Vestrado Broker Review: What To expect in 2025?

Vestrado Overviews

Vestrado was an online forex/CFD broker offering trading via MetaTrader 4/5, with a low minimum deposit (from USD 10), high leverage (up to 1:2000), and a variety of account types — designed to attract beginner and experienced traders alike.

Vestrado launched around 2020 and operated under the name Vestrado Ltd. The company claimed registration in Saint Vincent and the Grenadines (SVG), using the registered address “First Floor, SVG Teachers Co-operative Credit Union Limited, Uptown Building, Corner of James and Middle Street, Kingstown, St. Vincent and the Grenadines.”

Vestrado presented itself as an online trading broker enabling clients to trade a variety of instruments — including forex, commodities, indices, and CFDs — using well-known trading platforms (MT4 and MT5). They advertised features such as high leverage (up to 1:2000), a low minimum deposit (reportedly around USD 10), and a broad selection of account types to cater to traders of different experience levels.

On the surface, Vestrado appeared to offer competitive conditions: access to many instruments, flexible account tiers, leveraged trading, and the convenience of the popular MetaTrader infrastructure. However, the broker’s external reputation and regulatory standing have been subject to serious concerns — many of which are outlined below.

Importantly, as of 2025, Vestrado has issued an official notice announcing the cessation of its operations. According to the notice, the broker will shut down on 24 October 2025; new registrations were disabled as of 3 October 2025, and clients were instructed to close open positions and withdraw funds by between 10–20 October 2025.

Because of this closure, Vestrado can no longer be considered an active broker — any evaluation must bear in mind that its services are being terminated.

Pros and Cons

- Offers a low minimum deposit requirement, making it accessible for new traders.

- Provides a diverse range of tradable instruments including forex, commodities, indices, and CFDs.

- Supports widely used trading platforms such as MT4 and MT5 for a familiar trading environment.

- Features high leverage options of up to 1:2000 for traders seeking amplified market exposure.

- Includes promotional bonuses, demo accounts, and basic educational tools that appeal to beginners.

- Operates with weak regulatory oversight, raising questions about compliance and transparency.

- Lacks clear, publicly verifiable information regarding spreads, execution, and fund safeguards.

- Has a record of user-reported withdrawal delays and concerns over fund accessibility.

- Customer support performance has been inconsistent, with reports of slow and unhelpful responses.

- High leverage and limited oversight make it risky for inexperienced traders.

- Officially announced closure of operations in 2025, meaning the broker is no longer active for new or existing clients.

Is Vestrado Safe? Broker Regulations

Regulation and transparency are among the most critical factors when evaluating any broker’s trustworthiness. In the case of Vestrado, the regulatory picture is murky and concerning.

Vestrado is registered in Saint Vincent and the Grenadines (SVG) under company number 25911 BC 2020.

The broker has in some sources claimed a license under Financial Sector Conduct Authority (FSCA) of South Africa — license number 51891. However, inspection by external reviewers shows that this license status is currently flagged as “Exceeded,” which typically indicates that the firm is operating beyond authorized scope or failing to meet regulatory requirements.

Operating under SVG registration provides little real regulatory protection. SVG is known for minimal oversight of offshore forex/CFD brokers, and registration there does not equate to regulatory approval or enforcement.

Several independent evaluator sites highlight that Vestrado fails to offer verifiable segregated client accounts, does not publish audited financials, and lacks evidence of robust data/fund security procedures.

Regarding fund safety: while Vestrado claims to protect customer funds, there is no publicly available audited proof or credible documentation that confirms compliance with industry-standard protections (like separate trust accounts, client fund segregation, or insurance).

Negative balance protection — a feature that prevents clients from losing more than their initial deposit in leveraged trades — is not clearly documented. Independent reviews note the absence of explicit statements about such protection.

Given these factors, the regulatory and safety environment around Vestrado is highly uncertain. The combination of weak regulatory oversight, unclear fund protections, and ambiguous documentation poses a serious risk for clients.

Furthermore, the official notice of closure (operations ceasing as of 24 Oct 2025) means that Vestrado is no longer functioning, which further undermines any claims of ongoing compliance or fund safety.

Conclusion on Safety: Vestrado cannot be considered a safe, regulated broker by credible industry standards. At present, it should be regarded — at best — as a defunct or high-risk entity, not suitable for new or ongoing trading.

How to Trade with Vestrado?

