NAGA Review: Does This Broker Really Provide 4,000+ Assets?

Naga Overviews

NAGA is a multi-asset trading platform launched in 2015 that combines CFD trading with social investing features. Operated by the publicly listed NAGA Group AG, the platform offers access to over 4,000 instruments and allows users to copy experienced traders through its AutoCopy system.

NAGA is a multi-asset trading platform launched in 2015 as part of The NAGA Group AG, a German fintech company publicly listed on the Frankfurt Stock Exchange. The platform was designed to combine traditional online trading with social networking features, allowing users to interact, share strategies, and replicate the trades of other investors. This combination of trading and community functionality has positioned NAGA as a hybrid solution for traders who want both market access and collaborative learning.

It is headquartered at the group level in Germany and it operates through regulated entities in Cyprus and Seychelles, serving clients across multiple regions. The platform provides access to more than 4,000 tradable instruments, including forex, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds, all primarily offered through CFDs. The wide asset range allows traders to diversify portfolios within a single account.

Social trading ecosystem is one of the most finest features that NAGA trading or NAGA broker has. The replication of the strategies of some of the most experienced traders, that too in real time, is possible with the help of the auto-copy function, which is available to the users on this platform. This is one of the features that is very attractive for beginner traders, as they prefer a passive trading approach. The platform, in general, also includes a feed that gives information regarding socials, and traders have a place to share their insights, as well as receive performance updates and work on market commentary.

The platform has received industry recognition, including the “Best Social Trading Platform Europe 2025” award. Additionally, NAGA maintains a partnership with Borussia Dortmund, reflecting its efforts to strengthen brand visibility and credibility.

With a global community exceeding 2 million users and a strong emphasis on accessibility, education, and social interaction, NAGA aims to appeal to a broad audience. However, as a CFD-focused provider offering leveraged products, it is best suited for traders who understand the risks associated with derivatives. Overall, NAGA presents itself as a modern trading ecosystem that blends multi-asset market access, advanced analytics, and community-driven trading into a single platform.

Pros and Cons

- Access to 4,000+ instruments across forex, stocks, indices, commodities, ETFs, and cryptocurrencies

- Unique social trading and AutoCopy functionality for copying experienced traders

- Operated by The NAGA Group AG, a company listed on the Frankfurt Stock Exchange

- Integrated TradingView charts and Trading Central analysis for advanced market insights

- Available on web platform and mobile app for trading on the go

- Negative balance protection for retail clients

- Client funds kept in segregated accounts with regulated entities

- Strong global presence with 2+ million registered users

- Most products are CFDs, which carry high leverage and risk of losses

- Copy trading results depend on other traders’ performance, which is not guaranteed

- Services are not available in several restricted jurisdictions

- Fee structure and spreads vary by account tier, which may be confusing for beginners

- Social trading features may encourage frequent or impulsive trading

- Some advanced features and tools may feel complex for first-time traders

Is Naga Safe? Broker Regulations

NAGA operates through multiple regulated entities and incorporates several security measures designed to protect client funds and personal information. The platform is part of The NAGA Group AG, a German fintech company publicly listed on the Frankfurt Stock Exchange, which adds a layer of corporate transparency and financial reporting obligations.

The European arm of the company, NAGA Markets Europe Ltd, is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 204/13. This regulation requires the firm to comply with strict EU financial standards, including capital adequacy requirements, investor protection rules, and operational transparency.

For international clients outside the European Economic Area, services are provided by NAGA Capital Ltd, which is authorised and regulated by the Financial Services Authority (FSA) of Seychelles under license number SD026. While offshore regulation typically involves different oversight standards compared to EU regulators, it allows NAGA to offer broader global access and more flexible trading conditions.

From a client protection perspective, NAGA states that customer funds are held in segregated bank accounts, separate from company operating funds. This reduces the risk of misuse and ensures that client money remains protected in the event of financial difficulties.

The platform also provides negative balance protection, meaning traders cannot lose more than the amount deposited in their accounts. This is an important safeguard when trading leveraged CFD products, where market volatility can otherwise result in losses exceeding account equity.

In addition, NAGA implements industry-standard data security protocols and risk management tools such as Stop Loss and Take Profit orders to help users manage exposure. The company also issues clear risk warnings, noting that leveraged derivatives carry a high risk of rapid capital loss.

