The stock market today reflects a marked and ongoing shift in its structure. Over recent years, especially after the disruptions caused by the pandemic and what some market watchers term the “Liberation Day” phase of volatility, growth-oriented and well-capitalized stocks have taken a leading role. This group has outperformed smaller-cap and value stocks, altering the landscape across major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite.

Examining the Change in the Stock Market Today

Historically, many market participants leaned toward small-cap and value stocks, attracted by perceived growth opportunities or risk profiles within the dow jones industrial average and similar sectors. Recent trends, however, have shown these areas lag behind large-cap growth equities.

For example, the Russell 2000 small-cap index experienced a brief upswing last year amid hopes for economic improvement and potential Federal Reserve rate cuts. Yet this positive momentum proved temporary. Investors have shifted their attention back to larger, more established companies, which have cemented their dominance in the stock market.

The Role of Growth Stocks and the “Magnificent Seven”

Market analyst Nicholas Colas from DataTrek notes the performance gap between small and large stocks arises from structural market changes rather than short-term cycles. The stock market today exhibits what he calls a new normal. Large-cap firms, especially in growth sectors, benefit from their size, innovation, and global operations.

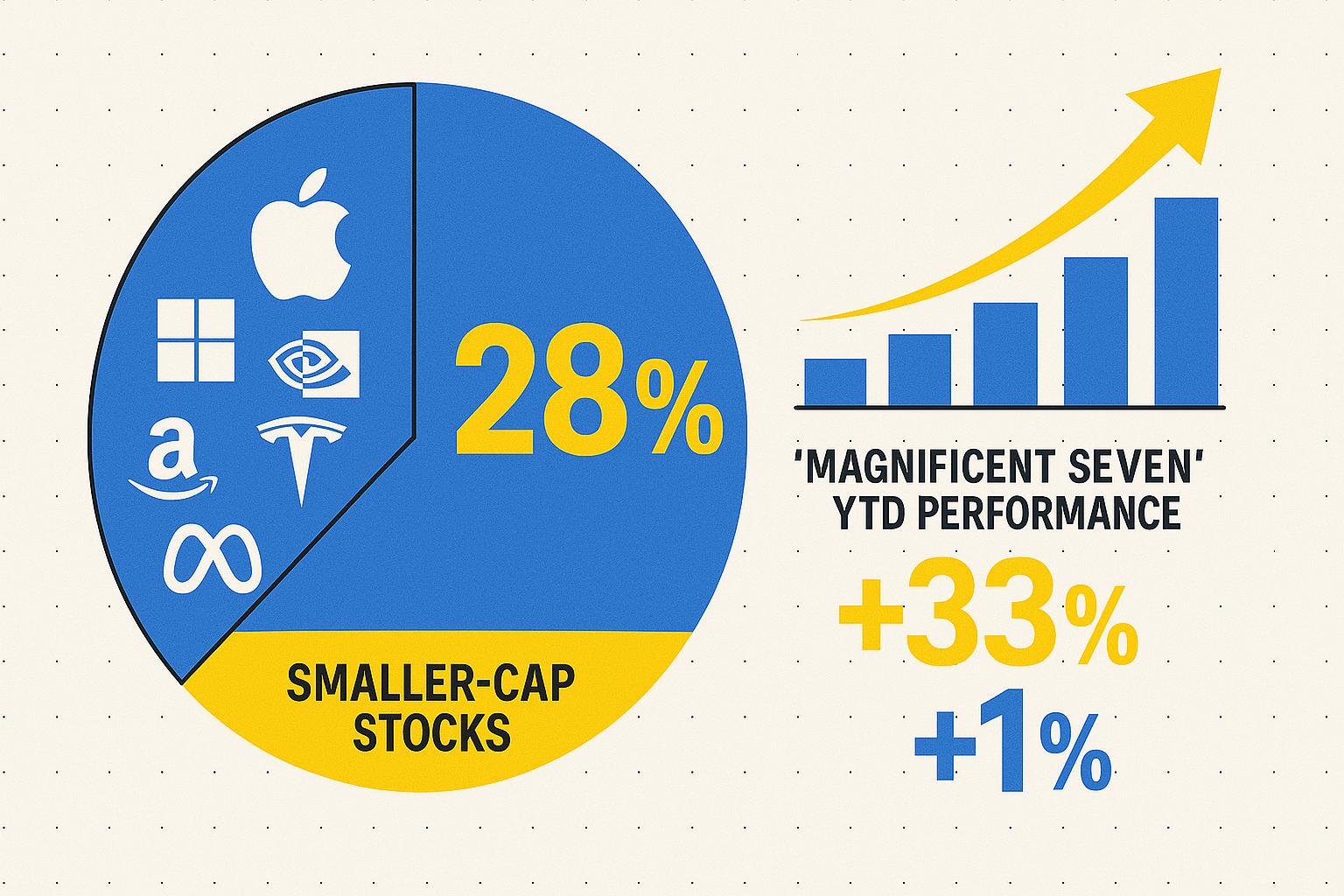

Central to this shift are the “Magnificent Seven” technology companies — Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Amazon (AMZN), Tesla (TSLA), Alphabet (GOOG), and Meta (META). These firms have driven share prices upward strongly, influencing market trends and returns heavily. Their combined market capitalization now comprises roughly 30% of the S&P 500, emphasizing their considerable impact (Statista, July 3, 2025).

