4XC: Is This Broker Worth The Hype?

4XC Overviews

4XC (operated by 4xCube Ltd) is an offshore forex and CFD broker that offers trading on globally popular platforms (MetaTrader 4 and MetaTrader 5) across a variety of asset classes, including forex, commodities, indices, and cryptocurrencies. With a low entry-point and flexible account types, 4XC aims to serve traders ranging from beginners to high-volume professionals.

The brokerage firm 4XC was established around 2018. Its company registration points to Cook Islands (address listed at “1st Floor, BCI House, Avarua, Rarotonga, Cook Islands”). The broker offers trading through industry-standard platforms — MetaTrader 4 and MetaTrader 5 — along with a web-based interface, enabling access via desktop or mobile devices.

One of 4XC’s defining characteristics is its flexible structure catering to different types of traders: from beginners using low-deposit Standard accounts to professional traders or high-volume clients using Pro or VIP accounts with raw spreads and higher leverage. The broker emphasizes low-commission or zero-commission models, competitive spreads (with some accounts offering raw spreads from 0.0 pips), and fast execution by using STP/ECN-style liquidity aggregation.

In addition, 4XC claims to support a broad range of tradable instruments — including forex, metals, commodities, indices, oil/energy, cryptocurrencies, and CFDs — giving traders a diversified set of markets to choose from. The broker also offers supplementary services such as a free VPS (for high-volume traders), educational content and trading tutorials, copy/PAMM or investment-style accounts, and 24/5 customer support.

On its website, 4XC presents itself as a broker that blends modern execution technology, competitive trading conditions, and client-centered services. According to some independent reviewers, its strong points include transparency (in terms of trading conditions), variable spreads, account segregation, and adherence to basic security standards.

However, 4XC operates under an offshore license from the Financial Supervisory Commission in the Cook Islands, a jurisdiction less stringent than major regulators. Critics have flagged this as a potential risk — especially for traders seeking robust regulatory protections.

In sum, 4XC markets itself as a flexible, cost-efficient, and execution-focused broker that seeks to serve a broad spectrum of traders — from beginners to high-volume professionals — by offering competitive trading conditions and varied account types. At the same time, its regulatory status and certain limitations raise important considerations, which we will examine in further sections.

Pros and Cons

- 4XC offers tight trading conditions: competitive spreads, especially on Pro and VIP accounts, and relatively low-cost trading.

- The broker supports a broad range of asset classes — forex, metals, commodities, indices, cryptocurrencies, and CFDs — giving traders a diversified set of markets.

- Multiple account types (Standard, Pro, VIP) with different deposit thresholds allow flexibility for beginners and experienced traders alike.

- 4XC claims to maintain segregated client funds (i.e., keeping client money separate from company operational funds) and uses encryption/data-security measures.

- They provide access to widely used platforms (MetaTrader 4, MetaTrader 5, and web-based trading), which are familiar to many traders.

- 4XC offers educational resources and support for different trader levels, which can benefit beginners.

- The regulatory oversight comes from the regulator in the Cook Islands (Financial Supervisory Commission (Cook Islands) or FSC), under a “Money Changing & Remittance” license — not a full-fledged global broker-regulation license — which reduces the regulatory protections compared to brokers regulated by major jurisdictions.

- Some third-party reviews raise doubts about 4XC’s legitimacy as a forex broker, suggesting that the license may not cover full FX brokerage operations.

- Withdrawal fees may apply for non-VIP accounts, and there is a limitation to one withdrawal per day.

- Compared to larger, better-regulated brokers, 4XC lacks a proprietary trading platform (relies solely on MT4/MT5/web).

- Support is 24/5 (i.e., weekdays only), so weekend support may not be available — which could be a limitation for traders across different time zones.

- The regulatory jurisdiction (tier-3 environment) may offer limited investor protection compared to major regulators.

Is 4XC Safe? Broker Regulations

4XC states that it is the trading name of 4xCube Ltd and that it is authorised and regulated by the Financial Supervisory Commission (FSC) in the Cook Islands under license number 12767/2018. According to 4XC, client funds are held in segregated accounts (i.e., kept separate from the company’s operational funds), aiming to ensure that clients’ deposits are not used for the company’s operations. They further state that the company undergoes regular internal and external audits by a recognized audit firm, McMillan Woods.