Overall, NAGA offers a reasonable level of safety through regulatory oversight, fund segregation, and risk controls, though traders should always consider the inherent risks associated with leveraged CFD trading.

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) of Seychelles

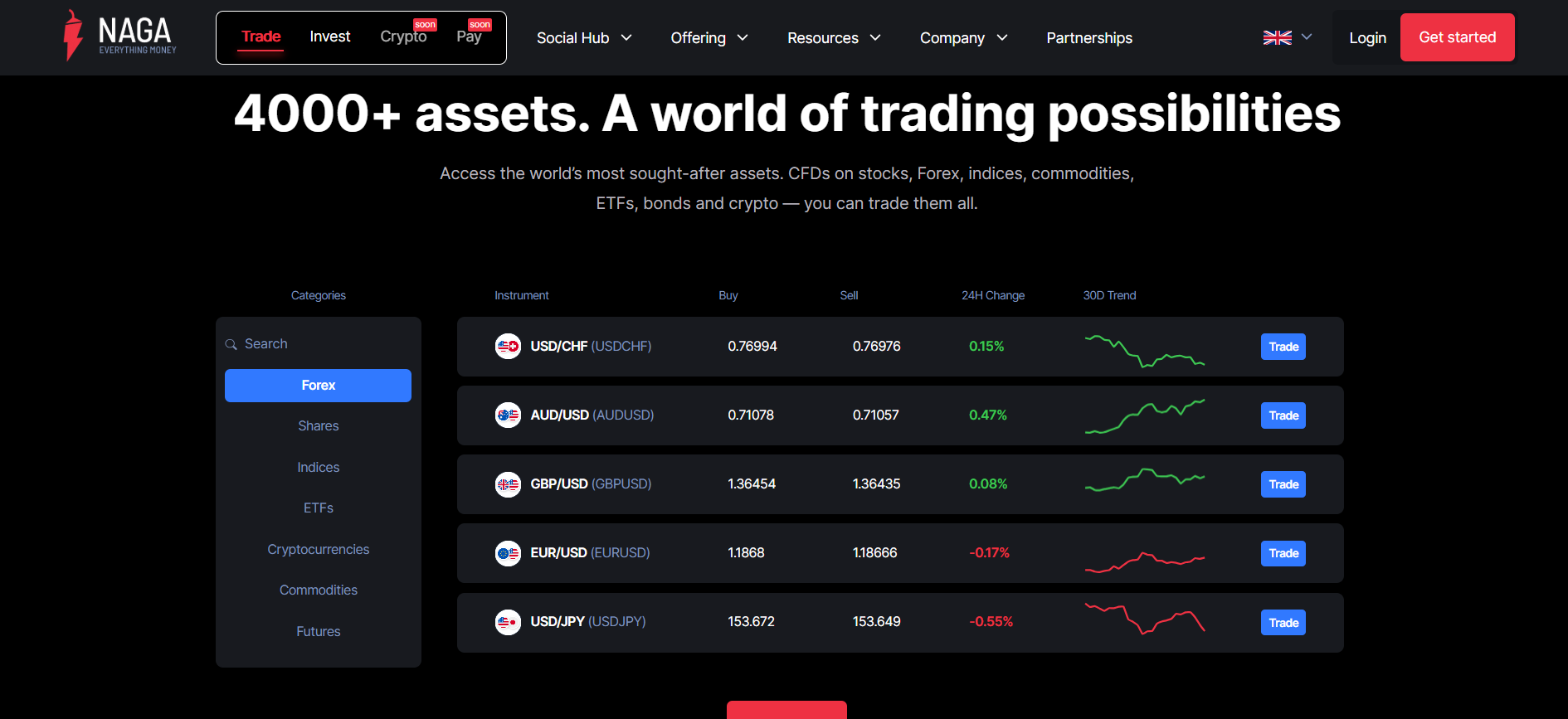

What Can I Trade with Naga?

NAGA provides access to a broad range of financial markets, offering more than 4,000 instruments across multiple asset classes. The platform is designed as a multi-asset environment where traders can diversify their portfolios and manage different market exposures from a single account. Most instruments are available through Contracts for Difference (CFDs), allowing traders to speculate on price movements without owning the underlying asset.

