GMI Markets Review 2025: Is GMI A Scam or Legit Broker?

GMI Markets Overviews

GMI Markets is an intriguing online trading broker with a range of offerings, but also an array of questions surrounding its operations. Is it the right broker for you? Dive into our comprehensive review to find out.

GMI Markets, or Global Market Index, is a known broker in the world of online trading. Despite being in the trading industry for some time, GMI Markets has kept a relatively low profile, lacking comprehensive information on its establishment and history. The firm is recognized for its forex trading services, with multiple account types to cater to different trading preferences. Although GMI Markets has made efforts to cater to various trading needs, it lacks transparency in some aspects of its services. If you’re considering GMI Markets as your potential trading platform, this GMI review will provide you with a clear analysis and critical information to help you make an informed decision.

| Broker Feature | Overview |

| Type of Broker | ECN, STP Broker |

| Regulation & Licensing | FSC |

| Applicable Countries Allowed To Trade | See Section Below |

| Assets Offered | Gold, Oil, Silver, Forex, Indices |

| Platforms Available | MT4, MAM, GMI Edge |

| Mobile Compatibility | Yes |

| Payment & Withdrawal Options

|

Bank Transfer, Neteller, Skrill |

Pros and Cons

- Offers a range of account types catering to different types of traders

- Provides a 30% Welcome Bonus for first-time deposits

- Limited and unclear information about withdrawal methods

- No visible details about negative balance protection

- Limited customer support options

- Lack of transparency about region-specific operation policies

- Absence of educational resources

- Limited trading platform features and deposit methods

Is GMI Markets Safe? Broker Regulations

GMI Markets holds significant relevance due to its international operations. This prominent broker is not a singular entity but comprises several branches that are duly registered and regulated in their respective jurisdictions. The basis of this information is discernible from the footer section of the official GMI Markets website or the “About Us” page.

Regulations safeguard both brokers and their clients, ensuring fairness, transparency, and accountability in all transactions. They protect investors from fraudulent practices and provide a framework for resolving disputes.

Global Market Index Limited is an International Business Company registered in Vanuatu under the number 14646. The company operates from its registered address at the Govant Building, BP 1276 Port Vila, Vanuatu. The laws and regulations of Vanuatu thus bind this branch of GMI Markets.

Further, another offshoot of GMI Markets, Global Market Index LLC, maintains its registration in St. Vincent and Grenadines under registration number 2763 LLC 2022. The company’s registered office is situated at Euro House, Richmond Hill Road, Kingstown, St. Vincent and the Grenadines. As such, it adheres to the regulatory framework established by St. Vincent and the Grenadines authorities.

Additionally, GMI Markets extends its international presence through Global Market Index Limited, which is registered in Mauritius under registration number 158643 C1/GBL. This entity is authorized and regulated by the Mauritius Financial Services Commission “FSC,” with a license number C118023454. Its registered address is at The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius. Therefore, this division is regulated by the robust financial regulations instituted by the Mauritius Financial Services Commission.

Delving into the awards accorded to GMI Markets, it is important to note that specific details are somewhat elusive. While the information is purported to be available either on their home page or the about us page, there is a lack of clear, detailed information regarding their awards even from available GMI reviews out there.

Despite this, GMI Markets’ ability to operate across multiple jurisdictions and its compliance with various regulatory bodies speaks volumes about its commitment to maintaining high standards of service and operations. This commitment is a testament to their inherent worth, suggesting a level of recognition and respect within the industry even without explicit awards.

GMI Markets is a global presence marked by adherence to regulatory standards across multiple jurisdictions, thereby earning a reputation as a trustworthy broker. Although the specifics of their awards remain vague, their commitment to quality service speaks for itself, marking GMI Markets as a notable entity in the financial world.

- Financial Services Commission (FSC)

What Can I Trade with GMI Markets?

In operation since 2009, GMI Markets, as outlined on its official website offers its clients an array of trading instruments. Out of the trading services they offer, this broker is best known for CFD and forex trading.

Navigate to the ‘Markets’ section of the website and you’ll be able to access detailed information on the tradable instruments and trading terms provided by this brokerage firm. However, upon examination, the list appears somewhat lean for an international broker of GMI Markets’ stature: Gold, Oil, Silver, Forex, and Indices.

It’s worth noting that multiple asset classes, the more extensive the better, often provide clients with better portfolio diversification and risk management opportunities. This is why one might expect a global broker to offer a broader selection, including a wider range of commodities, currencies, and indices, and possibly even additional asset classes such as cryptocurrencies or bonds.