From a security-technology standpoint, 4XC claims to use up-to-date encryption and standard data-protection practices to safeguard user information.

However, multiple independent reviews raise concern about the regulatory strength of that licence. While 4XC holds a “Money Changing & Remittance” license from the Cook Islands’ FSC, critics assert that this license does not equate to a full Forex-broker licence in major jurisdictions — meaning 4XC may not be subject to the same rigorous oversight, capital-reserve requirements, or investor-protection schemes as brokers regulated by stronger, tier-1 regulators.

In short: 4XC has taken measures that are typical for maintaining client fund safety (segregation, audits, encrypted data), which offers a baseline level of security. But because the regulatory jurisdiction is relatively weak and the licence type is limited, traders should view 4XC’s “safe” status with caution — especially if they require the highest level of regulatory protection.

How to Trade with 4XC?

What Can I Trade with 4XC?

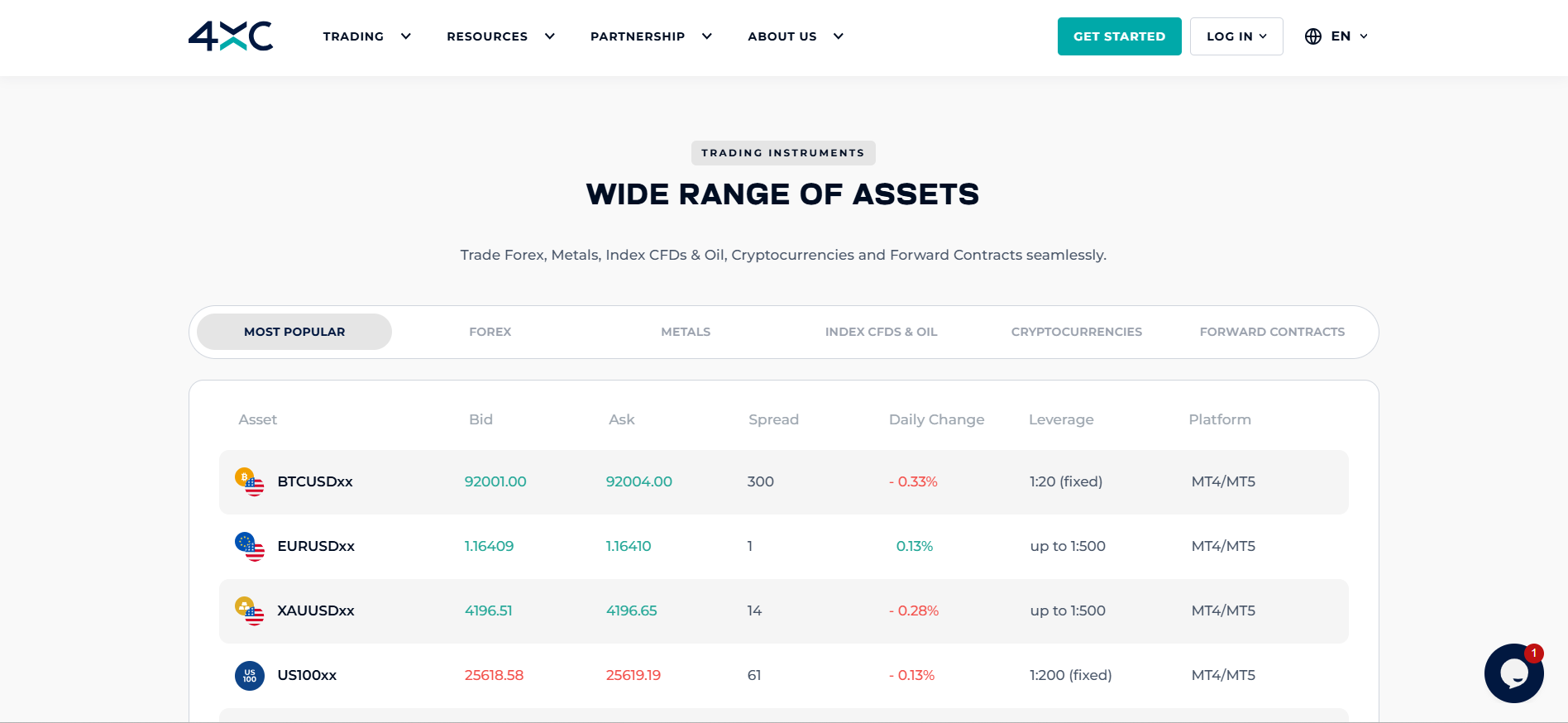

4XC offers a diversified set of tradable instruments. According to its publicly available information, tradable asset classes include forex currency pairs, precious metals, oil and energy commodities, index CFDs, commodity CFDs, stock CFDs, and cryptocurrencies. Forward contracts are also listed among the offerings.