What Could You Trade with Vestrado?

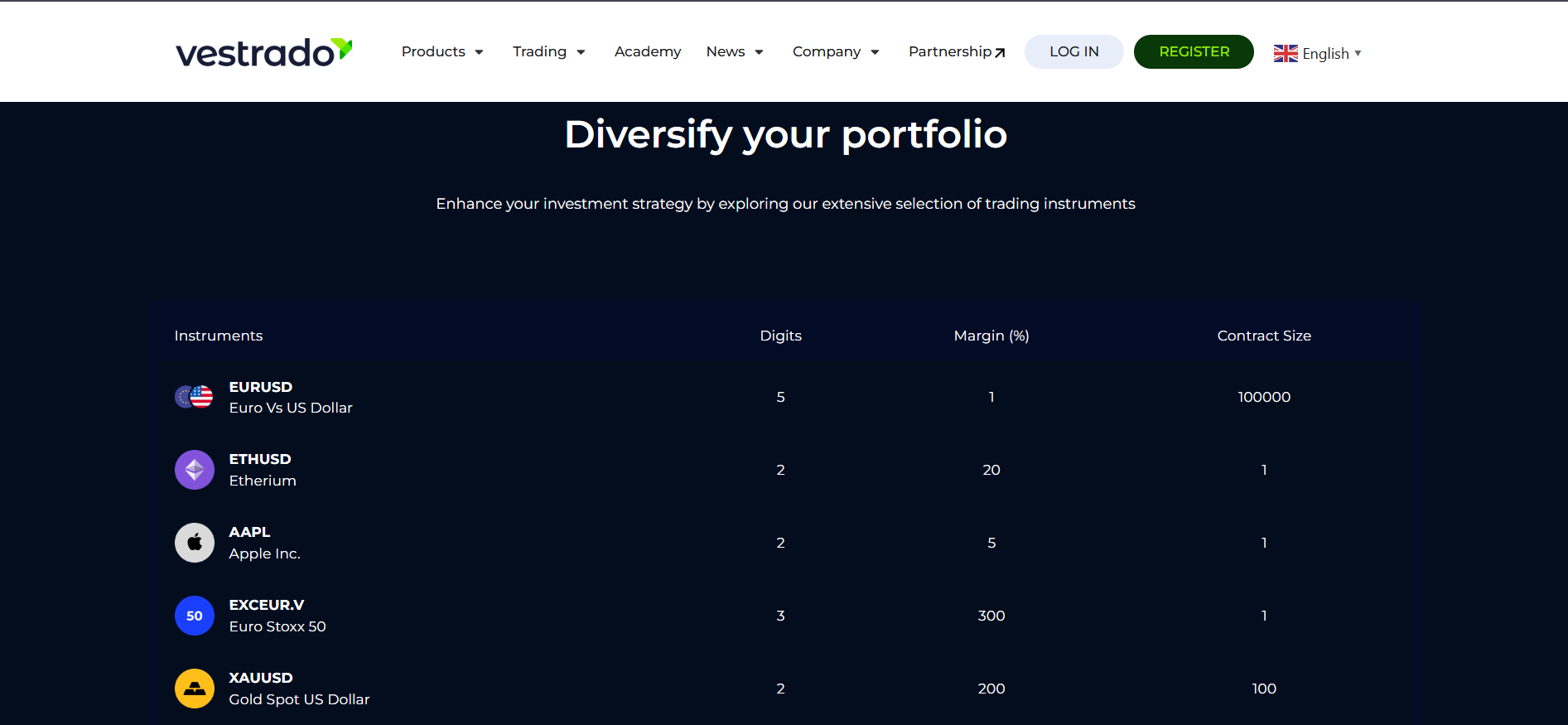

When it was active, Vestrado claimed to offer a broad selection of tradable instruments across multiple asset classes:

Forex: Major, minor, and exotic currency pairs. As a forex broker with high leverage offerings, this was reportedly a core part of its services.

Commodities and Indices: According to the broker’s marketing, clients could trade commodities (e.g. precious metals, maybe energy) and indices — similar to many CFD brokers.

CFDs on Assets: Vestrado presented itself as a CFD broker, meaning clients could use leverage and trade derivative products tied to various underlying assets.

Diverse Instruments: The website claimed “150+ markets / instruments,” which suggests a wide scope — potentially including more exotic or niche instruments depending on region and account type.

