Crypto Exchange Volumes Reach New Heights in November

In an unprecedented turn of events, the crypto market saw exchange volumes soar to a three-year high this past November. This surge has been largely attributed to the election of Donald Trump as President of the United States, which has invigorated hopes for a friendlier regulatory landscape for digital currencies.

Record-Breaking Volumes and Investor Optimism

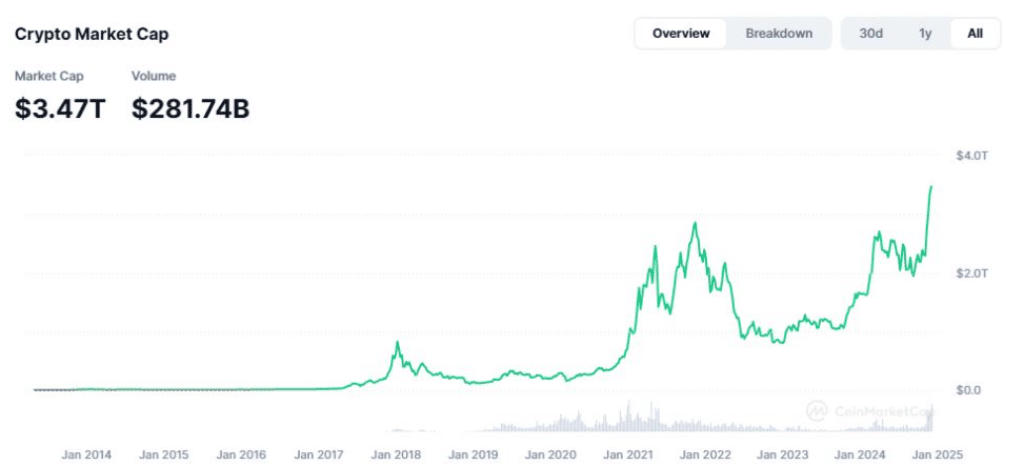

Data from crypto market analysts New Hedge revealed that spot trading volumes reached an astonishing $2.9 trillion in November, marking a peak not seen since May 2021. This boom is indicative of the mounting optimism among investors and traders who foresee potential policy shifts under the Trump administration that could benefit digital assets and exchanges.

Crypto.com, a major player in the field, reported its strongest trading month in over a year, achieving record-breaking volume levels. A representative from the platform shared insights on the general trend, stating, “The increased interest in cryptocurrencies is reflected in the unprecedented trading activities we’re witnessing globally. We expect this optimistic market vibe to carry into the early months of next year.”

A Global Pulse: The Impact of Regulatory Clarity

The anticipation of favorable regulations has not only influenced the United States but has also resonated with investors worldwide. Many nations are either in the process of establishing or have already committed to regulatory frameworks that support the growth of digital asset markets. This clarity is instrumental in fostering global adoption and contributing to the increased trading volumes observed.

Perpetual Contracts Lead the Charge

Jonathon Miller, Kraken’s managing director for Australia, noted that perpetual contracts have been a significant driver of the month’s trading activities. Miller highlighted the substantial trading volume in Bitcoin (BTC) perpetuals and pointed out the rising interest in Solana (SOL) and Dogecoin (DOGE) contracts, both of which reached new monthly highs.

He explained, “”We’ve seen a pronounced uptick in perpetual contract volumes as traders seek leverage opportunities or risk hedging amid the post-election market’s positive run. Bitcoin remains the primary focus, but the activity surrounding Dogecoin and Solana perpetuates indicates a broader engagement with diverse assets, particularly in the volatile memecoin sector.””

Institutional Investment: Bitcoin ETFs as a Catalyst

Beyond regulatory expectations, the introduction of Bitcoin exchange-traded funds (ETFs) has significantly contributed to the vigorous trading environment. A Binance spokesperson highlighted the influx of institutional participation facilitated by the availability of Bitcoin ETFs in major markets, which amassed over $6.87 billion in inflows through November, despite some outflows recorded.

“”Bitcoin ETFs have simplified access for institutional investors seeking exposure and risk mitigation, adding more fuel to the recent bull market,”” according to Binance’s insights. They further noted that these developments could strengthen Bitcoin’s integration into conventional financial markets.

Macroeconomic Shifts Supporting the Crypto Surge

Concurrently, ongoing macroeconomic trends have played a crucial role in the crypto market’s upward momentum. Notably, the decision by the US Federal Reserve to reduce interest rates has boosted global liquidity, prompting a greater allocation of capital into scarce and inflation-resistant assets like Bitcoin and other cryptocurrencies.

The anticipated Trump administration’s crypto-friendly stance has provided an additional layer of optimism. Discussions around potential regulatory adjustments and the proposed establishment of a US Strategic Bitcoin Reserve have further buoyed investor confidence, reinforcing the sense that the United States could emerge as a global hub for cryptocurrency innovation and investment.

As we move forward, the crypto landscape appears poised to benefit from this wave of favorable political, economic, and financial conditions that promise to reshape the ecosystem for the better in the coming years.