More specifically:

Forex: Major, minor, and possibly exotic currency pairs, with leverage up to 1:500 and lot sizes starting at 0.01.

Metals & Commodities: Precious metals (e.g., gold, silver) and other commodity instruments via CFDs.

Indices & Oil / Energy: CFDs based on global market indices, and energy-sector commodities like oil.

Cryptocurrencies: CFD exposure to cryptocurrencies, allowing traders to speculate on crypto-price movements without holding underlying coins directly.

Stock CFDs: CFD-based stock instruments (though the selection breadth compared with full-stock brokers may be narrower).

Forward Contracts & Other CFDs: For users looking for more advanced or long-term exposure, forward contracts and other CFD-based instruments are available.

Because 4XC uses widely-used platforms (MT4/MT5/web), traders familiar with standard Forex/CFD trading can easily access and trade these instruments. The availability of high leverage (up to 1:500) may appeal to traders seeking amplified exposure, though this also raises risk.

Overall, 4XC offers a broad, flexible offering that covers many popular asset classes — making it potentially suitable for traders who want variety under one roof.

How to Trade with 4XC?

Here’s a general walkthrough of how trading with 4XC works — from platform login through placing a trade:

Account Setup and Login

After registration (see the “How to Open an Account” section below), you log in to the 4XC client portal using your credentials. Once logged in, you can access the trading dashboard and choose your platform (MT4, MT5, or web).

Platform Selection

Choose between MetaTrader 4, MetaTrader 5, or the web-based platform. On their website, 4XC emphasizes that they support both MT4 and MT5 to cater to different trader preferences.

Installation (for desktop) or direct login (web/mobile) is required; for web or mobile trading, there is no need for separate software downloads.

Funding the Account

Deposit funds using one of the supported methods (bank wire transfer, credit/debit card, crypto, e-wallets, etc.). The “Deposit” button becomes active once KYC verification is completed.

Choose the account type that fits your needs (Standard, Pro, VIP) depending on your deposit amount and trading style.

Placing a Trade

Once funds are in your account, open the chosen platform (MT4/MT5/web).

Select the asset/instrument you want to trade (e.g., a forex pair, commodity, crypto CFD, etc.). 4XC offers a broad instrument set covering forex, metals, commodities, indices, crypto, and more.

Choose your trade parameters — lot size (minimum 0.01), leverage (up to 1:500), order type (market or pending), stop-loss/take-profit levels if desired. Execute the trade and monitor via charts/price windows; you can close positions manually whenever desired.

Use of Trading Tools and Features

Use the analytical tools, indicators, and order types available on MT4/MT5 or the 4XC web platform for technical analysis. These platforms are widely supported and familiar among traders.

For more advanced strategies or high-volume trading, features like raw spreads (on Pro/VIP accounts) and high leverage may be used to optimize cost and exposure.

Educational resources provided by 4XC — such as market analysis, tutorials, and possibly webinars — can help traders build or improve their trading strategies.

Monitoring and Risk Management

Traders should manage risk carefully, especially given high leverage. Setting appropriate stop-loss/take-profit levels is important. The platforms supported allow flexible management of positions.

Because 4XC reportedly offers negative balance protection (see later section), your exposure to risk may be limited to your invested capital (subject to eligibility).

In short: Trading with 4XC follows the familiar workflow used among many retail Forex/CFD brokers — account funding → platform login → choosing instrument → setting trade parameters → execution. Their use of standard trading platforms and broad instruments make the trading process relatively straightforward for both new and experienced traders.

How Can I Open 4XC Account? A Simple Tutorial

Here’s how to open an account with 4XC, step by step — along with what you should expect regarding verification, timelines, and requirements:

Visit the 4XC Website and Begin Registration

Navigate to the official 4XC website and click on “Open Account” or “Register.” The website guides new users to start the sign-up process.