Because the trading platform was advertised as both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), traders would have had access to standard functionalities: leverage, margin trading, charts, indicators, and typical forex/CFD trading functions.

Unique / Standout Offerings (as claimed):

High leverage (up to 1:2000), making it attractive to aggressive, high-risk traders.

Low deposit threshold (reportedly $10) — potentially enabling traders with minimal capital to get started.

Variety of account types, which seemingly catered to different risk appetites and trading volumes (from entry-level to more advanced).

Reality given Current Status:

Given Vestrado’s announced shutdown (24 October 2025) and disabling of new registrations as of 3 October 2025, these offerings are no longer available for new clients. Existing clients were instructed to close positions and withdraw funds by specified deadlines. Therefore, while historically Vestrado offered a broad instrument suite, at present there is essentially nothing available for trading.

How to Trade with Vestrado

Platform Access: Vestrado provided access to standard trading terminals — MT4 and MT5 — widely used in the forex and CFD industry. This would allow traders to use charting, technical indicators, order types (market, limit, stop), and multiple asset classes.

Account Selection & Deposit: A prospective trader would choose among Vestrado’s account types (e.g. “Frux STP”, “Respectus ECN”, “Fides Cashback”), each with different conditions. Then deposit funds (with the reportedly low minimum) to fund trading activity.

Leverage & Margin: The broker advertised high leverage — up to 1:2000 — meaning small capital could control larger positions (though this also increases risk).

Order Execution & Trading: Using MT4/MT5 interface, traders could place orders (forex pairs, commodities, indices, CFDs) and monitor positions, margin levels, and manage assets. The platform should support standard trading operations: opening/closing positions, setting stop-loss/take-profit, etc.

Account Monitoring / Management: Traders would use the broker’s client area to monitor their account balance, margin levels, open positions. Vestrado likely provided a withdrawal/deposit interface, and possibly educational materials or support features (as per their marketing).

Withdrawals / Account Closure: When a trader decided to leave or exit, they would submit a withdrawal request via the withdrawal section. Under the closure notice (2025), clients were urged to withdraw all funds between 10–20 October 2025.

Tools & Features (as claimed):

MetaTrader 4 and 5 — widely used trading terminals, offering charting tools, technical indicators, order management, and multi-asset support.

Account types with different conditions (leverage, spreads, possibly commission structure) to suit different trader profiles.

Bonus and promotion features (e.g. deposit bonus, demo account) for traders testing or starting out.

In some cases, educational material or training offered (as claimed in marketing).

Important Note (2025): As of October 2025, Vestrado discontinued operations — so none of the above trading functionalities are effectively accessible to new or existing traders beyond the closure process.

How Can I Open Vestrado Account? A Simple Tutorial

Below is a reconstruction of how a trader would have opened an account with Vestrado, based on their own website and industry-standard practices. (Note: as of the 2025 closure announcement, new registrations are disabled.)

Visit Vestrado Website & Registration Page

One would go to the homepage and click “Sign Up” / “Open Account.” Vestrado offered a standard registration flow.

Provide basic personal information: name, email, possibly phone number, and country of residence, and set login credentials.

Select Account Type

During signup or soon after, choose among the offered account types (e.g. “Frux STP”, “Respectus ECN”, “Fides Cashback”). Each type had different conditions (leverage, spreads, perks).

The minimum deposit, depending on account type, could be as low as USD 10 (as advertised).

Submit Required Documents (if verification required)

As typical in brokers, verification likely involved identity proof and address proof — though Vestrado’s publicly available site offers little detail on what documents were required, or how verification was processed. Independent reviews note that verification and withdrawal were sometimes problematic.

Once documents approved, the account would be activated, and the trader could fund it.

Deposit Funds

Use the deposit interface. Vestrado claimed to support multiple deposit/withdrawal methods (though details are vague).

As soon as funds reflect, the trader can log in via MT4/MT5 and start trading.

Start Trading

With the account funded and active, the trader could access the trading platform (MT4/MT5), choose instruments, set leverage and margin, and open positions.

Given Vestrado’s closure notice in October 2025 — new registrations were disabled from 3 October 2025. As such, this step-by-step onboarding process is now only of historical interest; new traders cannot open accounts on Vestrado.

Vestrado Charts and Analysis

When active, because Vestrado used MetaTrader 4 and MetaTrader 5, traders had access to standard charting and analysis tools that these platforms provide. That includes:

Multiple time-frames (minutes to monthly), candlestick or other chart types. — helpful for both short-term (day trading, scalping) and long-term analyses.

