Current Gold Price Insights

Gold prices saw an increase in the domestic futures market on January 15, driven largely by a minor dip in the US dollar’s strength. Market participants are eagerly awaiting the current US inflation data as a significant economic indicator. At around 9:50 AM, the MCX Gold for February 5 expiry was trading 0.27 percent higher, priced at ₹78,367 per 10 grams.

Investor Caution in International Markets

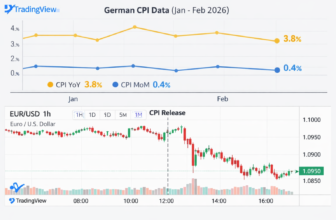

On the international stage, investor sentiment appeared cautious ahead of the US consumer price index (CPI) numbers, a key marker of the US inflation rate. The SPDR Gold Trust, the largest gold-backed exchange-traded fund, reported a decrease in its holdings by 0.23 percent to 872.52 tonnes, reflecting a subtle, short-term shift in investor positioning.

Impact of US Economic Indicators on Gold Prices

The release of stronger-than-expected US jobs data last Friday has added another layer of complexity to the economic landscape. The forthcoming US CPI data is poised to play a critical role in steering the US inflation forecast and determining the Federal Reserve’s approach to interest rates. A Reuters poll suggests that the consumer price index might have risen by 2.9 percent in year-on-year analysis for December, up from 2.7 percent in November.

Effects on the Indian Rupee and Gold Imports

In parallel, the Indian rupee opened at 86.49 per dollar, slightly recovering from a previous 86.53, following an all-time low of 86.73. The rupee’s fluctuation is particularly crucial for Indian gold pricing because India stands as one of the largest gold importers worldwide. The dynamics between the gold price per gram and the currency’s value can significantly affect local market rates.

Expert Analysis and Gold Price Forecast

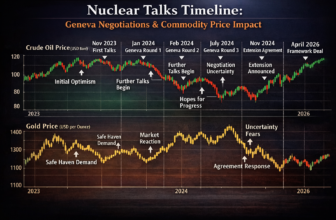

As anticipation builds surrounding the economic policies of the incoming government, led by President Donald Trump, the potential influences on inflation through trade and tax strategies remain under scrutiny. Financial experts have shared key support and resistance levels for both gold and silver, predicting some degree of market volatility ahead of the US inflation data announcement.

Gold Market News and Movements

To stay abreast of shifts in the gold market news, investors are advised to monitor the intricate balance of global economic indicators and geopolitical developments. The gold price chart and latest gold news serve as invaluable tools for those navigating these fluctuating markets.

Quick Insights

- The recent rise in gold prices reflects a strategic position amid economic uncertainty.

- US CPI data release is anticipated to influence both gold and currency markets significantly.

- Gold-backed ETFs show a reactively subdued investor sentiment.