Headway : Is It a Reliable Broker?

Headway Overviews

Headway is a full-service online trading broker offering access to forex, stocks, indices, commodities and cryptocurrencies with ultra-low minimums, modern mobile apps and both MetaTrader 4 and 5 support.

Founded by experienced professionals who rose through the ranks of the financial industry, Headway presents itself as a full-service trading broker aimed at both novice and professional traders. The company emphasises a user-friendly ecosystem that makes access to the financial markets relatively straightforward.

Headway’s headquarters are listed at 3 Flamingo Crescent, East London, 5200, South Africa. Although the exact founding year is not prominently shown on the public site, the “About us” page indicates that the firm was built by people with prior experience in the industry and emphasises its global outlook.

What distinguishes Headway is its marketing of “start with just US$1” for a trading account, unlimited leverage (in certain conditions), zero-commission deposits and withdrawals, and access to a broad range of instruments including forex, stocks, commodities, indices, and cryptocurrencies.

Headway also promotes a mobile trading app that integrates with both MetaTrader 4 and MetaTrader 5, and highlights its aim to provide “comfortable, ethical trading” with high execution quality.

In the awards and recognition domain, Headway claims several accolades: for example, “Best Global Forex Broker 2025”, “Best Zero Spread Broker for Copy Trading” and others.

In sum, Headway positions itself as a broker with low barriers to entry, broad instrument coverage, strong marketing of promotions, and a platform-agnostic environment for trading across devices.

Pros and Cons

- Very low minimum deposit of US$1 makes Headway accessible to new traders.

- Broad instrument range (forex, stocks, indices, commodities, crypto) allows diversified trading.

- Supports both MetaTrader 4 and MetaTrader 5 platforms, plus mobile apps.

- Marketing of unlimited leverage (under certain conditions) and zero-commission deposits/withdrawals.

- Promotions and recognition (e.g., awards) give a positive marketing image.

- Good user reviews for ease of use and low entry-barriers for beginners.

- Regulatory status is opaque (see next section); some caution required.

- Whilst marketing claims unlimited leverage, in practice high leverage increases risk.

- Some user reviews report withdrawal delays or possible issues with bonus-account terms.

- Bonus/promotions may come with complicated terms (e.g., you may need to trade a certain volume before withdrawing profit).

- As with many brokers targeting global audiences, geographic restrictions and local regulatory coverage may limit availability.

Is Headway Safe? Broker Regulations

When assessing the safety of a broker, key elements include regulatory licensing, fund segregation, transparency of terms, and user feedback. In the case of Headway, the regulatory picture is somewhat mixed.

On its website, Headway claims: “We provide easy access to the financial market for everyone”, “Safety as a priority” with “we impeccably protect the security and privacy of our customers.” It also lists its headquarters in South Africa (East London) via its app store listing.

However, outside verification reveals caveats: According to BrokerView, Headway claims registration with South Africa’s Financial Sector Conduct Authority (FSCA) licence 52108, but the domain ownership and exact match to the registered company are not clearly verified.

User reviews provide both positive and negative indications: Trustpilot reviews highlight fast withdrawals and ease of starting, yet a substantial portion of 1-star reviews complain about withdrawals being stuck or unclear terms.

There is limited public disclosure (on the website) of specific fund-segregation practices, investor compensation schemes or audited financial statements. The site does claim “High execution quality” and “Handy payments … instant and convenient”.

In plain terms: while Headway markets itself as prioritising safety and accessibility, the regulatory transparency is not as robust as some well-established major brokers. Traders should be aware of the risks and consider whether Headway’s level of regulation is acceptable for their risk tolerance. For users in India (West Bengal) and similar jurisdictions, the lack of a major local regulatory licence means extra due diligence is prudent.

How to Trade with Headway?

Headway offers a fairly wide range of trading instruments. According to its website:

Forex: major, minor and exotic currency pairs.

Indices: such as NASDAQ, S&P 500, Hong Kong indices, Dow Jones.

Energies: e.g., gas and crude oil (WTI/Brent).

Cryptocurrencies: e.g., Bitcoin, Ethereum, Dogecoin and “31 other popular crypto coins”.

