FXCC Broker Review: Is This Broker Suitable for Beginner Traders?

FXCC Overviews

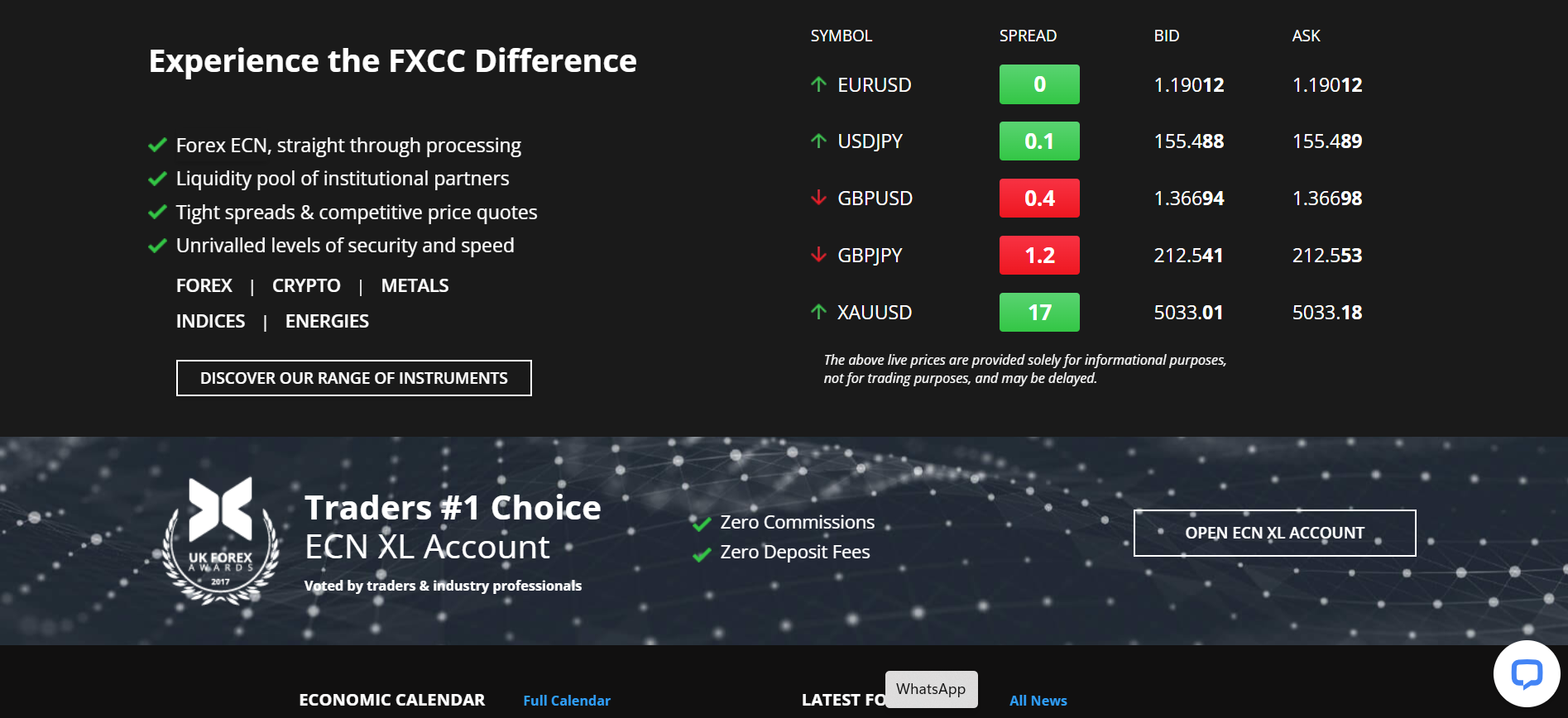

FXCC is a global forex and CFD broker founded in 2010 offering competitive ECN trading with low spreads from 0.0 pips and zero commissions. Regulated by CySEC and other authorities, it supports MetaTrader 4 and MetaTrader 5 platforms with access to forex, metals, indices, energies, and cryptocurrency CFDs. FXCC is designed for traders seeking cost-efficient execution and flexible account access.

FXCC is an international online trading brokerage founded in 2010, with the stated aim of providing global traders with direct access to forex markets through an ECN/STP-based trading model. This model allows traders to execute orders directly into the market without interference from a dealing desk, which can help ensure more transparent pricing and faster execution. FXCC has built its reputation around cost-efficient trading conditions, competitive spreads, and accessible trading tools that appeal to both beginner traders and seasoned professionals.