That being said, this GMI review will delve into the details of the available trading instruments at GMI Markets.

CFD Trading: Financial Derivative Instruments

CFD trading being one of their main focuses, we briefly discuss the financial derivate instruments they offer here. For CFD trading, this broker offers Crude Oil, Metal and Indices all of which are discussed in more detail below.

Gold, Silver, Oil

Recognized as safe-haven assets, Gold, Silver, and Oil hold an intrinsic financial value. GMI Markets offers these commodities for trading, catering to traders who seek to hedge their funds during market turbulence. The brokerage provides 24/5 market access, competitive trading costs, and swift execution times, creating a conducive environment for commodity trading.

Market spreads and pricing at GMI Markets are also commendable. For instance, the spread for gold (XAUUSD) starts from 0.0 pips, silver (XAGUSD) from 0.1 pips, and oil (USOUSD and UKOUSD) from 1.2 pips and 1.4 pips, respectively. Trading hours for these commodities extend from early Monday to late Friday, providing ample time for traders to make their moves.

Forex

GMI Markets also allows its clients to trade Forex, supported by tight spreads and 24/5 market access. Whether on mobile or desktop, traders can leverage the world-renowned MT4 trading platform to analyze and trade a range of currency pairs, including EURUSD, USDJPY, GBPUSD, and others. The spreads for these currency pairs are highly competitive, starting from 0.0 pips.

Indices

Lastly, GMI Markets provides the ability to trade major global indices such as the Dow Jones (U30USD) and the FTSE 100 (100GBP). These indices, comprising some of the world’s largest companies, often mirror the economic performance of their respective countries. GMI offers attractive spreads on these instruments, starting from 0.6 pips for D40EUR to 6.0 pips for CHN50U.

While the list of trading instruments at GMI Markets may seem narrow for an international broker, the firm manages to offer key instruments in the commodities, Forex, and Indices sectors. This array of offerings, competitive spreads, and reliable trading hours still present noteworthy opportunities for traders worldwide.

- Forex

- Indices

- Gold, Silver, Oil

How to Trade with GMI Markets?

GMI Markets provides its clientele with multiple trading platforms, demonstrating a commitment to offering a versatile and adaptable trading environment. Prospective users can learn more about these platforms under the “Platforms” section of the GMI Markets website. However, the information found in this section could be viewed as somewhat limited, which might perplex some.