Choose the type of account you want to open (Standard, Pro, or VIP). Minimum deposit thresholds vary depending on account type: Standard requires USD 50, Pro USD 100, VIP USD 10,000.

Complete Your Profile: KYC / AML Verification

After registration, you will likely be prompted to submit identity verification. 4XC requires that the deposit come from a personal account (i.e., payments from third parties are not permitted) — a standard anti-money-laundering measure.

Typically, you may need to provide a government-issued ID (passport, national ID card, etc.) and possibly proof of address. (As with most brokers, this helps ensure compliance with AML regulations.)

Approval and Funding the Account

Once KYC verification is completed and approved, you can access the deposit functionality. On 4XC’s site, the “Deposit” button becomes available only after verification.

Select your preferred funding method from those supported (bank wire transfer, credit/debit card, crypto, e-wallets).

Deposit the required minimum amount corresponding to your chosen account type.

Platform Setup

After funding, you can download or open the platform (MT4 or MT5) or use the web-based interface. For desktop, install the appropriate software; for web or mobile, simply log in using your credentials. 4XC supports both MT4 and MT5, which are among the most widely used trading platforms worldwide.

Optional Setup / Extras

If you choose a Pro or VIP account, you may benefit from tighter spreads or raw-spread execution.

Some clients may opt for additional services such as PAMM / investment accounts or copy-trading features, if 4XC offers them (as indicated in account-type listings).

Timeframes and Other Considerations

The time for account approval depends on how quickly you submit valid documentation and complete KYC. The documentation on 4XC indicates they follow standard compliance procedures, which may require review and approval.

After approval and deposit, trading can begin almost immediately via the chosen platform.

This process reflects standard industry practice for retail Forex/CFD brokers. For a smooth experience, ensure that your identity and funding documents are correct and comply with 4XC’s policies (e.g., deposit from your own account).

4XC Charts and Analysis

4XC does not provide a proprietary trading platform; instead, it relies on industry-standard platforms — MT4, MT5, and a web-based interface.

Charting Tools & Indicators

On these platforms (MT4/MT5), traders gain access to a broad range of built-in charting tools: multiple time-frames, standard chart types (line, bar, candlestick), and a wide library of technical indicators (moving averages, RSI, MACD, Bollinger Bands, etc.), as common for these platforms.

Advanced features of MT5 in particular (compared with MT4) include more time-frames, additional order types, and enhanced analytical capabilities — useful for intermediate to advanced traders. 4XC highlights that MT5 allows a wider range of assets and advanced order types.

Usability Across Trader Levels

For beginners: Using familiar chart interfaces and classic indicators helps in learning basic technical analysis. Also, the availability of educational materials (as claimed by 4XC) supports learning.

For experienced traders: The combination of MT5’s advanced features, leverage, and access to multiple asset classes gives room for more sophisticated strategies (scalping, hedging, multi-asset portfolios, etc.).

Limitations / Considerations

Since 4XC does not have its own proprietary analytics platform, the user relies entirely on what MT4/MT5 (or web interface) offers. For some traders expecting broker-provided advanced analytics, this could be a limitation.

Chart performance, connection stability, and order execution speed depend also on 4XC’s servers and data-feed quality — as with any broker. 4XC claims to run “lightning-fast servers in LD4 data-centers” for fast execution.

In summary, charts and analytical resources at 4XC are standard but robust, aligning with widespread industry tools (MT4/MT5). For most traders — from beginner to advanced — the tools should be adequate; advanced traders may however miss some specialized analytics features absent in standard platforms.