From the outset, the company positioned itself as a cost-effective alternative in the industry, offering zero trading commissions and the possibility of tight spreads starting from 0.0 pips under its ECN XL account structure. This pricing model is intended to keep trading costs low and straightforward for clients. FXCC also promotes its lack of a minimum deposit requirement for some account types, meaning traders can begin with virtually any budget.

One of FXCC’s defining characteristics is its regulatory footprint across multiple jurisdictions. Its European arm, FX Central Clearing Ltd, is regulated by the Cyprus Securities and Exchange Commission (CySEC) and operates under the EU MiFID directive, enabling it to serve clients within the European Economic Area under robust regulatory supervision. FXCC is also registered with authorities in Comoros (MISA) and has corporate entities in St. Vincent & the Grenadines and Nevis, expanding its global reach.

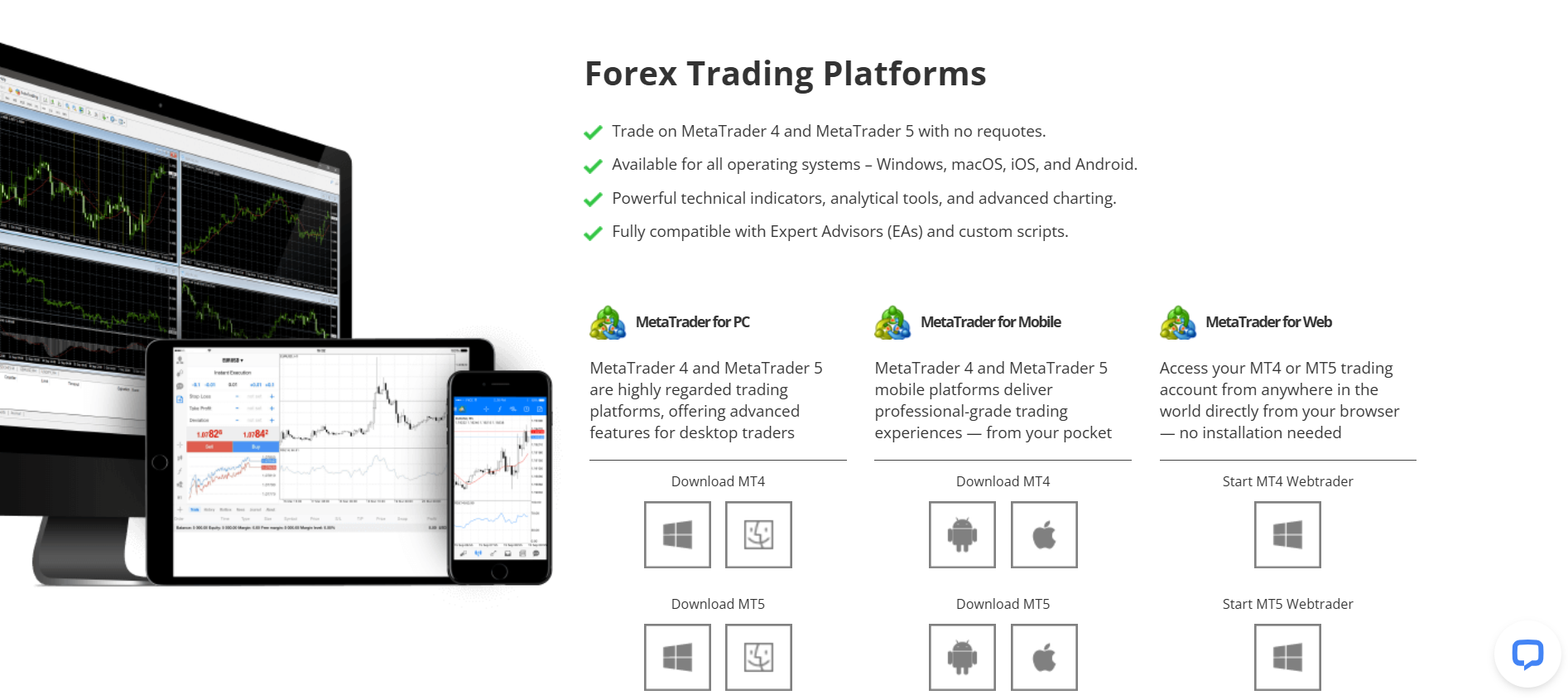

FXCC supports popular trading platforms, notably MetaTrader 4 (MT4) and, according to multiple industry reviews, MetaTrader 5 (MT5), allowing traders to access advanced charting, automated strategies, and algorithmic trading capabilities. This platform choice reflects FXCC’s focus on ensuring traders have reliable tools across desktops, web, and mobile devices.