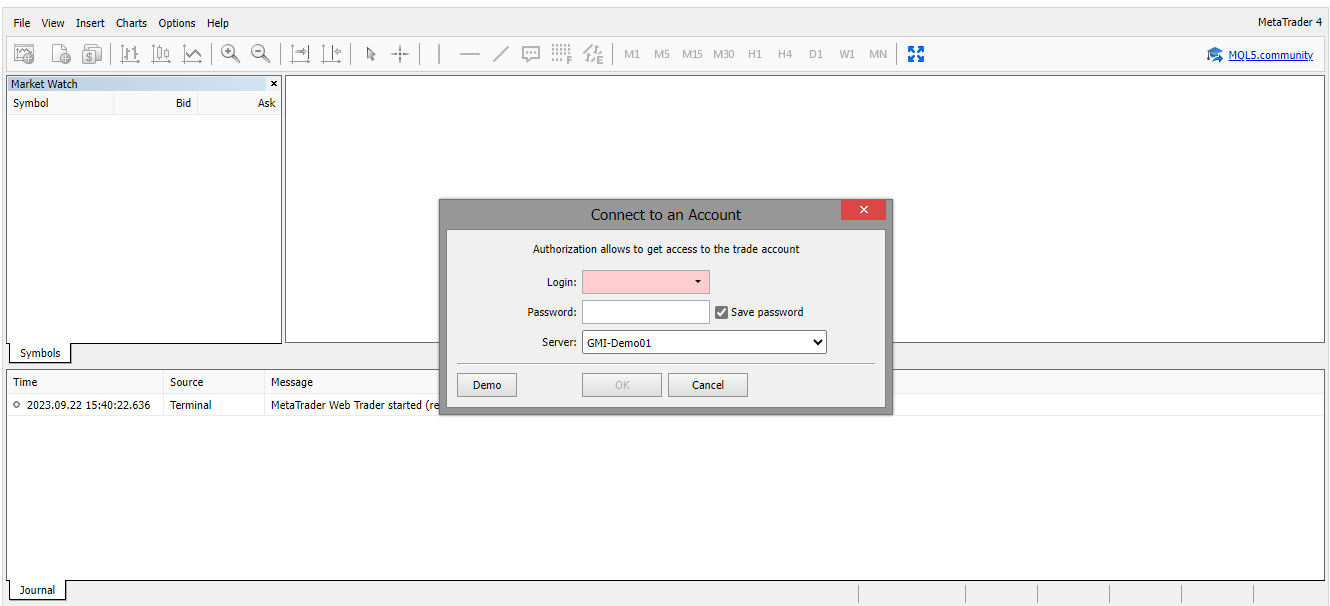

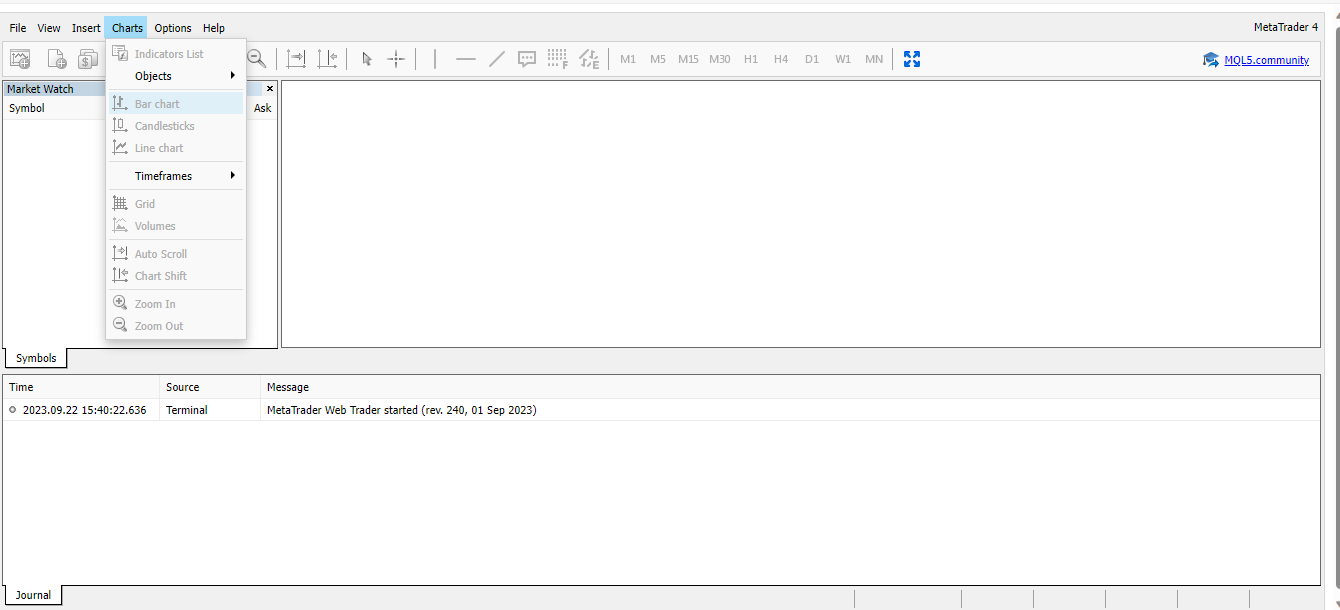

MetaTrader 4 (MT4)

GMI Markets allows its clients to trade via the globally renowned MetaTrader 4 platform. Renowned for its robustness and versatility, MT4 allows traders to design unique algorithms or follow other traders by utilizing customizable Expert Advisors (EAs).

The platform also connects seamlessly with the GMI Edge mobile app, offering users the convenience of managing trades and funding accounts from their handheld devices. Additionally, MT4 provides an extensive array of analytical tools, aiding traders in dissecting various market aspects. It is compatible with various operating systems, including Windows, MacOS, Android, and iOS, and is also accessible via the web.

Multi-Account Manager (MAM)

Designed with money managers in mind, the Multi-Account Manager (MAM) service provided by GMI Markets allows for the streamlined management of multiple accounts. With a single click, money managers can execute trades across all accounts, making it an efficient tool for managing multiple investments simultaneously.

The MAM platform also enables automated billing of performance fees and offers flexible trade allocation types, such as by lot size, equity, or balance. These features facilitate smooth and efficient account management for those managing multiple trading accounts.

Introducing Broker (IB)

Brokers are known to offer tailored partnership programs to their clients. GMI offers their own partnership Introducing Broker (IB) program to incentivize clientship with their brokerage.

Through the IB program, clients are able to benefit from GMI special offers, exclusive GMI fees, added customer care support and more.

GMI Edge

Lastly, GMI Markets has its proprietary mobile app, GMI Edge, which serves as a convenient trading portal. From the comfort of their palms, users can access their trading accounts anytime, anywhere, and trade in Forex, gold, silver, indices, and over 70 other instruments.