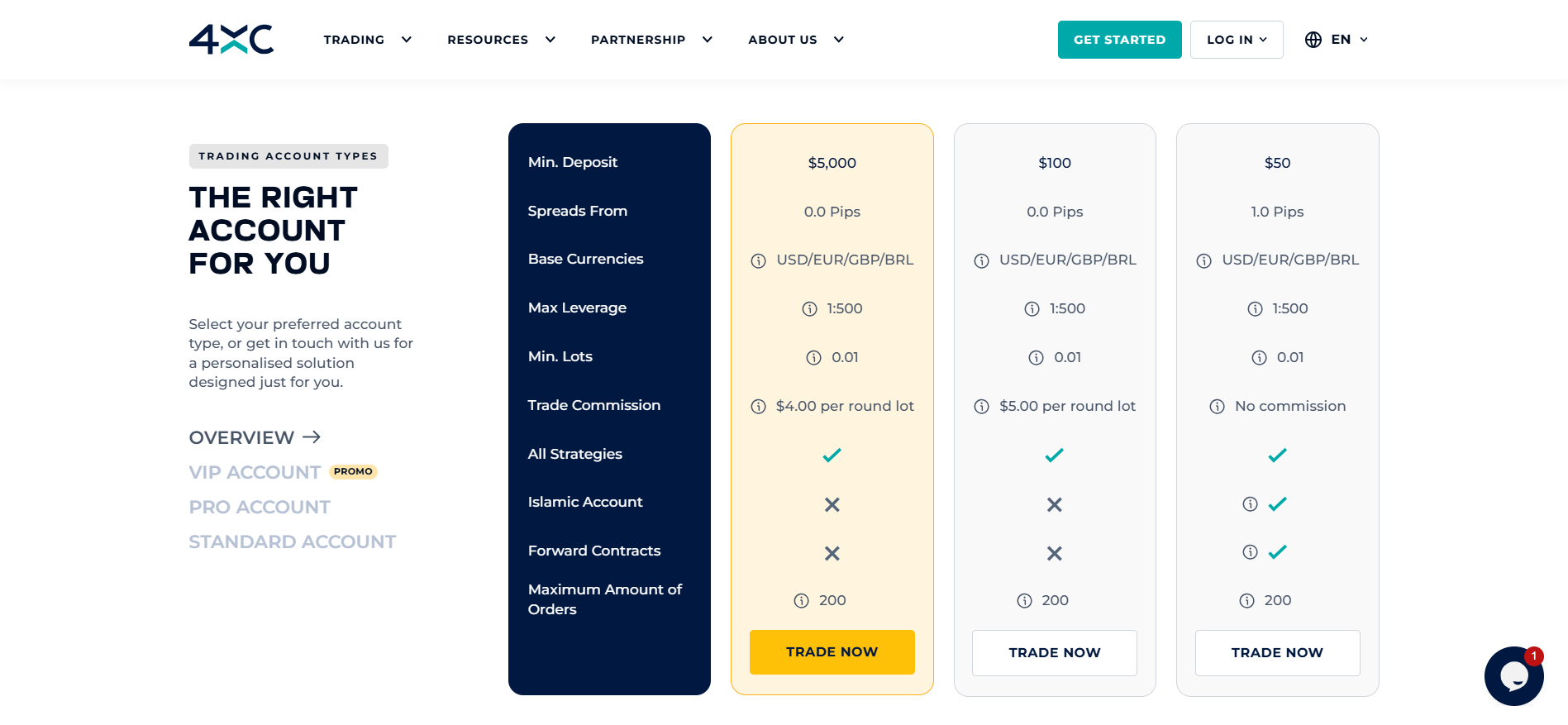

4XC Account Types

Here is a summary of the main account types offered by 4XC, along with their typical features and eligibility requirements:

| Account Type | Minimum Deposit | Spreads / Commissions / Leverage | Eligibility / Notes |

|---|---|---|---|

| Standard | USD 50 | Variable spreads; standard account conditions | Entry-level; suitable for beginners or small-capital traders |

| Pro | USD 100 | Tighter spreads, possibly lower commission, up to 1:500 leverage. | Traders seeking improved conditions versus Standard; more active trading |

| VIP | USD 10,000 | Raw spreads (from 0.0 pips as claimed), minimal commission, high leverage (up to 1:500) | High-volume or professional traders; potentially better withdrawal/fee terms |

Additional account-type features: 4XC offers PAMM / copy-trading or investment-style accounts (for users wanting managed-account exposure) in some cases.

Note: According to 4XC’s “Funding Methods” page, deposit and withdrawal minimums correspond to account types; VIP account holders may enjoy waived withdrawal/deposit fees.

Do I Have Negative Balance Protection with This Broker?

Yes — 4XC states that it offers negative balance protection for client accounts.