Technical indicators: moving averages, RSI, MACD, Bollinger Bands, oscillators, etc., as per MT4/MT5 libraries — useful for technical traders.

Drawing tools: trendlines, support/resistance, channels — for traders who rely on chart patterns or price action.

Order types: market orders, limit/stop orders, stop-loss/take-profit — allowing risk management and strategic trade entry/exit.

Customization and automated tools (expert advisors) — since MT4/MT5 supports algorithmic trading, enabling advanced users to deploy bots or custom scripts.

For beginners, these tools offer a flexible learning environment: demo account plus standard charting and indicators allow experimentation without risk (back when Vestrado offered demo). For more advanced traders, the flexibility of MT4/MT5 means they could deploy sophisticated strategies (e.g., automated trading, advanced risk management).

However — because Vestrado is now shut down — none of these tools are practically usable via Vestrado any more (unless a third-party rehosts or revives the platform, which there is no public plan for, per the closure notice).

Therefore, while the charting environment (during operation) was standard and competitive, its current irrelevance means that charts and analysis under Vestrado are effectively defunct.

Vestrado Account Types

Here is a reconstructed table of account types as advertised by Vestrado when active. Note that publicly available details are limited, and some descriptions come from marketing material rather than independent verification.

| Account Type (as advertised) | Key Features / Claimed Conditions |

|---|---|

| Frux STP | Entry-level account type; likely lower minimum deposit, possibly standard spreads, STP-style execution. |

| Respectus ECN | For more advanced traders — ECN-type execution (direct to market), possibly tighter spreads, variable commissions/spreads, higher flexibility. |

| Fides Cashback | Account type with promotional or cashback features — perhaps rebates or bonuses tied to volume or trades. |

| Frux Cent (coming soon) | A lower-tier / cent-style account — targeted at micro-traders or those testing small capital, though as of last publicly available data it was listed as “coming soon.” |

Additional Key Conditions (as advertised):

Leverage up to 1:2000 (varies by account type).

Low minimum deposit threshold (e.g. USD 10) — making entry easier for small-scale traders.

Use of MT4 / MT5 trading platforms, giving access to standard trading tools.

Important Caveats: The public information on account types, spreads, commissions, and other conditions was limited and lacked independent verification.Also, due to the closure of operations, these account types are no longer active.

Do I Have Negative Balance Protection with This Broker?

Negative balance protection (NBP) is a claim by which a broker ensures that a trader’s account balance cannot go below zero — protecting clients from owing more than their initial deposit in volatile markets. Unfortunately, in the case of Vestrado, there is no clear or credible evidence that such protection was genuinely implemented or legally enforceable.

Independent reviews note that although Vestrado claimed negative balance protection and segregated accounts, there was no verifiable documentation or audit publicly available to confirm that client funds were truly segregated or that NBP was enforced.

In a risk evaluation, some reviewers flagged the absence of explicit policy statements about NBP as a major oversight, meaning traders could be exposed to full downside risk (including losses beyond deposit) under extreme market conditions.

Given the lack of regulatory oversight — Vestrado is registered in SVG (a jurisdiction with minimal regulatory stringency) and its claimed license under South Africa’s FSCA is flagged “Exceeded” (suggesting non-compliance or over-reach) — even the broker’s internal claims about NBP and fund segregation lose credibility.

Finally — because Vestrado has officially announced shutdown of operations (October 2025), any previously offered protections are effectively moot for future or ongoing trading.

Implications for Trader Risk Management: Without credible negative balance protection or independently verified fund segregation, trading through Vestrado would have exposed traders to elevated risks: loss of entire deposit, inability to recover funds if the broker becomes insolvent, or in extreme cases, losses beyond initial capital. For a now-defunct broker, such risk was amplified — meaning that funds deposited may be difficult or impossible to recover.

Vestrado Deposits and Withdrawals

Historically, Vestrado claimed to provide deposit and withdrawal services — but publicly available documentation and independent reviews raise serious concerns.

Vestrado’s website mentioned deposit and withdrawal methods, but did not provide detailed, transparent data on minimum or maximum amounts, processing times, or fee schedules.

Independent reviews highlight frequent withdrawal issues — including delays, long verification requests, arbitrary fees, blocked withdrawals, or outright refusal to process withdrawals.