The instrument range on FXCC is diversified, covering 1100+ Forex, Indices, Commodities, Crypto and Equities. This suite of instruments supports a variety of trading strategies from forex day trading to diversified CFD portfolio construction.

FXCC also emphasises educational resources like trading tools and market analysis, although independent reviews note that its educational offerings may not be as comprehensive as those from some larger competitors. Nonetheless, FXCC’s combination of features, pricing, and regulatory oversight positions it as a competitive option within the global online brokerage landscape.

Pros and Cons

- FXCC offers tight spreads from around 0 pips with no trading commissions, making overall costs low for traders.

- The broker does not require a minimum deposit, lowering the barrier to entry for new and small traders.

- FXCC is regulated by CySEC (MiFID) and MISA, with client funds held in Tier 1 banks for added security.

- Traders can access 70+ forex pairs and other CFDs, covering major markets and diverse instruments.

- MetaTrader platforms supported (MT4/MT5) provide robust charting and automated trading options.

- Free VPS hosting is available for traders who meet balance or volume conditions.

- FXCC’s platform choice is limited to MetaTrader, with no proprietary platform alternatives.

- The broker offers limited educational and research tools compared with larger competitors.

- Some independent reviews note inactivity fees after periods of no trading.

Is FXCC Safe? Broker Regulations

FXCC operates under formal regulatory oversight in multiple jurisdictions, which helps establish it as a legitimate and transparent online trading provider rather than a scam. One of its primary legal entities, FX Central Clearing Ltd, is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) as a Cyprus Investment Firm (CIF) — License No. 121/10 — and operates under the EU’s Markets in Financial Instruments Directive (MiFID). This regulatory framework mandates strict rules on capital requirements, risk disclosure, client fund protection, and reporting standards that brokers must adhere to when serving clients in the European Economic Area (EEA). CySEC oversight also typically includes segregation of client funds in separate bank accounts and participation in compensation schemes under EU law.

In addition to its CySEC regulation, FXCC is regulated by the Mwali International Services Authority (MISA) in the Comoros Union. This licence enables FXCC’s offshore operations outside the EEA, although regulatory protections under MISA may be less stringent than those in the EU. FXCC also operates corporate entities registered in St. Vincent & the Grenadines and Nevis, expanding its legal footprint, though these jurisdictions generally provide less rigorous investor protection compared with CySEC.

Industry reviews affirm that FXCC holds client funds in segregated accounts with Tier 1 banks, which helps safeguard traders’ capital in the event of insolvency or financial stress at the broker. Many independent assessments also note that FXCC offers negative balance protection, meaning clients should not lose more than their account balance, helping prevent debt beyond deposited funds.

While FXCC’s regulation via CySEC provides strong oversight and a reliable legal framework for EEA clients, protections can vary for traders outside the EU depending on which legal entity they choose. Prospective users are encouraged to confirm their specific entity and applicable safeguards before opening an account. Overall, FXCC’s regulatory portfolio and security measures support its reputation as a legitimate and safe broker within the contexts of regulated trading environments.

- Cyprus Securities and Exchange Commission (CySEC)

- Markets in Financial Instruments Directive (MiFID)

- Mwali International Services Authority (MISA)

How to Trade with FXCC ?

What Can I Trade with FXCC?

FXCC offers a diverse selection of tradable financial instruments, allowing traders to build a range of strategies across different markets. The broker’s offering includes forex currency pairs, indices, cryptocurrencies, and equity CFD instruments, providing access to many of the world’s most popular markets.

At the core of FXCC’s markets is forex trading, with access to more than 70 major, minor and exotic currency pairs. This extensive forex coverage enables traders to speculate on the price movements of global currency combinations such as EUR/USD, GBP/JPY, AUD/USD, and many others. Forex trading via FXCC uses the widely used MetaTrader platforms, where real-time pricing and execution is supported.

In addition to forex, FXCC allows trading of precious metals including gold, silver, palladium and platinum as spot CFDs. These metals are often used by traders both to hedge portfolio risk and to capitalize on movements tied to macroeconomic events.

FXCC also supports indices CFD trading, giving speculative access to major global indices such as Dow Jones, NASDAQ, UK100, and Germany 40 — enabling traders to participate in broader market trends rather than individual stocks.