Single stocks: major stocks of Apple, Google (Alphabet), Meta etc, with “unlimited leverage” claimed in some cases.

Metals and other commodities: listed via the app description.

Unique or standout offerings include:

Use of both MetaTrader 4 and MetaTrader 5 platforms, giving access to advanced functionality and expert advisors.

“Unlimited leverage” in account specifications for higher-tier accounts (although unlimited leverage carries high risk).

Copy-trading functionality: Headway offers a copy-trading service which received the award “Best Zero Spread Broker for Copy Trading” in Jan 2025.

For different trader styles:

Beginners can begin with the Cent account (minimum US$1) and trade small lots on forex and indices.

Intermediate/advanced traders can access tighter spreads, unlimited leverage, and stock/crypto trading.

The copy-trading service allows semi-passive participation if you prefer less hands-on trading.

In summary: Headway provides a broad set of asset classes and supports multiple trading platforms, making it reasonably suitable for a range of traders (beginner to advanced). But as always with leveraged trading, strong risk management is required.

How to Trade with Headway?

Here’s a step-by-step guide to trading with Headway, along with an overview of tools and features:

Select and Register an Account

Visit the Headway website (hw.online) and choose an account type (Cent, Standard, Pro).

Complete registration by providing email, personal information and accepting terms.

Verification / KYC

Submit required identity documents (passport/ID) and proof of residence (utility bill, bank statement) as per the broker’s verification process. While the website does not provide full detail of documents, standard practice applies.

Wait for verification approval—this may vary depending on region and time of day.

Deposit Funds

Log into your “Personal Area” or trading account.

Choose a deposit method: credit/debit card, bank transfer, e-wallet or even crypto (depending on region). Headway emphasises “Handy payments … instant and convenient.”

Enter deposit amount (as little as US$1 for a Cent account). Confirm and wait for the funds to appear.

Choose Platform and Instruments

Decide whether to trade via MetaTrader 4 or MetaTrader 5 (Headway supports both).

Download the appropriate software (desktop, web, mobile) or use the Headway app. The Headway Trading App integrates with MT4/MT5 and supports mobile trading.

Navigate to the instrument list, select your asset class (forex pair, stock, crypto, commodity, index).

Placing a Trade

Select “New Order” in the platform, choose the asset, direction (buy/sell), size (lot/minimum 0.01 for Cent account) and apply stop-loss/take-profit as desired. Headway’s account spec shows min lot size 0.01 for Cent and Standard accounts.

Review spread, commission (if any) and click “Execute”.

Monitoring and Risk Management

Use the charting tools, indicators, pending orders, etc., within MT4/MT5.

You can apply stop-loss, take-profit levels, monitor open position, margin level, equity.

For copy-trading: choose a strategy provider within Headway’s copy platform, allocate funds and monitor performance. The website states you can start copying with just US$1.

Closing a Position / Withdrawal Preparation

To close manually: choose the open trade, hit “Close”.

Monitor your balance, available margin, and if you’re eligible for a withdrawal, follow the withdraw process (see next section).

Regularly review your performance, ensure you’re compliant with bonus/trading‐volume conditions (if you used a bonus). For example, the $111 no-deposit bonus requires trading a certain lot volume before profit withdrawal.

Using Analytical Tools and Support

Headway’s website provides various resources: education, demo contest announcements, and there is a mobile app with integrated tools and risk-management options via biometric login.

Customer support is available 24/7 (see separate section).

With this process, you can set up, fund, trade, and manage positions with Headway. The combination of accessible deposit levels, platform choice (MT4/MT5), and broad instrument list makes it flexible for different trader profiles.

How Can I Open Headway Account? A Simple Tutorial

Opening an account with Headway is designed to be straightforward, especially for beginners. Below is a step-by-step tutorial, along with verification and timeline details:

Access the Website / App

Visit hw.online and click on “Sign Up” or “Open Account”.

Alternatively, download the Headway Trading App on iOS or Android and sign up via mobile.

Registration Form

Provide your email address, create a password, accept the broker’s terms and conditions.