Forex

The foreign exchange market is one of the core offerings on NAGA. Traders can access a wide selection of major, minor, and exotic currency pairs, with leveraged trading options and tight spreads depending on the account type. This makes the platform suitable for both short-term traders and those focusing on macroeconomic trends.

Stocks

NAGA offers CFDs on global shares from major exchanges, including companies listed in the United States, Europe, and other international markets. In some regions, users may also have the option to trade real stocks without leverage, providing flexibility for longer-term investors.

Indices

Major global indices such as the S&P 500, NASDAQ, DAX, and FTSE are available for trading. These instruments allow traders to speculate on overall market performance rather than individual companies.

Commodities

The platform includes popular commodities such as gold, silver, oil, and natural gas, enabling traders to hedge against inflation or diversify beyond traditional financial markets.

Cryptocurrencies

NAGA offers CFDs on leading digital assets, including Bitcoin, Ethereum, and other major cryptocurrencies, allowing traders to benefit from crypto price movements without using a separate exchange or wallet.

ETFs and Bonds

In addition to traditional markets, NAGA provides access to Exchange-Traded Funds (ETFs) and government bond CFDs, expanding the range of portfolio strategies available.

A standout feature is the integration of social trading, which allows users to discover and automatically copy traders who specialize in specific asset classes. This makes NAGA particularly appealing to beginners looking to gain exposure to different markets while learning from more experienced participants.

How to Trade with Naga?

It is supposed to be a very straightforward process when it comes to trading with NAGA Broker. It is said to be so because it combines a user-friendly interface, which has some of the most advanced tools and is absolutely suitable for both traders who are beginners as well as experienced ones. The platform is also very simple and accessible to all the users via their web browsers as well as their mobile applications. This particular feature allows the users to monitor the markets directly and provides the ease of executing trades from anywhere in the world virtually.

Step 1: Log in to the Platform

After opening and verifying an account, traders can log in to the NAGA Web Trader or mobile app using their registered credentials. The dashboard provides an overview of account balance, open positions, watchlists, and market news.

Step 2: Explore Markets

From the main interface, users can browse available instruments across categories such as forex, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds. A search function helps locate specific assets quickly, while watchlists allow traders to track preferred markets.

Step 3: Analyze the Market

NAGA integrates TradingView charts and technical analysis tools, enabling traders to study price movements before entering a position. Users can apply indicators, draw trend lines, switch timeframes, and review Trading Central insights to support decision-making.

Step 4: Choose Trade Size and Parameters

Once an asset is selected, traders can open the order window and define the trade volume, leverage (where applicable), and risk controls. NAGA allows the use of Stop Loss and Take Profit levels to manage potential losses and lock in profits automatically.

Step 5: Place the Trade

After confirming the order details, the trade can be executed instantly at market price or set as a pending order to trigger at a specific level. Open positions are displayed in real time, showing profit/loss and margin usage.

Step 6: Monitor and Manage Positions

Traders can modify Stop Loss or Take Profit levels, partially close positions, or exit trades at any time. Real-time pricing and account metrics help users stay informed about market exposure.

Step 7: Use Social Trading (Optional)

One of NAGA’s key features is AutoCopy, which allows users to automatically replicate the trades of other investors. Traders can review performance statistics, risk scores, and historical results before selecting someone to copy.

Step 8: Review Performance

The platform provides account history, analytics, and performance tracking tools, helping traders evaluate strategies and improve over time.

How Can I Open Naga Account? A Simple Tutorial

Opening an account with NAGA is a structured process designed to comply with international financial regulations while keeping the experience user-friendly. The registration and verification steps can typically be completed online within a short time, allowing traders to begin accessing the platform quickly once approved.

Step 1: Visit the Official Website

Start by going to the official NAGA website and clicking the “Sign Up” or “Open Account” button. You will be asked to enter basic details such as your name, email address, phone number, and a secure password. Alternatively, registration may be available through social login options in certain regions.

Step 2: Complete Your Profile

After initial registration, NAGA requires additional personal information to comply with regulatory standards. This includes your date of birth, residential address, and financial background. You may also need to answer questions about your trading experience, income level, and risk tolerance. This information helps the platform assess suitability for leveraged products.