The GMI Edge app also simplifies deposit, withdrawal, and fund transfer processes. It allows users to manage their trades, and deposit and withdraw funds from a single location. Additionally, registration, verification, and account opening are streamlined on the app, with the entire process taking just a few minutes.

This GMI review then concludes that while the information provided on the GMI Markets website regarding their platforms may seem a bit scant, the firm offers a solid range of trading platforms that cater to various trading needs, from individual traders to money managers and mobile users.

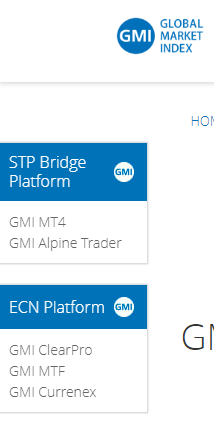

Platforms By Trading Account

On their website, GMI mentions three main trading platforms: GMI Edge, Meta Trader 4 and Multi-Account Manager (MAM).

However, it is also made mention on their other website here that their platforms are separately categorised according to which GMI trading account is being used. An STP account groups two platforms under STP Bridge Platform. While an ECN account groups three platforms as under ECN Platform.

Straight-Through-Processing (STP) Bridge Platform

The two platforms in this category are: GMI Alpine Trader, belonging to one of GMI Alpine Trader Platforms, and GMI MT4.

More on this can be read up on here: GMI Account info.

Electronic Communication Network (ECN) Platform

Features: Electronic Communicaton Network Account

As for the ECN Platform, it groups three platforms: GMI ClearPro, GMI MTF and GMI Currenex.

Keep in mind that not all these platforms are available to all GMI clients. More on this can be read up on here: GMI Account info.

Trading Account Highlights

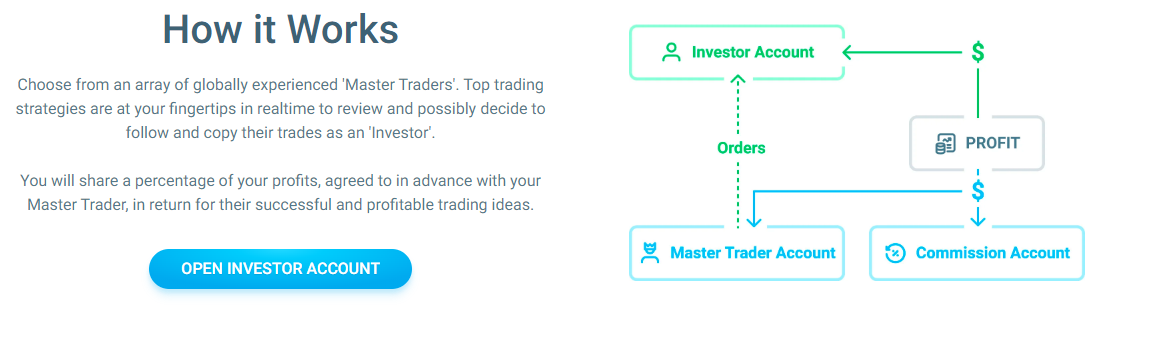

GMI hosts several trading perks, but some key ones are social trading and commission free trading.

GMI Social Trading Edge

GMI Social Trading Edge is a copy trading platform that is catered towards serving both investors and master traders seamlessly. This technology driven brokerage solution has been designed to be user-friendly for professional and beginner traders alike. With ease of use and sophistication combined in a single account, traders from novice to institutional traders will find the user interface highly manageable and efficient in executing trades.

All three of GMI’s trader accounts: ECN, Cen and Standard allow social trading. All three accounts also come with Expert Advisors and so have enabled EA trading capabilities for automated trading.

GMI Edge Commission-free Trading

This advanced proprietary software and trading platform of GMI allows commission-free trading through the Cent and Standard accounts. However, swap free trading is available with GMI’s ECN trading as well. Additionally, commission-free trading on the GMI platforms also provide competitive trading conditions as traders get to set their own leverage on the ECN, Cent and Standard accounts affording traders with flexible leverage for a more customized trading environment.

| Features | MetaTrader 4 | Multi-Account Manager (MAM) | GMI Edge |

| One-Click or One-Tap Trading | Yes | Yes | Yes |

| Trade Straight off Charts | Yes | No | Yes |

| Email Alerts or Push Notifications | Yes | No | Yes |

| Mobile Alerts | Yes | No | Yes |

| Stop Order | Yes | Yes | Yes |

| Market Order | Yes | Yes | Yes |

| Trailing Stop Order | Yes | No | Yes |

| OCO Orders (One-Cancels-The-Other) | Yes | No | No |

| Limit Order | Yes | Yes | Yes |

| 24hr trading | Yes | Yes | Yes |

| Charting Package | Yes | No | Yes |

| Streaming News Feed | Yes | No | Yes |

- MT4

- MAM

- GMI Edge

How Can I Open GMI Markets Account? A Simple Tutorial

To open an account, head to their website and then click on the “create account” button which is located in the menu.