For traders seeking exposure to energy markets, FXCC provides CFDs on crude oil and other energy products, while its cryptocurrency CFD offering includes popular digital assets like Bitcoin, Ethereum, Litecoin, Ripple and others, allowing crypto strategies without the need for direct digital asset custody.

Some review sources also indicate that FXCC supports CFDs on global equities and a broader pool of over 1,000 instruments, including stock CFDs, though the availability of these can vary by entity and platform.

Overall, FXCC’s tradable markets cover most of the major asset classes relevant to forex and CFD traders — from FX and indices, energies, cryptos and equity CFDs — offering flexibility for different trading styles and diversification preferences.

How to Trade with FXCC?

Trading with FXCC centers on using industry-standard platforms and understanding the mechanics of entering and managing trades. The broker supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — globally recognised trading platforms that offer robust tools for execution, analysis, and strategy development. Traders can access these platforms on desktop (Windows/macOS), mobile (iOS/Android), and web browser versions, allowing them to trade from virtually any connected device. Both platforms support advanced charting, technical indicators, and automated scripts, making them suitable for beginners through to professional algorithmic traders.

To begin trading, existing FXCC clients first log in to their account via MT4/MT5 using the credentials provided after account registration. Once logged in, traders can select the market or instrument they wish to trade — such as a forex pair, metal, index, or cryptocurrency CFD — from the platform’s Market Watch panel. Typically, clicking a symbol will open its price chart and trading window.

When placing a trade on FXCC via MetaTrader, traders have two primary options: market execution or pending orders. Market execution opens a position instantly at the current price, while pending orders are set to trigger when an instrument reaches a predetermined price level. Traders must specify the volume (lot size) and may set risk-management parameters such as stop-loss and take-profit levels before confirming a trade.

Another key feature FXCC traders can use is One-Click Trading, which allows trades to be opened directly from the chart with a single click by enabling this function in the MT4/MT5 settings. This option is especially useful in fast-moving markets where speed of execution matters.

Once trades are live, FXCC users can monitor and adjust positions through the Trade tab on their platform — closing positions, amending stop-loss/take-profit orders, or adding new trades as market conditions evolve. Advanced traders can also deploy technical indicators, customised scripts, and Expert Advisors (EAs) to automate strategies or help with analysis.

FXCC also emphasises the use of demo accounts to practice trading in a risk-free environment before committing real capital, enabling users to familiarise themselves with platform features and strategy execution without financial risk.

Overall, trading with FXCC involves a straightforward login to MetaTrader, selecting an instrument, executing orders using built-in charting tools, and managing positions through responsive platform interfaces tailored for various trader skill levels.

How Can I Open FXCC Account? A Simple Tutorial

Opening a trading account with FXCC is designed to be simple, digital, and user-friendly, allowing traders to complete the process and start trading in a relatively short time. The entire workflow from initial registration to funding and verification — can be done online without visiting a physical office. Most users find that their account is fully approved and ready for trading including live deposit access within a few hours once all requirements are met.

1. Visit FXCC’s Official Website

To begin, go to the FXCC official website and locate the “Register” or “Open Account” button, usually positioned in the top right corner of the homepage. This directs you to the registration page where you will start the process.

2. Complete the Online Registration Form

On the registration page, you will be asked to create your login credentials. Provide key details such as your full name, email address, and a secure password (typically requiring a mix of uppercase, lowercase, and numbers). Some users may also have the option to sign up using Google or Facebook logins for added convenience.

Once you’ve entered this basic information and submitted the form, FXCC will send you a verification email. Click the link in this email to confirm and activate your initial account registration.

3. Log in and Provide Personal Details

After email verification, log into your newly created FXCC account dashboard. Here, you will be required to provide additional personal details, such as your date of birth, country of residence, physical address, and sometimes basic financial or trading background questions. This information helps FXCC comply with regulatory and risk-profiling requirements.

4. Upload Verification Documents

To complete full account verification and unlock live trading and funding options, FXCC requires you to upload standard proof of identity (POI) and proof of address (POR) documents. These typically include:

- Government-issued ID (e.g., passport, driver’s license, or national ID card)

- Proof of residential address (e.g., utility bill or bank statement issued within the last six months)

Once these documents are submitted, the broker will review them to ensure they meet compliance standards. For most clients, this verification step is completed within a few hours but depending on volume and document clarity, it may take slightly longer.

