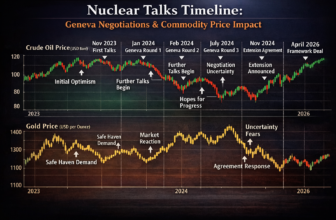

Oil prices slipped at the market open on Tuesday but held close to four-month highs. This trend comes as Chinese and Indian buyers seek alternative suppliers following the Biden administration’s imposition of severe oil sanctions on Russian oil.

Current Oil Prices and Market Dynamics

Following recent sanctions, Brent crude oil futures fell slightly by 22 cents, making it $80.79 per barrel, while U.S. WTI crude eased to $78.66 per barrel. Despite these minor decreases, oil prices experienced a 2% climb on Monday due to the disruption caused by the U.S. Treasury’s sanctions. The sanctions encompass two major Russian oil companies, Gazprom Neft and Surgutneftegas, alongside over 183 oil vessels involved in the so-called “shadow fleet”.

Sanctions and Their Impact on the Oil Market

The U.S. aims to pressure the Russian economy by impeding its oil market through these economic sanctions. According to U.S. officials, this strategy can potentially drain Russia’s revenue by billions monthly by restricting up to 700,000 barrels per day from entering the market. The sanctions’ effectiveness hinges on enforcement, and some analysts believe the market might adapt to circumvent these obstacles eventually.

Global Oil Market Adjustments

In response to these comprehensive sanctions, analysts from various institutions, including ING, have highlighted potential supply disruptions. They predict that while up to 800,000 bpd of Russian crude could be affected, the real impact may softly transition as market players find ways around the restrictions. The broader global oil supply chain must also manage the aftermath of these regulatory changes.

Oil Sanctions and Global Repercussions

The new international oil sanctions are a direct reaction to geopolitical tensions and target the Russian energy sector, hoping to reduce its ability to maneuver in global markets. Notably, these actions could ripple through the U.S. inflation rate, potentially adding pressure to gasoline prices nationwide as crude oil prices adjust.

Market Analyst Predictions and Expert Opinions

Market experts like Robert Rennie, a head strategist at Westpac, suggest that the continued sanctions coupled with OPEC+ production cuts could propel Brent crude prices to levels nearing $85 per barrel. Such adjustments might cause oil consumption patterns to shift significantly, directly impacting global oil prices and resulting in an intricate balance between supply and demand.

Future Outlook: Oil Supply and Economic Strategy

Amid these changes, the oil market remains intensely focused on the U.S. inflation forecast and the Federal Reserve inflation policy. While the current inflation in the U.S. is being monitored for its broader economic ripple effects, the oil price volatility due to sanctions creates a multifaceted strategic challenge, linking it back to underlying monetary policy and global market strategies.

Anticipated Trends in the Oil Market

As oil traders and economists observe the situation, the long-term implications on the petroleum industry will become evident in areas such as oil reserves management and energy market stabilization. The potential for oil price fluctuations and the global response through further sanctions or diplomatic negotiations will further define the future landscape.

Conclusion

In conclusion, the geopolitical oil tensions resulting from these rigorous sanctions against Russian oil exports showcase a period of transition for the global oil market. As new alliances and trade routes form in response to these economic pressures, monitoring how this trend impacts both consumer price index and broader economic indicators becomes crucial. The oil market’s direction continues to evolve as it manages current challenges, striving to adapt and stabilize in this volatile era.