Opofinance : How much Leverage does it Provide?

Opofinance Overviews

Opofinance is a multi-asset online trading platform offering forex, CFDs (stocks, commodities, indices, metals) and cryptocurrencies. It supports standard trading platforms (MT4, MT5, cTrader) and its own proprietary environment, along with social trading and copy-trading features. The broker targets a broad audience — from beginner to experienced traders — by offering various account types and a relatively modest entry threshold.

Opofinance is a relatively new entrant in the online trading space, having been founded in 2021. The company positions itself as a global, multi-asset broker offering access to a broad range of financial markets — including forex, CFDs on stocks, indices, commodities, metals, and cryptocurrencies. Opofinance claims to operate under entities registered in jurisdictions such as Seychelles, with a license from the Financial Services Authority (Seychelles) (FSA), identified by license number SD124.

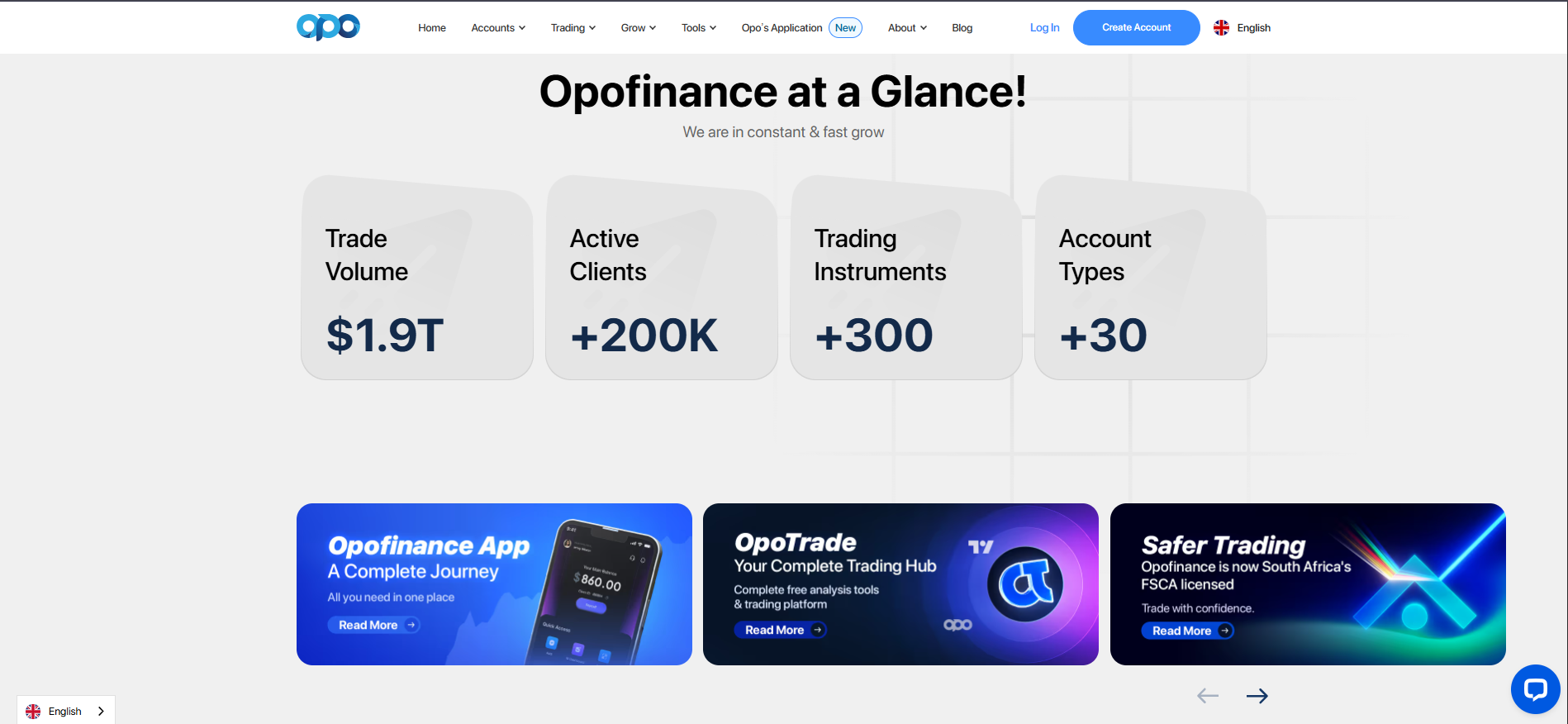

One of Opofinance’s defining qualities is its emphasis on technology and modern trading infrastructure. The broker offers traditional platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), while also providing a proprietary environment called “OpoTrade.” Through OpoTrade, users can access advanced tools — including integration with TradingView for charting and technical analysis, AI-driven analytics, social trading features, and “prop trading” or copy trading functionalities.

Moreover, Opofinance markets itself as accessible to a wide range of traders. With a relatively modest minimum deposit requirement (around US$100) and advertised leverage up to 1:500 (or higher depending on account type), the platform seems to cater to both beginners looking for an easy entry and more experienced traders seeking high leverage or diverse instruments.

