Libertex Broker Review- Is it Safe?

Libertex Overviews

Libertex is a CySEC-regulated trading platform founded in 1997, offering over 300 assets including forex, stocks, crypto, and commodities. With a zero-spread pricing model, intuitive platform options (WebTrader, MT4, MT5), and a long-standing industry reputation, it appeals to both beginner and professional traders across Europe and other supported regions.

Founded in 1997, Libertex is a well-established online trading platform operated by Indication Investments Ltd., a company based in Limassol, Cyprus. With over two decades of experience in the financial markets, Libertex has grown to become a globally recognized name in online trading, serving millions of clients across multiple countries. The broker operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), offering a secure and regulated environment primarily for European traders.

One of Libertex’s standout features is its proprietary trading platform, known for its user-friendly interface and streamlined trade execution process. In addition to its native WebTrader and mobile app, the broker also supports MetaTrader 4 and MetaTrader 5, giving traders access to more advanced charting and automation tools.

Libertex distinguishes itself by offering zero-spread trading, which means clients only pay a commission per trade. This pricing model is especially appealing for those who prefer clear and transparent cost structures over fluctuating spreads. With access to over 300 tradable assets including forex pairs, stocks, cryptocurrencies, indices, ETFs, and commodities, Libertex caters to a diverse range of trading strategies and investor interests.

Over the years, Libertex has received numerous accolades in the financial industry. It has won awards for its trading platform, customer service, and overall brokerage experience. These include recognitions such as “Best Trading Platform” from Forex Report and “Most Trusted Broker” in various global markets.

In terms of client support, Libertex offers multi-channel assistance through email, live chat, and phone, with a range of educational materials to support both beginners and advanced traders. The broker’s focus on simplicity, combined with regulatory compliance and professional-grade tools, makes it a compelling option for traders looking for a balanced and reliable trading experience.

Pros and Cons

- Over 25 years in the industry with millions of clients worldwide.

- Regulated by CySEC, ensuring compliance with European financial standards.

- Transparent zero-spread trading with fixed per-trade commissions.

- Intuitive WebTrader and mobile app designed for beginner-friendly use.

- Offers MT4 and MT5 platforms with advanced tools and automation.

- Trade forex, stocks, commodities, crypto, ETFs, and indices.

- Access to educational resources and strategy guides for all levels.

- Per-trade commissions may be higher despite zero spreads.

- Customer support is limited to business hours only.

- Not available in the U.S., Canada, or Japan.

- No option for Islamic (swap-free) trading accounts.

Is Libertex Safe? Broker Regulations

Yes, Libertex is considered a safe and regulated broker for trading. The company is operated by Indication Investments Ltd., which is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 164/12. Being governed by CySEC means that Libertex adheres to the Markets in Financial Instruments Directive (MiFID II)—a European Union framework designed to enhance investor protection and increase transparency in financial markets.

CySEC-regulated brokers are required to:

Maintain segregated client funds, ensuring that traders’ money is not used for company operations.

Participate in the Investor Compensation Fund (ICF), which offers additional protection to eligible retail clients in case of broker insolvency—up to €20,000 per person.

Submit regular reports and undergo strict auditing to ensure financial health and operational integrity.

In addition to regulatory compliance, Libertex employs modern data encryption protocols and secure socket layer (SSL) technology to protect user data during all transactions. The broker also offers two-factor authentication (2FA) to enhance account-level security.

For European retail clients, negative balance protection is standard. This means that in volatile markets, clients cannot lose more than the amount they have deposited, protecting them from incurring debt through leveraged trades.

While Libertex is not publicly listed, nor does it hold banking licenses, it has demonstrated a long-term commitment to regulatory transparency and responsible brokerage practices. The broker’s multi-decade history, CySEC license, and adherence to EU financial standards all contribute to its reputation as a secure trading platform.

- Cyprus Securities and Exchange Commission (CySEC)

- Markets in Financial Instruments Directive (MiFID II)

How to Trade with Libertex ?