You will then be redirected to their registration page, and here you will need to fill in some personal details to proceed. This included First and Last name, date of birth, Email address, phone number, and password. The routing should automatically fill in your correct country of residence, as shown in the image below.

Filling in this page is all you will need to fill in to sign up with the broker because after you are done you will be redirected to the client area where you can deposit capital or complete your profile (verify your identity).

Remember that many brokers let you deposit capital and trade through a live account, but if you want to withdraw any funds, you will need to verify your identity.

Payment methods and the payment provider available are e-payment Skrill, credit and debit cards and bank wire transfer.

Register a Demo Account

GMI invites traders, seasoned and beginners, to trade risk-free with them on their demo account. Via this free, demo account, beginner traders can explore trading in GMI’s trading environment, and real market conditions.

Professional traders can further test out their trading against GMI’s institutional platform with an ECN account. Transparent pricing and a deep liquidity pool will benefit traders who choose ECN trading when registering for a demo account.

Above are just a few examples of simulated live market conditions that can be experienced with GMI’s free account.

- Go to the broker's website

- Click on the "Create account" button in the menu

- You will be redirected to the registration page

- Fill in personal details: First and Last name, date of birth, Email address, phone number, and password.

- The routing should automatically fill in your correct country of residence

- After filling in the registration page, you will be redirected to the client area

- In the client area, you can deposit capital or complete your profile (verify your identity)

GMI Markets Charts and Analysis

For new and experienced traders, education plays a vital role in understanding the markets, leading to informed decision-making and more robust trading strategies. Regrettably, in the case of GMI Markets, it appears this broker does not offer any educational materials or trading resources on their website.

MT4 Trading Analysis Tools

A comprehensive review of GMI Markets’ website and menu fails to reveal dedicated sections for education, trading tools, or even a simple blog or economic calenda. The absence of such resources creates an information vacuum, making it challenging for both novices and seasoned traders to expand their knowledge and sharpen their skills.

Educational materials and trading resources play a critical role in providing traders with the foundational knowledge required to navigate the financial markets successfully. These typically range from simple explanatory articles and tutorials to in-depth webinars, eBooks, and interactive courses that cover various topics, including trading basics, market analysis techniques, risk management, and advanced trading strategies.

For example, a broker like Zeal Capital Market (ZFX) offers a comprehensive suite of educational materials that both clients and non-clients can access. They provide an array of educational content, including detailed market analysis, trading guides, and A-Z Academy, all aimed at enriching the trading knowledge of their users.

Moreover, many brokers also provide practical tools such as economic calendars, which keep traders abreast of major economic events that could influence the markets. In addition, blog articles often offer expert insights into market trends, tips, and strategies.

The lack of such resources at GMI Markets is a significant drawback, particularly for novice traders who are still familiarizing themselves with the nuances of the financial markets. In the increasingly competitive trading world, brokers who fail to provide educational content and trading resources may find themselves at a disadvantage, as traders might prefer brokers that offer extensive support and learning materials.

GMI’s absence of educational materials and trading resources is a considerable shortcoming. It’s essential for traders, particularly those just starting their trading journey, to choose brokers that provide comprehensive educational resources to support their growth and success in the trading arena.

- Nothing

GMI Markets Account Types

When deciding on a broker, one important factor to consider is the variety and flexibility of the account types they offer. These account types should cater to different trading styles and experience levels, from beginners to professional traders. At GMI Markets, they offer three distinct trading accounts – the ECN, Cent and Standard. Information about these can be found on their website under the “Account Types” menu.