In its communications, Opofinance also highlights its global reach — serving clients from many countries through its online infrastructure. As of a recent press release, the broker claimed to serve “more than 200,000 clients globally,” offering over 1,000 trading instruments.

However, Opofinance’s profile also contains contradictory and concerning regulatory and transparency signals. Some independent reviews and watchdog reports characterize the firm as “offshore,” with multiple past licenses (FSCA, Australian Securities and Investments Commission – ASIC) now expired or non-renewed.

In summary: Opofinance presents itself as a modern, technology-driven, multi-asset broker — offering broad market access, flexible platforms, and low entry thresholds — which could potentially appeal to a variety of traders. At the same time, there are significant questions around its regulatory standing and transparency, which warrant careful due diligence from prospective users.

Pros and Cons

- Broad market access covering forex, commodities, indices, stocks, metals, and cryptocurrencies — enabling diversified trading.

- Flexible platform options: traders can choose between MT4/MT5 or the broker’s OpoTrade platform, which integrates with TradingView and offers social trading, copy trading, and AI-powered tools — adding convenience, especially for users familiar with charting and analysis workflows.

- Low barrier to entry: relatively small minimum deposit requirement (around US$100) and advertised leverage up to 1:500 may appeal to beginners or traders with limited capital.

- Social and prop trading features may help less experienced traders by allowing them to follow or mimic strategies of more experienced traders.

- Regulatory status is unclear: while Opofinance claims licensing under FSA (Seychelles), its past licenses from FSCA and ASIC appear expired — raising concerns about current oversight and legitimacy.

- Offshore regulation offers limited investor protection compared to brokers licensed under Tier-1 regulators; in many jurisdictions, regulatory safeguards (compensation schemes, ombudsman support) may not apply.

- Independent reviews and watchdog reports raise serious concerns: reports of withdrawal delays or difficulties, poor transparency regarding fees and conditions, and possible mismatches between marketing claims (e.g., “zero-spread,” “AI-automated trading,” “instant withdrawals”) and actual user experiences.

- Lack of transparent information about company ownership and physical office address; some sources describe the legal background as opaque and unverifiable.

Is Opofinance Safe? Broker Regulations

Opofinance claims that it is regulated under the authority of the Seychelles FSA (license number SD124), which provides a basic regulatory framework under a light offshore jurisdiction. The broker also lists membership with the The Financial Commission (FC), suggesting an additional layer of dispute-resolution coverage and offering — in theory — a compensation fund up to €20,000 per case for clients in the event of disputes.

However, the regulatory picture is more complex and raises notable concerns:

Past claims of regulation via the Financial Sector Conduct Authority (FSCA) of South Africa, and the Australian Securities and Investments Commission (ASIC) are now questionable — according to recent analysis, both licenses have been marked as “Exceeded,” meaning they are no longer active or valid.

Independent sources note that Opofinance’s regulatory disclosures are inconsistent and sometimes opaque. There is limited verifiable information about physical offices, company ownership, or public regulatory filings.

Even with the Seychelles FSA license, many regulatory authorities worldwide (especially in stricter jurisdictions) do not consider such offshore licensing as sufficient investor protection; for clients in Europe, North America, or other regulated territories, recourse via ombudsman or compensation schemes may not be available.

Regarding security measures — Opofinance claims to hold client funds in segregated accounts (separate from company operational funds), which is a standard safety practice when legitimately implemented. The claimed membership in the Financial Commission might offer dispute-resolution mechanisms that could help in case of issues.

Nevertheless, due to the expired status of some former licenses, the offshore nature of its oversight, and the lack of independent public evidence verifying key claims (ownership, licensing, transparency), there remain substantial doubts about whether Opofinance offers the same level of safety and protection as brokers regulated by top-tier authorities. Several watchdog and watchdog-style reviews categorize it as high-risk, warning prospective users of the elevated possibility of withdrawal issues, fund mismanagement, or lack of recourse.

Conclusion on Safety: While Opofinance offers some regulatory claims and structural safeguards (segregated accounts, membership in a dispute-resolution body), the inconsistent regulatory history, offshore jurisdiction, and independent red-flags suggest that using Opofinance carries significantly above-average risk compared to brokers with strong Tier-1 regulation. Traders should approach with caution, limit exposure, and avoid allocating more capital than they can afford to lose.

How to Trade with Opofinance?

What Can I Trade with Opofinance?