Trade Assets

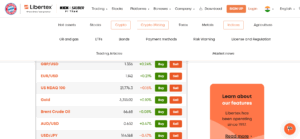

Libertex offers a diverse and comprehensive range of tradable assets across global financial markets, making it suitable for a wide spectrum of traders—from forex specialists to crypto enthusiasts. With over 300+ instruments available on the platform, traders have access to various asset classes, including:

Forex

Libertex features a robust selection of major, minor, and exotic currency pairs. Popular pairs such as EUR/USD, GBP/JPY, and USD/ZAR are available with competitive commissions and leverage up to 1:30 for retail traders (higher for professionals).

Stocks & Indices

The broker provides CFDs on a wide array of global equities and stock indices. Traders can speculate on the performance of giants like Apple, Tesla, Amazon, and Microsoft, or major indices such as the S&P 500, DAX 40, and FTSE 100—all without owning the underlying assets.

Commodities

Libertex supports trading in major commodities, including gold, silver, crude oil, natural gas, and agricultural products. These instruments are often favored for portfolio diversification and inflation hedging.

Cryptocurrencies

Crypto traders will find a strong lineup of digital assets including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) and more. Trades are conducted via CFDs, allowing for speculation in both rising and falling markets.

ETFs & Others

Exchange-Traded Funds (ETFs) and other niche assets are also available, enabling users to track sector-based performance or invest in thematic baskets.

Libertex’s asset offering is further enhanced by its zero-spread model, enabling clear cost visibility. Whether you’re trading short-term price swings in forex or looking to capitalize on long-term crypto trends, the platform provides the depth and flexibility needed for multiple trading styles.

How to Trade with Libertex?

Trading with Libertex is designed to be intuitive, whether you’re using their proprietary WebTrader platform, mobile app, or MetaTrader terminals (MT4 and MT5). Here’s a step-by-step guide on how the process works:

1. Login to the Platform

Once your account is registered and verified, you can log in via the Libertex web platform or download the Libertex mobile app from the App Store or Google Play. Alternatively, advanced users may opt for MetaTrader 4 or 5, depending on their preference for technical analysis and automation.

2. Choose Your Asset

The dashboard features a categorized list of markets including Forex, Stocks, Commodities, Cryptocurrencies, and ETFs. Traders can use filters or the search bar to locate the instrument of interest.

3. Conduct Analysis

Libertex offers integrated market analysis tools such as:

Price charts with multiple timeframes (from 1 minute to 1 month)

Popular indicators (RSI, MACD, Moving Averages)

Technical drawing tools for trendlines and patterns

Market news and sentiment widgets

These tools are especially useful for short-term traders and those looking to enter positions based on momentum or technical patterns.

4. Set Trade Parameters

Once an asset is selected, a trading window appears allowing you to:

Select buy or sell based on your market outlook

Adjust trade amount

Set leverage (up to 1:30 for retail clients)

Add stop loss or take profit levels to manage risk and lock in gains

5. Place the Trade

Click on “Open Trade” to execute your order. The trade will then appear in your open positions tab, where you can monitor it in real time or adjust parameters as needed.

6. Monitor and Manage

Libertex provides a clean, real-time interface for monitoring all active trades, account balance, margin levels, and trade history. You can also set price alerts and notifications directly on the mobile app.

Overall, the Libertex platform is highly accessible, making it suitable for new traders, while also supporting enough analytical features for seasoned professionals.

How Can I Open Libertex Account? A Simple Tutorial

Opening a trading account with Libertex is a streamlined process that can typically be completed within minutes, followed by verification. Here’s a step-by-step walkthrough of how to get started:

Step 1: Visit the Official Website

Go to libertex.com and click on the “Register” or “Sign Up” button, usually found at the top-right corner of the homepage.

Step 2: Fill Out the Registration Form

You will be prompted to enter your email address and create a secure password. Alternatively, you can sign up using your Google or Apple account for a faster process.

