly states that retail client accounts are protected – should they go negative, Pepperstone will adjust the account back to $0 balance promptly. This policy covers all trading instruments (forex, CFDs) under normal trading conditions.

- Professional/Institutional Clients: If you qualify and elect to be a professional client (or you’re trading under an entity where you’re considered a wholesale client), NBP is not guaranteed. Professional clients are assumed to understand the risks and have more capital, so regulators allow brokers to waive NBP for them. In Pepperstone’s case, professional accounts do not automatically get negative balance protection. However, Pepperstone has a courtesy policy: they may forgive negative balances up to a certain amount (reportedly up to USD $100,000 one-time) for professionals on a goodwill basis. This is not a hard guarantee, but it shows Pepperstone’s intention to treat clients fairly even at the pro level. Regardless, a professional trader should manage risk to avoid going deeply negative since that protection is not assured.

- Clients under different entities: Pepperstone’s multiple jurisdictions could imply slight differences in NBP practice:

- In ASIC-regulated accounts (Australia), from 2021 ASIC also requires negative balance protection for retail CFD traders, so Aussie clients have it by regulation.

- In SCB (Bahamas) or other offshore entity accounts, NBP might not be legally required. However, Pepperstone’s terms indicate that they still extend NBP to retail clients globally as part of their policy. This means even if you are trading under Pepperstone’s Bahamas entity (which many international clients do), if you’re categorized as a standard retail trader, you should be covered by the same NBP practice.

- It’s always wise to double-check the client agreement of the specific entity you sign with. But Pepperstone’s overarching ethos has been to provide NBP to avoid punishing clients for freak market events.

How can a negative balance occur? Normally, Pepperstone’s risk management will close out your positions if your margin level falls to 50% (stop-out level). This usually prevents your account from going into negative territory. However, in extremely volatile or gapping markets (think Swiss Franc 2015 event or weekend gaps, or a flash crash in an index), prices can move so fast that your position cannot be closed before the loss exceeds your equity. That’s when negative balance can happen. It’s rare but not impossible, especially with high leverage.

Pepperstone’s Handling of NBP Events: If such an event occurs, Pepperstone’s support will adjust your account balance. For instance, say you had $5,000 in your account and a sudden event on a highly leveraged trade causes a -$10,000 balance. Pepperstone would forgive that -$10,000 and set your account to $0, absorbing the loss themselves. They do this as soon as practicable after the incident, so you can start fresh. You typically won’t have to contact them; it’s done automatically per policy. In fact, during the extreme volatility of the 2015 CHF crisis, Pepperstone was noted as one of the brokers that honored negative balance protection for clients even if it wasn’t mandated at that time, helping maintain trust.

Exceptions and Best Practices: Negative balance protection is not an excuse to take on reckless risk. Brokers can have clauses (for instance, if they detect client abuse of NBP or intentional trading strategies to exploit it, they might reserve the right not to cover those cases). But for genuine unforeseen market moves, Pepperstone’s got you covered. It’s still crucial for traders to use stops and not overleverage so that you’re not relying on NBP. It’s a safety net for the worst-case scenarios.

Also, note NBP covers trading losses. If you have multiple accounts or other obligations, those are treated separately (one account’s negative won’t drain another’s funds; it will be individually reset).

Conclusion: If you’re trading with Pepperstone as a typical retail customer, you can be confident that you won’t end up owing money to the broker beyond your deposited funds – negative balance protection is in place to protect you. This is a key risk management feature that Pepperstone offers, aligning with industry best practices and regulatory standards. It adds an extra layer of security, letting you trade knowing that a black swan event won’t put you in debt. Of course, it’s better to never need NBP by managing your account wisely, but it’s reassuring that Pepperstone has this client-friendly policy if disaster strikes.

Pepperstone Deposits and Withdrawals

Pepperstone has made funding and withdrawing from your trading account as convenient as possible, with a variety of options and generally low costs. Here’s what to expect regarding deposits and withdrawals:

Deposit Methods: Pepperstone supports a wide range of deposit methods, catering to global clients:

- Bank Transfer (Wire): You can deposit via bank wire transfer. Pepperstone has local bank accounts in major regions (U.K., EU, U.S., Australia, etc.) which often means faster and fee-free local transfers. Domestic transfers usually clear within the same or next business day. International SWIFT transfers may take 2-3 business days. Pepperstone does not charge any fee for incoming transfers, but your bank might charge you. They also accept local payment methods like BPay or POLi in Australia for instant bank payments.