What does this mean? Negative balance protection ensures that you cannot lose more than your account balance. In volatile markets, if losses threaten to exceed your deposit, the protection mechanism resets your balance so you do not end up owing more money than you invested.

How it works with 4XC: According to their Help Center, clients can request negative balance protection by contacting the broker (via email) and providing their account number. This suggests that negative balance protection may not be automatic for all accounts — you may need to opt in or request it explicitly.

Impact on Risk Management:

For retail traders, negative balance protection reduces the risk of catastrophic debt in highly leveraged trades — a valuable safety net.

It encourages more responsible trading: knowing that you cannot owe more than your deposit helps in planning position sizes and leverage more conservatively.

However, negative balance protection does not remove market risk. Trades can still result in full loss of deposited funds; it just prevents a negative balance.

Caveats: Given 4XC’s regulatory context (see earlier section), the effectiveness of such protection may depend on the firm’s compliance, liquidity, and back-office integrity. While 4XC claims that the protection is available, in practice traders should verify that their account is properly enrolled and that the broker upholds the mechanism during volatile conditions.

4XC Deposits and Withdrawals

Deposit Methods & Process

4XC accepts a variety of funding methods: bank wire transfer, credit/debit cards, cryptocurrencies, and various e-wallets, depending on client’s country of residence.

Deposits must originate from personal accounts — transfers from third-party accounts are not allowed. This is standard AML/KYC compliance.

Minimum deposit thresholds depend on account type: Standard → USD 50; Pro → USD 100; VIP → USD 10,000.

Withdrawal Methods, Fees & Limits

Withdrawals can be made to clients’ own personal accounts only, for security and compliance.

There is a limit of one withdrawal per day.

According to some external reviews (though not official 4XC pages), certain payment methods (e.g., credit/debit cards, wire transfers, crypto) may carry fees: for example, card withdrawals charged 0.5%, crypto withdrawals a flat fee (e.g., $25), and wire transfers significant fees (e.g., SWIFT).

Processing times may vary depending on method: external reviews indicate 1–3 business days for withdrawals under some methods.

On 4XC’s own page, VIP account holders may enjoy waived fees for deposits and withdrawals (or more favorable terms).

Considerations & Potential Drawbacks

Because withdrawal fees may apply (especially for non-VIP accounts), small-balance traders might find costs significant relative to account size.

The one-withdrawal-per-day policy may limit flexibility, especially for clients who need frequent withdrawals.

Given mixed third-party reviews (some reporting delays or issues with withdrawal), prospective clients should start with small amounts and test the deposit/withdrawal process first. For example, one user on a review site wrote that withdrawals with a credit card took 7–10 business days.

Support Service for Customer

4XC advertises 24/5 support (i.e., around-the-clock during trading weekdays). Their contact channels reportedly include live chat, email, phone, and possibly messaging (e.g., WhatsApp) depending on region.

Support Quality & Response Times

On a popular review platform, 4XC holds a TrustScore of 4.1/5 based on 550+ reviews, with many clients praising their support: one user wrote, “When I had an issue, they looked into it straight away and it was resolved within a very short time.”

Generally, users report satisfactory support, especially in resolving deposit/withdrawal or account-related problems.

Limitations

Support is only weekdays (i.e., 24/5), so weekend support may not be available — a disadvantage for traders operating across different time zones or needing assistance on weekends.

As with many brokers, support quality may vary depending on demand; some negative user reviews report difficulties or delays during verification or withdrawal.

Languages & Global Reach

While precise language-support details are not publicly documented, the global user base and multiple currency/account-currency support suggest 4XC serves a diverse, international community.

Overall: 4XC’s support services appear relatively robust for a small offshore broker, with multiple contact channels and generally positive user feedback — though the limitation to 24/5 and occasional reports of delays or issues should be kept in mind.

Prohibited Countries: Where Can I Not Trade with this Broker?

According to 4XC’s own Help-Center information, the broker does not offer services to residents of certain jurisdictions. Specifically, it lists the following as restricted:

United States

Iraq

Iran

Myanmar

North Korea

This list may not be exhaustive; availability of services depends on local regulatory compliance and payment method support. As such, potential clients should check 4XC’s website (or contact support) to confirm whether their country of residence is eligible.