Once submitted, you’ll gain immediate access to the platform in “demo mode,” where you can explore features and trade with virtual funds.

Step 3: Start the Verification Process (KYC)

To unlock full trading features and switch to a live account, you’ll need to complete the Know Your Customer (KYC) process, which includes:

Personal details: Full name, date of birth, and phone number

Residential address: Must match your proof of address document

Identity verification: Upload a valid passport, national ID, or driver’s license

Proof of address: Provide a recent utility bill, bank statement, or official letter not older than 3 months

Libertex uses secure digital verification, and most accounts are approved within 1–2 business days, although some may take longer depending on document quality and jurisdiction.

Step 4: Make Your First Deposit

Once verified, log in to the Client Portal and select “Deposit.” Choose your preferred funding method, which may include:

Credit/Debit cards (Visa, Mastercard)

Bank transfer

Skrill, Neteller, or PayPal

The minimum deposit is generally €100, but this can vary by country and payment method. Most deposits are processed instantly, while bank transfers may take 2–5 business days.

Step 5: Choose a Platform

After funding, you can begin trading using:

The Libertex Web Platform (for simplicity and accessibility)

The Libertex Mobile App (for trading on-the-go)

MetaTrader 4/5 (for more advanced features)

Download credentials for MT4/MT5 are provided in your account dashboard if you choose that route.

Step 6: Begin Live Trading

With your account verified and funded, you’re ready to explore markets and execute trades. You can also continue practicing in the demo environment until you’re confident with the interface and tools.

Libertex also provides in-platform tutorials and guides, which are particularly useful for beginners navigating their first live trades.

- Step 1: Visit the Official Website

- Step 2: Fill Out the Registration Form

- Step 3: Start the Verification Process (KYC)

- Step 4: Make Your First Deposit

- Step 5: Choose a Platform

- Step 6: Begin Live Trading

Libertex Charts and Analysis

Libertex provides traders with an intuitive charting and analysis experience through both its proprietary platform and integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Whether you’re a beginner learning the basics or a technical trader applying advanced strategies, Libertex’s analytical tools cater to a wide spectrum of users.

Proprietary Web and Mobile Platform

The Libertex WebTrader and mobile app include built-in, responsive charts that allow users to:

View multiple timeframes, from 1-minute to monthly

Use trendlines, drawing tools, and price markers for technical mapping

Access a wide range of technical indicators like RSI, MACD, Bollinger Bands, Moving Averages, and more

Track real-time price action and historical data across all asset classes

While the proprietary platform is ideal for fast and clean execution, it offers enough depth for intermediate charting needs. Its simplicity is particularly appreciated by new traders who prefer clarity over complexity.

MetaTrader 4/5 Integration

Advanced traders using MT4 or MT5 gain access to:

Custom indicators, automated trading through Expert Advisors (EAs)

Multi-chart layouts, backtesting, and high-precision drawing tools

Support for dozens of technical studies and advanced order types

This makes Libertex a flexible choice for strategy-based traders, especially those who rely heavily on analytical rigor and backtesting models.

News & Sentiment Tools

The Libertex platform also integrates real-time news feeds, economic calendars, and market sentiment indicators to help traders stay informed on macroeconomic events that could impact their trades.

In summary, Libertex provides a solid charting infrastructure that balances simplicity and depth, allowing both casual and technical traders to analyze markets effectively.

Libertex Account Types

| Account Type | Target Audience | Key Features | Leverage | Spreads / Commissions | Requirements |

|---|---|---|---|---|---|

| Retail Account | Beginner to intermediate traders | Access to all instruments; suitable for most users | Up to 1:30 (EU) | Zero spreads, fixed commissions | Basic KYC verification; no trading experience needed |

| Professional Account | Experienced/high-volume traders | Higher leverage, fewer restrictions, no negative balance protection (EU) | Up to 1:500 | Lower commissions; zero spreads | Proof of experience, portfolio over €500,000 |

| Demo Account | All user levels | Practice trading with virtual funds; full access to platform tools | N/A | No real costs; virtual simulation | Instant registration; no verification required |

Notes:

Retail clients in the EU benefit from negative balance protection and Investor Compensation Fund (ICF) coverage.