- Credit/Debit Cards: Visa and MasterCard deposits are accepted. This is one of the quickest ways to fund – typically the deposit is credited instantly or within a few minutes. No fees from Pepperstone’s side. Many traders use cards for the convenience and immediate access to funds.

- E-Wallets: Pepperstone supports popular online payment wallets such as PayPal, Neteller, Skrill, and in some regions Fasapay, etc.. Depositing via PayPal or Skrill is usually instant, and Pepperstone absorbs the processing fees (so you deposit 100, you get 100 in account). E-wallets are great for those who prefer not to directly use a bank or card, and often have faster withdrawals too.

- Other Local Methods: Depending on your country, Pepperstone provides methods like UnionPay for Chinese clients, MPESA for Kenyan clients, and so on. These cater to local needs and can be very useful (for example, MPESA allows mobile money deposits in Kenya instantly in local currency).

- Cryptocurrency: Currently Pepperstone does not accept crypto deposits (some brokers do via tether etc., but Pepperstone sticks to traditional methods).

Deposit Currencies: As mentioned, Pepperstone offers accounts in 10 base currencies (USD, EUR, GBP, AUD, JPY, CHF, CAD, NZD, SGD, HKD). If possible, deposit in the same currency as your account base to avoid conversion fees. For example, if your account is in USD, sending USD or using a USD card is best. If you send a different currency, the funds will be converted at Pepperstone’s prevailing rate which is usually competitive but might include a small margin.

Minimum Deposit: Pepperstone does not impose a strict minimum deposit for standard accounts – you could deposit even $50 or $100. They do recommend about $200 or equivalent as a practical minimum to have enough margin to trade comfortably. For Razor accounts or higher leverage, a bit more might be sensible, but technically there’s no barrier. Having no high minimum makes Pepperstone accessible to beginners.

Funding Speed: In practice:

- Card/PayPal/Skrill: Instant or within minutes (24/7 automated funding).

- Bank transfer: 1-3 days depending on banks (though local transfers can be same day).

- If you deposit on a weekend via card or e-wallet, it still often goes through immediately, so you can start trading even on Sunday (for crypto) or be ready for Monday markets.

Pepperstone’s internal process is very efficient, and you can track deposit status in the Secure Client Area. They also email confirmation once funds are credited.

Withdrawals: Withdrawals are requested through the same Secure Client Area under the “Withdraw Funds” option. Pepperstone’s policy is to return funds to the original source whenever possible, following anti-money laundering rules:

- If you deposited by card, you can withdraw back to that same card (typically up to the amount you originally deposited via that card). This usually is processed as a refund and can take 3-5 business days to reflect on your card statement. If you have profits beyond what you deposited by card, those profits would need to go by bank transfer or e-wallet because card refunds are limited to deposit amounts.

- If you deposited via PayPal/Skrill, you can usually withdraw to the same wallet. These are quick – often once processed by Pepperstone, you see the money in your PayPal within minutes/hours.

- Bank withdrawal: If you deposited via bank or have excess funds, Pepperstone can send via bank wire to your nominated bank account. You’ll need to provide your bank details (account number, SWIFT code, etc.) in the withdrawal form if not already on file. Domestic withdrawals (e.g., to an Australian bank if you have an AUD account) can arrive within 1 day. International withdrawals typically take 2-3 business days to reach your bank.

Fees for Withdrawal: Pepperstone itself does not charge withdrawal fees for most methods:

- Card withdrawals: free (Pepperstone doesn’t charge; your card issuer typically doesn’t either, since it’s like a refund).

- E-wallet withdrawals: free.

- Bank withdrawals: Pepperstone does not charge a fee, but here’s a caveat: for international bank wires, the correspondent/intermediary banks often levy a fee (around $20). Pepperstone will pass on any such bank fee to the client. For example, if you’re withdrawing from a USD account to a non-US bank, an intermediary might charge $20 and you receive $20 less. Clients in EU/AU often have local accounts so this isn’t an issue (SEPA transfers or local AU transfers are usually free). But non-local transfers can incur that. BrokerChooser noted a $20 fee for clients outside EU/Australia for bank withdrawals, which aligns with this – essentially the cost of international wire.

- Same-day international withdrawal: If for some reason you request an express SWIFT, your bank might charge extra – but that’s rare and usually not done unless urgent.

