Asian stock markets are a sea of green on Thursday, responding positively to new developments in the US inflation landscape. Following the latest US CPI data which showed a slowdown in the core US inflation rate, concerns over the Federal Reserve’s interest rate trajectory have eased. As a result, Asian stock market indices are experiencing an uptrend.

Market Highlights

The currencies in Asian financial markets strengthened against the US dollar, buoyed by optimism in global economic updates. On Wednesday, the Asian market indices closed mostly lower, but Thursday brought a turnaround with markets showing significant resilience.

Australian Market Analysis

In Australia, the benchmark S&P/ASX 200 Index surged, influenced by the positive cues from Wall Street and softened inflation concerns. Moving above the 8,300 level, the gains were primarily led by technology and financial stocks. Notably, stock market news from Australia highlighted a 1.29% gain, reversing previous session losses.

Major miners like BHP Group and Fortescue Metals witnessed modest gains, while oil stocks showed varied movements amidst fluctuations in crude oil prices. Meanwhile, the tech sector experienced strong performances, with Afterpay owner Block and others gaining over 3%.

Japanese Market Trends

Japan’s market ended a five-session losing streak. The Nikkei 225 climbed above the 38,500 level, supported by gains across technology stocks and heavyweights like SoftBank Group. Meanwhile, in tech, Advantest saw more than a 2% rise, reflecting a collective market uplift.

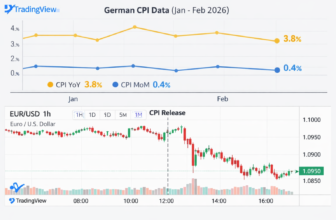

Impact of US Economic Indicators

Globally, market movements have closely mirrored key economic indicators from the US, such as the US consumer price index and employment statistics. The recent deceleration in inflation eased earlier concerns, reflected in the positive stock market forecast.

Federal Reserve and FOMC Updates

The upcoming FOMC meeting schedule and their minutes will be pivotal for providing clarity on future monetary policies. Investors are keenly observing these developments, as the FOMC statement will likely address potential changes in the FOMC interest rate.

US Employment and Market Movements

Employment data also played a significant role in influencing investor sentiment. The US unemployment rate along with robust nonfarm payroll growth influenced the optimism in global markets. As investors digest these reports, the current employment rates present a more positive landscape influencing market dynamics.

These economic indicators are critical to shaping expectations surrounding monetary policies and further actions by the Federal Reserve, especially after the recent Federal Reserve meeting outcomes.

Global Stock Market Reactions

On Wall Street, the reactions were robust as indices like the Nasdaq and Dow saw substantial gains following the stock updates. This momentum has spurred optimism in currency trading markets, affecting the foreign exchange market as well.

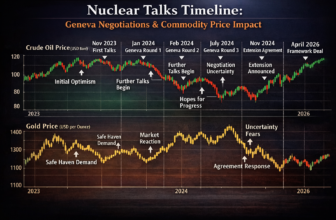

Commodity and Currency Market Analysis

Crude oil prices spiked on Wednesday, supported by reduced US inventories and potential supply disruptions due to geopolitical tensions. Factors in the Forex market have seen varied reactions, particularly as the dollar oscillates in response to diverse economic cues.

Conclusion

As global markets absorb the latest on US inflation rates and employment figures, investors remain cautiously optimistic. The next few sessions could likely redefine market trends, heavily influenced by both local and international economic policies as the FOMC interest rate adjustments and BOJ policies play out.