Step 3: Verify Your Identity (KYC Process)

Like all regulated financial platforms, NAGA follows Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. You will need to upload:

A valid government-issued ID (passport, national ID, or driver’s license)

Proof of residence (utility bill or bank statement issued within the last few months)

Verification is usually completed within a few hours to one business day, depending on document clarity and regional requirements.

Step 4: Choose Your Account Type

Once your profile is verified, you can select the appropriate account tier based on your planned deposit and trading needs. Different tiers may offer varying spreads, features, and service levels.

Step 5: Fund Your Account

Before trading, you need to deposit funds using one of the available payment methods. Options typically include:

Credit/debit cards

Bank transfers

E-wallets (availability varies by region)

Minimum deposit requirements depend on the account level and jurisdiction. Funds are credited once the transaction is processed, allowing immediate access to the trading platform in most cases.

Step 6: Access the Platform

After funding, you can log in to the NAGA Web Trader or mobile app and begin exploring the available markets. New users may choose to start with smaller trade sizes or explore the social trading features before committing larger capital.

Step 7: Optional – Enable Social Trading

If you prefer a guided approach, you can activate AutoCopy to follow experienced traders. Performance statistics and risk levels are displayed to help you choose suitable profiles.

Step 8: Stay Compliant and Secure

NAGA may request additional documents or account updates if regulatory requirements change. Users should also enable security features such as strong passwords and account monitoring.

Naga Charts and Analysis

NAGA provides a comprehensive set of charting and analytical tools designed to support traders across different experience levels and trading styles. The platform integrates TradingView technology, one of the most widely used charting solutions in the industry, offering advanced visual analysis and a smooth user experience.

Advanced Charting Capabilities

Traders can access interactive charts with multiple timeframes, ranging from one minute to monthly views. This flexibility makes the platform suitable for scalpers, day traders, swing traders, and long-term investors. Users can switch between different chart types, including candlestick, line, and bar charts, depending on their preferred analysis method.

Technical Indicators and Drawing Tools

NAGA supports a wide range of technical indicators such as Moving Averages, RSI, MACD, Bollinger Bands, and Fibonacci tools. These indicators help traders identify trends, momentum, and potential entry or exit points. Drawing tools allow users to mark support and resistance levels, trend lines, and chart patterns for more precise analysis.

Trading Central Integration

In addition to self-directed analysis, NAGA offers Trading Central insights, providing market research, technical signals, and trade ideas. These professional analytics can be particularly useful for traders who want additional confirmation before placing positions.

Real-Time Market Data

The platform delivers real-time price feeds and market updates, ensuring traders have access to current information when making decisions. Economic calendar features and market sentiment tools further enhance situational awareness.

Social Insight and Performance Tracking

A unique aspect of NAGA’s analytical environment is its social component. Traders can review performance statistics, risk scores, and historical results of other users. This transparency supports informed decision-making when using the AutoCopy feature.

Naga Account Types

| Account Type | Minimum Deposit* | Key Features | Spreads & Costs | Additional Benefits | Suitable For |

|---|---|---|---|---|---|

| Iron | From $10–$250 (region dependent) | Basic access to all markets, Web & Mobile platform, Social Trading, AutoCopy | Standard spreads, standard fees | Entry-level access, educational resources | Beginners and casual traders |

| Bronze | Higher deposit than Iron | Full market access, Social Trading, basic Trading Central insights | Slightly improved spreads vs. Iron | Priority customer support, enhanced platform tools | Traders with moderate activity |

| Silver | Mid-tier deposit level | Access to advanced tools, improved trading conditions | Reduced spreads and lower trading costs | Dedicated account manager (region dependent) | Active retail traders |

| Gold | Higher-tier account | Enhanced Trading Central analytics, priority execution | Tighter spreads and reduced commissions | Premium support, faster withdrawals | Frequent traders seeking better pricing |

| Diamond | High deposit requirement | Premium trading conditions across all assets | Very tight spreads and lower fees | Personal account manager, exclusive market insights | High-volume traders |

| Crystal | VIP-level funding | Institutional-style conditions, full feature access | Lowest spreads available within retail tiers | Priority withdrawals, exclusive events and services | Professional and high-net-worth traders |

*Minimum deposit requirements and benefits may vary by region and regulatory entity.