To avoid bank fees, many traders use e-wallets or crypto-friendly options if available, or ensure they withdraw larger amounts less frequently so a single $20 fee on a big withdrawal is negligible.

Processing Time: Pepperstone processes withdrawals on business days. They often advertise that if you submit a withdrawal request by a certain cut-off (e.g., 07:00 AEST for Australian entity), it will be processed that same day (usually afternoon). Requests later in the day might roll to the next day. Pepperstone commits to processing within 1 working day in most cases. During weekends, withdrawal requests will queue for Monday. In my experience and community feedback, Pepperstone’s withdrawals are reliable and timely, with very few complaints.

Important Withdrawal Notes:

- The name on the trading account and the beneficiary account must match. Pepperstone will not withdraw to third-party accounts (e.g., they won’t send your funds to someone else’s bank or a different name). This is standard AML procedure.

- If you deposited via multiple methods, Pepperstone might split withdrawals among them. For instance, if you deposited $500 by card and $500 by PayPal, and want to withdraw $800, they may send $500 back to card (refund) and $300 to PayPal, to balance the sources.

- Pepperstone doesn’t impose a minimum withdrawal amount via most methods, but it’s sensible to withdraw, say, at least $20 or so (withdrawing extremely tiny amounts might not be practical due to bank fees).

- No withdrawal on credit: Pepperstone will only let you withdraw up to your available balance not in margin. If you have open positions, ensure you have enough free margin or close trades before taking out most of your funds.

Currency Conversion: If you withdraw in a currency different from your account base, Pepperstone will do a conversion. E.g., if your account is in EUR and you want USD in your bank, they’ll convert EUR to USD at competitive rates. To avoid multiple conversions, try to withdraw in the same currency as your bank. With Pepperstone’s multiple base currency option, many clients just maintain an account in the currency they ultimately want to withdraw in.

Overall Ease: Pepperstone’s deposit & withdrawal system is considered very user-friendly and transparent:

- Deposits are typically instant and free.

- Withdrawals are straightforward, with no unexpected charges besides possible bank fees for international transfers.

- The client area keeps a log of your transactions, so you can track the status. And you’ll get email updates (e.g., “Your withdrawal request has been processed”).

In conclusion, Pepperstone scores highly on banking aspects. They understand that traders want quick access to their money, so they’ve partnered with reputable payment providers to ensure smooth transactions. The absence of deposit/withdrawal fees on their end, and the wide variety of methods (from traditional bank wires to PayPal) give clients flexibility. Just keep an eye on any third-party bank charges if you’re using wire transfers across borders. Otherwise, funding your Pepperstone account and withdrawing profits should be a hassle-free experience, letting you focus on trading rather than worrying about moving funds.

Support Service for Customer

Pepperstone prides itself on delivering strong customer support and has earned a good reputation for client service not only in Pepperstone Australia but globally. Whether you are a new trader with basic questions or an advanced user facing a technical issue, Pepperstone’s support team is equipped to assist. Here’s an overview of their customer support:

Support Channels:

- Live Chat: Available on Pepperstone’s website and client area. This is often the fastest way to get help. You simply click the chat icon and connect to a representative. Chat is open 24 hours during weekdays (when markets are open). Pepperstone’s live chat agents are generally quick to respond and knowledgeable. They can help with anything from account setup issues to platform guidance. (Do note that during peak times, there might be a short queue, as some users have noted slightly slower chat responses when there’s high demand, but overall it’s efficient).

- Email Support: You can email support@ for assistance. Pepperstone aims to reply to emails within 24 hours or sooner. Email is suitable for less urgent queries or if you need to send documents, etc. They also have specialized departments – for example, [email protected] for press or perhaps separate emails for account funding issues, but the general support email works for all.

- Phone Support: Pepperstone provides telephone support with local and international numbers. For instance, they have a toll-free number in the UK (0800… number) and an Australian number. They also list numbers for other regions (like a global line in Bahamas, since Pepperstone Markets is based there). Phone support is 24/5 as well. Having a human to talk to can be reassuring, and Pepperstone’s phone reps can help walk you through urgent matters (like if you have trouble with a withdrawal or a trading issue that needs immediate attention).

- Contact Form: On their website, there’s a contact form under “Contact Us” where you fill in your details and question. This essentially routes to their email system.