Additionally, because 4XC is regulated under the FSC (Cook Islands) and uses an offshore-style license structure, clients in jurisdictions with strict regulatory standards may face difficulties — and the broker may restrict services accordingly. Some external reviews point out that 4XC has received warnings from regulators in some countries (e.g., about operating without license).

Lastly, payment and funding options may vary depending on a client’s country — meaning that even if account creation is possible, deposit/withdrawal methods may be limited or unavailable in certain regions.

Special Offers for Customers

4XC’s website currently advertises certain promotional offers, especially around holiday seasons or special events. For example: a “75% Deposit Bonus” and promotional campaigns (e.g., “VIP Christmas,” “Christmas Signals”).

Other features that may function as long-term incentives or loyalty benefits:

Access to raw spreads for Pro/VIP account holders, which reduces trading costs for active or high-volume traders.

For VIP clients, more favorable deposit/withdrawal terms — possibly no fees on funding transfers.

Educational resources: 4XC claims to offer courses for beginners, advanced traders, and experts. This may count as a value-added benefit for those seeking to learn or sharpen their trading skills.

Terms & Conditions / Cautions with Offers

According to user reviews, some promotional bonuses (e.g., first-deposit bonus) are subject to terms and conditions, and may be removed or adjusted at 4XC’s discretion.

As with many brokers offering bonuses or incentives, traders should carefully read the bonus terms (leverage, withdrawal restrictions, minimum volume/trade amount) before relying on them. One complaint noted that the bonus was removed under what the broker described as “company discretion,” leading to dissatisfaction.

Relying on promotions rather than core trading conditions may carry additional risk — so traders should be cautious and treat bonuses as secondary to account’s standard trading terms.

In summary: 4XC provides occasional promotions and long-term incentives that can benefit traders, especially those with larger accounts or who trade actively. However, as with all bonuses, it’s important to read and understand the associated terms to avoid surprises.

4XC Review Conclusion

4XC presents itself as a flexible, multi-asset broker aiming to serve a broad spectrum of traders — from beginners to experienced professionals — by offering low minimum deposits, varied account types, competitive trading conditions, and a suite of asset classes. Their use of standard, widely accepted trading platforms (MT4/MT5/web) makes it easy for traders with prior experience to get started; new traders may appreciate the availability of educational materials and lower-entry barriers.

On the strengths side: 4XC offers competitive spreads (especially on Pro/VIP accounts), high leverage, diversified instruments (forex, metals, commodities, indices, crypto, CFDs), and standard brokerage security practices (segregated accounts, audited by an external auditor, data encryption). Their support services and multiple funding options add to convenience and accessibility.

However — and importantly — 4XC’s regulatory status sits in a weaker jurisdiction (the Cook Islands), under a license type that may not afford the same protections as major regulatory regimes (such as those in the EU, UK, US, or Australia). External reviews question whether the license covers full FX brokerage operations — raising doubts on the depth of oversight. The use of an offshore license, combined with limitations such as withdrawal fees, one-withdrawal-per-day policy, and occasional user complaints about withdrawal delays or issues, means there is some degree of risk involved.

Thus, while 4XC may be a reasonable option for traders who accept higher risk in exchange for flexibility and lower cost, it is less suitable for traders who prioritise strong regulatory protection or institutional-level safeguards.

For new or budget-limited traders seeking to explore forex/CFD trading with minimal initial capital, 4XC could be an entry point — so long as they start small, carefully test deposit/withdrawal procedures, and stay aware of risks. For high-volume or long-term traders, the VIP or Pro accounts may offer advantages, but they should weigh those against regulatory limitations and their own risk tolerance.

In short: 4XC offers an accessible, feature-rich trading environment under standard platforms — but its offshore regulatory status and mixed external reputation make it best suited for traders comfortable with moderate risk and cautious oversight.

Summary and Key Takeaways

4XC’s strengths (low minimum deposit, breadth of instruments, competitive conditions) make it potentially useful for beginners or cost-conscious traders; but its regulatory limitations and occasional criticism mean it may not suit those seeking maximum security or strong regulatory safeguards.

- 4XC is operated by 4xCube Ltd, registered in the Cook Islands, offering Standard, Pro, and VIP account types with minimum deposits from USD 50 upward.