You may also need to provide your country of residence. Headway restricts certain countries (see “Prohibited Countries” section below) and may refuse service to residents of blacklisted jurisdictions.

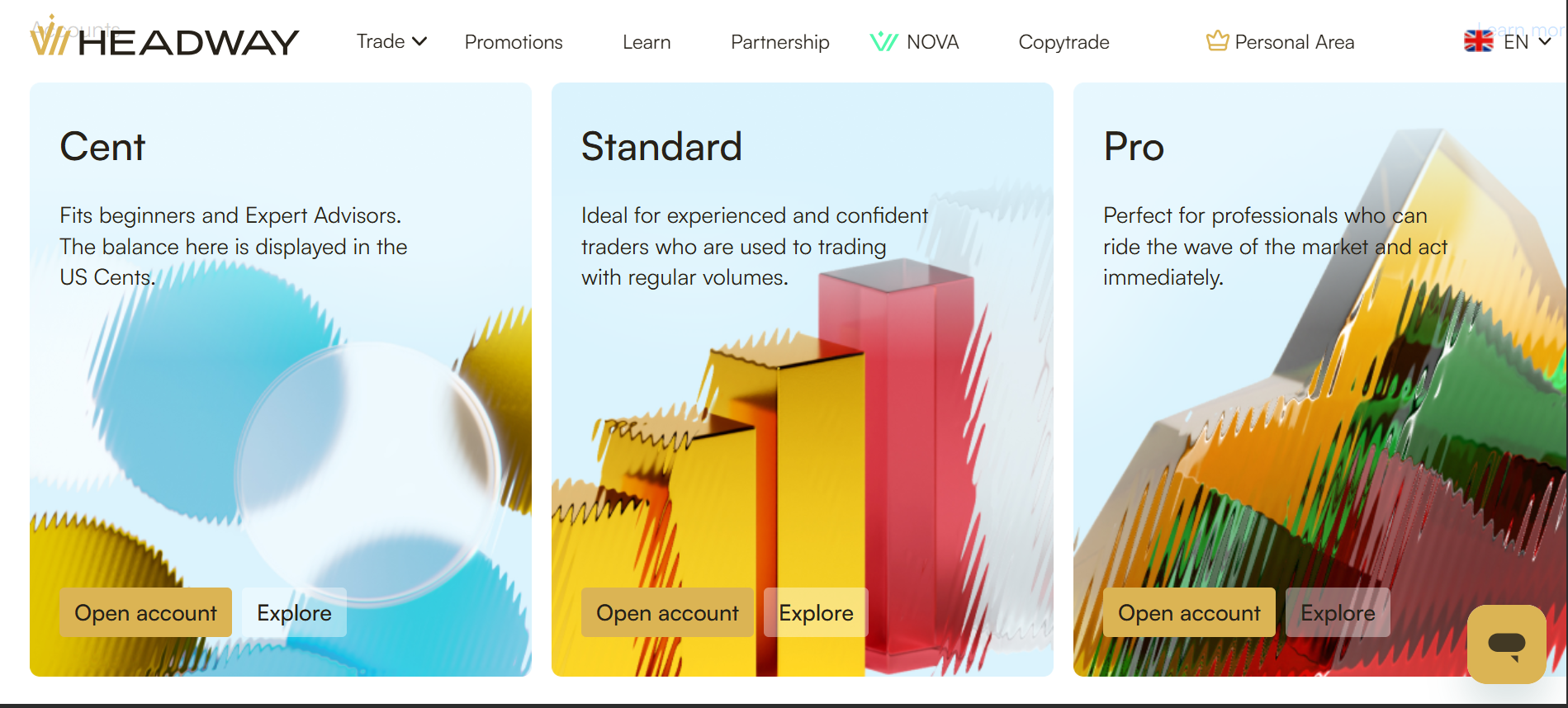

Select Account Type

Choose from the available account types: Cent, Standard or Pro. Each has different minimum deposit, spreads, lot size etc. (see account types section below).

Confirm your selection.