Market Index Performance Highlights

The differences between various indices help illustrate this trend. The S&P 500, with a significant growth stock weighting, posted a 12.5% year-to-date return, led by companies like Apple, Microsoft, and Amazon. The Nasdaq Composite, featuring many technology firms, had an even stronger showing with a 15.7% rise. In contrast, the Russell 2000 small-cap index rose just 2.1%, underscoring the challenges faced by smaller companies (Bloomberg, CNBC, July 2025).

| Index | YTD Performance (2025) | Key Constituents |

|---|---|---|

| S&P 500 | +12.5% | Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) |

| Dow Jones Industrial Average (DJIA) | +9.3% | JPMorgan (JPM), Boeing (BA), Coca-Cola (KO) |

| Nasdaq Composite | +15.7% | NVIDIA (NVDA), Tesla (TSLA), Meta (META) |

| Russell 2000 (Small-caps) | +2.1% | Various small to mid-cap companies |

Growth Stock Concentration in the Dow Jones Industrial Average

The dominance of major market players is visible during dow jones industrial average today sessions and in djia futures activity. These companies show resilience amidst global trade shifts, regulatory developments, and economic uncertainty. Many investors consider large-cap growth stocks both growth engines and defensive holdings; characteristics less commonly found in smaller-cap sectors.

Investor Implications in the Current Market

Attention given to large-cap technology and growth companies is clear in stock market news and continuous reporting on nasdaq today and dow futures now. Despite some volatility in premarket trading, these stocks remain vital portfolio components. Tesla’s ongoing prominence is one example, with the tsla stock price symbolizing technological leadership and growth potential.

This emphasis on large-cap growth challenges traditional diversification strategies but also opens up new opportunities for investors prepared to adjust. The movements seen in djia today and s&p 500 today underline the strong performance and influence of these stocks on broader market sentiment.

Historical Rate Hike Comparison: 2008 vs. 2023

Looking back to 2008, market stress affected all sectors and sizes broadly. In contrast, since 2023, Federal Reserve rate hikes have coincided with a preference for growth and large-cap stocks. This pattern, evident in dow jones index futures and nasdaq composite data, highlights fundamental shifts rather than cyclical fluctuations.

Outlook and Predictions for the Stock Market

Looking forward, growth stocks are expected to remain central in the stock market. Advancements in technology, including artificial intelligence and renewable energy, along with the financial strength of large companies, suggest this trend continues. Futures on the dow jones industrial average futures and nasdaq qqq reinforce a positive outlook for growth sectors despite ongoing volatility (Goldman Sachs, July 6, 2025).

While the stock market today live chart shows fluctuations, the dominant pattern favors large-cap growth stocks as core holdings.

Recommended Strategies for Market Participants

Investors should consider the evolving structure and leadership within the market. Below is a summary of suggested actions reflecting current conditions:

| If You Are… | Recommended Actions | Confidence Level |

|---|---|---|

| Small-Cap Investor | Target niche sectors likely to experience growth; watch stock market futures to gauge broad trends. | Medium |

| Growth Stock Trader | Focus on technology-driven firms; monitor nasdaq futures and djia futures movements. | High |

| Value Investor | Be selective; consider defensive sectors within the Dow Jones Industrial Average; use dow jones futures for timing entries and exits. | Medium |

| Long-Term Investor | Diversify with emphasis on large-cap growth; track economic indicators and Federal Reserve announcements. | High |

The Limitations of Data Alone in the Stock Market

While raw data and real-time analytics such as those available for nasdaq googl or dow jones chart can provide valuable insights, interpreting market behavior requires human context. Factors like sentiment shifts, policy changes, and global economic events often transcend what numbers alone display.

For example, NVIDIA’s strong performance in nasdaq nvda price trends reflects not just financial results but also management’s ability to steer innovation. Similarly, analyzing Dow Jones Industrial Average companies such as JPMorgan (JPM) calls for understanding responses to monetary policy beyond chart patterns.

The Evolving Stock Market Environment

The stock market is currently shaped by the growing influence of large-cap growth stocks. The shift, mirrored across the Dow Jones Industrial Average, Nasdaq Composite, and S&P 500, points to deeper market forces beyond typical cycles. Investors are encouraged to revisit their strategies in light of these dominant players and their impact on returns and confidence.

For detailed market updates and analysis, refer to sources such as Yahoo Finance’s full coverage. Staying informed on djia live, nasdaq today, and s&p 500 index chart developments remains essential for following modern trends in the stock market today.