Opofinance offers a broad range of asset classes and trading instruments, positioning itself as a multi-asset broker. Here’s a breakdown of what you can trade with Opofinance:

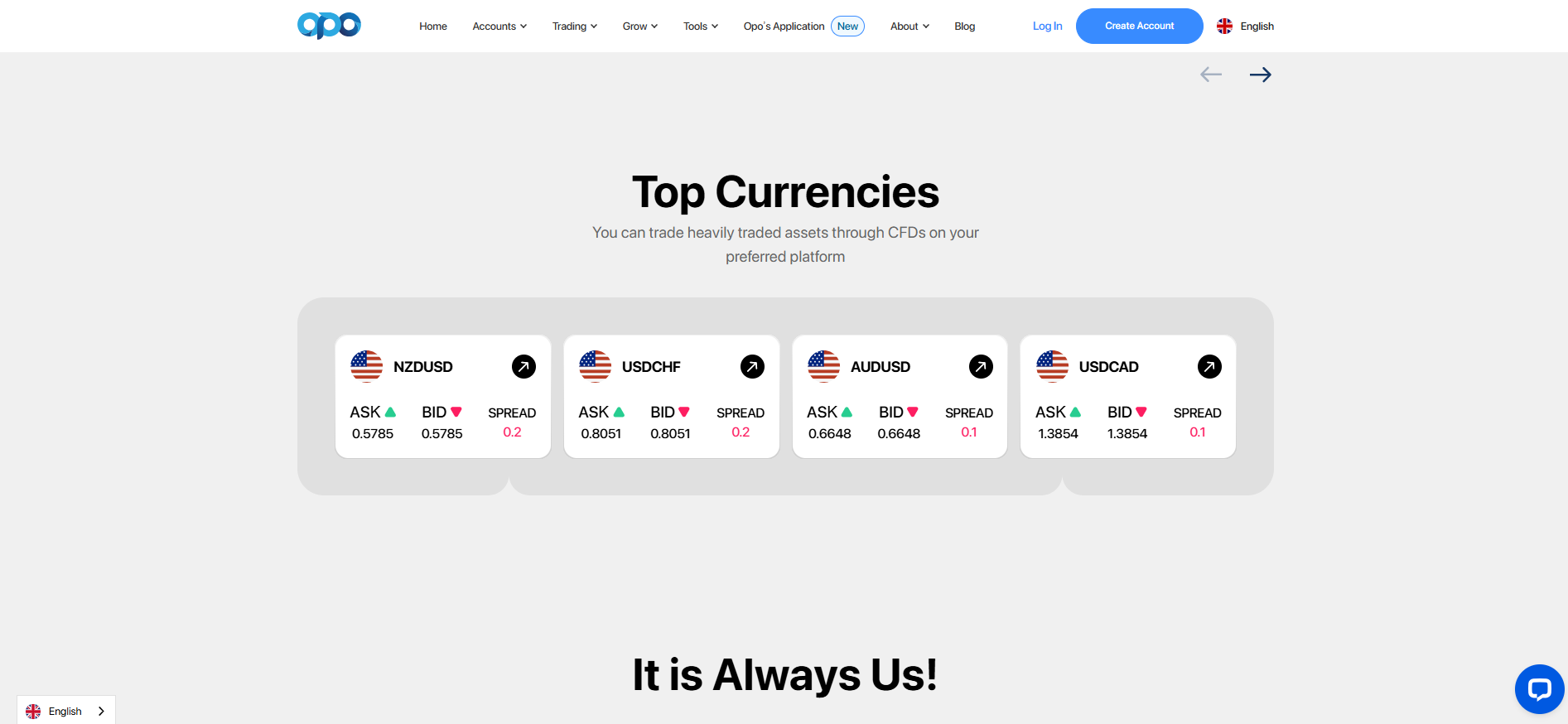

Forex (Currency Pairs)

The broker supports numerous forex pairs, covering major and minor currency combinations. This allows traders to participate in traditional currency markets with flexible leverage and varying exposure.

CFDs on Stocks and Indices

Opofinance provides CFD (Contract for Difference) trading on various stocks and stock indices. This enables traders to gain exposure to equity markets without owning the underlying shares, using margin, and potentially profiting from price movements in either direction.

Commodities & Metals

Traders can access commodities and precious metals via CFDs, enabling exposure to markets like gold, silver, and other commodity classes. This can serve as a diversification tool or a hedge against volatility in other markets.

Cryptocurrencies

Opofinance includes various cryptocurrencies among its tradable assets — allowing clients to trade crypto CFDs (rather than owning the coins directly). This addition can appeal to traders interested in crypto volatility without the need to manage wallets or custody.

Social Trading / Copy Trading & Prop Trading

Beyond traditional instruments, Opofinance offers social trading features — where less experienced traders can follow or copy the trades of more experienced peers. Additionally, “prop trading” (proprietary trading environment) is offered — potentially allowing exposure to more advanced strategies, or different risk/reward structures.

Advanced / Platform-Exclusive Instruments

Through its proprietary platform environment and integrations (e.g., with TradingView), Opofinance claims to provide advanced tools for analytics, automated trading signals, and technical/fundamental analysis — possibly enabling access to more sophisticated trading strategies or setups.

Overall, the instrument and asset coverage offered by Opofinance is wide and flexible — suitable for traders interested in global markets, diversification across asset classes, and both speculative and hedging strategies. However, given the regulatory and trust concerns (discussed earlier), the broad offering should be balanced against risk awareness and prudent capital management.

How to Trade with Opofinance

Here’s a step-by-step guide on how a trader would typically begin trading with Opofinance, from account setup to placing trades — along with an overview of tools and features that can enhance the trading experience.