Because fund segregation and regulatory oversight were unclear or absent, there is no reliable external guarantee that deposited funds and client balances were held separate from broker’s operating funds — a common industry safeguard that protects clients in case of insolvency.

Given the official shutdown notice (as of October 2025), all clients were instructed to withdraw funds between 10–20 October 2025. After that date, any remaining funds would be subject to manual processing upon request.

For anyone who did not withdraw in time or was unable to — there is no guarantee that funds remain accessible. The closure notice indicates limited support until 7 November 2025, but after that, even residual support may lapse.

Conclusion on Withdrawals / Deposits: While Vestrado ostensibly offered standard deposit/withdrawal methods, the lack of transparency, frequent withdrawal complaints, and final shutdown make deposits highly risky. For users now, the withdrawal window may have closed; for prospective traders (if considering similar brokers), it illustrates the importance of regulatory clarity, fund segregation, and transparent payout records.

Support Service for Customer

Vestrado’s public-facing materials claimed 24/5 customer support via helpdesk, ticketing system, and account managers.

Positive — Claimed Support Features:

Live support / help-desk ticket system.

Personalized account management for certain clients (as implied by marketing).

Support for deposits / withdrawals, account verification, general inquiries.

Real-World Feedback / Issues:

Independent reviews cite poor responsiveness, long wait times, and inadequate problem resolution, especially for withdrawals and verification issues.

Some users complained about account freezing or restrictions, sometimes without clear explanation.

Given Vestrado’s lack of transparent contact information (verifiable physical address, phone number), it is difficult to independently verify support claims.

Current Status (2025): With operations ceased, customer support is slated to remain accessible only for a limited period (until 7 November 2025) for residual inquiries. After this, support availability — if any — is uncertain.

Thus, while Vestrado advertised relatively robust support service, real-world performance appears inconsistent, and with the closure, support reliability is effectively discontinued.

Prohibited Countries: Where Can I Not Trade with this Broker?

According to Vestrado’s website, the broker restricted services to clients from certain jurisdictions. The list included (among others): USA, Canada, Australia, China, Russia, Ukraine, Belarus, North Korea, Venezuela, and other unspecified regions.

Such restrictions are common among offshore brokers seeking to avoid rigorous regulatory environments. However, in Vestrado’s case, they also reflect the broker’s limited regulatory compliance and possible efforts to avoid oversight.

Because of the closure, these restrictions are now mostly historical — but they illustrate how Vestrado’s services were never universally available, and that traders from many major jurisdictions would have been excluded.

Special Offers for Customers

When operational, Vestrado promoted multiple incentives aimed at attracting and retaining clients:

Welcome / Deposit Bonus: For example, a “20% deposit bonus” was advertised — giving extra trading capital on initial deposit.

Free Demo Account: To let beginners try the platform without risking real money.

“Cashback” or Promotional Account Types: An account type labeled “Fides Cashback” aimed at providing rebates or special perks tied to trading volume or loyalty.

Educational Resources & Community Access: According to marketing content, the broker offered support for traders including educational materials, market analysis, and community channels for sharing insights.

As with other aspects, while these offers may superficially seem appealing — especially for new or budget-constrained traders — they came attached with the broader risks of using a loosely regulated offshore broker. The incentives may have served more as marketing hooks than meaningful long-term benefits.

Given that Vestrado has shut down, these promotions are no longer available and now only serve as historical artifacts.

Vestrado Review Conclusion

In hindsight, Vestrado was not a reputable broker in the conventional, industry-standard sense — and the official shutdown confirms that even Vestrado’s own management no longer considered the operation viable.

When it was active, Vestrado offered many features that might attract traders: access to widely used trading platforms (MT4/MT5), a broad range of instruments (forex, commodities, CFDs), high leverage, low entry deposit, and various account types. For budget traders or those seeking high-risk/high-reward strategies, these features may have seemed appealing.

However, critical weaknesses overshadowed those strengths:

Regulatory ambiguity: registration in a lightly regulated jurisdiction (SVG) plus a claimed license under FSCA that was flagged “Exceeded,” undermining legitimacy and trust.

Lack of transparency: limited information on spreads, commissions, fund security, client asset segregation, and withdrawal policies.

Reports of withdrawal issues, poor customer support, and account access problems.

High-risk structural issues: very high leverage, no verifiable negative balance protection, and minimal investor protection mechanisms.