- Tradable instruments include forex, metals, commodities, indices, stock CFDs, cryptocurrencies, and forward contracts — providing a broad, multi-asset offering.

- Platforms supported are MetaTrader 4, MetaTrader 5, and a web interface — familiar and widely accepted tools for trading.

- 4XC claims to maintain segregated client funds, uses encryption, and is audited by an external auditor — offering baseline safety measures.

- Negative balance protection is reportedly available (upon request), which can help limit downside risk.

- Deposit and withdrawal methods are varied (wire transfer, card, crypto, e-wallets), though fees and a one-withdrawal-per-day limit may apply for non-VIP accounts.

- Customer support is available 24/5, with generally positive user feedback on responsiveness and issue resolution.

- Regulatory oversight via Cook Islands’ FSC under a money-changing license offers only limited investor protection compared with brokers regulated in major jurisdictions — a central risk factor.

FAQs

Is 4XC regulated and are my funds safe?

4XC states that it is operated by 4xCube Ltd, registered in the Cook Islands under license number ICA 12767/2018, and licensed by the Financial Supervisory Commission (FSC, Cook Islands) under a Money Changing & Remittance licence.

They claim to keep client funds in segregated accounts (separate from operational funds), use modern encryption for data security, and are audited by external auditors (McMillan Woods). 4XC+2forexrating.com+2

However, independent reviews caution that the license held is not equivalent to a full FX-broker licence under major regulatory regimes. Some expert reviewers consider this a limitation in terms of investor protection and oversight. TheForexReview.com+255brokers+2

Thus, while 4XC provides certain safety measures, its regulatory status may not offer the same level of protection as brokers licensed under top-tier regulatory authorities.

What instruments can I trade on 4XC?

4XC supports a wide range of tradable instruments including forex currency pairs, commodities (e.g., precious metals, energy), indices, CFDs on commodities and stocks, and cryptocurrencies.

The broker claims to offer high leverage (up to 1:500) and variable spreads (with raw / low-spread accounts available), enabling traders to access multiple asset classes under one roof.

This diversity makes 4XC suitable for traders seeking a multi-asset portfolio or flexible exposure across different markets, from forex to crypto and commodities.

Does 4XC offer negative balance protection?

Yes — 4XC states that negative balance protection is available. To access it, users need to request it by sending an email with their trading account number.

Negative balance protection means that in volatile markets, a trader’s losses cannot exceed their account balance — thereby avoiding owing more than their initial deposit. This can help limit downside risk when using leverage.

However, as with other aspects of 4XC, the effectiveness of this protection depends on the broker honouring it. Given regulatory and oversight limitations, traders should verify that protection is activated for their account and treat it as one of several risk-management tools, not a guarantee against all risk.

What are the account types and minimum deposits at 4XC?

4XC offers three primary real-money account types: Standard, Pro, and VIP.

The Standard account has the lowest entry barrier — suitable for beginners or small-capital traders.

The Pro account is targeted at more active or cost-conscious traders — offering tighter spreads, potentially lower commissions, and access to full platform features.

The VIP account is intended for high-volume or experienced traders — often featuring the most competitive spreads (raw spreads), possibly reduced fees, and premium support or conditions.

This tiered structure allows traders to choose an account aligned with their capital, experience, and trading goals.

Are there user complaints or risks associated with 4XC?

Yes — while many clients report smooth service and satisfactory support, there are also several complaints and risk-related concerns. According to one review site, some users experienced delays or complications in withdrawals, and occasional issues with verification procedures.

Independent watchdogs and review platforms often highlight the fact that 4XC’s licence is considered weak compared to major regulators, raising concerns about transparency, investor protection, and long-term reliability.

Additionally, because there is no government-backed deposit compensation scheme tied to 4XC, clients relying on full safety nets (as offered by some regulators) may find that protection lacking.

For these reasons, potential clients should proceed cautiously: consider starting with a small deposit, thoroughly test withdrawals, and avoid investing more than they can afford to lose.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.

- 4XC Overviews

- Pros and Cons

- Is 4XC Safe? Broker Regulations

- How to Trade with 4XC?

- How Can I Open 4XC Account? A Simple Tutorial

- 4XC Charts and Analysis

- 4XC Account Types

- Do I Have Negative Balance Protection with This Broker?

- 4XC Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- 4XC Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author