5. Select Account Preferences

After verification, you can configure your live trading account. This includes selecting the base currency (USD, EUR, GBP, etc.), choosing your account type (live or demo), and setting leverage preferences according to your risk tolerance. Demo accounts can be accessed prior to verification to practice trading without real funds.

6. Fund Your Account and Start Trading

Once your account is fully activated and verified, you can fund your account using supported methods such as bank wire transfer, Visa/Mastercard, e-wallets (Skrill, Neteller), or even cryptocurrencies. FXCC does not charge deposit fees, and many traders report fast processing times especially with e-wallet or card transfers.

After funding, you can link your account to MetaTrader 4 or MetaTrader 5, download the platform of your choice, and begin placing trades.

Summary of Steps

- Visit FXCC and click Register

- Complete signup with your email and password

- Verify your email and log in

- Provide personal details and upload POI/POR

- Configure account settings

- Fund and begin trading

FXCC Charts and Analysis

FXCC provides traders with a robust suite of charting and analytical tools primarily through its supported trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — both widely recognised and feature-rich platforms in the online trading industry. These platforms serve as the backbone for market analysis and decision-making for FXCC traders. MT4 and MT5 offer interactive and customisable charts with multiple timeframes and a range of visual styles, including candlestick, line, and bar charts, giving traders flexibility in how they view price action and trends.

On MT4, traders can access over 50 built-in indicators and analytical objects, while MT5 expands this further with 38+ built-in indicators and more analytical tools, along with up to 21 timeframes — making it particularly suitable for comprehensive technical analysis across different trading horizons. Both platforms allow users to add custom indicators, apply drawing tools, and develop automated strategies (Expert Advisors) tailored to specific trading setups, helping both novice and experienced traders implement and test technical approaches.

FXCC also highlights supplementary analytical resources on its website, such as an economic calendar and daily technical analysis updates, which can help traders monitor key market events and sentiment drivers. These resources allow traders to integrate both technical and fundamental analysis into their strategies.

For traders who prefer quick access or trading without software installation, MT4 and MT5 WebTrader versions offer the same analytical capabilities directly from a web browser, making charting and trade monitoring highly accessible.

Overall, FXCC equips traders with industry-standard charting and analytical functionality via MetaTrader platforms plus accessible market insight tools — combining flexible technical indicators, multi-timeframe charts, and supplementary market resources that support a wide range of trading styles and experience levels.

FXCC Account Types

Here’s the FXCC Account Types table displayed directly in this chat (no code block), summarising the main live and demo options available:

| Account Type | Key Features | Minimum Deposit | Maximum Leverage | Best For |

| ECN XL | Raw spreads from ~0.0 pips, no commission, MT4/MT5 access, swap-free/Islamic option available | No strict minimum* (commonly ~$100+) | Up to 1:1000 on some entities | Most retail traders |

| Demo Account | Virtual funds, full access to MetaTrader platforms for practice | $0 | N/A | Beginners & strategy testing |

Notes:

• FXCC offers a single core live account — ECN XL — which combines low-cost trading with STP/ECN execution and zero commissions.

• The Demo account lets users practice trading with virtual funds and explore the MT4/MT5 platforms before committing real capital.

• Minimum deposit amounts can vary based on entity and region, though FXCC advertises no rigid minimum requirement for the ECN XL live account.

• Maximum leverage may reach up to 1:1000 depending on jurisdiction and regulatory constraints.

Do I Have Negative Balance Protection with This Broker?

One important consideration for any trader is whether a broker offers negative balance protection (NBP) — a safeguard designed to prevent your account equity from dropping below zero during extreme market conditions. FXCC does provide such protection as part of its risk management framework, but the specifics depend on which legal entity you register with and under which regulatory regime your account operates.

According to FXCC’s publicly available account specifications, “Negative Balance Protection” is listed among the features for its ECN account types, indicating that clients are protected from owing more than their invested capital. In practical terms, this means that if market volatility pushes your account equity below zero — for example, during sudden price gaps or extremely sharp market moves — FXCC’s systems will prevent your balance from going negative. This effectively limits your risk to the funds you have deposited, helping to protect your financial exposure.

Additional industry reviews note that FXCC’s risk management setup includes automatic margin close-out rules triggered at predefined levels — typically reducing open positions before losses can push equity into negative territory. These measures are common among well-regulated brokers and serve to protect both the trader and the brokerage from excessive risk.