NAGA structures its account tiers primarily around deposit levels and trading activity. As traders move up the tiers, they typically receive improved trading conditions such as tighter spreads, enhanced analytical tools, and higher service priority. All account types provide access to the core platform features, including multi-asset trading, social trading, and the AutoCopy function.

The tiered system is designed to accommodate different experience levels and capital sizes, from beginners starting with smaller deposits to high-volume traders seeking premium conditions and personalized support. However, traders should carefully review the exact benefits and cost differences for their jurisdiction, as conditions may vary depending on regulatory requirements and regional availability.

Do I Have Negative Balance Protection with This Broker?

Yes, NAGA provides negative balance protection for retail clients, an important risk-management feature designed to prevent traders from losing more money than they have deposited in their trading accounts. This protection is particularly relevant when trading leveraged products such as CFDs, where market volatility and leverage can amplify both gains and losses.

Negative balance protection works by automatically resetting a client’s account balance to zero if losses exceed the available equity. In extreme market conditions—such as sudden price gaps, high volatility, or rapid market movements—traders may experience losses that would otherwise push the account into a negative balance. With this safeguard in place, NAGA absorbs the deficit instead of requiring the client to repay the additional amount.

In addition to negative balance protection, NAGA offers several built-in tools to help traders manage risk more effectively. Users can set Stop Loss and Take Profit orders to automatically close positions at predefined levels. The platform also provides real-time margin monitoring, helping traders track their available equity and avoid margin calls.

Overall, NAGA’s negative balance protection adds a meaningful layer of security for retail traders, particularly those using leverage or participating in social trading through AutoCopy. While it cannot prevent losses, it ensures that risk remains limited to the funds deposited, helping traders manage exposure more responsibly.

Naga Deposits and Withdrawals

NAGA offers a range of deposit and withdrawal options designed to make account funding and cash management convenient for traders across different regions. The platform supports multiple payment methods, although availability may vary depending on the client’s country of residence and the regulatory entity under which the account is opened.

Deposit Methods

Clients can fund their NAGA accounts using several commonly used payment channels, including:

Credit and debit cards (Visa, Mastercard)

Bank wire transfers

E-wallets, such as Skrill and Neteller (availability depends on region)

Local payment methods in selected countries

Card and e-wallet deposits are typically processed instantly or within a few minutes, allowing traders to begin trading almost immediately. Bank transfers may take 1–3 business days, depending on the sending institution and international processing times.

The minimum deposit requirement depends on the account tier and jurisdiction, but entry-level accounts generally start from a relatively low amount, making the platform accessible to new traders.

Withdrawal Process

Withdrawals are processed through the same method used for deposits whenever possible, in line with Anti-Money Laundering (AML) regulations. Clients can submit withdrawal requests directly from their account dashboard.

Processing times typically include:

Internal processing: 24–48 business hours

Card or e-wallet receipt: 1–5 business days

Bank transfer receipt: 3–7 business days, depending on the bank and country

Fees and Considerations

NAGA may charge withdrawal fees, and certain payment providers may apply their own transaction costs. Currency conversion fees may also apply if the account currency differs from the payment method.

To ensure smooth transactions, users must complete full account verification (KYC) before requesting withdrawals. In some cases, additional documentation may be required for security or compliance purposes.

Support Service for Customer

NAGA provides a multi-channel customer support system designed to assist traders with technical issues, account management, and general trading inquiries. The platform aims to offer accessible and responsive assistance to its global user base, although the level of service may vary depending on the client’s account tier and region.

Contact Channels

Clients can reach NAGA support through the following primary methods:

Live Chat – Available directly on the website and within the platform for quick assistance with common issues.

Email Support – Users can submit detailed queries or documentation-related requests through the official support email.

Phone Support – Available in certain regions for direct communication with the customer service team.

Help Center / FAQ – A comprehensive knowledge base covering account setup, trading, payments, verification, and platform usage.

Live chat is typically the fastest option, often providing responses within minutes during business hours, while email inquiries are generally handled within 24–48 hours, depending on complexity.

Availability and Languages

Customer support is available during extended business hours aligned with global trading schedules. NAGA serves an international audience and offers support in multiple languages, including English and several European and international languages, helping users receive assistance in their preferred language where available.

Account Management Support

Higher-tier account holders may receive additional benefits such as dedicated account managers, faster response times, and priority service. These features are designed for active or high-volume traders who require more personalized assistance.