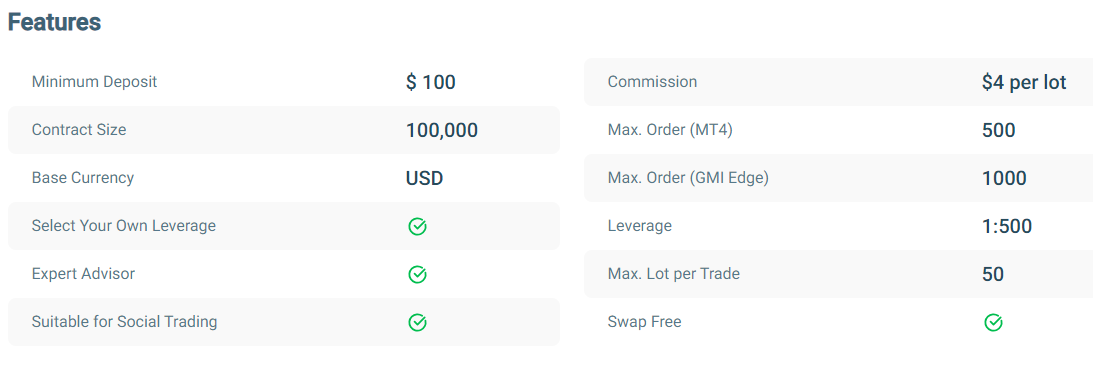

Electronic Communication Network (ECN) Account

The Electronic Communication Network Account benefits active short-term traders who frequently enter and exit the market. It draws liquidity and pricing from a broad network, including 15 major banks, hedge funds, and institutional liquidity providers. This gives rise to ‘choice pricing,’ often resulting in a zero spread. It means traders can see profits as soon as the market moves in their favor.

Key features of the Electronic Communication Network Account include a minimum deposit of $100, a contract size of 100,000, the ability to select your own leverage, the use of Expert Advisors for automated trading, and a commission of $4 per lot. All ECN Accounts at GMI Markets are swap-free.

Cent Account

Ideal for beginners and algorithmic traders, the Cent Account allows traders to transact in the smallest denomination possible – one cent. This low-risk environment is excellent for testing trading strategies and automated trading robots. After successfully validating strategies, traders can then transition to the Standard Account for higher risk-reward trades.

The Cent Account requires a minimum deposit of $15, offers a contract size of 1,000, the ability to select your own leverage, the use of Expert Advisors for automated trading, and has no commission. Cent Accounts at GMI Markets are also swap-free.

Standard Account

For those who prefer to trade similar to how the interbank and major financial institutions do, the Standard Account at GMI Markets offers tight spreads and high leverage of up to 1:2000, with no commission fees.

Key features of the Standard Account include a minimum deposit of $25, a contract size of 100,000, the ability to select your own leverage, the use of Expert Advisors for automated trading, and no commission. Like the other accounts, the Standard Account is swap-free.

GMI Markets has carefully considered catering to various trader types and their specific needs with its array of account options. Whether you are a novice looking to dip your toes into trading or an experienced trader looking for institutional-grade trading conditions, GMI Markets offers suitable account options to meet your requirements.

| Features | ECN Account | Cent Account | Standard Account |

| Account Currencies | USD | USD | USD |

| Available Leverage | Up to 1:500 | Up to 1:1000 | Up to 1:2000 |

| Minimum Deposit | $100 | $15 | $25 |

| Commission Per Trade | $4 per lot | No | No |

| Decimal Pricing | Not Specified | Not Specified | Not Specified |

| Trading Instruments | Not Specified | Not Specified | Not Specified |

| Min. Lot Size Per Trade | Not Specified | Not Specified | Not Specified |

| Max. Lot Size Per Trade | 50 | 150 | 50 |

| Spreads | As low as 0 | Not Specified | As low as 0 |

| Demo Account | Not Specified | Not Specified | Not Specified |

| Swap/Rollover Free | Yes | Yes | Yes |

| Hedging | Not Specified | Not Specified | Not Specified |

| Scalping | Not Specified | Not Specified | Not Specified |

| Copy Trading Support | Not Specified | Not Specified | Not Specified |

| Available to U.S. Residents | Not Specified | Not Specified | Not Specified |

Given the “Not Specified” above, it’s important to note that GMI Markets hasn’t publicly provided specific information related to these points. It’s highly recommended that you contact GMI Markets directly or visit their website for precise and comprehensive details.

A noticeable gap in information can also be seen in the absence of any disclosure on margin in any of the GMI trading accounts. Where most brokers readily disclose information on account margin, GMI fails to do the same which clients should make a note of as margin carries a lot of weight on determining trading strategy.

- Standard account

- ECN Account

- Cent Account

Do I Have Negative Balance Protection with This Broker?

GMI Markets have certainly made a name for themselves in the intricate web of global financial trading. Despite their vast offerings, we’ll focus on an essential policy that every trader should be aware of: Negative Balance Protection.