Multilingual Support: Pepperstone caters to a global clientele and offers support in multiple languages. Their website is translated into ~15 languages, and they have support staff who speak languages such as English, Mandarin Chinese, Arabic, Spanish, German, French, Italian, Polish, Vietnamese, Thai, and more. So if you’re more comfortable in a language other than English, Pepperstone likely has someone who can assist (particularly during their regional office hours). For example, the Dubai office can handle Arabic inquiries, the German office for German-language, etc.

Knowledge and Help Resources: Before reaching out to support, you might find answers in Pepperstone’s extensive FAQ and Help Center. They have a well-organized help section on the website covering common questions (from “How do I fund my account?” to technical queries like “How to install an indicator on MT4”). It’s searchable and can be very handy for self-service. This resource is available 24/7 and often contains step-by-step guides with screenshots.

Responsiveness: Pepperstone has a commitment to timely support. Live chat is immediate, phone calls are answered promptly. Emails usually get a response well within a day; in many cases, clients report getting email answers in just a few hours. The support operates 24 hours on trading days (Monday through Friday). On weekends, Pepperstone has limited staff – they mention being available about 18 hours on weekends, primarily to support crypto trading or account queries (since forex market is closed, fewer inquiries). So while not completely 24/7, they cover a broad time span, ensuring someone is on hand almost all the time.

Quality of Support: The support team is generally well-trained. Since Pepperstone’s focus is on active traders, the support reps are used to handling both simple questions and complex ones. For instance, if you have an issue placing a trade or see a discrepancy, they can investigate with their trade support team quickly. They also help with technical issues like platform troubleshooting (e.g., if MT4 isn’t logging in, they’ll guide you through checking the server or firewall settings). And because they have offices in multiple regions, more complex issues can be escalated to relevant departments (compliance, technical, etc.) seamlessly.

Dedicated Account Managers: For Premium/Pepperstone Pro clients, Pepperstone assigns a dedicated account manager. This means high-volume or professional traders have a single point of contact who understands their trading needs. The account manager can provide personalized service – for example, helping expedite any account changes, offering market insights, or generally being an advocate for the client within Pepperstone. This is part of the premium client service which also includes priority support. Even for regular clients, Pepperstone’s team tries to be personable – you’re not just a number; they often address you by name and can reference previous conversations for context.

Community and Social Media: Pepperstone is active on social platforms like Twitter, Facebook, etc. While those are more for marketing and news, occasionally clients might reach out there and get directed to support. Additionally, Pepperstone’s YouTube channel contains tutorials and weekly analysis videos, which is indirectly a form of support by educating clients.

User Feedback: Pepperstone consistently gets positive reviews for its customer service in industry surveys. For example, Investment Trends surveys have ranked Pepperstone #1 in Customer Support and Service in past years. On forums and review sites, many users cite helpful and friendly support as a key advantage of Pepperstone. Issues, if they arise, are typically resolved efficiently.

Emergency Handling: In case of major events (like system outages or market halts), Pepperstone communicates with clients via emails or platform announcements. Their support lines also handle a surge in inquiries during such times. For instance, if MetaTrader servers have a blip, you can call and often they’ll reassure that it’s being fixed and even place trades for you if needed over the phone (Pepperstone, like most brokers, can execute or close trades by phone if you cannot due to technical problems).

In summary, Pepperstone offers a comprehensive customer support service that matches its global brokerage status. Accessibility via chat, phone, and email around the clock on trading days ensures that help is always near when you need it. The emphasis on multilingual support and knowledgeable staff means traders from all backgrounds can communicate issues clearly. This level of support is crucial, especially in fast-moving markets where timely assistance can make a difference. Pepperstone appears to understand that and invests in keeping their clients satisfied and informed, which in turn fosters loyalty and trust.

Prohibited Countries: Where Can I Not Trade with this Broker?

Pepperstone may serve clients in over 170 countries, but there are certain countries where it cannot offer its services due to legal or regulatory restrictions. If you reside in one of these prohibited countries, you will be unable to open an account or trade with Pepperstone. It’s important to be aware of these limitations:

Major Restricted Regions:

- United States – U.S. residents (and citizens, including those living abroad in many cases) cannot open a Pepperstone account. This is because the U.S. has strict regulations that require brokers to be registered with the CFTC and NFA to offer forex/CFDs to Americans, and Pepperstone is not registered in the US. Instead, U.S. traders must use domestic brokers that comply with Dodd-Frank Act rules.

- Canada – Pepperstone is not available to Canadian residents. Canada’s provinces each have their own regulators, and offering CFDs in Canada typically requires regulation there (which Pepperstone doesn’t have). Canadian traders have access to a limited set of locally regulated brokers or certain others via exemptions, but Pepperstone isn’t accessible.