Verification (KYC)

Upload identification document (passport, national ID card) and proof of address (utility bill, bank statement) as per Headway’s KYC requirements. The timeline for this is not explicitly detailed, but should typically take anywhere from a few hours to a few business days depending on the provider and region.

During verification the broker may ask for selfie-photo, document selfie, or further details—typical for forex brokers.

Deposit Funds

Once verification is approved (or sometimes before it, depending on broker policy), you can deposit funds to your trading account. Headway lists multiple payment methods, aiming for “instant and convenient” payments.

For the Cent account, you can deposit from US$1. For Standard and Pro accounts, minimums are US$10 and US$100 respectively.

Download/Launch Platform

Download MT4 or MT5 (desktop, web or mobile) or use the Headway app which integrates the trading features.

Log in using the credentials provided (account number, password) and ensure you are trading on the correct server.

Make Your First Trade

After funding, review the instruments list, choose the product (e.g., forex, stock, crypto) and place your first trade as described in the “How to Trade” section above.

Monitor account balance, margin, stop-loss/take-profit orders, risk management.

Withdrawals/Profit Taking

When you decide to withdraw, ensure you have met any bonus conditions (if you claimed a promotional bonus) and adhere to the broker’s withdrawal policy. Some users have reported delays (see user reviews).

Initiate request from the personal area, choose withdrawal method, amount, and wait for processing.

Timeline Expectations

Registration & account creation: typically a few minutes (if automated).

Verification: could take from a few hours to several business days depending on documents and region.

Deposit: often near-instant for many e-wallet/cryptocurrency methods; bank transfers may take longer.

Trading: immediate once funds are available.

Withdrawal: timing depends on method and whether conditions (bonus, verification) are satisfied; user feedback indicates some delays in certain cases.

Overall, Headway offers a relatively simple onboarding process with low barrier to entry, which is especially positive for new traders.

Headway Charts and Analysis

When it comes to the charting tools and analysis capabilities offered by Headway, the key aspects are via the MetaTrader platforms and the mobile app.

The broker supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are industry-standard for charting, technical analysis, algorithmic trading and multiple device support. On the Headway website under “MetaTrader 5 & 4” the features include: market execution, hedging, quantitative trading, advanced timeframes, close all positions, etc.

Through MT4/MT5 one has access to comprehensive charting: multiple time-frames, indicators, drawing tools, Expert Advisors (EAs), backtesting (especially in MT5), web-terminal access.

In addition, the Headway Trading App offers a mobile-friendly interface for managing trading accounts, viewing live charts, watching analytics, managing risk (via biometrics login, etc).

For different styles of trader:

Beginners: they can rely on mobile app, simple charts, basic indicators (moving averages, RSI) to learn the markets.

Advanced traders: Using MT5 they can utilise advanced features, algorithmic trading, expert advisors, and full-blown charting toolsets.

The availability of both desktop/web and mobile platforms means you can monitor positions on desktop at home and on the go via smartphone.

One potential area for improvement: while the broker mentions “bundle of educational resources” and “getting started” pages, detailed analytics (e.g., proprietary research, dedicated market commentary) are less prominently advertised compared with some larger brokers.

In summary: Headway provides robust charting and analytical resources via MT4/MT5 and its app, making it capable of supporting trading from beginner through advanced levels. Traders should ensure they are comfortable with MetaTrader platforms (or willing to learn) to maximise the benefit.

Headway Account Types

Below is a table summarising the account types offered by Headway and their key features.

| Account Type | Minimum Deposit | Spread (From) | Commission | Eligibility / Key Features |

|---|---|---|---|---|

| Cent | US$1 | Floating from ~0.3 pips (or similar) | No commission | Entry-level for beginners, micro lots allowed (min lot 0.01), max positions 300. |

| Standard | US$10 | Floating from ~0.3 pips | No commission | Broader instrument access, account currencies multiple (USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR) |

| Pro | US$100 | Floating from 0.0 pips | Up to US$1.50 per side per lot | Lowest spreads, unlimited maximum lot size/positions, for more experienced traders. |

Additional common features across account types:

Platforms: MT4/MT5 supported.

Execution: “from ~0.16 sec” listed as order execution time for all account types.