Sign Up / Registration

Visit Opofinance’s website and choose “Create account” to begin registration.

Provide basic personal information as prompted in the registration form.

Some KYC (Know Your Customer) verification may be required — depending on your chosen account type and funding method.

Create a Trading Account

After registration, log in to your dashboard and select a trading account type suitable to your needs (e.g., standard, ECN, etc.).

If you prefer to test the platform first, Opofinance reportedly offers demo or test-account functionality (in some reviews, though availability may vary).

Deposit Funds

Once the account is created and verified, deposit funds via supported methods (see the relevant section below). Opofinance claims to support a variety of funding methods.

Make sure you meet the minimum deposit requirement (often ~US$100 for a standard account).

Select Your Trading Platform / Interface

Choose between standard platforms like MT4 or MT5, or use Opofinance’s proprietary environment (OpoTrade).

Alternatively, if you use TradingView and want charting + execution integrated, you can connect your Opofinance account directly via their partnership — allowing you to analyze markets and place trades from within TradingView.

Analyze Markets & Charting

Use built-in charting tools, technical indicators, and (if using TradingView integration) access to advanced charts and community-driven analysis.

Optionally use AI-driven analytics, as promoted on Opofinance’s “Innovation Hub.”

Place a Trade

Choose the asset/instrument (e.g., forex pair, CFD on a stock/commodity/crypto).

Set parameters: position size, stop-loss/take-profit (if desired), leverage (within allowed limits), order type (market, limit, etc.).

Execute the trade — via the selected platform (MT4/MT5/OpoTrade/TradingView).

Manage Open Positions / Account

Monitor trades using the platform’s interface; use risk-management tools (stop losses, margin monitoring, position sizing).

Use social trading or copy-trading features if desired (especially for less-experienced traders).

Use any analytics tools or reports provided by Opofinance (e.g., in “Innovation Hub”) to refine strategy and monitor performance.

Withdraw / Close Account (if needed)

When you decide to withdraw funds or close positions/account, submit a withdrawal request via the account portal. Opofinance claims to support “uninterrupted deposit & withdrawal,” though independent reports raise caution about delayed or problematic withdrawals.

Trading Tools & Features Summary:

Standard platforms (MT4, MT5) — widely used for forex and CFD trading.

Proprietary platform (OpoTrade) with enhanced features and flexibility.

Integration with TradingView — enabling advanced charting, technical analysis, community insights, and direct trade execution.

Social trading / Copy-trading / Prop-trading features — potentially useful for beginners or those seeking passive or network-based strategies.

AI-driven analytics and tools (as per broker’s “Innovation Hub”), which may aid decision-making, trend detection, or risk management (though the effectiveness of these is difficult to independently verify).

How Can I Open Opofinance Account? A Simple Tutorial

Here’s a step-by-step tutorial for opening a trading account with Opofinance, including what to expect, required documentation (as per common practice), and typical timelines.

Registration / Sign-Up

Visit the Opofinance website and click on “Create account” or “Sign up.”

Fill out the online form with basic personal information (name, email, phone number, country of residence, etc.) and create login credentials (username/password).

Email Confirmation & Dashboard Access

After submitting your details, you may receive a confirmation email to verify your registration. Once confirmed, you’ll have access to your Opofinance client dashboard.

KYC / Identity Verification

As with most brokers, Opofinance likely requires identity verification before full account activation — especially if you plan to deposit real funds or use higher-risk instruments. This typically involves uploading identity documents (passport/ID card, proof of address such as utility bill or bank statement, possibly a proof of payment method). Though Opofinance mentions KYC in promotional material, independent sources note that transparency around verification requirements is limited.

The verification process may take from a few hours to several days depending on document clarity and compliance checks.

Selecting Account Type & Funding

Once verified, choose the type of trading account (e.g., Standard, ECN, etc.).

Deposit funds via one of the supported methods (bank wire, credit/debit card, e-wallets, cryptocurrencies, etc.). Opofinance states that deposits and withdrawals can be made via multiple methods without additional commission.

Note the minimum deposit requirement (around US$100 for standard accounts) and ensure compliance with any funding or KYC conditions.

Activate Trading Account

After funds are deposited and cleared, your account becomes active and you can begin trading. According to some reviews, both live and demo accounts reportedly become available instantly after registration and funding.

Optional: Demo Account or Practice Mode

If you are new to trading or want to test strategies, consider using a demo account (if offered) to practice without risking real capital. Some sources report that Opofinance offers such demo/test functionality.

Start Trading

Choose your platform (MT4, MT5, OpoTrade, or TradingView interface).

Perform market analysis using the built-in tools or external analytic platforms if integrated (e.g., TradingView).

Place trades, monitor open positions, manage risk (stop-loss/take-profit), and track account performance.

Withdrawals / Account Closure

When you wish to withdraw funds, initiate a withdrawal request from your account dashboard. Ensure compliance with any identity verification or documentation requirements. Opofinance claims “uninterrupted deposit & withdrawal” with no extra fees, but independent reviews caution about withdrawal delays, review periods, or possible complications.