Final closure: as of 2025, Vestrado ceased operations, disabling new registrations and instructing clients to withdraw funds — effectively terminating its services.

Given these factors, Vestrado does not represent a reliable or safe choice for traders — beginner or experienced. Its combination of risk factors, regulatory weakness, and ultimate shutdown suggests that it failed to meet the basic standards of a professional, stable brokerage.

For prospective traders, Vestrado serves as a cautionary example: before engaging with any broker, it is essential to verify regulatory status, fund segregation, transparent terms, and user reviews. Relying on marketing claims alone (low deposit, high leverage, bonuses) can carry significant risks.

In summary: Vestrado may once have seemed attractive, but its real-world performance and final outcome reveal serious deficiencies. For those seeking a reliable trading partner, established and well-regulated brokers should be preferred over entities with uncertain history and opaque operations.

Summary and Key Takeaways

Vestrado should not be considered a safe or viable platform. Traders should prioritize brokers with transparent regulation, credible oversight, and verifiable fund security — especially when engaging with leveraged trading.

- Vestrado was an online forex/CFD broker founded around 2020, registered in SVG, and claimed to offer high-leverage trading via MT4/MT5 with a low deposit threshold.

- The broker’s regulatory status was dubious: a claimed license under South Africa’s FSCA exists, but its status is flagged “Exceeded,” undermining credibility.

- Although Vestrado offered a wide range of instruments, account types, and promotional bonuses, independent reviews flagged serious issues: withdrawal delays/failures, lack of transparency, and poor customer support.

- Crucially, Vestrado announced the cessation of operations on 24 October 2025 — new registrations disabled, clients asked to withdraw funds by a deadline.

- As a result, Vestrado is no longer a functioning broker, and any claims of regulatory compliance, fund protection, or trading services are effectively void.

FAQs

Is Vestrado still operating and can I open a new account now?

As of October 2025, Vestrado has officially announced that it will cease operations on 24 October 2025. Their notice states that new client registrations were disabled from 3 October 2025.

Therefore — no, you cannot open a new account with Vestrado anymore. Any previous account-opening procedures are no longer valid.

If you are considering trading now, you should not treat Vestrado as an active broker.

Was Vestrado regulated and safe for clients?

Vestrado was registered in Saint Vincent & the Grenadines (SVG) — a jurisdiction that does not provide meaningful regulation for forex/CFD brokers.

The broker also claimed to hold a license from the Financial Sector Conduct Authority (FSCA) of South Africa (license # 51891), but recent audits show its FSCA status as “Exceeded”, indicating non-compliance or regulatory overreach.

Because of this — no, Vestrado was not a reliably regulated broker. The weak regulatory oversight and lack of verifiable fund protections made it risky for clients.

Could I reliably withdraw my funds from Vestrado?

There are multiple reports and independent reviews pointing to serious withdrawal issues with Vestrado: long delays, blocked withdrawals, and unresponsive customer support.

Given these documented problems — plus the broker’s eventual shutdown — there is no guarantee that funds deposited or profits earned would be returned smoothly, or at all.

Hence, trusting Vestrado for fund withdrawals carried significant risk.

Did Vestrado offer negative-balance protection or segregated client accounts?

Although Vestrado claimed to offer protections like segregated accounts and negative-balance protection, there is no credible independent evidence confirming these safeguards were ever enforced.

Regulatory oversight was weak or non-existent, and independent watchdog reviews flagged these claims as unsubstantiated.

Therefore, traders using Vestrado were exposed to full downside risk — including the possibility of losing more than their deposit in volatile markets.

What should I do if I still have funds or open positions with Vestrado?

According to Vestrado’s own closure notice, clients were instructed to close all open trades by 10 October 2025 and withdraw all funds between 10–20 October 2025.

If you still have funds or open positions, you should attempt to contact their support email (as given in the notice) immediately and request withdrawal. Note that support after closure is limited and may not guarantee full recovery.

For future security, consider reporting any unresolved issues to local financial-fraud authorities in your country.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.

- Vestrado Overviews

- Pros and Cons

- Is Vestrado Safe? Broker Regulations

- How to Trade with Vestrado?

- How to Trade with Vestrado

- How Can I Open Vestrado Account? A Simple Tutorial

- Vestrado Charts and Analysis

- Vestrado Account Types

- Do I Have Negative Balance Protection with This Broker?

- Vestrado Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Vestrado Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author