Swap-free (Islamic) accounts available (“+” listed for each account type).

Leverage: from 1:1 to “unlimited” (all account types) under certain conditions.

This table gives an at-a-glance view of what Headway offers in terms of account structure.

Do I Have Negative Balance Protection with This Broker?

Negative balance protection refers to the policy where a trader cannot lose more than their account equity (i.e., the balance will not go into negative). Whether Headway offers this is not explicitly detailed on their website in the typical phrasing “negative balance protection”.

Here’s what we can infer:

The account specification page shows “Stop Out” level = 0% for all account types.

A 0% stop-out level suggests positions may be closed when margin is depleted, potentially before the account goes negative, but this is not a guaranteed “no negative balance” policy.

The website does not explicitly state “we guarantee you will never lose more than your account equity” or use the term “negative balance protection” prominently.

Some features emphasise risk management: e.g., the mobile app mentions you can “decide how much you put into trading”.

User reviews do not clearly state whether negative balances have occurred or been reversed. That said, some user comments on platforms raise concerns about withdrawals and spread widening during news events.

Given this information:

It appears that Headway may execute automatic stop-outs when margin levels reach critical points (e.g., margin call at 30% as listed) but they do not make a public guarantee of full negative-balance protection. The margin call level is 30% for all account types.

Traders should therefore assume risk that in extremely volatile markets (gap moves etc.) they could temporarily have a negative balance, unless the broker’s internal policy prevents this (which is not confirmed).

If negative balance protection is a key requirement for your trading plan, you might wish to contact Headway directly and request written confirmation of whether they offer such protection in your jurisdiction, or look for a broker that explicitly provides it under local regulation.

In short: Headway does not clearly advertise negative-balance protection as a headline feature; while margin-call and stop-out levels are defined, the guarantee that you cannot lose more than your deposit is not fully documented publicly. Traders should proceed with caution and manage risk accordingly.

Headway Deposits and Withdrawals

Here are the details regarding deposit and withdrawal processes with Headway:

Deposit Methods

Headway states that they support “all well-known payment methods” and that payments are “instant and convenient”.

The Headway Trading App page lists that you can make deposits in the app (and via the account), and suggests the use of cards, crypto and possibly other e-wallets.

Minimum deposit: for the Cent account, US$1. For Standard and Pro, US$10 and US$100 respectively.

Withdrawal Methods and Processing

The website does not clearly list all withdrawal methods, minimum/maximums or explicit fees in the public account spec section.

In the promotion section and user reviews, Headway claims “no-commission deposits and withdrawals” for certain offers. For example, the “Best Global Forex Broker” award page lists “no-commission deposits and withdrawals” among the features.

User reviews are mixed: some users praise “fast withdrawals” and “quick deposit and withdrawal” experiences. However, others report delays in receiving funds.

The minimum withdrawal amount and processing times are not clearly stated publicly — this may vary by region and payment method.

Fees and Conditions

While many deposits appear commission-free, potential fees may still apply depending on method or bank; users should check their chosen payment provider.

For withdrawals, Headway’s promotional page says profits from the $111 no-deposit bonus become withdrawable after you meet a trading-volume condition (for example: if you made US$30 profit, you need to trade 10 lots to withdraw). Processing time appears variable: some users claim very quick (minutes to hours), others report longer (days) depending on payment method and region.

Summary for Indian/West Bengal Traders

For a trader in India (West Bengal), it is important to check whether Indian deposit/withdrawal methods (e.g., bank transfer from Indian bank) are allowed and whether there are local currency options (Headway lists multiple currencies including USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR but not explicitly INR).

Be aware of your local bank’s foreign-remittance rules and charges.

Confirm expectancy of processing time for your chosen method.

In conclusion: Headway offers very low minimum deposits and claims rapid deposit/withdrawal with no commission in many cases. However, transparency over withdrawal timelines, method-specific fees, and regional restrictions is not fully clarified publicly, so users should verify details before committing significant funds.

Support Service for Customer

Customer support is an important dimension of any broker, and here is what we found about Headway.