Professional clients waive certain protections in exchange for more flexible trading conditions.

The Demo Account is available indefinitely, allowing traders to test strategies or learn the platform risk-free.

Do I Have Negative Balance Protection with This Broker?

Yes, Libertex offers Negative Balance Protection (NBP) to its clients, ensuring that traders cannot lose more money than they have deposited into their accounts. This feature is particularly crucial in volatile markets, where rapid price movements can lead to significant losses.

What is Negative Balance Protection?

Negative Balance Protection is a risk management feature that prevents a trader’s account from going into a negative balance. In scenarios where market volatility causes losses that exceed the account balance, NBP ensures that the trader’s losses are capped at the amount deposited, and they are not liable for any deficit beyond that.

Libertex’s Implementation of NBP

Libertex provides NBP as part of its commitment to client protection. This means that in the event of extreme market conditions, clients’ losses will not exceed their account balance. This policy is in line with regulatory requirements and industry best practices, offering traders peace of mind when engaging in leveraged trading.Topbrokers+3FX Leaders+3investfox+3

Applicability to Different Account Types

Retail Clients: NBP is automatically applied to all retail accounts, ensuring that individual traders are protected from incurring debts due to trading losses.

Professional Clients: Professional accounts may not have NBP, as these clients are considered to have a higher level of trading experience and risk tolerance. It’s essential for professional clients to understand the implications of trading without NBP and to manage their risk accordingly.

Importance of NBP in Risk Management

NBP is a vital component of a comprehensive risk management strategy. It provides a safety net that allows traders to engage in the markets with the assurance that their potential losses are limited to their invested capital. This protection is especially important for those using leverage, as it mitigates the risk of owing additional funds beyond the initial investment.

In summary, Libertex’s provision of Negative Balance Protection demonstrates its dedication to safeguarding clients’ interests and promoting responsible trading practices.

Libertex Deposits and Withdrawals

Libertex provides a range of convenient and secure options for both deposits and withdrawals, catering to a global client base. The process is designed to be fast, transparent, and user-friendly, whether you are funding your account or taking profits out.

Deposit Methods

Libertex accepts multiple funding methods, which may vary depending on your country of residence. Common options include:

Credit/Debit Cards: Visa, Mastercard – typically processed instantly.

Bank Transfer: May take 2–5 business days to reflect.

E-wallets: Skrill, Neteller, PayPal – instant or same-day processing.

Local Payment Systems: Available in selected regions.

The minimum deposit is generally €100, although it may vary slightly based on the selected method or location. Libertex does not charge fees for most deposit methods, but third-party providers may impose transaction costs.

Withdrawal Methods

Withdrawals can be made through the same methods used for deposits. This helps maintain compliance with anti-money laundering (AML) regulations. Typical options include:

Bank Transfers (SEPA & SWIFT)

Credit/Debit Cards

E-wallets like Skrill, Neteller, and PayPal

Processing Times and Fees

E-wallet withdrawals are usually processed within 24 hours

Credit/debit card and bank transfers may take 2–5 business days

Libertex charges a small withdrawal fee for some methods, typically around €1–€2, or a percentage in certain cases

Additional Notes

Clients are required to complete account verification (KYC) before making withdrawals.

Funds must typically be withdrawn using the same method used for deposit.

Libertex maintains secure processing with encryption and anti-fraud checks to ensure user funds remain protected.

In summary, Libertex offers a straightforward and efficient funding process with enough flexibility for most traders, backed by strong security protocols.

Support Service for Customer

Libertex offers a reliable and multilingual customer support service designed to assist users with both technical and account-related inquiries. While the support structure is not 24/7, it is responsive and professional during working hours.