In case of problems or disputes, membership in The Financial Commission might provide some recourse — though the effectiveness of such dispute-resolution mechanisms can vary, especially given the offshore regulatory status.

Opofinance Charts and Analysis

Opofinance provides a combination of standard trading charting tools and an enhanced analysis environment — especially when using its proprietary platform or integrations. Key features related to charts and analysis include:

TradingView Integration: Through a recent partnership, Opofinance allows clients to connect their trading accounts directly to TradingView — enabling them to perform technical analysis, apply indicators, draw chart annotations, and then execute trades directly from the TradingView interface.

Standard Platforms’ Charting Tools: For users of MT4 or MT5, standard charting capabilities are available — including built-in technical indicators, drawing tools, timeframes, and support for Expert Advisors (EAs) or automated strategies.

AI-Driven Analytics & “Innovation Hub”: Opofinance advertises access to AI-powered analytics tools for market scanning, fundamental and technical analysis, and risk monitoring. While the exact nature and depth of these tools are not fully verified independently, this suggests an ambition to provide more than just raw charts — potentially including automated signals or analytical insights.

Usability for Different Trader Types:

Beginners: The availability of TradingView’s intuitive charting interface plus ability to copy trades (social trading) can lower the technical barrier and help new traders get started with analysis and execution.

Intermediate / Advanced Traders: Access to MT4/MT5 with full indicator suites, charting tools, and support for automation (EAs) caters to experienced traders who rely on technical or algorithmic strategies.

Diversified Strategies: Combining multiple asset classes (forex, commodities, crypto, stocks) with flexible charting allows traders to implement diverse strategies — from short-term momentum plays to long-term investments.

In short, Opofinance offers a reasonably robust charting and analysis toolkit — especially via TradingView integration — which could suit both new and advanced traders. That said, given the broader regulatory and trust-related concerns, users should remain cautious and perhaps test the analysis tools in a demo environment first (if available).

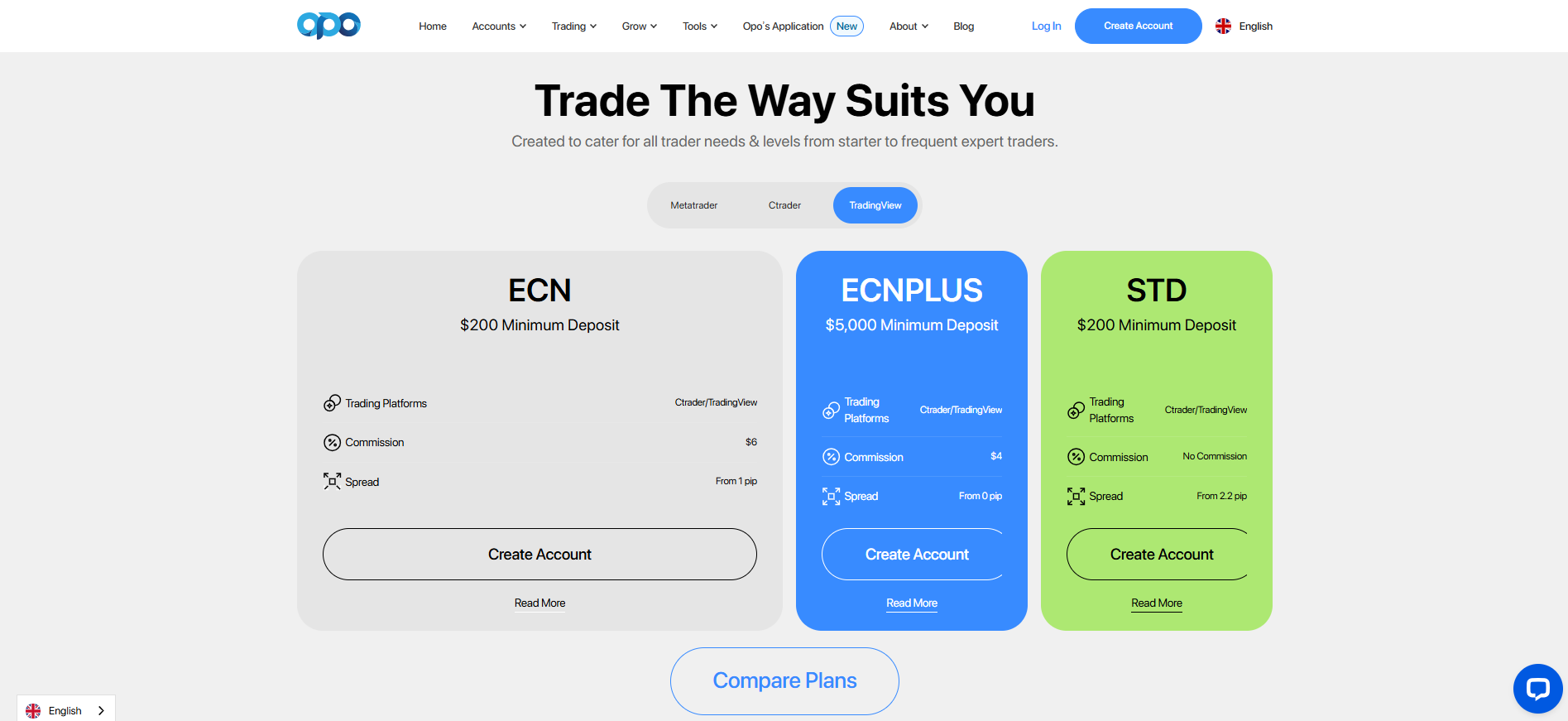

Opofinance Account Types

Here is a comparison table of the account types reportedly offered by Opofinance — along with their key features (as advertised). Note: Information is based on publicly available data; actual terms may vary and should be verified on the broker’s website.