While browsing through GMI Markets’ site, you might notice that a myriad of policies and documents are at your fingertips, including “Trading Policies,” “Legal Documents,” and “Risk Disclosure.” Yet, an explicit mention of the Negative Balance Protection policy is notably absent. Contrary to this, some external reviews suggest that GMI Markets does, in fact, offer such protection.

Negative Balance Protection is a financial safety net, essentially shielding you from falling into debt due to losses in trading. In the volatile world of financial markets, prices can swing dramatically, leading to potential losses surpassing your account balance. If this happens, a broker with a Negative Balance Protection policy will absolve you of the responsibility of covering the deficit. It’s a crucial element that safeguards the trader’s capital.

If GMI Markets indeed offers Negative Balance Protection, their website’s lack of explicit mention is rather puzzling. This policy is a significant boon for traders and showcases the broker’s commitment to its clientele’s financial security. Therefore, prominently featuring such information on their site would likely inspire confidence in potential and existing traders alike.

The importance of transparency in this regard cannot be overstressed. For example, brokers like ZFX openly display their commitment to Negative Balance Protection. This clear communication fosters trust and provides assurance to their clients, who know their financial liabilities will never exceed their deposited funds. Thus, if GMI Markets does offer this policy, highlighting it within their official materials would significantly improve their communication and customer assurance.

- Yes*

GMI Markets Deposits and Withdrawals

In the trading world, the ease of moving your funds in and out of your trading account is an essential part of a smooth trading experience. When examining GMI Markets, we can see this critical aspect demands attention.

Upon exploration of GMI Markets’ website, specifically under each account type page, you will find a limited set of deposit methods. Astonishingly, they offer only three means to fund an account: Local Bank or Wire Transfers, Neteller, and Skrill. Remarkably absent from their offerings are universally accepted methods such as Mastercard or Visa, which most brokers commonly provide.

The absence of information regarding withdrawal methods further compounds this deficiency. While most brokers strive to make the process of funding and withdrawing as seamless as possible by providing a variety of well-known and globally accepted options, GMI Markets appears to fall short in this respect.

Why is this important? The diversity of deposit and withdrawal methods is key to providing an inclusive trading environment. Traders across the globe have varied preferences and access to financial services, and having a broad spectrum of deposit and withdrawal methods ensures that the broker caters to as many potential clients as possible.

Furthermore, transparency regarding withdrawal methods is crucial. It lends an air of trust and assures the trader that they can access their funds conveniently and quickly. As an example, other brokers provide explicit information about how traders can withdraw their funds and the associated timelines, fostering a sense of security and trust.

GMI Markets does ensure that all transactions adhere to Anti-Money Laundering controls, indicating a commitment to legal and ethical operations. However, expanding their deposit and withdrawal options and clear communication regarding these processes would vastly improve their service to traders worldwide.

- Skrill

- Neteller

- Bank Transfer

Support Service for Customer

In the intricate and dynamic world of trading, excellent customer support plays a pivotal role in enhancing the user experience and trust in a broker. We encounter some surprising findings as we delve into the customer support methods provided by GMI Markets.

Information about GMI Markets’ customer support can be found in the footer section of their website. Surprisingly, the main avenue of support that GMI Markets provides is a contact form. Beyond this, there appear to be no additional methods of customer service provided on their website.

The absence of readily available, diverse customer service channels is unusual, especially in an industry where the complexity of services and time sensitivity of operations often necessitates robust customer support. Traders may need assistance with a variety of issues, from account setup and trading instructions to technical glitches and transaction inquiries. The lack of multiple customer support options might present a significant challenge for clients needing immediate or specialized assistance.

Most leading brokers offer various customer support methods such as live chat, email, telephone lines, and, often, a comprehensive FAQ section. These varied channels allow for immediate assistance and serve different user preferences and needs. Live chat, for instance, is perfect for resolving quick queries, while email or phone support can be beneficial for more complex issues. An FAQ section can answer common questions immediately, enhancing the user’s self-service capabilities.

As it stands, GMI Markets’ offering of only a contact form may prove insufficient in providing the level of customer service that today’s traders require and expect. The implementation of diverse, readily accessible support channels would be a significant enhancement to their overall service.

| GMI Markets Customer Support | Overview |

| Supported Languages | English* |

| Customer Service By | GMI Markets |

| Customer Service Hours | Unknown |

| Email Response Time | Unknown |

| Telephonic Support | No |

| Personal Account Manager | Yes |

- Supported Languages: English*

- Customer Service Channels: Contact Form

- Customer Service Hours: Unknown

Prohibited Countries: Where Can I Not Trade with this Broker?