Overall Service Quality

NAGA’s support structure combines real-time assistance, self-service resources, and tier-based service levels. While response times are generally efficient for standard requests, complex issues such as verification or withdrawals may require additional processing time.

Overall, NAGA provides a solid customer support framework that balances accessibility and scalability, with enhanced service options available for traders operating at higher account levels.

Prohibited Countries: Where Can I Not Trade with this Broker?

NAGA operates globally, but like most regulated trading platforms, its services are not available in certain countries due to regulatory restrictions, local financial laws, or internal risk policies. Availability depends on the entity providing the service and the regulatory framework under which the client falls.

Restricted Jurisdictions

NAGA does not provide services to residents of several countries where local regulations prohibit or limit the offering of leveraged trading or CFD products. These typically include:

United States

Canada (in many provinces)

Japan

Iran

North Korea

Syria

Cuba

Sudan

Myanmar

Any countries subject to international sanctions or high-risk financial monitoring

In addition, certain European or international jurisdictions may have specific limitations depending on regulatory passporting rights and licensing permissions.

Entity-Based Limitations

Clients within the European Economic Area (EEA) are onboarded under the CySEC-regulated entity, which operates under strict EU rules, including leverage caps and investor protection requirements. Clients outside the EEA are typically registered under the Seychelles entity, where trading conditions may differ.

However, even under the offshore entity, NAGA applies internal compliance checks and may reject applications from regions considered high-risk from an Anti-Money Laundering (AML) or regulatory perspective.

Verification and Compliance Checks

During account registration, NAGA verifies the applicant’s country of residence through the Know Your Customer (KYC) process. If a country is restricted, the account will not be approved or trading access will be denied.

Why Restrictions Exist

These geographic limitations are standard across the industry and reflect:

Local financial regulations

Licensing limitations

International sanctions compliance

Risk management and legal considerations

Before opening an account, traders should check availability for their country on the official website to ensure they are eligible to use NAGA’s services.

Special Offers for Customers

NAGA provides a range of promotional programs and value-added features designed to enhance the trading experience and reward active users. While the availability of specific promotions may vary by region and regulatory entity, the platform focuses primarily on loyalty benefits, social trading incentives, and account-tier advantages rather than aggressive bonus structures.

NAGA Cashback and Loyalty Benefits

One of the key ongoing incentives is the NAGA Cashback program, where traders can receive rebates based on their trading volume. As users trade more frequently or move up account tiers, they may qualify for reduced costs or cashback rewards, helping to lower overall trading expenses.

AutoCopy Earnings

NAGA’s social trading ecosystem also includes a unique incentive structure. Traders who perform well and build a strong following can earn additional income when other users copy their strategies through the AutoCopy feature. This creates a performance-based reward system that encourages disciplined trading and transparency.

Account Tier Advantages

Higher-tier accounts come with exclusive benefits, such as:

Tighter spreads and improved trading conditions

Priority customer support

Dedicated account managers

Faster withdrawal processing

Access to premium market analysis and Trading Central insights

These benefits function as a loyalty framework rather than short-term promotional campaigns.

Referral Program

NAGA also offers a refer-a-friend program, allowing existing users to earn rewards when they invite new traders who open and fund an account.

Promotions and Regional Campaigns

Occasionally, NAGA runs limited-time promotions or regional campaigns, which may include deposit-related incentives, trading competitions, or seasonal offers. Terms and eligibility vary depending on local regulations.

Overall, NAGA’s promotional approach focuses on long-term engagement, performance rewards, and improved trading conditions rather than high-risk bonus schemes, aligning with regulatory expectations in many jurisdictions.

Naga Review Conclusion

NAGA positions itself as a modern multi-asset trading platform that combines traditional online trading with social investing features. Since its launch in 2015, the company has grown into a globally recognized fintech brand, supported by its parent company, The NAGA Group AG, which is publicly listed on the Frankfurt Stock Exchange. This public listing adds a level of transparency and corporate accountability that strengthens the platform’s overall credibility.

One of NAGA’s strongest advantages is its social trading ecosystem. The AutoCopy feature allows users to follow and replicate experienced traders, making the platform particularly attractive to beginners or those looking for a more passive approach. At the same time, the availability of detailed performance statistics and risk scores helps users make more informed decisions when selecting traders to copy.