Channels of Support

Traders can contact Libertex through the following methods:

Live Chat: Available directly on the Libertex website and mobile app. This is typically the fastest way to get real-time answers to questions.

Email Support: Users can submit inquiries to [email protected], and responses are usually received within 24 hours on business days.

Phone Support: Available in certain regions, particularly for account verification or complex technical support.

Help Center/FAQ: Libertex maintains a searchable knowledge base with detailed guides on account setup, deposits, trading platforms, and more.

Availability and Languages

Libertex’s support team operates primarily during business hours, Monday to Friday, and offers assistance in multiple languages, including:

English

Spanish

German

Portuguese

Russian

And others, depending on the user’s location

Quality of Support

Most users report that Libertex’s support is professional and knowledgeable, especially through the live chat function. While response times via email may vary, critical issues such as login problems or account verification are generally prioritized.

In summary, Libertex provides solid customer service for most users, though lack of 24/7 support may be a limitation for those in different time zones or with urgent after-hours issues.

Prohibited Countries: Where Can I Not Trade with this Broker?

Libertex maintains a list of countries where its services are restricted or unavailable, primarily due to regulatory constraints, international sanctions, and internal compliance policies. These restrictions are in place to ensure adherence to global financial regulations and to maintain the integrity of its operations.

❌ Countries Where Libertex Services Are Restricted

As of 2025, Libertex does not accept clients from the following countries:

United States

Russia

Japan

Brazil

European Union countries

North Korea

Iran

Syria

Sudan

Cuba

Afghanistan

Algeria

Belarus

Canada

Democratic Republic of the Congo

Iraq

Lebanon

Libya

Myanmar

Pakistan

Somalia

South Sudan

Ukraine

Venezuela

Yemen

Zimbabwe

This list is not exhaustive and may include other countries identified by the Financial Action Task Force (FATF) as high-risk or non-cooperative jurisdictions with strategic Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) deficiencies, as well as countries under international sanctions.

⚠️ Important Considerations

Regulatory Compliance: Libertex adheres strictly to international laws and regulations, which necessitates these restrictions.

Dynamic Restrictions: The list of prohibited countries is subject to change based on evolving international laws and sanctions.

Verification Process: During the account registration process, Libertex employs a verification system to ensure compliance with these restrictions.

Potential clients are advised to consult the official Libertex website or contact customer support to confirm their eligibility before attempting to register.

Special Offers for Customers

Libertex offers a variety of promotions and incentives aimed at both new and existing clients. These programs are designed to enhance the trading experience and provide additional value.

1. 100% Welcome Deposit Bonus

New clients can benefit from a 100% bonus on their initial deposit, up to a maximum of $10,000. This bonus is credited in 10% installments as trading volume milestones are achieved. To qualify, a minimum deposit of $100 is required. The bonus funds become withdrawable once specific trading conditions are met.

2. Loyalty Programme

Libertex’s Loyalty Programme rewards active traders with exclusive benefits, including:

Weekly investment ideas

The ability to adjust leverage on open trades

Tailored trading conditions

Dedicated VIP manager support

Participation in the programme is automatic for eligible clients, and the benefits increase with trading activity.

3. Seasonal Promotions

Libertex frequently runs time-limited promotions aligned with holidays and special events. For example, the “New Year’s Gold Fever 2025” campaign awarded participants with a share of 100 ounces of gold and other trading bonuses. Such promotions provide traders with opportunities to earn additional rewards based on their activity during the promotional period.

4. Referral Program

Clients can participate in Libertex’s referral program, earning up to 40% of the trading commissions paid by referred clients. The program offers multiple tiers of rewards and includes support from a personal IB manager.

5. Promotional Codes

Occasionally, Libertex provides promotional codes that offer discounts or bonuses. These codes can be applied during the deposit process to unlock special offers. Availability and terms vary, so clients are encouraged to check the Libertex website or affiliated promotional platforms for current codes.

These special offers are subject to terms and conditions, and clients should review the specific requirements and eligibility criteria before participating.