When you open an FXCC account under its CySEC-regulated entity (FX Central Clearing Ltd) — which serves clients within the European Union — the negative balance protection is typically supported by regulatory requirements under MiFID II and reinforced by strong compliance standards. In addition, clients under this entity may have access to compensation schemes such as the Investor Compensation Fund (ICF) protecting up to a set amount in case of insolvency, which adds another layer of client safekeeping.

It’s important to highlight, however, that the strength and scope of protection can vary for clients outside the EU trading through FXCC’s offshore entities. While these branches may still offer negative balance protection as a policy, regulatory safeguards and compensation schemes associated with local regulators (e.g., MISA, or offshore registrations) may be less robust compared with European protections. Traders in such regions should carefully review the specific legal documentation and terms applicable to their account.

In summary, FXCC does offer negative balance protection across its account structures, helping ensure that traders will not incur debts beyond their deposited funds. That said, the extent of this protection and any associated benefits — such as investor compensation coverage — will vary depending on which FXCC legal entity you register with and under what regulatory framework your trading account is held.

FXCC Deposits and Withdrawals

Funding your account and accessing your profits with FXCC is generally straightforward, though there are a few important details to understand about methods, fees, and procedures.

Deposit Methods and Process

FXCC accepts a range of deposit methods, allowing traders flexibility when funding accounts. These typically include bank wire transfers, credit/debit cards (Visa/Mastercard), and popular e-wallets such as Skrill and Neteller. In many regions, crypto-based deposits are also supported depending on the entity and payment service provider. Deposits are usually processed instantly for card and e-wallet methods, while bank transfers can take several business days depending on the banks involved. FXCC promotes a “zero deposit fee” policy, meaning that the broker does not charge fees for deposits and may even reimburse third-party costs charged by the payment processor.

To start trading, you simply log into your FXCC client portal, choose your preferred payment method, enter the amount, and confirm the transfer. The funds will then be credited to your trading account once the transaction completes — most frequently instantly or within a few hours for digital options.

Withdrawal Methods and Rules

When it comes to withdrawing funds, FXCC uses a policy designed to comply with industry anti-money-laundering rules. This means that withdrawals must be processed back through the same payment method used for the original deposit, up to the amount deposited, and profits above that amount are typically sent via bank wire transfer. For example, if you deposited $1,000 via Neteller and want to withdraw $1,500, the original $1,000 will be returned to Neteller, and the $500 profit will be remitted via bank wire.

Supported withdrawal options include credit/debit cards, Skrill, Neteller, Rapid Transfer, Sofort, CASHU, Neosurf, Netbanx Asia, and bank wire, although precise availability can vary by region and the entity with which you’re registered.

Minimums, Fees, and Processing Times

The minimum withdrawal amount is typically around $50 per method unless a specific method has different limits stated by FXCC. Processing times differ based on the method used — e-wallet and card withdrawals are usually completed within 24 hours, while bank wire transfers can take multiple business days depending on banking networks. Some methods (especially wire transfers or certain PSPs) may incur third-party fees, and in some cases traders report withdrawal costs such as percentage-based charges on crypto transfers or wire charges.

User Feedback on Transactions

User community feedback generally echoes that deposits and withdrawals are functional and smooth, with many traders noting quick turnarounds especially for e-wallet and crypto withdrawals. However, some users mention that fees on certain withdrawal methods (e.g., ~2 % on crypto) can apply, which is an important factor to consider when choosing how to fund or withdraw.

Summary

- FXCC supports multiple funding options, including cards, bank wires, e-wallets, and crypto, providing flexibility.

• Deposits are generally free and may be credited instantly for digital methods.

• Withdrawals must follow AML rules — original deposits return via the original method, and profits via wire.

• Processing times vary but e-wallets tend to be fastest.

• Some withdrawal fees from PSPs or intermediaries may apply.

Support Service for Customer

FXCC offers a range of customer support channels designed to assist traders with account queries, technical issues, and general information — and these services are available during active market hours throughout the trading week. The broker provides live chat and email support, enabling traders to get timely help directly through the website or by messaging support@fxcc.net. Live chat is particularly useful for quick questions or immediate troubleshooting, while email support is better suited for detailed account or documentation queries.

In addition to chat and email, FXCC lists telephone support via direct phone lines — such as +44 203 150 0832 and regional numbers depending on your entity or location — allowing traders to speak with a representative if needed. These phone contacts are especially helpful for users who prefer verbal communication or need more in-depth assistance that might be complex to handle via text.

Customer support for FXCC generally operates 24 hours a day, Monday through Friday, aligning with global forex market hours. This means traders can receive help at almost any time during active trading periods, which is important for addressing urgent issues that arise during market volatility or order execution.

