US President Donald Trump continues to strongly defend his tariff policies, describing them as necessary “medicine” despite causing notable turbulence on global stock markets. Major indices, including the Dow Jones Industrial Average, face significant sell-offs amid investor concern.

Trump’s Justification for Tariffs

Speaking aboard Air Force One, Trump explained, “I don’t want anything to go down but sometimes you have to take medicine to fix something.” He criticized past US administrations for allowing other nations to take advantage, remarking, “They took our businesses, they took our money, they took our jobs.”

Trump remains determined about “reciprocal tariffs,” clarifying his stance with foreign counterparts as he aims for balanced trade relationships. He asserted that countries trading with America should expect zero deficits. Ideally, he seeks either equal or surplus trade scenarios.

Global Market Reaction

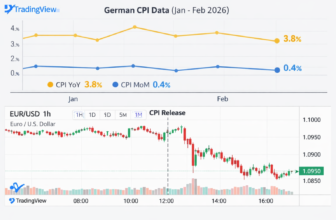

Fear of an escalating trade conflict has rattled international markets, driving down key indices substantially. Hong Kong’s Hang Seng Index plummeted 13%, marking its steepest decline in almost three decades. Taiwan’s TAIEX fell 9.7%, while Japan’s Nikkei 225 dropped 7.83%. Losses spread to Singapore’s Straits Times and South Korea’s KOSPI indexes.

The downturn echoed in Europe’s major exchanges, too, with London’s FTSE 100 and Frankfurt’s DAX losing roughly 5% and 7%, respectively. US stock market futures pointed downward, continuing last week’s staggering $6 trillion market capitalization decline.

Impact on US Stock Markets

US indices indicate further declines ahead. Futures tied to the S&P 500 traded off 2.7%, and the Nasdaq composite futures dropped 3.55%. The Dow Jones Industrial Average looks set to open even lower, reinforcing bearish sentiment evident in the stock market today.

Tariff Details and International Response

President Trump’s administration imposes a basic tariff of 10% on imported items. But tariffs escalate significantly—up to 50%—for selected nations such as China, the European Union, South Korea, and Japan. In retaliation, China responded strongly, enforcing a 34% tariff on US goods and placing export limits on critical minerals. The EU is preparing countermeasures in return.

Still, Trump voiced openness to negotiations with China, provided adjustments to their large surplus against the US occur. China’s Vice Commerce Minister Ling Ji insists their actions aim to realign American policy with the multilateral trading system.

Possible Economic Implications in 2025

Amid current market volatility and uncertainty, prominent institutions offered cautious forecasts for 2025. According to Goldman Sachs, the S&P 500’s volatility index (VIX) will likely average around 18 in 2025, signifying somewhat improved stability compared to recent choppy sessions.

The International Monetary Fund (IMF) forecasts global GDP growth at approximately 3.2% for 2025, signaling modest economic recovery. Specifically, the US economy is projected to grow by 2.3%, reflecting careful adjustments in trade policy and economic strategy.

Despite ongoing tariff tensions, new trade agreements may soon ease conditions. The US Trade Representative anticipates finalized trade pacts with Japan and the EU by mid-2025, aiming to reduce barriers and enhance bilateral economic cooperation significantly.

Potential Recession Risks

The sustained trade battle has prompted renewed recession fears among financial analysts. JPMorgan assigns a 60% risk of recession in the US economy stemming from protracted trade disputes, whereas S&P Global estimates chances between 30%-35%.

Bruce Kasman from JPMorgan noted such tariff-driven tensions could derail America’s current economic momentum. Former Treasury Secretary Lawrence Summers criticized the tariffs, labeling the policies at least as harmful economically as many post-war decisions. But the Trump administration downplayed recessionary fears, pointing toward solid fundamentals underpinning the broader US economy.

Global Leadership Responses

Israeli Prime Minister Benjamin Netanyahu plans to discuss the implications of recent tariff actions directly with President Trump, alongside other regional geopolitics. US allies, including Australia and the UK, have thus far avoided immediate retaliatory responses, signaling caution and a desire for diplomatic resolution.

Conclusion

As fears persist regarding tariff-driven instability in the stock market, global indices like the Dow Jones Industrial Average continue to mirror investor unease. With cautious optimism for fresh trade pacts in 2025, short-term volatility remains a concrete reality for international finance markets immersed in these trade tensions.