Headway states on its website: “Care anytime, anywhere — We are here 24/7 to make you happy.”

The Headway Trading App page emphasises customer care available 24/7 and “Chat with Customer Care right in the app… we will help you in your language anytime.”

On Trustpilot and review platforms, many users praise the broker for quick and polite support. For example: “The team is very kind and friendly… always answered my questions with great care and attention to detail.”

On the flip side, some users complain about slower responses, especially around withdrawal issues. Some comments: “the withdrawal is 15-30 mins but it is way more than that. Sometimes 2 hrs and customer care doesn’t reply swiftly.”

Languages supported: the review site indicates multiple languages (English, Arabic, French, Indonesian, Malay, Portuguese, Spanish, Thai, Vietnamese) for the website and service.

Availability Hours: The claim is 24/7 support, which is favourable for global traders across time-zones.

Channels: Likely live chat (via app or website), email ([email protected] or support address noted), and possibly phone/telegram/instagram (based on social links).

Tip for users:

Before depositing significant funds, test the support channel by asking a few questions to evaluate responsiveness.

Save chat logs or email correspondence in case you need to escalate any issue (withdrawal, verification, etc.).

Check if support is provided in your local language or region (important when you are in West Bengal/India).

Overall, Headway’s customer support appears quite strong in terms of global availability and positive user feedback, but as with all brokers, individual experiences vary and due diligence is warranted.

Prohibited Countries: Where Can I Not Trade with this Broker?

According to Headway’s FAQ page and external review sites:

The “What do you need to know before choosing a Forex broker?” FAQ states: “Headway Inc. does not offer its services to residents of countries that were, are, or will be blacklisted by the Financial Action Task Force (FATF).”

The BrokerView site lists that residents of certain jurisdictions may be restricted and that the regulatory verification is not fully clear.

On the Trustpilot listing, some users from various countries indicate they were able to open accounts, while others highlight local regional issues (local bank transfer restrictions, etc).

Specific countries where Headway’s services are explicitly excluded are not fully published on the website (at least in the publicly-accessible areas found). Therefore, as a trader in India (West Bengal), you should expect to check:

Whether Indian residents are permitted (sometimes brokers accept Indian clients but may have limited withdrawal/payment methods).

Whether local regulatory requirements (India’s regulatory authorities) affect your ability to use the broker and the availability of local payment methods.

Whether your country is on the FATF black-list (though India is not).

Whether the broker accepts and supports your local currency (INR) and deposit/withdrawal methods.

Given the global marketing of Headway (mentioning Africa, Southeast Asia, etc.), it appears to cover many regions, but you must verify eligibility for India (and West Bengal specifically) by contacting Headway’s support or reading the back-office terms for your region.

Special Offers for Customers

Headway advertises several promotions, loyalty programs and incentives. Here are the details:

No-deposit bonus: US$111

Under the “$111 bonus for your first trade” promotion: you open a “bonus account”, instantly receive US$111 credited, then you trade for seven days. After that, the bonus account is closed and any profit you made may be transferred or withdrawn once you meet the lot-volume requirement (profit ÷ 3 = required lots) and move to a real account.Deposit bonus up to 75%

On the “Awards” or promotional pages, Headway lists “Up to 75% bonus on all deposits”. For example the “Best Global Forex Broker 2025” award page lists this among standout offerings.Demo contests & prize pools

Headway promotes demo contests (e.g., “Demo contest for Egypt: US$2,175 prize pool; Get US$111 bonus for your first trade”).

Also on their YouTube channel, they show traders winning prizes, laptops, motorcycles via their “Dreamway” program.Copy-trading low minimum

Their copy-trading offering allows investors to start copying strategies with only US$1 (according to their award page).

How to Qualify & Terms

Each bonus has terms and conditions: e.g., for the no-deposit US$111 bonus, you cannot deposit, withdraw or internally transferised funds while the bonus account is active. You must trade within seven days, and then trade a certain number of lots to withdraw profits.

Always check the terms (which may vary by region). Bonuses may carry higher risk / volume requirements and might restrict strategy types (e.g., scalping, hedging may be disallowed).