Trader feedback from independent review platforms also reflects that FXCC’s support team is responsive and professional, with many users noting swift replies and helpful guidance from support staff when dealing with inquiries about deposits, withdrawals, or platform navigation. However, as with many brokers, response times can vary depending on overall contact volume, and some complex issues may require follow-up over a longer period.

FXCC also maintains a FAQ section and informational resources on its website, which can help traders find quick answers without needing to contact support directly. These educational and support resources add another layer of accessibility for both new and experienced traders.

In summary, FXCC’s customer support includes live chat, email, and phone options with coverage aligned to trading hours (24/5), supported by online FAQ resources and generally positive user reviews regarding responsiveness and professionalism.

Prohibited Countries: Where Can I Not Trade with this Broker?

When considering whether FXCC is available in your region, it’s important to understand that access depends on both local laws and which FXCC legal entity you use. FXCC operates multiple corporate entities — some regulated under CySEC and MiFID in the European Economic Area (EEA), and others registered offshore through jurisdictions like Mwali (Comoros), St. Vincent & the Grenadines, or Nevis — each with distinct client eligibility rules.

For its CySEC-regulated entity (FX Central Clearing Ltd), which serves clients within the EEA, services are strictly offered only to residents of countries where CySEC is authorised to operate under MiFID. At the same time, this regulated arm cannot accept clients from certain restricted countries where offering leveraged CFD trading would violate local laws or require additional licensing. Specifically, FXCC does not provide services to residents of the United States, Japan, or the entire EEA when the offshore entity is used, as well as other jurisdictions deemed unsuitable under its terms.

In practice, this means that traders located in the following regions are generally prohibited from opening accounts with FXCC:

- United States — U.S. residents cannot open FXCC trading accounts due to strict local regulations on leveraged financial products.

- Japan — Japanese traders are excluded under FXCC’s restricted region policies.

- European Economic Area (EEA) — FXCC’s offshore entity (Central Clearing Ltd) does not serve EEA residents; however, EEA clients may be served by the CySEC-regulated arm under MiFID.

Beyond these well-defined restrictions, FXCC’s terms also indicate additional unspecified “other countries” where services may be unavailable if distribution would conflict with local law or regulatory requirements.

In summary, FXCC excludes certain territories due to legal and regulatory constraints, notably including the United States, Japan, and regions where local financial laws prohibit CFD or leveraged trading without specific licensing. Traders in these and other restricted jurisdictions should confirm eligibility directly with FXCC before attempting to open an account.

Special Offers for Customers

FXCC runs promotional incentives designed to reward both new and existing traders — though the availability and terms of these offers can vary depending on your region and the specific entity through which you open your account. One of the most notable current promotions is the 100% First Deposit Bonus, which matches your first qualifying deposit with bonus trading credit up to $2,000, effectively doubling your available trading margin for speculative purposes. To claim this bonus, you must make a deposit into your ECN XL live account and explicitly opt in either through email, live chat, or the Trader Hub interface; the bonus is then credited to your wallet within about 24 working hours.

The deposit bonus is added as trading credit — meaning it increases your effective equity for trading — but it cannot be withdrawn directly as cash. Traders can, however, convert bonus funds into withdrawable balance through trading: for each standard lot traded, a small portion of the bonus converts into real balance, and profits generated from bonus-enhanced trades are typically withdrawable. The maximum bonus amount for this first deposit match is $2,000 (or equivalent).

In addition to this main sign-up offer, FXCC’s “Exclusive Forex Offers” section highlights other perks such as free VPS hosting for eligible traders, which can help enhance automated or expert advisor performance on MetaTrader platforms. These offers are aimed at both newer and long-term clients to encourage more advanced strategies and improve execution quality. However, the range of promotions outside the first-deposit bonus is limited compared with some larger online brokers.

It’s important to keep in mind that promotional terms can change, and regulatory restrictions may apply — for example, clients in the EEA or the United States may not be eligible for certain bonuses under local law. Always check the specific terms and conditions and consult with FXCC support or legal disclosures before participating.

FXCC Review Conclusion

In evaluating FXCC, several key strengths and limitations become clear, helping you determine whether it’s a good fit for your trading goals. Established in 2010, FXCC has more than a decade of market presence and has built a reputation as a cost-effective ECN/STP broker focused on transparent pricing and direct market access. Industry sources consistently note that FXCC offers competitive spreads with no trading commissions on its ECN XL account, which appeals to both beginner and professional traders seeking low-cost execution.