| Account Type | Features / Conditions |

|---|---|

| Standard | Minimum deposit: ~US$100; leverage up to 1:500 (or up to 1:2000 as per some sources); access to forex, CFDs, crypto; standard spreads (variable) |

| ECN / ECN Pro | Tight spreads (from as low as 0.0–0.1 pips in ECN mode per broker’s promotion), more direct market access (DMA/ECN), possibly more favorable execution for high-frequency or volume traders. |

| Prop / Social / Introducer (IB) Account | Ability to join social trading or copy-trading programs; or to become an introducing broker to earn rebates or commissions; may include special perks, network-based income, and flexible trading access. |

Eligibility Requirements & Conditions:

Minimum deposit requirement (~US$100) applies at least for Standard account; higher account tiers (like ECN/Pro) may require larger deposits or trading volume.

Spreads, leverage, and instrument access can vary depending on the account — ECN/Pro tends to offer tighter spreads and more favorable execution than standard accounts.

Additional features (social trading, IB programs) may have separate terms and conditions; prospective users should review contract documents carefully before opting in.

Because of varying reports and some opacity in publicly available documentation, potential clients should confirm exact account specifications directly with Opofinance before committing funds.

Do I Have Negative Balance Protection with This Broker?

Negative balance protection is an important safeguard that ensures traders cannot lose more money than they have deposited. Unfortunately, publicly available documentation does not clearly confirm that Opofinance offers robust negative balance protection — and several independent reviews raise doubts about the broker’s risk-management transparency.

Here’s what can be gleaned:

No clear public statement: On the Opofinance website and its promotional materials, there is no explicit, verifiable guarantee of negative balance protection for all clients. While marketing highlights include leverage, wide instrument access, and flexible account types, there is little in the way of clear consumer-protection language.

High leverage increases risk: Because Opofinance offers high leverage (up to 1:500 or more), exposure to market volatility is magnified — making negative balance protection more relevant. Without a guarantee, this leverage becomes especially risky.

Regulatory and structural uncertainty: Given the offshore regulatory status, expired past licenses, and limited investor-protection mechanisms, there may not be an enforceable framework to ensure negative balance protection — in contrast to brokers regulated under stricter regimes, which often mandate such protections.

User reports & independent reviews raising red flags: Several independent reviews and expert analyses classify Opofinance as high-risk, citing issues such as opaque trading conditions, possible manipulative behavior (e.g., not honoring withdrawals, denying profits from certain trading strategies, delayed processing), which indirectly suggests that risk-management safeguards (like negative-balance protection) may not be reliable.

Implication for Traders: Without a verified and trustworthy commitment to negative balance protection, users risk potentially losing more than their initial deposit — especially when using high leverage. This significantly increases the risk exposure, particularly for traders using aggressive strategies or those new to margin trading.

Conclusion for This Segment: As things stand, there is insufficient evidence to confirm that Opofinance provides robust negative balance protection — or that any such measure would be enforceable under a reliable regulatory framework. Traders should assume that they might be exposed to full negative equity risk and plan their capital allocation accordingly.

Opofinance Deposits and Withdrawals

Opofinance advertises a range of deposit and withdrawal methods along with claims of smooth, commission-free transactions. However, independent analyses and user reports cast doubt on the reliability and transparency of these claims. Here’s a detailed look:

Deposit Methods

The broker purportedly supports multiple funding methods: bank wire transfers, credit/debit cards, local bank transfers, e-wallets, and cryptocurrencies.

The minimum deposit for standard accounts is reported to be around US$100.

Opofinance presents deposits as “uninterrupted” and claims there are no extra fees or commissions on deposits.

Withdrawals & Processing Times

On its website, Opofinance claims “zero hassle” withdrawals — implying instant or rapid processing.

However, independent reviews and watchdog sources raise serious concerns: multiple reports highlight withdrawal delays, account freezes, refusal or denial of withdrawals, or extended review periods — especially when profits or certain trading strategies are involved.

In some cases, users report unresponsive or inconsistent customer support when withdrawal requests are made — which undermines the claim of “instant withdrawals.”

Transparency and Fees

While Opofinance markets “zero commission” for funds movement, independent sources indicate a lack of clarity regarding fee schedules, potential hidden charges, or conditions tied to certain payment methods (e.g., e-wallets, cryptocurrencies).

There is limited publicly available documentation on minimum or maximum withdrawal amounts, processing cut-off times, or terms related to specific payment channels.