So, why is it that brokers can only operate in specific regions? It comes down to regulatory permissions and legalities. Each country or region has its own set of financial regulations designed to protect consumers and maintain the integrity of their financial systems. Before a broker can legally offer its services in a particular jurisdiction, it needs to meet the requirements set out by the local financial regulatory body.

In the case of GMI Markets, their website’s lack of clear information about where they are permitted to operate is a point of concern. This kind of information should be readily available to potential clients for clarity and trust-building. It is important for traders to confirm a broker’s operational jurisdictions before starting to trade to ensure they are making a safe and informed choice.

- USA

Special Offers for Customers

In the bustling world of online trading, brokers often provide special offers, cash advance and promotions as an incentive to attract new clients and keep existing ones engaged.

The above is one GMI offer among others. To find out more, visit this link.

The GMI Markets’ 30% Welcome Bonus promotion is designed for new and existing clients placing their first-time deposit into their Live trading account. Following the terms and conditions, the company will deposit a 30% credit into the client’s trading account. This promotion began on 22nd June 2022 and is scheduled to end on 31st August 2022.

However, while this GMI offer is a benefit, it carries several restrictions with some risks involved. For example, a minimum deposit of $25 or its equivalent is required within the promotional period to qualify for the offer. Any subsequent deposits made beyond the initial one will not qualify for the promotion. The maximum credit obtainable via this offer is limited to $500 or its equivalent.

Potential clients need to understand the significance of these special offers and promotions. They can offer a kick-start to a trading journey, particularly for novice traders with a smaller initial deposit. That being said, this GMI offer of a 30% bonus may not seem like a substantial offer, especially when compared to what other reputable online brokers may offer.

The absence of this information from GMI Markets’ main website can potentially raise eyebrows. Transparency in promotional offers is crucial as it helps traders make informed decisions. When the information isn’t easily accessible, potential clients may question the broker’s transparency and reliability. Hence, for GMI Markets to improve user experience and trust, it would be beneficial to have all relevant promotional information readily accessible on their website.

- 30% Welcome Bonus

GMI Markets Review Conclusion

Upon analysis of GMI Markets, several concerns suggest that the broker may not be as reliable or safe as some of its competitors.

PIPPENGUIN

After thorough analysis of this broker, in this GMI review, we highlight several concerns suggesting that the broker may not be as reliable or safe as some of its competitors. This conclusion is drawn considering a multitude of factors, including the lack of transparent information on their website regarding crucial aspects such as negative balance protection, deposit and withdrawal methods, and region-specific operation policies. The absence of trading educational resources and customer support methods, except for a contact form, could also make potential traders hesitant.

Summary and Key Takeaways

GMI Markets is a forex broker offering various account types – ECN, Cent, and Standard. The Electronic Communication Network account is suitable for short-term, active traders, offering liquidity and pricing through an extensive network of institutions. The Cent account is beginner-friendly, offering low-risk trading in cents, while the Standard account provides tight spreads and high leverage with zero commissions. Their special 30% Welcome Bonus is a promotional offer, but compared to other online brokers, it’s not very competitive and lacks visibility on their site.

GMI Markets (operated by Global Market Index Limited) provides an underwhelming selection of trading platforms without any explicit details on key features like one-click trading, charting packages, or news feeds. In terms of deposit methods, GMI Markets only supports local bank or wire transfers, Neteller, and Skrill, with no clear statement on withdrawal methods. Lack of transparency and information on significant aspects like these can raise questions about the broker’s credibility and reliability.

- GMI Markets offers three types of accounts: ECN, Cent, and Standard

- There's a 30% Welcome Bonus for first-time deposits, but the details aren't readily available on the site

- Limited trading platform features and deposit methods

- No clear information on withdrawal methods or negative balance protection

- The broker lacks educational resources and extensive customer support methods

FAQs

Is GMI Market legit?

What is the minimum deposit for GMI Market?

What is the highest leverage in GMI?

What is the withdrawal rate for GMI?

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.1 review for GMI Markets Review 2025: Is GMI A Scam or Legit Broker?

Add a review Cancel reply

- GMI Markets Overviews

- Pros and Cons

- Is GMI Markets Safe? Broker Regulations

- What Can I Trade with GMI Markets?

- How to Trade with GMI Markets?

- How Can I Open GMI Markets Account? A Simple Tutorial

- GMI Markets Charts and Analysis

- GMI Markets Account Types

- Do I Have Negative Balance Protection with This Broker?

- GMI Markets Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- GMI Markets Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

Ava –

Tried to talk to them about a problem, but they don’t respond. It’s like they don’t care about helping customers. Thinking of switching.