In terms of market access, NAGA offers a diverse selection of more than 4,000 instruments, covering forex, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds. This wide range allows traders to build diversified portfolios without needing multiple platforms. The integration of TradingView charts, Trading Central analysis, and real-time data further enhances the trading experience for both technical and fundamental traders.

From a safety perspective, NAGA operates under regulatory oversight from CySEC in Europe, with international services provided through its Seychelles entity. Client funds are held in segregated accounts, and negative balance protection is available for retail clients, helping to limit financial risk when trading leveraged products.

The platform’s tiered account structure provides flexibility for different types of traders, although the benefits and pricing improve significantly at higher deposit levels. While beginners can start with lower capital, they may encounter wider spreads compared to premium tiers.

There are, however, considerations to keep in mind. Most instruments are offered as CFDs, which carry a high level of risk due to leverage. Additionally, the social trading environment, while innovative, may encourage less experienced traders to rely too heavily on others’ performance.

Overall, NAGA is best suited for traders who value social trading, multi-asset access, and a modern platform environment. It offers a balanced combination of accessibility, functionality, and community features, making it a strong choice for beginners, intermediate traders, and active retail investors seeking an all-in-one trading ecosystem.

Summary and Key Takeaways

NAGA is a multi-asset trading platform that combines traditional CFD trading with a strong social trading ecosystem. Operated by The NAGA Group AG and publicly listed on the Frankfurt Stock Exchange, the platform offers an added level of transparency and corporate credibility compared to many privately held providers. Key advantages include strong social trading functionality, integrated TradingView charts, Trading Central research, and a wide range of markets. However, traders should note that most products are offered as CFDs, which involve leverage and a high risk of capital loss. Trading costs and benefits also vary by account tier. Overall, NAGA is best suited for traders seeking a social, multi-asset trading environment with modern tools and global market access, while maintaining awareness of the risks associated with leveraged CFD trading.

- The platform provides access to 4,000+ instruments, including forex, global stocks, indices, commodities, cryptocurrencies, ETFs, and bonds.

- NAGA operates under CySEC regulation in Europe, with international clients onboarded through its Seychelles entity.

- Client funds are held in segregated accounts, and negative balance protection helps limit risk for retail traders.

FAQs

Is NAGA a regulated and safe trading platform?

Yes, NAGA operates under regulatory oversight. Its European entity is regulated by the Cyprus Securities and Exchange Commission (CySEC), while international clients are served through a Seychelles-regulated entity. Client funds are held in segregated accounts, and negative balance protection is provided for retail traders.

What can I trade on NAGA?

NAGA offers access to more than 4,000 instruments, including forex pairs, global stocks, indices, commodities, cryptocurrencies, ETFs, and bonds. Most assets are available through CFDs, allowing traders to speculate on price movements with leverage.

Does NAGA support copy trading?

Yes, NAGA provides a social trading feature called AutoCopy. This allows users to follow and automatically replicate the trades of experienced traders based on their performance statistics and risk levels.

What is the minimum deposit required at NAGA?

The minimum deposit at NAGA typically starts from around $10 to $250, depending on the region and account type. Higher account tiers require larger deposits and offer improved trading conditions and additional benefits.

What leverage does NAGA offer?

Leverage at NAGA depends on the regulatory entity and client classification. Retail traders under CySEC are subject to ESMA limits (up to 1:30 for major forex pairs), while international clients under the offshore entity may access higher leverage, potentially up to 1:1000 depending on the instrument and account.

About Author

Beatrice Quinn

Beatrice Quinn Kingsley, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports. Beyond her corporate success, Beatrice is an advocate for financial literacy, actively engaging in workshops, seminars, and writing on topics like personal finance and investing. Recognized in the field, she's a featured voice in publications and a sought-after consultant, combining her financial know-how and communication prowess to empower ...

- Naga Overviews

- Pros and Cons

- Is Naga Safe? Broker Regulations

- What Can I Trade with Naga?

- How to Trade with Naga?

- How Can I Open Naga Account? A Simple Tutorial

- Naga Charts and Analysis

- Naga Account Types

- Do I Have Negative Balance Protection with This Broker?

- Naga Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Naga Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author