- Japan – Japan has a very strict licensing regime and low leverage limits for FX. Pepperstone exited the Japanese market in 2014 after realizing it didn’t have a JFSA license. Japanese residents now cannot open accounts with Pepperstone.

- New Zealand (Retail) – Notably, Pepperstone’s restriction list mentions “New Zealand (retail clients only)”. This implies Pepperstone does not take NZ retail clients. This could be due to New Zealand’s regulations (the FMA) or business decisions. Possibly Pepperstone might accept professional/New Zealand wholesale clients, but generally if you’re a regular NZ resident, Pepperstone is off-limits.

- India & Pakistan – While Pepperstone’s official list doesn’t explicitly highlight India as prohibited (some sources show India is accepted, others say it’s tricky due to RBI restrictions on forex trading), historically, many offshore brokers avoid India because sending money out for forex trading violates local law. Pepperstone’s accepted countries list did include India, but traders in India must be cautious of domestic rules. Pakistan is not singled out, so presumably allowed unless stated otherwise.

- France/Belgium – Pepperstone can serve EU clients via its CySEC and BaFin licenses, but one source indicated Belgium as bannedbestbrokers.com (Belgium has banned retail CFDs outright, so brokers generally exclude Belgian residents). For France, Pepperstone is allowed (as it’s in EU), but Québec (Canada) might be a confusion with French – but no, Pepperstone does not take any Canada including Québec.

- Israel – Many brokers avoid Israel due to regulatory complexities there. Pepperstone’s list in tradingbeasts doesn’t explicitly mention Israel, but some brokers do restrict it.

- Malaysia (SCM Alert) – Pepperstone was on a Malaysian regulator’s alert list historically (for operating without license), yet interestingly Pepperstone’s accepted list includes Malaysia. Possibly Pepperstone accepts Malaysian clients under SCB entity, though they cannot solicit. So Malaysia isn’t outright banned by Pepperstone’s terms, but caution exists from regulator side.

Other Prohibited Countries (from Pepperstone’s list):

Pepperstone’s terms and lists include many countries, often those with sanctions or unstable regimes:

- Sanctioned Countries: For example: North Korea, Iran, Syria, Sudan, South Sudan, Yemen – these are comprehensively sanctioned by the US/EU, so Pepperstone won’t do business with residents there.

- Conflict or High-Risk Zones: Afghanistan, Iraq, Libya, Somalia are on the prohibited list due to high-risk and regulatory constraints.

- Certain African Countries: A number like Congo (DRC), Congo (Republic), Zimbabwe, Liberia, Mali, Côte d’Ivoire, Burundi etc., are listed, possibly because of sanctions or lack of reliable infrastructure for compliance.

- Caribbean and Others: Cuba (though not explicitly in snippet, likely banned due to US sanctions), Haiti (possibly due to sanctions concerns), Puerto Rico & US Virgin Islands (US territories, treated like US for these purposes).

- Russia and Belarus: Interestingly, some brokers banned Russian residents after 2022 sanctions. Pepperstone’s list we saw doesn’t show Russia clearly (though the commodity list did end with “Russia.”). It’s likely Pepperstone now does not accept new Russian clients due to sanctions, even if it wasn’t always the case before.

- Other Europe: Belgium (as mentioned, due to local ban on CFDs for retail), possibly Spain only allows pro clients (Pepperstone’s CySEC license note said Spain only professional). This means Pepperstone EU might not accept Spanish retail – this is unusual, but could be because Spain’s CNMV had some specific stance or Pepperstone chose to not solicit Spanish retail actively. If you’re a retail client from Spain, the account might only be possible via BaFin Germany entity, but given that note, likely Pepperstone currently avoids Spain retail.

- South Korea: Pepperstone lists South Korea as banned, likely because Korea has capital controls and strict rules on FX trading offshore.

- Turkey: Many brokers restrict Turkey as well since Turkey requires a local license (and has very high minimum deposit requirements for FX). Pepperstone’s list includes Turkey implicitly? Actually the list snippet showed up to Turkmenistan in one part, but not Turkey. However, given many do ban Turkey, it might be banned or at least not targeted.

- Indonesia & Thailand: Pepperstone accepts these (both were in accepted list). So Southeast Asia largely allowed (except maybe minor places like Laos might be allowed too? It wasn’t listed as banned).