Libertex Review Conclusion

Libertex stands out as a well-established and regulated broker, offering a user-friendly platform suitable for both beginners and experienced traders. With over two decades in the industry, Libertex has built a reputation for reliability and transparency.

Strengths

Regulation and Security: Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European financial standards and providing a secure trading environment.

User-Friendly Platform: The proprietary Libertex platform is intuitive and accessible, making it ideal for traders of all levels. Additionally, support for MetaTrader 4 and MetaTrader 5 caters to those seeking advanced trading tools.

Diverse Asset Selection: Traders have access to a wide range of instruments, including forex, stocks, commodities, cryptocurrencies, indices, and ETFs, allowing for diversified trading strategies.

Transparent Pricing: Libertex offers a zero-spread model with fixed commissions, providing clarity on trading costs and aiding in effective risk management.

Promotional Offers: The broker provides various promotions, such as a 100% welcome bonus and a loyalty program, enhancing the trading experience for clients.

Areas for Improvement

Educational Resources: While Libertex offers some educational materials, the content is relatively limited compared to other brokers. Expanding these resources could benefit traders seeking to enhance their knowledge.

Customer Support Hours: Customer support is not available 24/7, which may be a limitation for traders in different time zones or those requiring assistance outside of business hours.

Restricted Countries: Libertex’s services are not available in certain countries due to regulatory restrictions, limiting access for some potential clients.

Final Thoughts

Overall, Libertex offers a robust trading platform with a broad range of assets and a transparent pricing structure. Its regulatory compliance and user-friendly interface make it a compelling choice for traders seeking a reliable broker. However, potential clients should consider the limitations in educational resources and customer support availability.

Summary and Key Takeaways

Libertex is a trusted and long-standing online broker regulated by CySEC, offering a streamlined and intuitive trading experience through its proprietary platform and support for MT4/MT5. With a zero-spread, commission-based model, traders benefit from clear cost structures across 300+ assets, including forex, stocks, commodities, indices, ETFs, and cryptocurrencies.

- Founded in 1997, with over 2.9 million clients worldwide

- Regulated by CySEC under license 164/12

- Offers negative balance protection for retail clients

- Supports multiple platforms: WebTrader, mobile app, MT4, MT5

- Wide range of deposit/withdrawal options

- Attractive bonuses and loyalty programs

- Multilingual customer support, though not 24/7

FAQs

Is Libertex a regulated broker?

Yes, Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 164/12. It operates in compliance with the European Union’s MiFID II framework, which ensures high standards of investor protection and regulatory oversight.

What is the minimum deposit required to start trading with Libertex?

The minimum deposit to open a live trading account with Libertex is €100. However, this amount can vary depending on the user’s region and the selected payment method.

Does Libertex offer MetaTrader platforms?

Yes, in addition to its proprietary WebTrader and mobile app, Libertex supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), allowing users access to advanced trading tools, indicators, and automated strategies.

Can I trade cryptocurrencies with Libertex?

Absolutely. Libertex offers CFD trading on a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and others. This allows for speculative trading on both rising and falling prices without owning the underlying crypto assets.

Does Libertex offer negative balance protection?

Yes, Libertex provides negative balance protection for retail clients, ensuring that traders cannot lose more money than they have deposited. This feature helps manage risk, especially when using leverage.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the University of Southern California, dove into finance clubs during his studies, honing his skills in portfolio management and risk analysis. With a career spanning prestigious firms like the Baltimore Sun and The Globe, he's become an authority in asset allocation and investment strategy, known for his insightful reports.

- Libertex Overviews

- Pros and Cons

- Is Libertex Safe? Broker Regulations

- How to Trade with Libertex ?

- Trade Assets

- How to Trade with Libertex?

- How Can I Open Libertex Account? A Simple Tutorial

- Libertex Charts and Analysis

- Libertex Account Types

- Do I Have Negative Balance Protection with This Broker?

- Libertex Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Libertex Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author