Risk and Reported Issues

Numerous user complaints highlight frustrations with delayed or blocked withdrawals, especially when profits were involved or when certain trading strategies were used.

Because of inconsistent regulatory oversight and lack of transparent audit trails (e.g., verified bank / e-wallet receipts, third-party confirmations), there is limited confidence that withdrawals will be reliably honored under all circumstances.

Conclusion for Deposits & Withdrawals: While Opofinance offers a variety of deposit methods and markets itself as providing smooth, fee-free transfers, real-world reports and independent reviews suggest that withdrawals may be problematic or subject to delays. Potential clients should approach with caution, avoid depositing or trading more than they can afford to lose, and consider verifying withdrawal processes (possibly beginning with small amounts) before committing larger funds.

Support Service for Customer

Opofinance publicly claims to offer 24/7 customer support via multiple channels: live chat, email, and phone support. On its website, support is listed among the core features, alongside trading tools, deposit/withdrawal services, and platform options.

According to feedback from some users (e.g., on review platforms), there are occasional positive reports: traders mention responsive support teams, helpful communication, and problem resolution when needed.

However, a number of independent reviews and user experiences cast doubt on the consistency and reliability of support:

Some users report delayed responses or no replies when requesting withdrawals or raising disputes.

Others claim that support may initially respond, but fails to follow up after account-freezing events, profit withdrawals, or compliance reviews — leading to frustration and distrust.

The broker’s support infrastructure and resource allocation may be limited — especially given reports that the company’s physical office location and corporate background are not clearly verifiable.

Because of these mixed signals, it is difficult to guarantee consistently high-quality support service. Prospective traders should treat support claims cautiously, especially when dealing with withdrawals or dispute resolution, and perhaps document all communications carefully.

Prohibited Countries: Where Can I Not Trade with this Broker?

Opofinance appears to restrict access for users in certain jurisdictions, though the full list is not clearly published. From independent reviews and compliance analyses, we can identify some of the factors and regions where services may be limited or prohibited:

Some watchdog reports argue that Opofinance offers its services in regulatory regimes where it is not authorized — including certain jurisdictions in the EEA (European Economic Area), North America, and other regions with strict financial-regulatory frameworks.

Additionally, when licensing has lapsed or appears invalid (e.g., expired FSCA or ASIC licenses), residents of regulated jurisdictions may be effectively excluded — or may face significant risk if using the platform.

Some sources mention that Opofinance restricts or refuses clients from high-risk or tightly regulated countries including the United States, Japan, Canada, Russia, and possibly others — though such lists might be selectively enforced or subject to change.

Because of its offshore regulation and uncertain compliance status, Opofinance may not be legally permitted to offer services in many jurisdictions with strong regulatory regimes. Users from those regions should check local laws and the broker’s disclaimers before attempting to open an account.

Special Offers for Customers

Opofinance markets several “special features” and promotional offerings to attract clients. Some of the most frequently mentioned are:

Social Trading & Copy Trading: Allows clients to follow or mimic trades of experienced or “top” traders — which may help beginners or those who prefer a more passive or guided trading approach.

Prop Trading & IB (Introducing Broker) Program: The broker promotes the ability for users to become partners or introducers — potentially earning commissions or rebates by bringing in other clients.

AI-Driven Tools and Analytics via “Innovation Hub”: Opofinance advertises AI-powered analytics, fundamental and technical analysis tools, and other trading-support functionalities — aimed at improving decision-making and risk management.

Flexible Entry & Low Minimum Deposit: With a minimum deposit advertised around US$100, Opofinance tries to make its services accessible to retail traders with limited capital.

Wide Instrument Range & Multiple Platforms: The multi-asset coverage (forex, CFDs, crypto, commodities) plus support for different platforms (MT4, MT5, OpoTrade, TradingView) are marketed as “all-in-one” benefits for traders seeking flexibility.

Terms and Conditions, and Risks:

Several independent reviews warn that many of these offers may be exaggerated or misleading — for instance, the “zero spreads” or “instant withdrawals” may not hold up under real trading conditions.

The IB program and social trading/copy trading features might carry conflicts of interest, especially if execution quality, spreads, or withdrawal reliability is inconsistent.

High leverage combined with aggressive promotional offers significantly increases risk, especially without strong regulatory protections or guaranteed negative balance protection.

In short: while Opofinance presents several attractive “special offers” that may draw in new or budget-conscious traders, these come with caveats and substantial risk — underscoring the need for careful evaluation and conservative capital management.

Opofinance Review Conclusion

Opofinance offers a compelling value proposition on the surface — modern trading platforms, wide asset coverage, flexible account types, low entry requirements, and advanced tools including TradingView integration and AI-based analytics. For traders seeking variety, convenience, and broad market access, the platform may seem attractive. Its multi-asset offering, social trading features, and relatively low deposit threshold can appeal to both beginners and more experienced traders exploring diversified strategies or different markets.