Promotions often have expiry dates (e.g., the seven-day bonus period) and the profits may only be withdrawn under certain conditions.

User Consideration

Promotions can be attractive for new traders, but they should be used with understanding of the fine print and potential limitations.

Ensure you don’t deposit large sums solely to unlock a bonus without reading the conditions, as it may increase risk or force you into higher trading volumes.

Always verify that the promotion is available in your region (India) and that you can withdraw from your local payment methods.

In short: Headway offers a strong range of promotional offers and incentives, especially targeted at beginner traders and for marketing engagement. These can be useful, but only if you understand the associated terms and volume requirements.

Headway Review Conclusion

In conclusion, Headway presents itself as a modern, accessible broker with features that cater to a wide range of traders—from complete beginners to more advanced market participants. Its low minimum deposit (US$1), broad instrument coverage (forex, stocks, crypto, indices, energies), and platform flexibility (MT4/MT5 + mobile app) make it especially appealing for traders who wish to get started with limited capital and scale up gradually.

Its marketing emphasises “trade your way”, unlimited leverage (under certain conditions), strong execution (“from 0.16 sec”), and user-friendly mobile access. The presence of promotions, bonuses and awards adds to the appeal of the offering.

On the other hand, the regulatory clarity is less strong compared to some of the major global brokers. While Headway claims safety and security, independent verification of its full regulatory licence and fund-segregation practices is not as transparent as one might wish. For traders in India (West Bengal) and other regulated jurisdictions, this means a higher level of due diligence is warranted. Also, while user reviews are mostly positive for ease of use and low entry costs, there are specific complaints around withdrawal delays and bonus-account conditions.

If you are a beginner trader seeking a flexible, low-cost entry into markets, Headway could be a good fit—especially if you are comfortable with MetaTrader platforms and the risks of leveraged trading. If you are a more advanced trader or one prioritising top-tier regulatory oversight (e.g., FCA, ASIC licensed brokers), you may wish to compare Headway with brokers who have broader regulatory pedigree.

In sum: Headway has many of the advantages of a next-generation broker: low cost, wide instrument range, modern platform choices and strong marketing. But like all brokers operating cross-border with less public regulatory transparency, it is wise to proceed with standard risk awareness—use small deposits initially, test withdrawals, and monitor your risk exposure.

Summary and Key Takeaways

- Headway enables account opening from just US$1, making it highly accessible for beginners.

- Supports major instruments: forex, stocks, indices, crypto, commodities, and both MT4/MT5 platforms.

- Offers strong mobile integration and modern trading features (unlimited leverage, tight spreads on higher-tier accounts).

- Includes attractive promotional offers (no-deposit bonus, deposit bonus, copy-trading minimums) — but with conditional terms.

- Regulatory transparency is limited; independent verification of full licence and fund-segregation details is not deeply documented.

- Customer support is available 24/7 and well-reviewed, though some users report withdrawal delays in certain cases.

- For traders in India/West Bengal: check regional eligibility, available local deposit/withdrawal methods, currency options (INR not explicitly listed).

- Use risk management: as with all leveraged trading, unlimited leverage is double-edged; understand margin requirements and stop-out rules.

- Before committing funds, make a small deposit, test withdrawal process, and ensure the broker meets your personal trading style and region-specific rules.

FAQs

What is the minimum deposit required to open an account with Headway?

What leverage does Headway offer to traders?

Which trading platforms are supported by Headway?

Are there promotional bonuses available with Headway?

Can traders from India open an account with Headway?

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the University of Southern California, dove into finance clubs during his studies, honing his skills in portfolio management and risk analysis. With a career spanning prestigious firms like the Baltimore Sun and The Globe, he's become an authority in asset allocation and investment strategy, known for his insightful reports.

- Headway Overviews

- Pros and Cons

- Is Headway Safe? Broker Regulations

- How to Trade with Headway?

- How to Trade with Headway?

- How Can I Open Headway Account? A Simple Tutorial

- Headway Charts and Analysis

- Headway Account Types

- Do I Have Negative Balance Protection with This Broker?

- Headway Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Headway Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author