- China: Mainland China residents often face difficulty sending funds out, but Pepperstone is popular among Chinese traders (using UnionPay etc.), so China is not prohibited by Pepperstone (they have a Chinese language site). It’s legally gray, but many still do it.

- Singapore: Pepperstone does not have a MAS license, but they accept Singapore residents (Pepperstone is fairly popular in Singapore too, via SCB entity).

- UAE and Middle East: Since Pepperstone has DFSA, they accept UAE and likely most GCC countries. They likely cannot accept any OFAC-sanctioned like Iran, Syria as noted, but e.g. Saudi, Kuwait, etc., are allowed (and listed in accepted).

- Latin America: Most LatAm countries are accepted (they list Brazil, Chile, etc., as supported). Exceptions: Cuba (sanctioned) and Argentina maybe? The commodity list included Argentina under banned, likely due to currency controls in Argentina. Also Belize was banned (maybe due to being a broker haven and for compliance, ironically).

- Europe’s conflict areas: Pepperstone does not accept residents of Crimea (the annexed region, as per sanctions), and likely Donetsk/Luhansk as well by extension though not listed explicitly. But Ukraine (government-controlled areas) is accepted (the accepted list included Ukraine).

- Other U.S. territories: As seen, American Samoa, Puerto Rico, US Virgin Islands are banned (since they fall under U.S. jurisdiction). Guam as well (Pepperstone list included Guam as banned).

For a concise answer, we can summarize: Pepperstone cannot be used by residents of the USA, Canada, Japan, and a range of countries primarily in sanctioned or high-risk categories. These include nations under international sanctions (like North Korea, Iran, Syria, etc.) and some others with restrictive financial regulations.

Geographic Limitations:

If you attempt to sign up on Pepperstone’s website, the country selection will simply not include the banned countries. So if your country is missing from the dropdown, that’s a sign Pepperstone cannot accept you. Pepperstone’s advice (as per their FAQ) is to check that list or attempt sign-up to know.

Reasons for Prohibitions:

- Regulatory Compliance: Pepperstone abides by international laws, so it won’t onboard clients from sanctioned countries or those that require a local license Pepperstone doesn’t have.

- Business Risk: Some countries might be excluded because of high fraud risk or unstable banking (a broker might avoid places where getting/sending money is very difficult).

- Local Laws: E.g., in India and some other countries, local law forbids residents from using offshore brokers for forex. While Pepperstone might not explicitly block all such countries, it’s a gray area. Typically though, Pepperstone’s explicit banned list covers most of these.

What If I Move Countries? If you already have a Pepperstone account and move to a prohibited country, technically you’d violate terms to keep trading. It’s advisable to inform Pepperstone of address changes. They might close your account if you become resident in a banned jurisdiction.

Prohibited for Certain Entities: Another nuance – Pepperstone has multiple entities. It might route clients to a specific entity based on region. Some entities might have extra restrictions. For example, Pepperstone EU (Cyprus) could only accept EU residents. Pepperstone Kenya (CMA) only serves Kenya domestic by license. But Pepperstone’s global (Bahamas) covers most others. So when you sign up, you’re assigned an entity automatically by your country. If your country is not served by any entity, you can’t sign up.

Where Can I Trade? On the flip side, Pepperstone’s reach is quite extensive:

- It covers all of Europe (except Belgium and perhaps Spanish retail).

- Asia: from Southeast Asia (Thailand, Malaysia, Vietnam, Indonesia) to China, Taiwan, India (though legally tricky), Pakistan, Bangladesh, etc. Their accepted list encompassed these.

- Africa: They accept many African countries (they even have a Kenya office for local). Countries like South Africa, Nigeria, Kenya, Egypt, Morocco, etc., are allowed (the list had many African nations).

- Middle East: UAE, Saudi Arabia, Kuwait, Qatar, Jordan, etc. (most listed), except obviously Iran, Syria, etc.

- Oceania: Australia (yes, home country), New Zealand retail (no), but perhaps NZ eligible as wholesale, small detail.

- Latin America: Most allowed (Brazil, Mexico, Chile, etc.), but Argentina and a few others like Belize were on banned list (Belize likely because Pepperstone doesn’t want to deal with clients in a jurisdiction known for easy registration – ironically Pepperstone itself isn’t Belize-registered so they skip it).

- OFAC list basically – Pepperstone’s banned list closely mirrors OFAC sanctions plus some extras.