However, beneath this polished façade lie considerable concerns: the regulatory and compliance history is murky, with expired licenses and reliance on offshore registration under a light-touch regulator (Seychelles FSA). Independent reviews and watchdog analyses point to repeated issues with transparency, withdrawal delays or denials, poor support follow-up, and contradictory or unverifiable company information (e.g., physical address, corporate ownership, license claims). These factors undermine confidence in the broker’s reliability and trustworthiness.

Because of these red flags, Opofinance should be considered a high-risk broker. For traders — especially those from regulated jurisdictions or with limited experience — the potential downside (loss of funds, inability to withdraw, lack of recourse) could outweigh the benefits. If you decide to proceed with Opofinance, it may be wise to start with small deposits, avoid using high leverage, and treat any special offers with caution.

In conclusion: while Opofinance provides many features typical of a modern, feature-rich broker, its structural and regulatory shortcomings significantly compromise its standing as a “safe and reliable” broker. It might suit experienced, risk-tolerant traders willing to monitor their positions closely — but for anyone seeking strong protection, transparent regulation, or stable withdrawal behavior, more established, well-regulated brokers may be a safer choice.

Summary and Key Takeaways

Opofinance could be considered a high-risk broker — possibly usable by experienced, cautious traders with small capital — but not ideal for those seeking fully secure, well-regulated brokerage services.

- Opofinance is a multi-asset broker founded around 2021, offering forex, CFDs (stocks, commodities, indices), cryptocurrencies, and social/prop trading.

- It provides flexible platforms (MT4, MT5, proprietary OpoTrade) and integrates with TradingView for advanced charting and trade execution.

- Minimum deposit requirement is relatively low (~US$100); advertised leverage goes up to 1:500 or more.

- On the positive side: wide instrument range, modern tools, social trading, and low entry barriers — potentially attractive for new or budget-conscious traders.

- On the negative side: regulatory status is unclear (offshore, expired past licenses), weak investor protection, and multiple independent red-flags regarding transparency, withdrawals, and support.

- There is no reliable confirmation that Opofinance offers negative balance protection or strong safeguards against systemic risk.

- Deposit and withdrawal processes may not match marketing claims — reports of delays, freezes, and inconsistent support warrant caution.

FAQs

Is Opofinance properly regulated and safe to use?

Opofinance claims to have a license from an offshore regulator, but multiple independent reviews and watchdog sites flag its regulatory status as dubious or insufficient. BrokerHiveX+2fraudreviews.net+2 Many regulators worldwide consider offshore-only licensing to offer limited investor protection. Brokers-Exchange+1 As a result, using Opofinance carries higher risk than working with brokers regulated under strict, well-recognized authorities. fintelegram.com+1

What trading instruments and services does Opofinance offer?

Opofinance offers access to a wide range of asset classes: forex, CFDs on stocks, indices, commodities and metals, and cryptocurrencies. TradingBrokers.com+2TheFinanceBase+2 It also provides standard trading platforms such as MetaTrader 4/5 alongside its own proprietary or integrated platform environment, potentially including social trading or other advanced features. Brokers-Exchange+2TradingBrokers.com+2 This makes the platform appealing for traders looking for variety and flexibility.

Are deposits and withdrawals with Opofinance reliable?

Although Opofinance advertises multiple deposit and withdrawal methods and a smooth process, a significant number of user reports and independent reviews indicate problems: delayed or blocked withdrawals, unexplained refusals, and lack of transparency regarding terms. DNB FOREX REVIEW+2Cyber Scam Recovery+2 Some complain that after making profits or using certain trading strategies, their withdrawal requests were denied — raising red flags about reliability. WikiFX+2BrokerHiveX+2 Therefore, withdrawals may not always work as promised.

Does Opofinance offer account types suitable for different kinds of traders?

Opofinance reportedly provides different account types — including standard, ECN-style or “Pro” accounts, and potentially social/trader-copying or introducing-broker programs. Brokers-Exchange+2TradingBrokers.com+2 These account types are marketed with varying conditions, such as different spreads, leverage, and access to advanced trading environments, which in principle allow customization to a trader’s experience level and capital. Brokers-Exchange+1 However, due to concerns about transparency and regulatory oversight, the practical benefits may not always match the marketing claims. fraudreviews.net+1

Should I trust positive reviews and promotional claims about Opofinance?

Although there are some user reviews praising Opofinance for good platform performance, fast execution, and a variety of instruments, such testimonies are mixed with serious complaints about withdrawals, support, and transparency. Trustpilot+2WikiFX+2 Independent investigations highlight widespread “red flags” such as unverifiable regulatory status, misleading promises, and structural risk typical of high-risk offshore brokers. TheFinanceBase+2fraudreviews.net+2 Given the balance of evidence, prospective users should treat promotional claims with caution and perform independent due diligence before investing significant funds.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.

- Opofinance Overviews

- Pros and Cons

- Is Opofinance Safe? Broker Regulations

- How to Trade with Opofinance?

- How to Trade with Opofinance

- How Can I Open Opofinance Account? A Simple Tutorial

- Opofinance Charts and Analysis

- Opofinance Account Types

- Do I Have Negative Balance Protection with This Broker?

- Opofinance Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Opofinance Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author