One of the broker’s standout features is its regulatory footprint, particularly through FX Central Clearing Ltd, which is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 121/10 and operates within the EU under MiFID. This regulatory status brings a higher standard of oversight and safeguards, such as segregated client funds and mandatory compliance with capital and reporting requirements. Reviews also indicate that client funds are held in Tier 1 banks for added protection, which is a positive signal for traders who prioritise capital safety.

User sentiment from platforms like Trustpilot shows generally positive feedback regarding trading conditions, tight spreads, fast execution, and responsive customer support, with many users recommending FXCC for both deposits and withdrawals. However, some traders — especially those with less experience — point out that FXCC’s range of educational and research tools is not as comprehensive as larger brokerages, making it less suited for traders who rely heavily on built-in learning resources.

Another limitation is FXCC’s relatively narrow asset coverage compared with brokers that offer direct stock trading or a broader suite of investment products. While its offering includes forex, metals, indices, energies, and cryptocurrencies, the absence of extensive share trading may be a downside for longer-term or diversified investment strategies.

The platform choice is straightforward — MetaTrader 4 and MetaTrader 5 — which are well-known and widely used but offer less variety than brokers with proprietary platforms or additional web-native tools.

In terms of suitability, FXCC’s strengths align closely with traders who prioritise low trading costs, direct market access, and a regulated environment, especially within the EU. Its competitive execution, regulation by CySEC, and generally positive user feedback make it a credible and reputable broker in the online trading space. However, traders looking for the widest possible asset selection, advanced proprietary tools, or extensive teaching resources may find the platform less compelling than bigger industry names. Overall, FXCC represents a solid choice for traders focused on forex and CFD markets with cost-efficient trading and reliable regulatory backing.

Summary and Key Takeaways

FXCC is a legitimate and established ECN/STP forex and CFD broker with a presence in the online trading industry since 2010, offering competitive trading conditions and trusted regulatory oversight. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) — a reputable European authority — and operates under the MiFID framework, which enhances investor protection and requires segregated client funds held in Tier 1 banks. FXCC also holds licences in other jurisdictions such as Mwali (Comoros) through the MISA regulator, extending its global access while highlighting regulatory variations for different client segments.

FXCC’s core live account, the ECN XL, offers tight spreads from 0.0 pips with no trading commissions, a welcome feature for cost-sensitive traders across experience levels. The broker supports MetaTrader 4 and MetaTrader 5, which are well-known platforms with advanced charting, technical indicators, and automated strategy tools, although it does not provide proprietary platforms. Tradable markets include forex, indices, commodities, metals, and cryptocurrencies, though stock or ETF CFDs are less prominent compared with some competitors.

Customer experience reviews show generally positive feedback regarding fast deposits, responsive support, and smooth withdrawals — though some users report occasional withdrawal fees and service variability. FXCC also runs promotions such as a first-deposit bonus, which can boost trading capital under defined conditions.

- FXCC’s regulated status, low trading costs, and trusted platform support make it a strong choice for forex and CFD traders.

- Traders seeking broader asset classes or extensive built-in research tools may find it less comprehensive than larger brokers.

FAQs

Is FXCC a regulated and safe broker to trade with?

Yes, FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC) and operates under MiFID regulations. It is also authorised by the Mwali International Services Authority (MISA) for international clients, providing an additional layer of regulatory oversight.

What trading platforms does FXCC support?

FXCC supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and mobile devices. These platforms offer advanced charting tools, multiple order types, and support for automated trading strategies.

What is the maximum leverage offered by FXCC?

FXCC offers leverage of up to 1:500 for eligible non-EU clients. Traders located within the EU may face lower leverage limits due to regulatory restrictions.

Does FXCC require a minimum deposit to open an account?

No, FXCC does not specify an official minimum deposit requirement, making it accessible to traders with varying capital sizes.

Can account leverage be changed after opening an account with FXCC?

Yes, leverage adjustments can typically be requested after account opening by contacting FXCC customer support. However, changes may depend on the trader’s jurisdiction and applicable regulatory requirements.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.

- FXCC Overviews

- Pros and Cons

- Is FXCC Safe? Broker Regulations

- How to Trade with FXCC ?

- How Can I Open FXCC Account? A Simple Tutorial

- FXCC Charts and Analysis

- FXCC Account Types

- Do I Have Negative Balance Protection with This Broker?

- FXCC Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- FXCC Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author